“Liberation Day” may or may not free markets from the tightening bind that they find themselves in with respect to US trade policy. Investors and company management dislike uncertainty, and the piecemeal, unreliable way in which tariff announcements are being delivered is creating plenty of it.

Wednesday looks set to bring a wide range of tariffs, but everything – from the scale to the timing to the variability across countries – still seems somewhat up in the air. Estimates on what the average tariff rate will look like range from a few percentage points in moderate outcomes to double-digit levels in more forceful scenarios. It also remains unclear to what extent tariffs are a negotiating strategy to attain some other goal versus being the objective end state. What does seem less uncertain is that tariffs are, without much exception, likely to be bad for economic growth, consumers, and markets.

Consumer concerns

US consumers have already shown their concerns about tariffs in recent surveys. The University of Michigan Consumer Sentiment Survey suggests that American consumers expect inflation to average 5% over the next year. While this perhaps should be taken with a pinch of salt, it has also coincided with a significant drop in consumer confidence as individuals worry about higher prices on the back of tariffs.

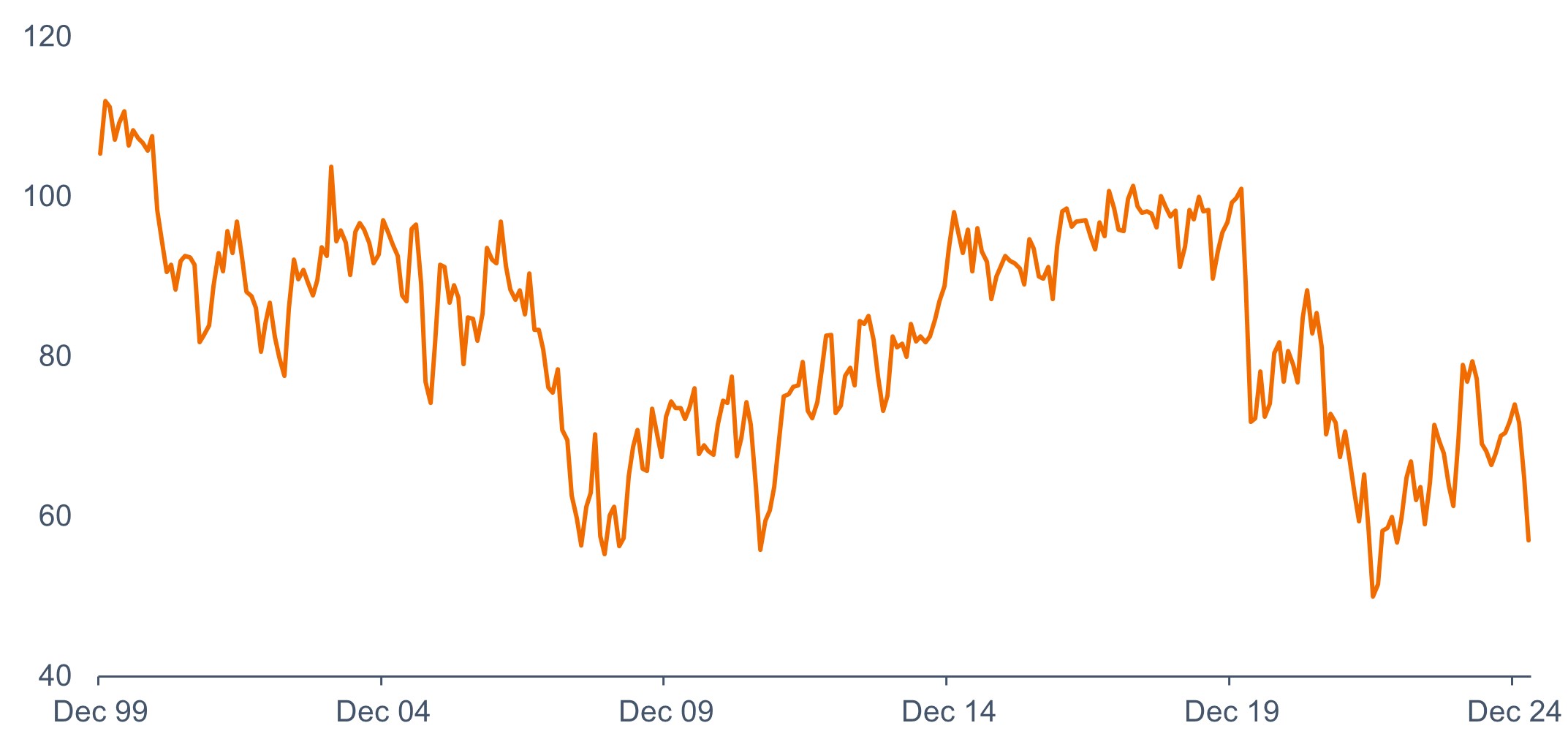

University of Michigan Consumer Sentiment Index, 31 January 1999 – 31 March 2025

Source: Bloomberg, as of 31 March 2025.

Similarly, corporate sentiment has sagged after jumping higher over the second half of 2024. The concern inside the US is that higher prices due to tariffs weigh on real income and spending growth. Outside of the US, where goods exports tend to be more economically important, the problem is more focused on the impact on industry and the knock-on effect to the wider economy.

Market implications

Recent performance differences across markets have been noticeable. After performing well following the US election in November 2024, US equities have been the biggest losers as uncertainty has risen in 2025. American stocks have lacked the positive catalysts that have driven European and Chinese equities higher year to date as both have seen new stimulus policies from their respective governments. However, this has left both looking somewhat vulnerable – particularly Europe, where there appears to be a significant time horizon gap between the negative implications of any immediate implementation of trade tariffs and the longer-term impact of higher government spending.

While it is always difficult to judge what markets are pricing in ahead of an event, we can read into a few areas for indications. Investor surveys suggest that expectations remain to the moderate side of the more extensive possible implementations of tariffs, although expectations are now more closely aligned with rhetoric than they were back in December. This suggests that if the pronouncements are in line with the messaging, there is still room for a more negative reaction. Similarly, valuations remain elevated compared to history, suggesting that an outcome with a more problematic effect on earnings may well still lead to further downside.

However, we can also find some signs of over-pessimism that may point to the move in markets becoming extended. This is most obvious in survey results showing sentiment among US retail and professional investors has soured to an extreme extent. Such bearishness about markets is often associated with better returns going forward but also doesn’t preclude further declines. However, it is also important to note that there have been fewer signs of capitulation among institutional investors. These could yet remain a source of further selling should news flow continue to cause concerns.

Portfolio positioning considerations

Perhaps the most important question is whether a global trade war can push this late-cycle economy into a global recession. Although right now we think the answer is still “no,” US equities remain relatively expensive and therefore likely sensitive to negative surprises relating to Liberation Day or any of the upcoming important US data releases (eg, Institute for Supply Management manufacturing purchasing managers index and non-farm payrolls).

It is also worth bearing in mind that timing markets is notoriously difficult, with some of the strongest market days often coming at times of uncertainty. For investors who are able to weather this short-term volatility, stimulative policy in Europe and China has the potential to combine with forthcoming stimulative US policy (eg, taxes, deregulation) to make for a fertile medium-term environment for active investors. Staying invested with a well-balanced portfolio may therefore be the best way to weather current volatility.

重要資料

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

外國證券須承受貨幣波動、政治和經濟不明朗因素、波幅較大以及流動性較低,上述風險在新興市場較為嚴重。固定收益證券受到利率、通脹、信貸和違約風險的影響。債券市場表現波動。隨著利率上升,債券價格通常會下跌,反之亦然。

貨幣政策指央行旨在影響經濟體系通脹和增長水平的政策,當中包括控制利率和貨幣供應。

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market

波幅 / 波動性是指投資組合、證券或指數價格升跌的速度和幅度。倘若價格大幅上下擺動,表明其波動性高。倘若價格變動更為緩慢且幅度更小,表明其波動性較低。波動性較高意味著投資風險較高。