固定收益展望:等待減息的同時獲取進賬

環球固定收益主管Jim Cielinski在年中展望中承認,市場急不及待地希望減息,但這也帶來新的機會,讓投資者能夠獲得具吸引力的孳息率。

9 分鐘閱讀

焦點分析:

- 市場已經推遲對減息時間及步伐的預期,但這創造了鎖定固定收益具吸引力孳息率的機會。

- 核心通脹正在接近央行的目標,而主要央行意識到政策行動存在滯後性後,應當會著手進行減息。

- 固定收益市場普遍預計經濟將會實現軟著陸,而投資者應當尋找能夠提供價值,但不會在經濟硬著陸情況下遭受重挫的領域。

有一個著名的笑話,一位在愛爾蘭迷路的遊客向一名當地人詢問前往都柏林的路線,當地農民皺著眉頭回答道:「好吧,先生,如果我是您,就不會從這裡開始走。」

幾年前的固定收益投資者會對此深有同感。當時孳息率處於歷史低位,上漲的可能性較大,而債券提供的收益有限。如今,固定收益市場情況截然不同。目前的孳息率水平高於通脹,且在利率下降的情況下更可能帶來資本收益。

因此,對於尋求具吸引力回報的投資者,此時是入市良機。我們認為,未來六個月,固定收益極有可能同時帶來不俗的收益及若干額外資本增值。

減息未如預期起步,但貨幣寬鬆正在進行中

固定收益市場一直聚焦減息的時間。這不僅需要關注經濟及通脹數據,而且需要關注政策制定者本身。市場並不指望央行糟糕的預測能力。相反,市場重視央行是因為他們負責制定政策。

央行明確承認自己缺乏預見力,因此高度「依賴數據」及保守。問題是央行關注的主要指標(通脹及就業)屬於滯後指標。更糟糕的是,央行的政策工具同樣具有滯後性。 由於通脹居高不下,市場重新調整對減息次數的預期,預計聯儲局將於本年度減息1或2次,而非年初預計的6至7次。1若未來數月通脹表現與預期不符,該作法將導致政策失誤。

推遲減息的必然結果是固定收益投資者有更多機會鎖定具吸引力的孳息率。投資者在等待減息的同時獲取進賬

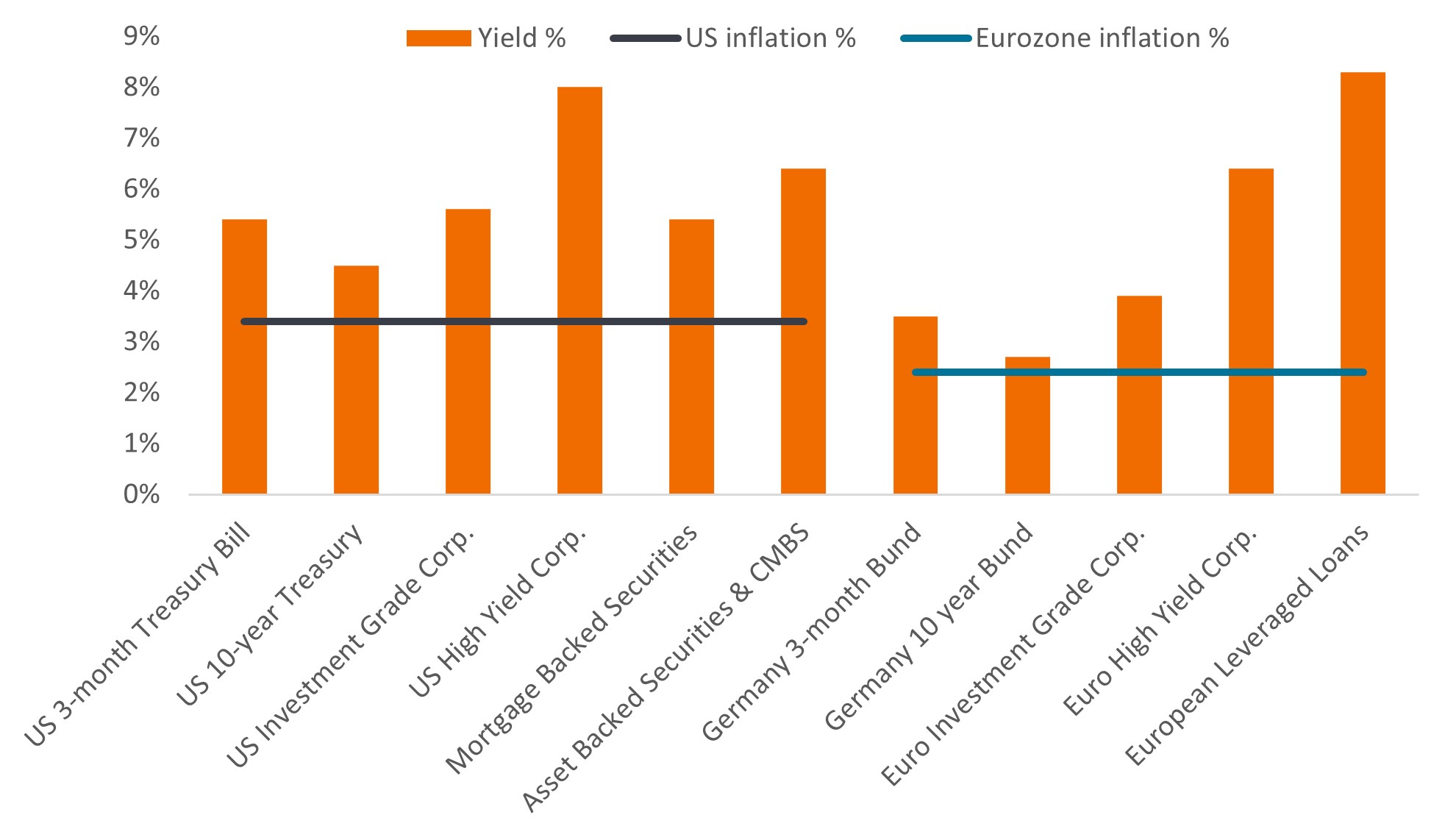

圖1:收益孳息率高於通脹

資料來源:彭博,通脹率,截至2024年4月30日的按年變動%:美國所有城市消費者所有項目的消費物價指數、歐元區消費物價調和指數。截至2024年5月31日的孳息率(按時間順序排列):3個月美國國庫券、美國10年期國庫債券、ICE美銀美國企業債券指數(最差孳息率)、ICE美銀美國高收益債券指數(最差孳息率)、ICE美銀美國按揭抵押證券指數、ICE美銀美國資產抵押證券及商業按揭抵押證券指數、3個月德國國債、10年期德國國債、ICE美銀歐洲企業債券指數(最差孳息率)、ICE美銀歐洲高收益債券指數(最差孳息率)、瑞士信貸西歐槓桿貸款指數。最差孳息率指發行人不違約時債券(指數)可達到的最低孳息率;計及特殊特徵,例如認購期權(賦予發行人在指定日期贖回債券的權利)。孳息率可能隨時間推移而有所變動,概不作出任何保證。

在美國以外地區,環球減息週期已經開啟。新興市場於去年下半年開始減息,此後減息步伐加快。在已發展國家,瑞士國家銀行於2024年3月打響減息的第一槍,隨後瑞典國家銀行於5月宣佈減息,加拿大央行及歐洲央行亦於6月減息。利率機制正在發生變化。

通脹回落是否減慢?

通脹是造成美國推遲減息的原因。造成通脹回落停滯的原因眾多,例如是機票、汽車保險或租金。在會計領域,有時公司會過於頻繁地使用「特殊項目」一詞,這會令投資者對公司的盈利能力產生懷疑。對於聯儲局及其對抗通脹的行動,我們是否應當採取同樣負面質疑的態度?

我們的答案是否定的。首先,通脹回落減慢出現在所有商品層面,包括波動較大的食品及能源價格。核心通脹仍呈下降趨勢。其次,通脹不會呈直線變化,因此我們應當容許偶爾出現波動。再次,通脹數據素以滯後性而聞名,按當前水平來看,距離聯儲局設定的目標並不太遠。事實上,若美國採用(歐洲常見的)消費物價調和指數指標來反映通脹,美國的通脹率將為2.4%。2此外,消費者對美國及歐元區來年的通脹預期仍然穩定在3%左右。3

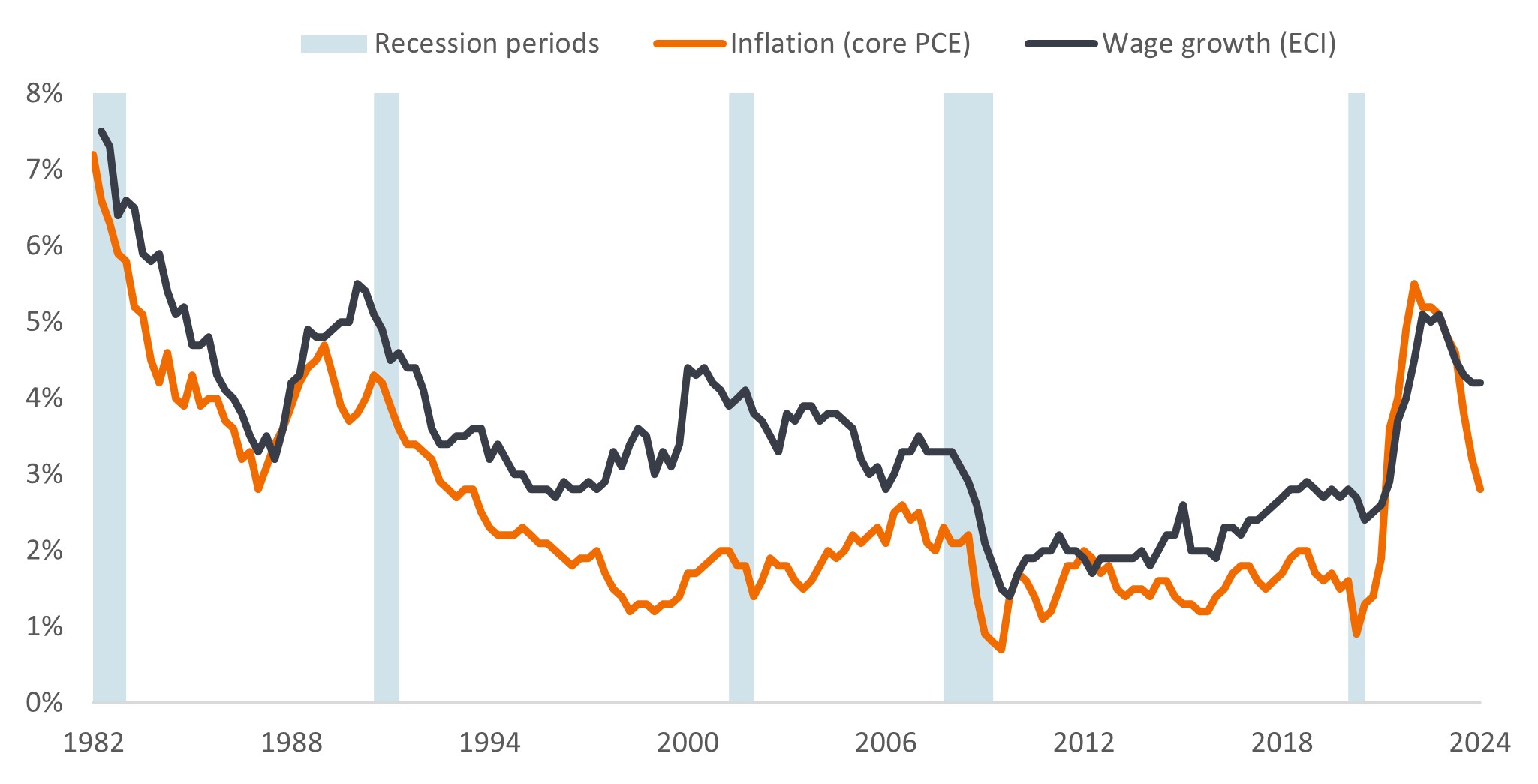

大多數經濟體的工資需求亦有所放緩。研究顯示,工資增長往往是通脹的症狀,而非通脹的成因。4因此,通脹回落很可能是凸顯工資需求的下降趨勢。雖然市場可能需要再耐心等待數月,但下降趨勢保持不變。

圖2:通脹往往會帶動工資增長(按年變動%)

資料來源:美國經濟分析局、不包括食品及能源的個人消費支出(核心個人消費支出)。工資增長以就業成本指數(總薪酬,所有平民)表示,1982年第一季至2024年第一季的季度數據(按年變動%)。核心個人消費支出是聯儲局首選的通脹指標。恕不保證過往趨勢將會延續,或者預測將會實現。

無為亦即有為

隨著2024年歐洲國家盃於今夏拉開帷幕,我們不禁想起一些關於守門員及十二碼大戰的研究。守門員傾向於往某個特定方向撲救十二碼,而如果他們只是留在球門中間,實際上可以扑出更多十二碼。 這是因為守門員對於不採取行動(留在中間)的進球感覺比採取行動(跳到兩側)更糟。5

央行官員可能會認為,既然經濟溫和增長,勞工市場健康發展,而通脹得以遏止,這樣的話何不按兵不動?畢竟,與造成經濟疲軟或失業相比,放任通脹上升會對央行官員造成更大的聲譽損失。然而,他們心知政策同樣具有滯後性,利率維持在當前水平的時間越長,融資壓力就越大。

去年的區域型銀行及最近債務水平過高的公司已經暴露出各種問題。然而,次投資級別債券的違約率僅輕微上升,且預計於今年餘下時間歐洲及美國次投資級別債券的違約率將維持在3%至5%的中低個位數。

違約率偏低的原因是投資者願意向企業提供貸款。發行人隨時有買家吸納債券的技術性環境一直有利好作用,但部分原因在於市場預期來年利率將會下調。這變相鼓勵投資者在債券孳息率相對較高的情況下鎖定已發行債券的孳息率,同時樂見未來利率向下應該有利經濟和企業的環境。

凡事都要適度

除非經濟意外大幅增長或出現通脹衝擊,否則很難看到主要央行加息。因此,利率市場面臨的風險是減息次數及速度不及預期。所以,我們更看好歐洲市場多於美國,原因是歐洲的經濟相對疲弱,提高了減息的可見度。

對於許多固定收益資產而言,經濟強勁(但並非過度強勁)增長而令減息速度放緩未必是壞事,而經濟增長對盈利及現金流量有利。考慮到美國經濟穩健增長但增速有所放緩、歐洲經濟復甦以及對中國經濟前景的悲觀情緒減弱的經濟環境,信貸息差可能會收窄。在企業板塊中,我們繼續看好利息覆蓋率良好、現金流強勁的公司,並且在一些不受青睞的領域(例如房地產)看到價值所在。

然而,我們明白整體信貸息差處於歷史低位,若企業前景轉差,便幾乎沒有任何緩衝空間。基於這一點,我們認為分散投資具有作用,尤其是不妨投資於證券化債務,例如按揭抵押證券、資產抵押證券及貸款抵押憑證。投資者對該等資產類別存有誤解,加上利率波動的殘留影響,意味著這些資產類別的息差及孳息率看來相當吸引。從歷史數據來看,證券化板塊的孳息率較具吸引力,在經濟更嚴重放緩的情景下,較不容易受到影響。

避而不談的棘手問題

鑒於今年下半年將迎來多場具有決定性意義的選舉,包括美國總統大選,我們沒有理由不顧及政治因素。大選可能會引起外界對政府債務水平及財政揮霍的關注,而法國成為最新遭受評級下調的主權債券發行國。6鑒於供應鏈樽頸緩和有助通脹從疫情後高位回落,這也可能重新引發大眾對貿易保護主義及貿易關稅的擔憂。

同樣,烏克蘭及中東的衝突可能出現不可預料的變化。2024年下半年政治風險上升,應當會吸引投資者轉向債券等傳統上風險較低的資產,該等資產能夠在經濟增長更顯著放緩或地緣政治風險升溫時提供一定保障。

總而言之,即使部分央行一直令市場等待,但政策寬鬆是2024年主旋律的實情並未改變。減息提供從固定收益獲得資本收益的潛力,但投資者不應忽視固定收益資產的收益特質。目前有大量收益機會可供選擇。

1資料來源:彭博,世界利率預測,2024年1月1日及2024年6月1日。恕不保證過往趨勢將會延續,或者預測將會實現。

2資料來源:彭博、歐盟統計局美國消費物價調和指數所有商品,於2024年3月31日(最新可得數據)。

3資料來源:紐約聯邦儲備銀行消費者預期調查(2024年4月),未來一年通脹預期,歐洲央行消費者預期調查(2024年4月),未來12個月通脹預期中位數。

4資料來源:《高工資會引發通脹嗎?》(Do higher wages cause inflation?),Magnus Jonnson及Stefan Palmqvist,瑞典國家銀行工作文件系列第159號,2004年4月,《勞工成本對通脹的影響有多大?》(How much do labour costs drive inflation?)Adam Shapiro,舊金山聯邦儲備銀行,2023年5月30日。

5資料來源:《精英足球守門員的行動偏見:十二碼案列》(Action bias among elite soccer goalkeepers: The case of penalty kicks),Bar-Li、Michael及Azar、Ofer H.及Ritov、Ilana及Keidar-Levin、Yaelr及Schein、Gailt,內蓋夫本古里安大學及以色列耶路撒冷希伯來大學(Ben-Gurion University of the Negev and Hebrew University of Jerusalem, Israel)。

6資料來源:標普全球評級,法國評級從AA級降至AA-級,2024年5月31日。

3-Month US Treasury is U.S Treasury bill that will mature 3 months from the date of purchase.

10年期美國國庫券是一種美國國債,自購買日起10年到期。

ICE 美國銀行美國企業指數追蹤在美國國內市場公開發行的以美元計價的投資等級企業債券。

ICE 美國銀行美國高收益指數追蹤在美國國內市場公開發行的低於投資等級的美元計價的公司債券。

ICE 美國銀行美國按揭抵押證券指數追蹤美國機構房利美(Fannie Mae)、房地美(Freddie Mac) 和吉利美(Ginnie Mae) 在美國國內市場公開發行的以美元計價的固定利率抵押貸款傳遞證券。

ICE 美國銀行資產抵押證券和商業按揭抵押證券指數(ICE BofA US ABS and CMBS Index)追蹤在美國國內市場公開發行的以美元計價的投資等級固定和浮動利率資產抵押證券以及固定利率商業按揭抵押證券。

3 個月期德國國債是德國政府債券,自購買日起 3 個月後到期。

十年期德國國債是德國政府債券,自購買日起 10 年到期。

ICE 美國銀行歐元企業指數追蹤在歐元債券或歐元成員國國內市場公開發行的以歐元計價的投資等級企業債務。

ICE 美國銀行歐元高收益指數以歐元計價, 追蹤在歐元區內或歐洲債券市場公開發行的低於投資等級的企業債劵。

The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leverage loan market. Loans denominated in US%$ or Western European currencies are eligible for inclusion in the index.

Asset-Backed Securities (ABS): A financial security that is backed (or collateralised) with existing assets (such as loans, credit card debts or leases), usually ones that generate some form of income (cash flow) over time.

Cash flow: The net amount of cash and cash equivalents transferred in and out of a company. Or a general term for the movement of money from one account to another.

Commercial Mortgage-Backed Securities (CMBS) are fixed income investments backed by mortgages on commercial properties rather than residential real estate.

Core Personal Consumption Expenditure (PCE) Price Index is a measure of prices that people living in the US pay for goods and services, excluding food and energy. It is a measure of inflation.

Credit rating: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P ranks investment grade bonds from the highest AAA down to BBB and high yields bonds from BB through B down to CCC in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

信貸息差是指年期相若但信貸質素不同的證券的孳息率差距,息差擴大一般反映企業借款人的信譽惡化,而息差收窄則反映情況有所改善。

違約:債務人(例如債券發行人)未能在到期時支付利息或歸還原始貸款金額。

Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal consolidation or discipline is when a government seeks to reduce its borrowing by spending less or raising taxes, fiscal easing or largesse is the opposite.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Inflation: The rate at which prices of goods and services are rising in the economy. Core inflation typically excludes volatile items such as food and energy prices. A common measure for inflation is the Consumer Price Index (CPI).

Interest cover ratio: This ratio reflects how well a company can pay the interest due on outstanding debt. It is typically calculated by dividing a company’s earnings before interest and taxes by its interest expense during a given period.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Leverage: This is a measure of the level of debt in a company. Net leverage is debt (minus cash and cash equivalents) as a ratio of earnings (typically before interest, tax, depreciation and amortisation). A leveraged company is typically one with high borrowings.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary loosening refers to central bank activity aimed at reinvigorating the economy by cutting interest rates.

Mortgage-Backed Securities (MBS): A security which is secured (or backed) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds.

經濟衰退:經濟活動顯著下降的現象持續超過幾個月。軟著陸是指可避免經濟衰退的經濟增長放緩。

Refinancing: The process of revising and replacing the terms of an existing borrowing agreement, including replacing debt with new borrowing before or at the time of the debt maturity.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. The investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the U.S. government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, at its most simple, this is calculated as the coupon payment divided by the current bond price.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e., the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

Volatility measures risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.

重要資料

固定收益證券 受到利率、通脹、信貸和違約風險的影響。債券市場表現波動。隨著利率上升,債券價格通常會下跌,反之亦然。不保證可退還本金,如發行人未能及時還款或其信貸實力減弱,價格可能下跌。

高收益債券或「垃圾」債券涉及較大的違約風險及價格波幅,可能出現突然及急劇的價格擺動。

按揭及資產抵押證券等證券化產品對利率變化較為敏感,牽涉續期及提前還款風險,信貸、估值及流動性風險高於其他固定收益證券。