US$1 trillion by 2030: the rise of active ETFs in Europe

Nick Cherney, Head of Innovation, explains why he believes European domiciled actively managed exchange traded funds (ETFs) will grow to US$1 trillion by 2030 – and what that means for investors.

6 minute read

Key takeaways:

- We believe the European domiciled active ETF market will grow to US$1 trillion by 2030, driven by shifting investor preferences, demographic pressures, and rising interest from global investors.

- The predicted growth of the European active ETF market underscores a broader trend in the global financial landscape, where immediacy, transparency, and active management are becoming increasingly valued.

- Against this backdrop, investors domestically and globally are likely to increasingly consider allocations to European domiciled active ETFs.

We believe European domiciled actively managed exchange traded funds (ETFs) will grow from under US$50 billion today to reach more than US$1 trillion by 2030. Investors, particularly within younger demographics, are increasingly expecting the transparency and timeliness of trading that ETFs provide. This, in our view, will drive evolution in the European asset management industry that follows the strong ETF growth trajectory seen in the US. But how has the ETF industry developed so far, and what can investors in Europe expect in the coming years?

The evolution of ETFs

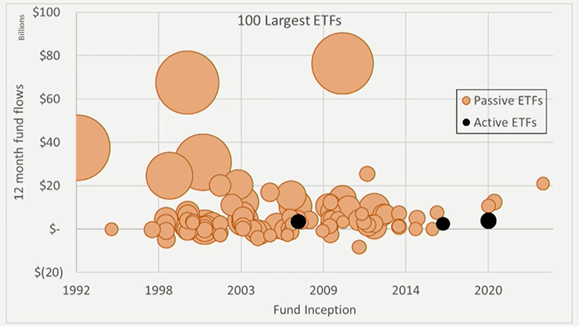

The history of ETF investing globally is marked by significant milestones and developments. The first ETF, SPY, was launched in 1993 to invest in the S&P 500 and now holds over 4% of global ETF assets. Over the years, the ETF market has grown to include nearly 13,000 ETFs globally, listed in at least 54 different countries, with assets around US$14 trillion. Initially, ETFs were synonymous with passive investing, where fund sponsors promoted the idea of investing in the total market. This era was characterised by the rise of index funds and the notion of “set and forget” investing. However, while the financial crisis of 2009 and recent market volatility have highlighted the need for more nuanced investment strategies, the industry is still dominated by passive ETFs, as figure 1 shows. In fact, the three largest are passive S&P 500 ETFs listed in the US, which in total have more than US$1.5 trillion in assets – more than the entire active ETF market. Only 16 of the largest are domiciled outside of the US.

Figure 1: Largest ETFs: dominated by large, passive strategies listed in the US

Source: Janus Henderson Investors, Bloomberg Professional, as at 30 August 2024. Shows the largest 100 ETFs globally with the size of the circle representing assets under management.

So, what led to the growth of ETFs? The benefits of the ETF structure were key, such as tax efficiency (notably in the US), tradability, and transparency. The second phase of evolution saw the introduction of bond ETFs and the early growth of the European ETF market. The growth in Europe had initially been hampered by challenges related to market fragmentation and regulatory differences, but these are starting to be overcome. The rise of independent financial advice, robo platforms, self-directed investing, and model portfolios further drove the adoption of ETFs, particularly among younger investors who sought the immediacy of intraday trading that the vehicle structure provided. Today, the market has evolved to include a variety of active strategies – and this is where we see the most exciting growth potential in Europe.

The growth potential of European active ETFs

In early 2021, I made a bold prediction that total assets in active ETFs globally would triple to reach US$1 trillion by 2025. Many considered this forecast to be overly ambitious and unrealistic. However, I was pleased to be proved correct with the goal surpassed in September 2024.

Today, it is essential for investors to focus on the future of active ETFs in Europe and the growth potential this brings. This gives me confidence in a new prediction. I believe that by 2030 assets in active ETFs domiciled in Europe will grow from their current level of under US$50 billion to reach the US$1 trillion mark. This growth will likely be driven not only by the rising interest of European investors in newer, active funds and the benefits of the ETF structure, but also by global investors, especially from Latin America, Asia, and the Middle East, all looking to grow ETF allocations beyond the US market as fund availability and liquidity increase.

How do we envision the US$1 trillion mark being reached in the next six years? Support for the prediction comes with a shift in focus from the largest ETFs to the fastest growing globally. Here, as illustrated in figure 2, we find that 15% are actively managed, 29% are domiciled outside of the US, and 38% are less than ten years old. This adds weight to the thesis that the market’s current concentration in a relatively low number of funds dominated by US passive strategies will likely change – and markedly.

Figure 2: Fastest growing ETFs: a shift towards active, younger, and ex US offerings

Source: Janus Henderson Investors, Bloomberg Professional, as at 30 August 2024. Shows the 100 ETFs globally with the strongest 12-month fund flows with the size of the circle representing assets under management.

Why active management matters

This shift is also reinforced by feedback we receive from clients on the ground. Yes, passive investing worked well through the era of historically low interest rates in which the rising tide lifted all boats. But this was not ‘normal’ on a longer-term perspective. Accommodative policy and the reach for yield resulted in wave after wave of macro developments and style factors influencing the trajectory of entire asset classes. Many investors grew comfortable with top-down, momentum, and passive strategies. Going forward, however, there is an acknowledgement that such strategies will likely face challenges, as a higher cost of capital and rapid innovation will likely lead to diverging fortunes between visionary companies and also-rans.

Distinguishing between these two camps by leveraging fundamental research and industry expertise should enable expert investors to resume their historical role of allocating capital to its most productive use. This is an environment for active investing, with a need to carefully navigate macro drivers and bottom-up security selection opportunities.

Poised for expansion

At a time when investors are looking for investment products that work hard on their behalf, coupled with immediacy and transparency of trading, the European domiciled active ETF market is poised for significant expansion. Partnering with expert asset managers can help investors navigate this evolving landscape and capitalise on the opportunities presented. At Janus Henderson, we have seen this play out in the US and client demand for our ETFs has led to us becoming the fourth largest active fixed income ETF provider globally.1 We now look forward to helping investors understand and participate in the growth of ETFs in Europe as they position themselves for success and a brighter future.

IMPORTANT INFORMATION

Past performance does not predict future returns.

There is no guarantee that past trends will continue, or forecasts will be realised.

S&P 500 is a market-capitalisation-weighted index of 500 leading publicly traded companies in the US.

1Source: Janus Henderson Investors, ‘Janus Henderson’s pioneering AAA CLO ETF (JAAA) surpasses $10 billion in AUM’, press release (10 June 2024)

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis and the investment choices they make.

Bottom-up investing: Bottom-up fund managers build portfolios by focusing on the analysis of individual securities, rather than broader macroeconomic or market factors, in order to identify the best opportunities in an industry or country/region.

Exchange traded fund (ETF): A security that tracks an index, sector, commodity, or pool of assets (such as an index fund). ETFs trade like an equity on a stock exchange and experience price changes as the underlying assets move up and down in price. ETFs typically have higher daily liquidity and lower fees than actively managed funds.

Fundamental research: The analysis of information that contributes to the valuation of a security, such as a company’s earnings or the evaluation of its management team, as well as wider economic factors. This contrasts with technical analysis, which is centred on idiosyncrasies within financial markets, such as detecting seasonal patterns.

Fixed income securities are debt instruments issued by a government, corporation, or other entity to finance and expand their operations. They provide investors a return in the form of fixed periodic payments and the eventual return of principal at maturity.

Macro drivers: Macroeconomics is the branch of economics that considers large-scale factors, or drivers, related to the economy, such as inflation, unemployment or productivity.

Passive investing: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively managed fund.

Robo platform: An investment platform that manages investments on an investor’s behalf using personal information such as age, risk tolerance, investment timeline. Algorithms are used to select investments with the intention of maximising returns within an acceptable level of risk to suit the individual.

SPY: SPDR® S&P 500® ETF Trust was the first ETF, launched in 1993 to provide exposure to the S&P 500 Index.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price. For investment trusts: Calculated by dividing the current financial year’s dividends per share (this will include prospective dividends) by the current price per share, then multiplying by 100 to arrive at a percentage figure.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.