Staying invested, staying patient: examining the case for resource stocks

Daniel Sullivan, Head of Global Natural Resources, discusses the outlook for 2024 and examines whether investors should revisit their allocations to the resources sector.

7 minute read

Key takeaways:

- 2023 has been a weak year for natural resource shares versus broader equities, and the sector has already priced in a lot of potential risks related to slower economic growth.

- Growing populations, the shift to renewable energy and decarbonisation, reshoring of supply chains, and capital discipline are supporting the long-term case for resource stocks.

- Key considerations for exposure to resources include diversification, quality of holdings, and the need for good or improving environmental, social and governance (ESG) profiles.

Softness in China’s economy, among other things, led to a weak year for natural resource shares relative to the broader equity market.1 Despite this, we feel that having a well-diversified exposure to natural resources has rarely looked more important as we head into 2024.

While geopolitical matters are almost impossible to predict, we think it is possible that 2024 could bring something of a “return to normal” in the macroeconomic environment. Over the past four years, commodity markets have been rocked by everything from COVID-19 and China-US trade tensions to fighting in Ukraine and the Middle East. As these conflicts reach some resolution in 2024, political attention in the US will turn increasingly to domestic affairs ahead of November’s elections. In our view, any return towards normalised trade and geopolitical relations would be positive for natural resource companies.

Growing demand for resources

Thankfully, our positive outlook on resource shares is underpinned by secular trends that are somewhat easier to assess or predict. First, the world’s population is still growing – the United Nations estimates that the Earth’s population passed eight billion in 2022 and will pass nine billion before 2040. Most of this growth is coming from developing countries that continue to pursue higher standards of living, including reducing the considerable gap between their consumption of food, energy, and materials versus developed countries. Secondly, developed economies are in the early stages of shifting to renewable energy, electric vehicles, and reshoring of supply chains. This will require the upheaval and duplication of existing infrastructure and will be very resource intensive. For example, a report released by the International Energy Agency (IEA) suggests that keeping track with current emission pledges would require around 80 million kilometres of power line installations or upgrades by 2040, an amount equivalent to the existing global grid.

In our view, the developing nations trend referred to above could blow the IEA’s prediction of peak oil demand by 2028 out of the water. Meanwhile, the developed nations’ shift to renewables could lead to even greater demand for certain metals and materials than we saw during China’s urbanisation drive in the 2000s.

Resource companies are well positioned

The supply side also looks encouraging in many sectors. While food demand looks set to rise, the amount of farmable land is falling due to urbanisation and the effects of changing weather patterns. Meanwhile, mining capital expenditure remains near 30-year lows due to higher costs, regulatory hurdles, and better capital discipline from mining majors. It is a similar story in the energy sector, where many oil majors have shunned growth capital expenditure in favour of retiring debt and buying back common stock. As a result, the balance sheets of many major natural resource companies look exceptionally healthy. We believe that companies like these are well positioned to ride out volatility and capitalise on opportunities for shareholder value creation.

Positive view on select areas

At the industry level, we are optimistic about the prospects for major oil producers, uranium, and gold miners. Oil prices fell towards the end of 2023 yet remain in profitable territory, helped in no small part by the Organization of the Petroleum Exporting Countries + (OPEC+) taking a far more proactive approach to managing prices. Gold performed poorly in absolute terms for much of 2023 amidst fast rising Treasury yields, but interest rate cuts now appear more likely than significant increases, and we are seeing many miners with attractive investment opportunities ahead of them. Meanwhile, uranium has performed well as utilities get serious about restocking their inventories. However, supply remains constrained due to years of falling prices and demand continues to grow thanks to the growing acceptance of nuclear power as a vital cog in a lower emissions energy mix. We also remain positive on lithium and copper, two key inputs for the increasing use of renewable energy and electric vehicles.

Assessing the risks

At the time of writing, close to the end of 2023, we believe that many natural resource shares have already priced in a lot of potential risks related to slower economic growth in the US and China. A less heralded risk is what will happen if funding and regulatory factors prevent responsible companies from producing enough energy and materials to maintain and grow standards of living. This could lead to higher sustained costs for commodities and disruptive price spikes in times of geopolitical turbulence. Although supply shocks can bring bumper short-term returns like those seen in 2022, we are of the view that they help nobody – both producers and consumers – with both benefiting from manageable prices rather than chaos.

Another underappreciated issue is that the natural resource sector is failing to attract a broad enough range of talent to science, technology, engineering, and mathematics (STEM) roles in the sector. These careers entail working on some of the most important challenges to society – most notably the need to provide life-enriching resources while minimising the environmental damage for future generations. Attracting new talent and different ideas from underrepresented groups like women and minorities could lead to a significant payoff for society.

Investors are significantly underweight a sector that plays a key role in decarbonisation

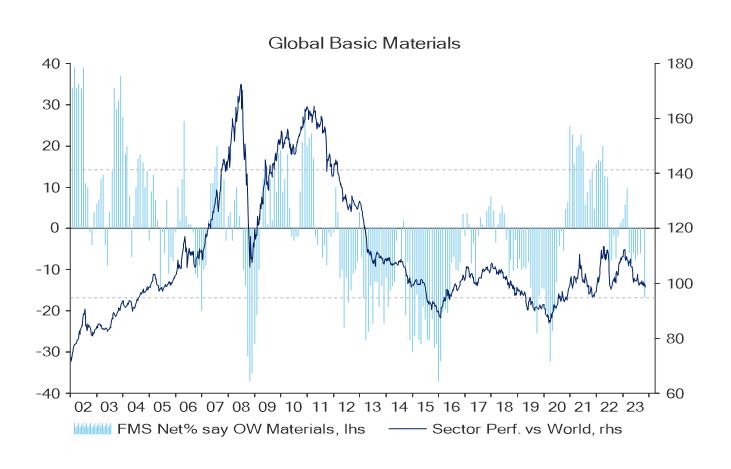

Given all the above, one could argue that natural resource companies play a bigger role in the world’s future than ever before. Yet most investors have minimal exposure to these companies (Figure 1).

Figure 1: Global investors are underweight metals and mining stocks

Source: BofA Global Research estimates. EMEA Metals & Mining 1 December 2023. There is no guarantee that past trends will continue, or forecasts will be realised. Republished with permission. FMS= fund manager survey; OW=overweight.

The MSCI World Index, which represents around 98% of equity market capitalisation worldwide, has just a 11.5% weighting to companies in the natural resources investment universe. Drill down further to mining companies – potentially the biggest enabler and beneficiary of the net zero transition – and this weighting falls to just 1.5%. For context, this is like the 0.05% weighting of mining companies at the height of the dot-com boom in 2000 and far below the 2.3% weighting reached at the top of the “China” super cycle in the early 2000s.2 Given that we expect the decarbonisation demand cycle to surpass that of the China boom, we believe that a well-diversified exposure to these companies makes sense. Previous mining upcycles have been hard to time and have often gathered pace very quickly. As a result, we are happy to be patient holders of firms boasting world-class assets, high quality management, strong financial positions and good or improving environmental, social and governance (ESG) profiles.

1 S&P Global Natural Resources Index vs MSCI World in USD terms, year-to-date to 8 December 2023. Past performance does not predict future returns.

2 Factset, Janus Henderson Investors analysis, MSCI All Countries World Index as at 30 November 2023.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time, used to gauge the financial health of a company.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.

IMPORTANT INFORMATION

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

There is no guarantee that past trends will continue, or forecasts will be realised.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.