Sitting in cash? What’s your next move?

Global Head of Client Portfolio Management Seth Meyer discusses the hidden risks and potential strategic pitfalls of sitting in cash.

6 minute read

Key takeaways:

- Amid higher interest rates, and consequently higher yields, investors have piled into cash. We believe it’s time to make a move.

- In our view, cash should be seen as an asset to provide for short-term (less than 12 months) liquidity needs. Beyond that, investors should consider an appropriately diversified portfolio to achieve their financial goals.

- While short-term performance may or may not work out in investors’ favor, we believe that over the long term, the benefits of being invested will outweigh the potential short-term benefits of sitting in cash.

Chess is a unique game in that winning is almost entirely dependent on skill and strategy. There are no dice, shuffled cards, or random numbers; there is no element of chance or luck.

For the best chess players in the world – the grandmasters – their key strategic strength lies in their ability to think many moves ahead (as many as 15-20) across multiple lines of play.

Their end goal? The checkmate – to win the game.

Investing and chess are alike in that strategy is critical to success. Notwithstanding the risk of the unknown in financial markets, we believe strategy is a vital aspect of investing.

This is of topical importance because in the U.S. alone there is currently more than $6.3 trillion sitting in cash (or money market funds) – more than at any point in history and almost double compared to five years ago. The key drivers of this trend have been a combination of excess liquidity that entered the financial system in response to COVID-19 and the higher yields on offer following the Federal Reserve’s (Fed) 525 basis points of rate hikes.

We get the appeal of cash. After a decade-plus of zero interest rates, savings accounts, money markets, and certificates of deposit are paying relatively attractive yields with negligible risk. Additionally, some investors may be worrying about a recession, opting to park their funds in cash and adopt the wait-and-see approach. Now that cash is giving them something, some investors may not feel like they are sacrificing much to be in a risk-off stance.

An easy target for a checkmate

While the 4-5% yields in U.S. money market funds are enticing, we believe investors need to think beyond their current move. Otherwise, in our view, their investment strategy may be facing a couple of strategic pitfalls.

First, cash yields are not defensible. If the Fed begins cutting rates this year, which it has signaled it intends to do, cash yields will drop in unison. While we do not expect the Fed to take rates back to zero, investors sitting in cash have not locked in current higher yields for any meaningful period.

Second, cash rates do not benefit from falling yields like many other risk assets. For example, fixed-rate bonds experience price appreciation when yields fall, and the present value of a company’s future earnings increases as rates come down, raising the value of its stock, all else equal.

Cash is king but for how long?

Investors who are parked in cash and waiting for some clarity around the future of the economy may find more risk in their approach than meets the eye. The veiled risk is that they are unknowingly making a bet on a single line of play: If their anticipated scenario does not materialize or if they do not see the signs they are looking for to get back into the market, they may be stuck without a next move.

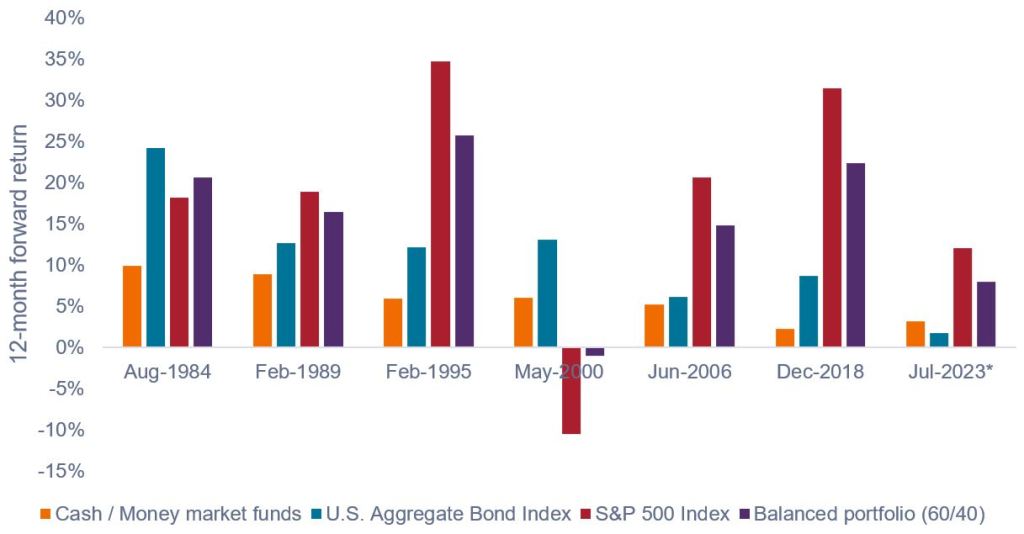

As shown in Exhibit 1, risk assets (stocks, bonds, and balanced portfolios) have largely outperformed cash in the 12-month period following the Fed’s last rate hike. The bottom line? We believe investors should be positioned for the next phase in the cycle because once markets do move, they are likely to move too fast for investors to react in time. This is important because missing out on the first leg up in a market rally may be one of the most significant drivers of inferior long-term returns.

Exhibit 1: 12-month forward returns following the Fed’s final rate hike

Cash has lagged risk assets in six of the last seven cycles once the Fed stopped hiking.

Source: Bloomberg, Janus Henderson Investors, as of 15 March 2024. *July 2023 period shows returns for the 7-month period from 31 July 2023 to 29 February 2024. Balanced portfolio is a combination of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index and assumes annual rebalancing. Past performance does not predict future returns.

How to think about strategy

Chess grandmasters spend a lot of time working on closing moves because effective strategies start with the end in mind. Successful investors can apply the same logic – defining one’s financial goals with a financial planner should be the first step in a goals-based approach to wealth management.

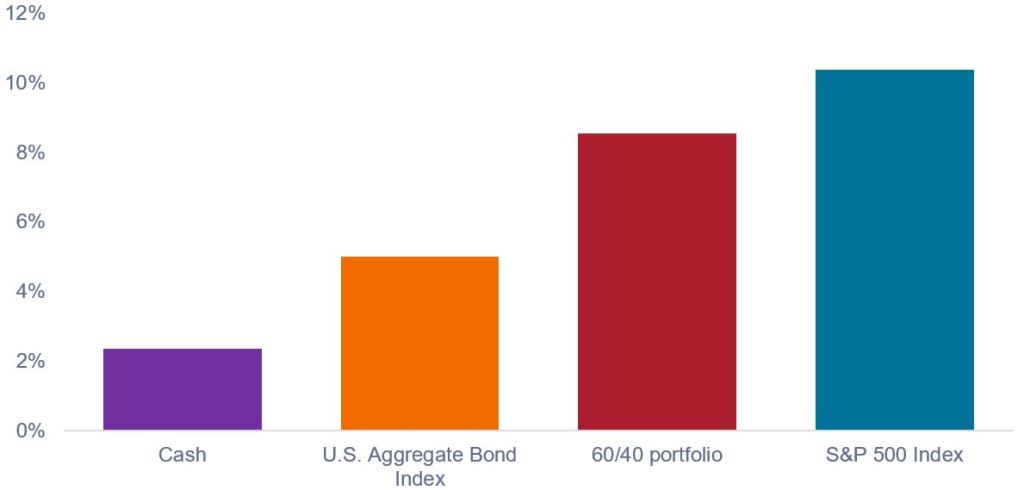

Once goals have been identified and quantified, we recommend investors stick to a strategy with a long-term perspective. In adopting this approach, cash should be seen as an asset to provide for short-term (less than 12 months) liquidity needs. Beyond that, risk assets have on average meaningfully outperformed cash over the long term, as shown in Exhibit 2. As a result, we think market timing strategies are risky due to the opportunity cost of being out of the markets. Similarly, waiting to get back in may prove costly in the long run.

Exhibit 2: Average rolling 5-year return (1996 – 2023)

Source: Bloomberg, as of 31 December 2023. Average of 5-year annualized rolling returns based on calendar year returns. 60/40 balanced portfolio is a combination of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index, and assumes annual rebalancing. Past performance does not predict future returns.

What’s your next move?

It may be daunting for investors who have been on the sidelines to think about moving back into risk assets. To mitigate some apprehension, several approaches may be considered, including:

- Dollar-cost averaging into risk assets over a 3–6-month period instead of putting all cash back to work at once.

- Investing in a 60/40 fund as a lower volatility option to an all-equity portfolio, particularly given stock/bond correlations are likely to normalize amid higher rates and a downtrend in inflation.

- Within equity allocations, focusing on high-quality, multi-year secular growth companies – especially those driven by digital innovation, artificial intelligence, and strong research and development – that have prospects to grow earnings despite an uncertain economic environment.

- Within fixed income, exploring multisector funds with the potential to offer higher yields than money markets, as well as price appreciation should yields fall.

- Seeking out cash-plus options for additional yield.

We believe investors who are sitting in cash should consider a next move that is congruent with a solid long-term strategy. In our view, reallocating to risk assets will prove more beneficial in the long run to achieving their financial goals.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Investing involves market risk and it is possible to lose money by investing. Investment return and value will fluctuate in response to issuer, political, market and economic developments, which can affect a single issuer, issuers within an industry, economic sector or geographic region, or the market as a whole.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.