Medical devices, tools, and insurers make the case for a rebound

Healthcare’s nontherapeutic subsectors have lagged in 2023. Portfolio Manager Andy Acker and Research Analyst Tim McCarty believe that could change in the coming year.

7 minute read

Key takeaways:

- Managed healthcare, life sciences tools and services, and medical devices have underperformed in recent months due to post-pandemic rationalization and idiosyncratic events.

- We believe many of the challenges are short term and could find resolution starting in 2024.

- Meanwhile, stock valuations have declined and, in our view, do not reflect the long-term growth potential of the industries.

Given this year’s excitement around new weight-loss therapies – and the double-digit rise of the related drugmakers’ stocks – it might be surprising to learn healthcare as a whole has lagged the broader market in 2023.

Much of that underperformance has been concentrated in the sector’s nontherapeutic areas, particularly managed healthcare, life sciences tools and services, and medical devices.

But we think the trend could soon change. Here, we explain the reasons for each industry’s underperformance, and why we believe the outlook could improve starting next year.

Lower valuations, less uncertainty for managed care

After a strong run during last year’s market sell-off, managed care stocks began 2023 with higher-than-normal valuations. That put them at a disadvantage when a series of negative shocks hit this year.

First, enrollment numbers in Medicaid (the health plan for low-income households) declined when the COVID-19 public health emergency expired, and states resumed verifying eligibility. In commercial policies (those offered by employers), investors worried a potential recession would lead to layoffs and, therefore, a drop in membership numbers. Meanwhile, Medicare Advantage (a private version of the federal insurance program for the elderly), saw reimbursement rates fall after years of significant rate increases.

Other factors were also at play: There was optimism that the Federal Reserve was nearing the end of its rate-tightening cycle; managed care companies reinvest premiums and benefit from higher rates. And demand for routine medical care rebounded, causing some insurers to lower earnings outlooks as utilization costs climbed.

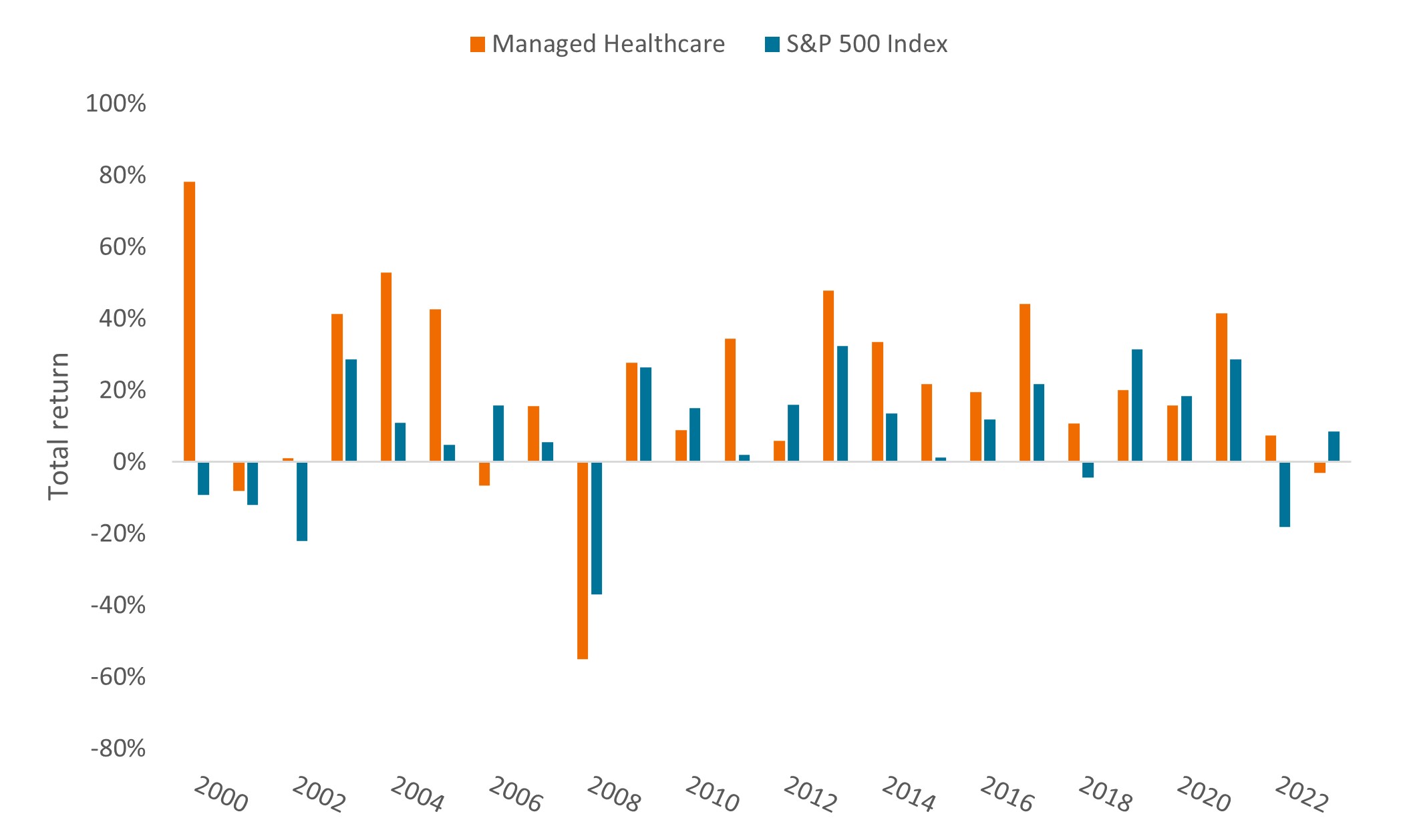

As numerous as the issues have been, managed care rarely stays beaten down for long given the consistent nature of demand for healthcare (Figure 1). Those who lose Medicaid coverage, for example, could now be eligible for heavily discounted plans through the health insurance marketplace. With roughly 10,000 people turning 65 every day in the U.S., Medicare Advantage is still the industry’s fastest growth area, and higher volumes and revised plan designs could help offset lower reimbursement rates. And there’s growing consensus that interest rates could stay higher for longer.

Figure 1: Managed care underperforms in 2023

However, since 2000, it has been rare for the industry to lag the S&P 500® Index for two consecutive years.

Source: Bloomberg, data as of 31 October 2023. The Managed Healthcare subsector is a cap-weighted benchmark of the managed care companies in the S&P 500 Index. Past performance does not predict future returns.

Source: Bloomberg, data as of 31 October 2023. The Managed Healthcare subsector is a cap-weighted benchmark of the managed care companies in the S&P 500 Index. Past performance does not predict future returns.

We’d also note that we are heading into an election year in the U.S., which in recent periods has created volatility for managed care. But we believe this election cycle may prove less damaging to the industry, as candidates have stayed away from the drastic proposals of years past, such as overhauling the Affordable Care Act or implementing universal health coverage.

As such, a combination of reduced election risk, better clarity around enrollment and costs, and the possibility of a prolonged period of elevated rates – along with valuations that have now turned lower – could set up managed care for better performance in 2024.

Tools regroup after pandemic boom

Companies that provide life sciences tools and services saw a surge in demand during the pandemic, as research and development for COVID vaccines and therapeutics soared and the need for diagnostics rose. Supply chain disruptions also drove many biopharma firms to double order drug manufacturing components to protect against shortages, inflating sales of so-called bioprocessing products.

These demand trends began to normalize in 2023 as the pandemic waned. But investors have worried about the duration of the slowdown, especially given funding shortages in biotech amid tight capital markets. China’s sluggish economic reopening, along with uncertainty around changes to drug pricing under the 2022 Inflation Reduction Act (IRA), have added to the pessimism.

We think the sell-off may be overdone. Most companies forecast that the worst of the bioprocessing inventory destocking is now behind us (or will bottom out in the coming months), while over the long term, we don’t see evidence of a permanent reduction in pharmaceutical R&D spend due to the IRA. China also has a multiyear plan to build out a domestic biotech industry regardless of near-term cyclical challenges. In the meantime, firms have acted to right-size cost structures for the current environment, which is expected to support profit margin expansion starting in 2024.

Medical devices down, not out

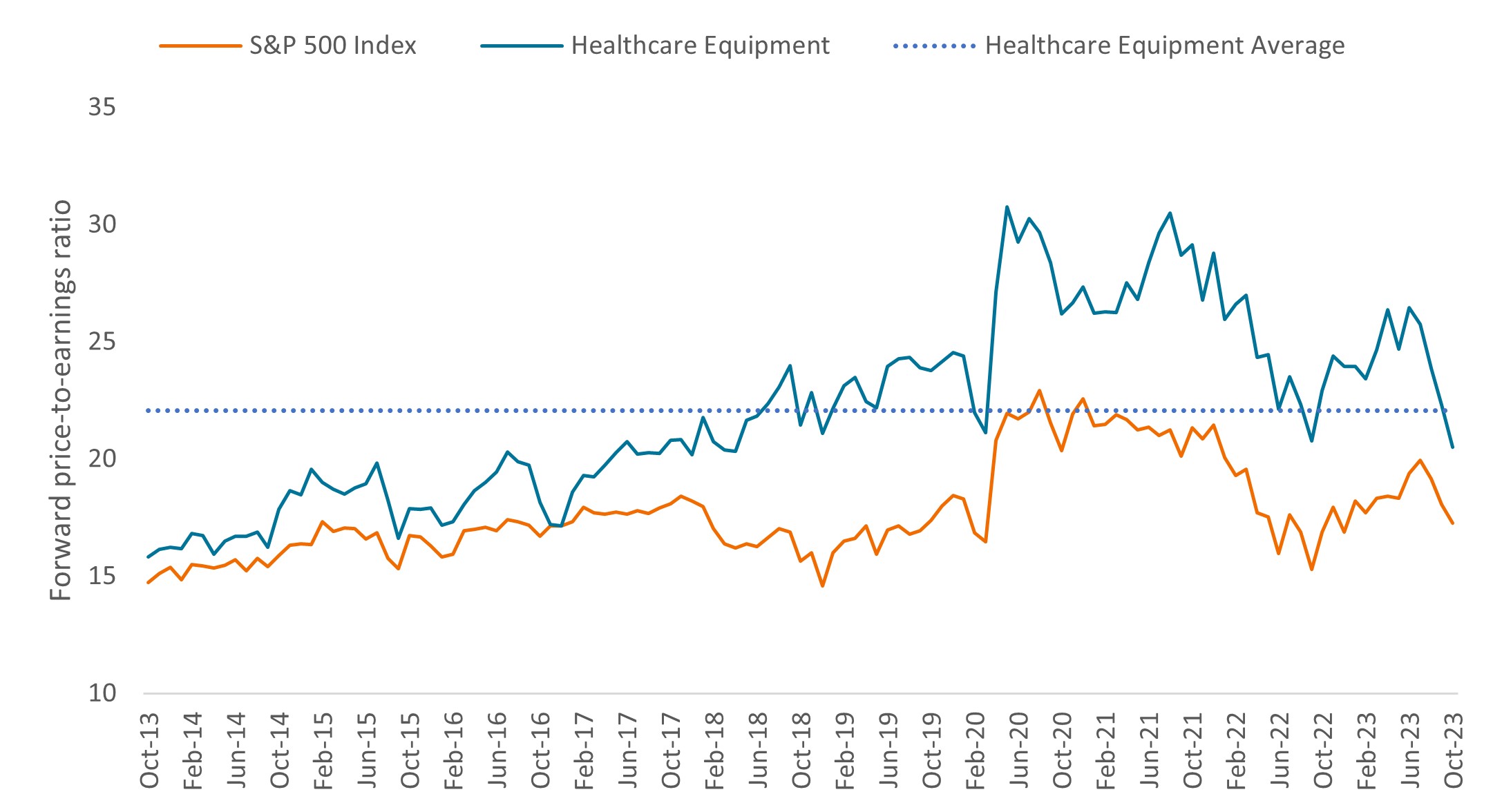

After trailing the sector in 2022, medical device stocks got off to a strong start in the first half of 2023, as pent-up demand for routine surgeries and other care was finally unleashed. Since then, however, many of the stocks have given up their gains and seen their valuations plummet (Figure 2). The culprit: the new class of weight-loss drugs called GLP-1 agonists.

Figure 2: Medical device stocks fall victim to GLP-1s

Having given up 2023 gains, the medical device subsector trades at a discount to its long-term average.

Source: Bloomberg. Data are monthly and reflect 12-month forward price-to-earnings ratios, from 31 October 2013 to 31 October 2023. The Healthcare Equipment subsector is a cap-weighted benchmark of the healthcare equipment companies in the S&P 500 Index. Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Source: Bloomberg. Data are monthly and reflect 12-month forward price-to-earnings ratios, from 31 October 2013 to 31 October 2023. The Healthcare Equipment subsector is a cap-weighted benchmark of the healthcare equipment companies in the S&P 500 Index. Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

GLP-1s have shown to deliver unprecedented levels of weight loss in patients (roughly 15%-20%), and in August, a landmark study demonstrated that one GLP-1, Wegovy, also reduced the relative risk of adverse cardiovascular events such as heart attack and stroke by 20%. These and other studies have led investors to worry that GLP-1s could obviate the need for devices across several large and related disease categories, including diabetes, sleep apnea, heart disease, and orthopedics.

Certainly, based on current trends the market for GLP-1s could be sizable, with sales forecast to top $100 billion by 2032. But at the same time, much remains unknown. Ongoing clinical research is being done, and there are still questions about cost, reimbursement, and patient willingness to stick with treatment in the drugs’ current formulation, a once-weekly injectable.

Furthermore, it could take decades to bend the demand curve for medical device procedures. For example, for an overweight 60-year-old with osteoarthritis, a GLP-1 prescribed today is unlikely to eliminate the need for a knee procedure since osteoarthritis is largely irreversible.

Medicine is also rarely binary. Statins, for instance, help lower cardiovascular disease but have not materially reduced the need for heart devices. And in some cases, GLP-1s could be a tailwind for the industry: 10% of orthopedic procedures cannot be performed because a patient’s body mass index is too high. Additionally, the demand for medical devices is heavily related to age, so if GLP-1s help people live longer, this could ultimately be a tailwind for the device industry.

Even so, medical device stocks could experience near-term volatility as GLP-1s continue to dominate the narrative. We think that could be an opportunity for long-term investors who can tune out the noise and take advantage of valuations that, in our view, reflect the market’s knee-jerk reaction, not a measured outlook for the sector.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.