The cherry blossom season has arrived again this year. The Japan Meteorological Agency plans to announce the blooming of Tokyo’s cherry blossoms earlier this year (typically it is late March to early April). The Japanese love cherry blossoms, which bloom all at once before falling in less than ten days. They admire the fleeting and graceful nature of cherry blossoms, seeing it as a reflection of their own lives. Blooming cherry blossoms signal new beginnings but at the same time, the short duration of its beauty reminds us of life’s impermanence.

Why does the Meteorological Agency predict the blooming of cherry blossoms? It’s because their prediction is very simple and hardly ever wrong. This is because the blooming of cherry blossoms is calculated based on the temperature patterns and cumulative temperatures since the coldest day. Moreover, most cherry blossoms seen in Japan are genetically identical clones – these trees do not bear fruit and can only be propagated through grafting. For me, it feels somewhat strange for people to have such a strong affection for artificial cherry trees!

Yen undervaluation is a major boost for tourism

The cherry blossom season, which usually runs from March to April is very popular with foreign visitors, with numbers look set to surpass an all-time high of 40 million in 2025. In recent years, inbound tourism to Japan has experienced a huge boom. According to Japan’s National Tourism Organization, the number of visitors to Japan was 13.4 million in 2014. Ten years later, this number expanded to 36.9 million.

Japan is seeing an increase in visitors not because the cherry blossoms have become three times more beautiful. It’s because prices have nearly halved. The USD/JPY exchange rate, at 103 yen to a US dollar in March 2014, depreciated to a record low of almost 162 yen in 2024.

Given many countries are used to higher prices each year, Japan seems to be an anomaly, hence the large influx of tourists eager to take advantage of this price differential in a country that historically was expensive to visit.

Better affordability is not limited to travel expenses. For example, real estate prices in Hokkaido’s Niseko ski resort region, considered to have the best snow quality in the world, have been rising at the highest rate in more than five years. The prices of apartments in many major cities are also at an all-time high, yet there is a strong buying interest from foreign investors. At the end of last year, despite a very low cap rate (yield), private equity giant Blackstone agreed to buy a mixed-use commercial property complex in Tokyo for US$2.6 billion, the largest real estate investment by a foreign investor in Japan.1

Japanese equities represent good value

Aside from the economic boost from more tourist dollars and a stronger property market, how has Japan’s stock market fared?

Investment decisions seem to be influenced more by short-term stock price movements than by a change in fundamentals. There was a significant influx of funds into Japanese stocks in the first half of 2024, but those positions were mostly unwound by the end of the year.

Japanese stocks have returned around 8% p.a. in US dollar terms over the past decade.2 Given the current undervalued valuations relative to history, it seems counterintuitive for investors to be impatient and adopt short termism.

Yen appreciation is due

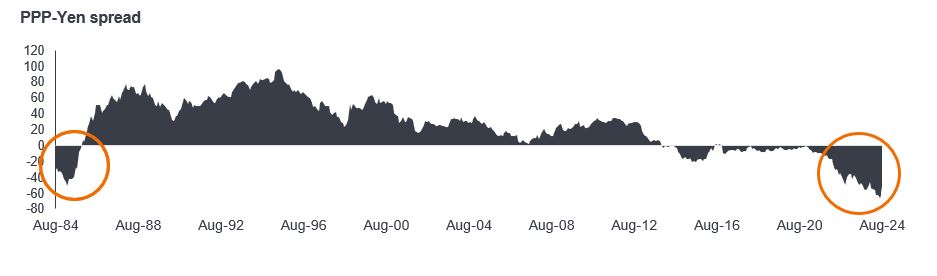

The USD/JPY exchange rate is currently at an undervalued level that can be considered abnormal in relation to purchasing power parity (the rate at which the currency of one country would have to be converted into that of another country to buy the same amount of goods and services). The actual exchange rate between the two currencies is lower than what PPP would suggest, meaning the yen is likely to appreciate to its median value.

This undervaluation of the yen is thought to be due to the large interest rate gap between the US and Japan. However, as the Bank of Japan abandons its negative/very low interest rate regime and steadily hikes rates, this will reduce the interest rate differential, helping USD/JPY to mean revert towards the PPP rate – a trend that is gradually happening.

The yen is undervalued versus history

Source: Janus Henderson Investors, Bloomberg, as at August 2024. These are the fund manager’s views and should not be construed as advice and may not reflect other opinions in the organisation. The views are subject to change without notice. Spreads are subject to change without notice.

A key concern for investors is the fear that yen depreciation will impact foreign currency-based returns. But I believe once a dollar-weakening trend begins and is observed, it will bring inflows into Japanese equities.

The attractiveness of Japanese equities is anything but fleeting

Reasons to be positive on this market, such as steady earnings growth, the positive impact of the revival of an inflationary economy, and the dramatic positive changes in corporate governance are being observed and look set to continue.

Investors who have invested in apartments near Niseko ski resorts should not overlook the potential of Hokkaido as one of the best summer resorts, particularly for the beauty of its summer flower fields. Kyoto is also enchanting during the cherry blossom season, but I believe the best times to visit are during the rainy season in June, and the cold, crisp air typical in February. Both are considered to be off-peak tourist seasons, allowing one to enjoy beautiful Kyoto at a lower cost.

Therefore, instead of trying to time the market like ‘Hanami’ cherry blossom viewers or skiers in Niseko – investors may want to consider an allocation to Japanese equities now.

Let me conclude with a Japanese proverb that can relate to investing:

ひとの行く裏に道あり花の山

Behind where people go, a way for a mountain of flowers

(If investors take a different path or view, it can be a rewarding experience)

1 Blackstone press room, as at 12 December 2024.

2 Source: Bloomberg, TOPIX 10 years to 28 February 2025. Past performance does not predict future returns. TOPIX (Tokyo SE First Section Index): a market benchmark covering an extensive proportion of the Japanese stock market and is a free-float adjusted market capitalization-weighted index.

Cap rate: capitalisation rate is calculated by dividing a property’s net operating income by its asset value. It is an assessment of the yield of a property over one year. Generally, the higher the cap rate, the greater the risk and return.

Mean reversion: suggests that, after an extreme price move, asset prices tend to return back to normal or average levels.

PPP: Purchasing Power Parity (PPP) is an economic theory that compares different countries’ currencies through a “basket of goods” approach. According to PPP, two currencies are in equilibrium when a basket of goods is priced the same in both countries, taking into account the exchange rates.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.