Healthcare’s small- and mid-cap opportunities amid aging populations

Healthcare is well positioned to benefit from the graying of populations in major global economies. Portfolio Managers Andy Acker, Dan Lyons, Jonathan Coleman, and Brian Demain explain how, in their view, investors can best capitalize on the megatrend in the sector.

8 minute read

Key takeaways:

- The number of people turning 65 and older is rising rapidly in some of the world’s largest economies and is likely to drive a commensurate increase in healthcare spending.

- Investors seeking to capitalize on this megatrend might find the greatest growth opportunities in small- and mid-cap firms, which are driving the sector’s innovation.

- Given the inherent risk of developing new therapeutics, minimizing downside risk when investing in healthcare is important – and lends itself it to an active approach, in our view.

With populations in large economies quickly aging, demand for healthcare is set to rise rapidly over the coming decades. By 2050, one in six people worldwide will be 65 or older – an age cohort that typically spends three times as much on medical services than younger generations and a pattern that stands in contrast to other consumption categories that tend to decline as people age.1

While the healthcare sector overall could benefit from graying populations, some of the biggest growth opportunities could occur in the innovations that target age-related conditions (i.e., Alzheimer’s, cardiovascular disease, cancer, and orthopedics). In our view, focusing on these growth areas – and the small- and mid-size companies driving the innovation within each – could help investors make the most of the demographic tailwind in healthcare.

Small/midcap lead innovation in healthcare

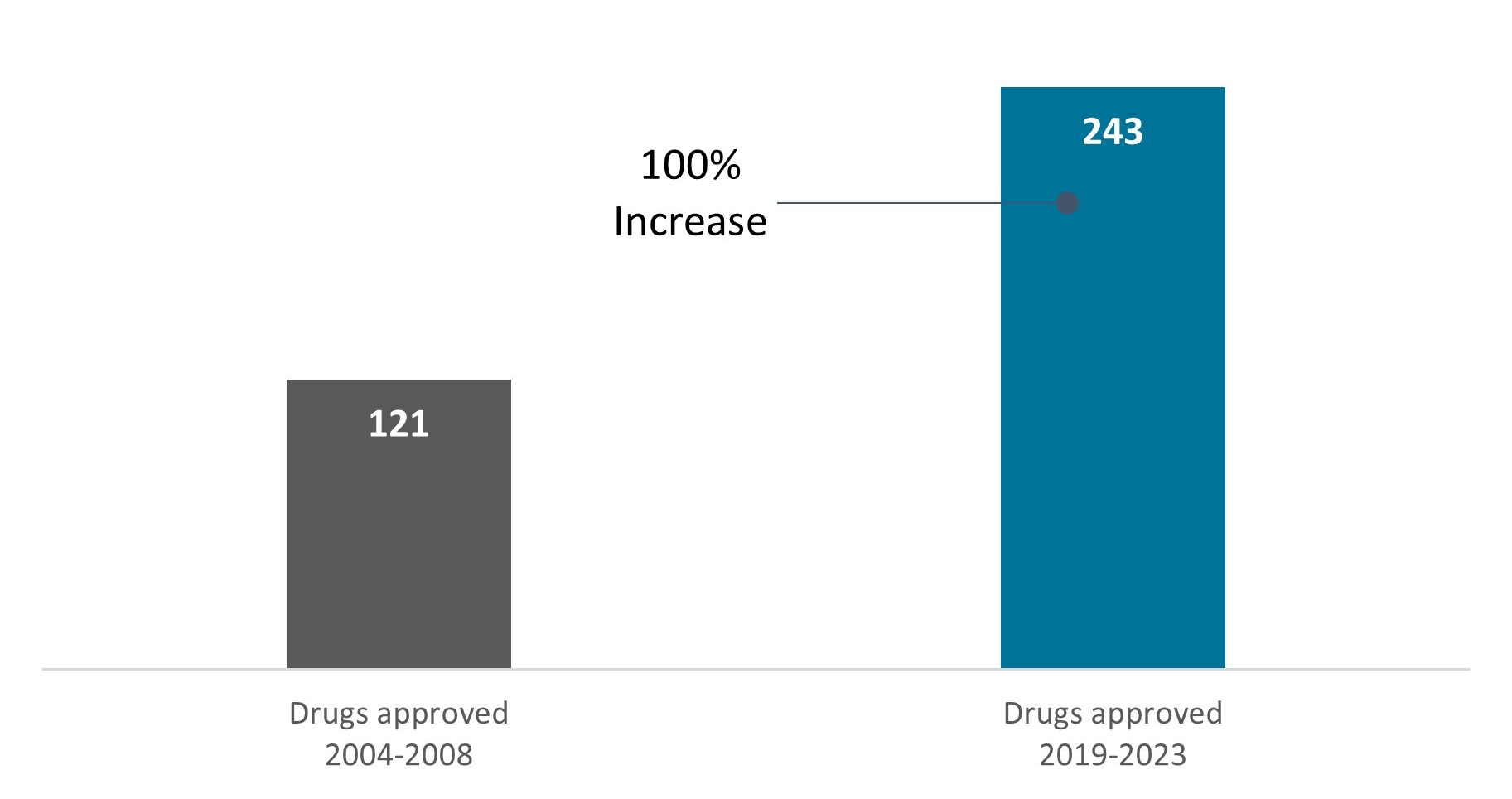

The aging of populations is occurring at a time when an accommodative regulatory environment and a better understanding of the biology of disease is leading to an explosion in advanced therapeutics. Over the last two decades, the number of drugs approved by the U.S. Food and Drug Administration (FDA) has increased 100%, with a record 73 novel medicines greenlighted in 2023 (Exhibit 1). These therapies include the first disease-modifying drug for Alzheimer’s and the first vaccines to help prevent respiratory syncytial virus (RSV) in those 60 and over, a condition that can be particularly dangerous for seniors (as well as infants).

Exhibit 1: Accelerating innovation in medicine

FDA-approved drugs

Source: FDA, as of 31 December 2023.

Many of these medicines were developed by small- and mid-cap companies. In fact, “emerging” biopharma firms are now responsible for 65% of molecules in the research and development (R&D) pipeline, up from roughly one-third in 2001. And over the last decade, the number of products filed for regulatory approval by emerging biopharma has increased fourfold.2

A similar trend is occurring in medical devices, life sciences tools, and drug manufacturing. In these industries, smaller-size companies have been aggressively investing in R&D, thanks to high gross margins and accelerating rates of innovation. As such, these firms have been responsible for some of the biggest advances in recent years, including next-generation genomic sequencing, radiopharmaceutical diagnostics, robotic surgery, high-energy shock waves that break up blocked blood vessels, and new ways to treat glaucoma. Or they are providing the advanced tools and manufacturing capabilities needed to develop and commercialize complex drugs.

Innovation + aging = growth opportunities

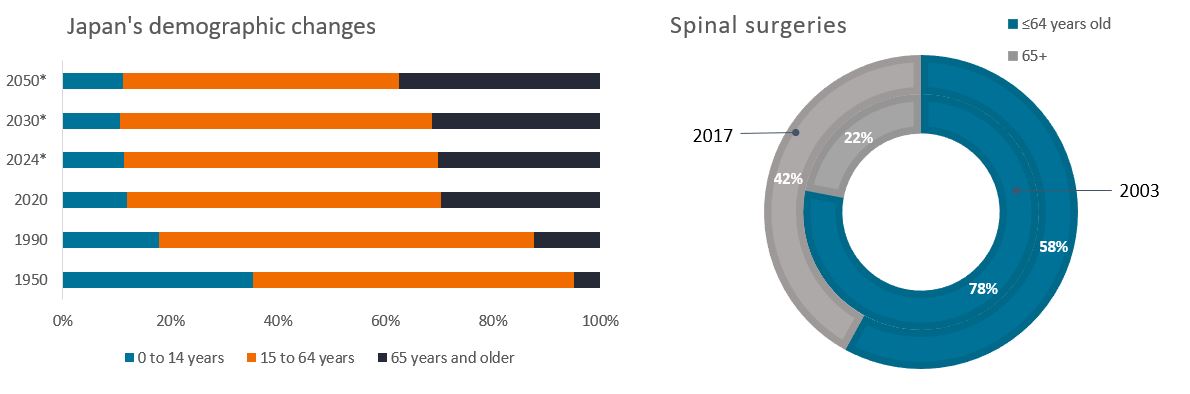

This combination of innovation and aging populations is creating a positive feedback loop for growth. For instance, as surgical techniques have gotten better with the aid of robotics and other devices, outcomes have improved, driving more patients to opt for surgery – all as the pool of patients needing surgery continues to grow. In Japan – a super-aging society, where roughly 30% of the population is age 65 and older and one in 10 people is at least 80 – the number of spinal surgeries has more than doubled since 2003, with the elderly making up a greater percentage of procedures (Exhibit 2).3

Exhibit 2: Japan’s aging population drives demand for medical services

Source: Economic and Social Commission for Asia and the Pacific, 2022.

Similar growth opportunities exist in novel drugs. Consider Alzheimer’s: More than 55 million people worldwide have dementia, with nearly 10 million new cases diagnosed each year.4 Alzheimer’s is the most common type of dementia, and for decades, no new treatments were made available to patients. That changed in 2023 when the FDA granted full approval to Leqembi, the first drug to slow the progression of cognitive decline. A second drug is expected to launch this year, and we remain hopeful for further innovation in the space as companies and regulators see the growing unmet medical need.

These and other advanced drugs increasingly take the form of biologics – large molecules that are produced using a living system, such as a microorganism or animal cell. Given the difficulty of manufacturing these drugs to a consistently high standard, biopharma companies are seeking the help of contract development and manufacturing organizations (CDMOs) – third-party firms that support biopharmaceuticals throughout all stages of drug development and manufacturing. The CDMO industry is forecast to grow by more than 7% annually through the end of the decade, thanks in large part to demand from small- and mid-cap biopharma companies, which often lack the manufacturing capabilities of bigger peers.5

Minimizing downside risk

Such growth rates can translate to big returns for investors, but the inherent difficulty of developing and commercializing new therapeutics also poses significant risks. In biotech, for example, 90% of molecules that enter human clinical trials will never make it to market.6 Among therapies that do launch, our experience has found that Wall Street analysts either under- or overestimate a drug’s market opportunity 90% of the time. In addition, companies are subject to the whims of legislation and dependent on securing funding for R&D.

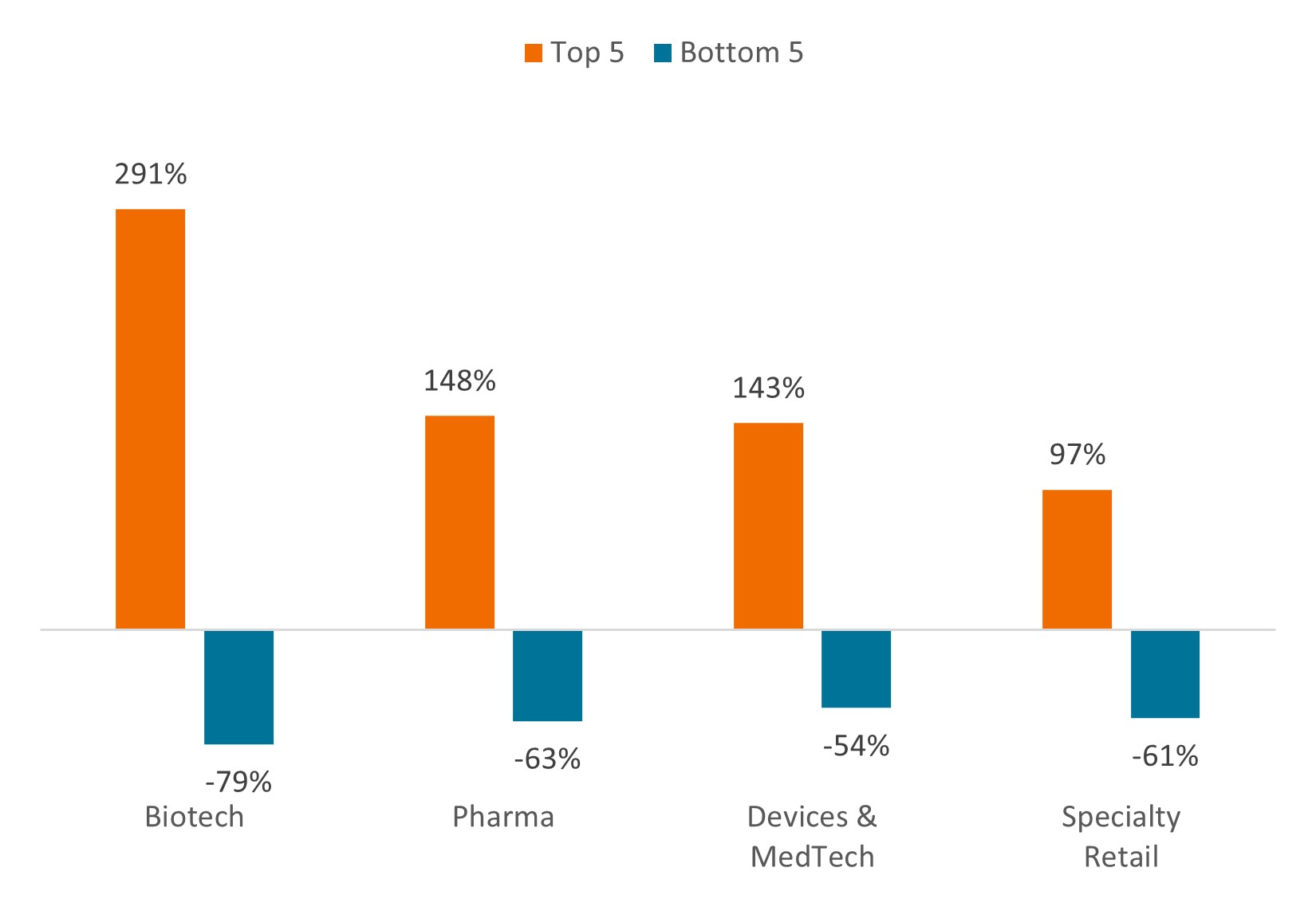

Investors, as a result, may benefit from a more active approach to investing in small- and mid-cap healthcare. Understanding both the science and commercial opportunities of new products could help reduce the wide disparity of stock returns the sector has historically experienced (Exhibit 3). It could also help investors navigate through near-term noise.

Exhibit 3: Healthcare has the biggest disparity between winners and losers

10-year average return of top/bottom 5 stocks

Source: Wilshire 5000 Index, 2014-2023. Based on analysis of 10-year period. The Wilshire 5000 is a market capitalization-weighted index that seeks to represent the broad U.S. equity market.

Source: Wilshire 5000 Index, 2014-2023. Based on analysis of 10-year period. The Wilshire 5000 is a market capitalization-weighted index that seeks to represent the broad U.S. equity market.

For example, when the U.S. Inflation Reduction Act (IRA) was passed in 2022, markets worried the law – which allowed for price negotiations for the first time for select drugs sold to the elderly – would hurt biopharma revenues. But a deeper dive would have also considered provisions that were positive for the industry, including a 13-year grace period for biologics (around the time most drugs lose patent protection anyway) and out-of-pocket spending caps on drugs, making it easier for seniors to afford their medications. The net result: While the IRA will likely have some negative consequences for specific firms, overall, the law is forecast to cost the global biopharma industry less than $200 billion in total revenue over 10 years, or under 2% of sales.7

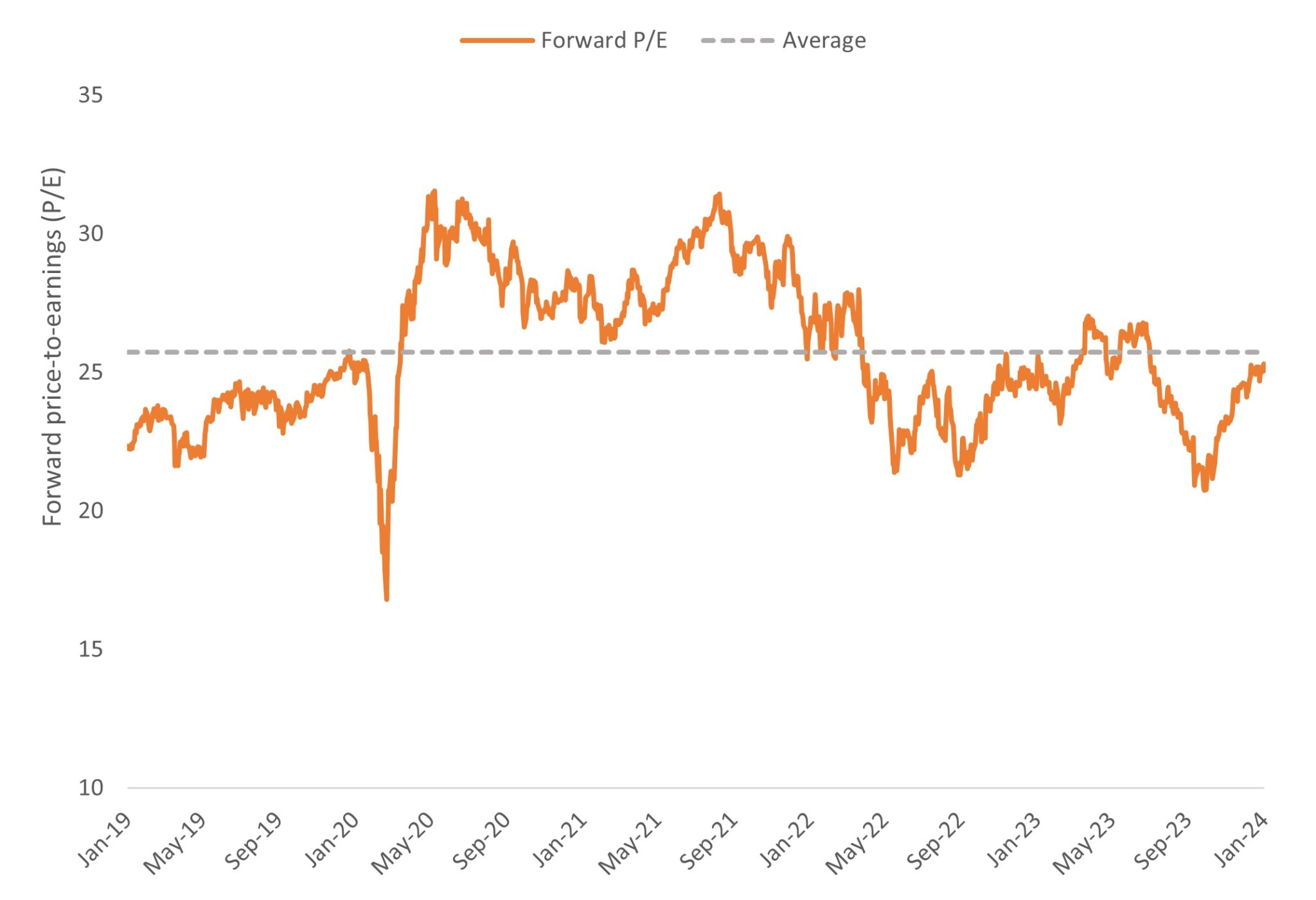

Valuations could yield additional upside

These periods of short-term volatility can create opportunities to buy into healthcare’s demographic tailwind at attractive valuations. In 2023, small- and mid-cap biotech, medical device, and tools companies were weighed down by rising interest rates and market distortions created by COVID-19. In turn, many valuations now look attractive relative to the broader market and long-term industry averages.

Exhibit 4: Valuations for medical device stocks look attractive

Forward price-to-earnings ratios for the S&P® Composite 1500 healthcare equipment industry

Source: Bloomberg, from 31 January 2019 to 31 January 2024. P/Es based on forward 12-month earnings estimates. The S&P Composite 1500 Health Care Equipment (sub-industry) comprises those companies included in the S&P Composite 1500 that are classified as members of the GICS® Health Care Equipment sub-industry.

Low valuations and promising pipelines have appealed to large-cap biopharmaceutical firms. These companies face a revenue shortfall in the coming years as many blockbuster products lose patent protection, making it critical for large pharma to replenish their pipelines.

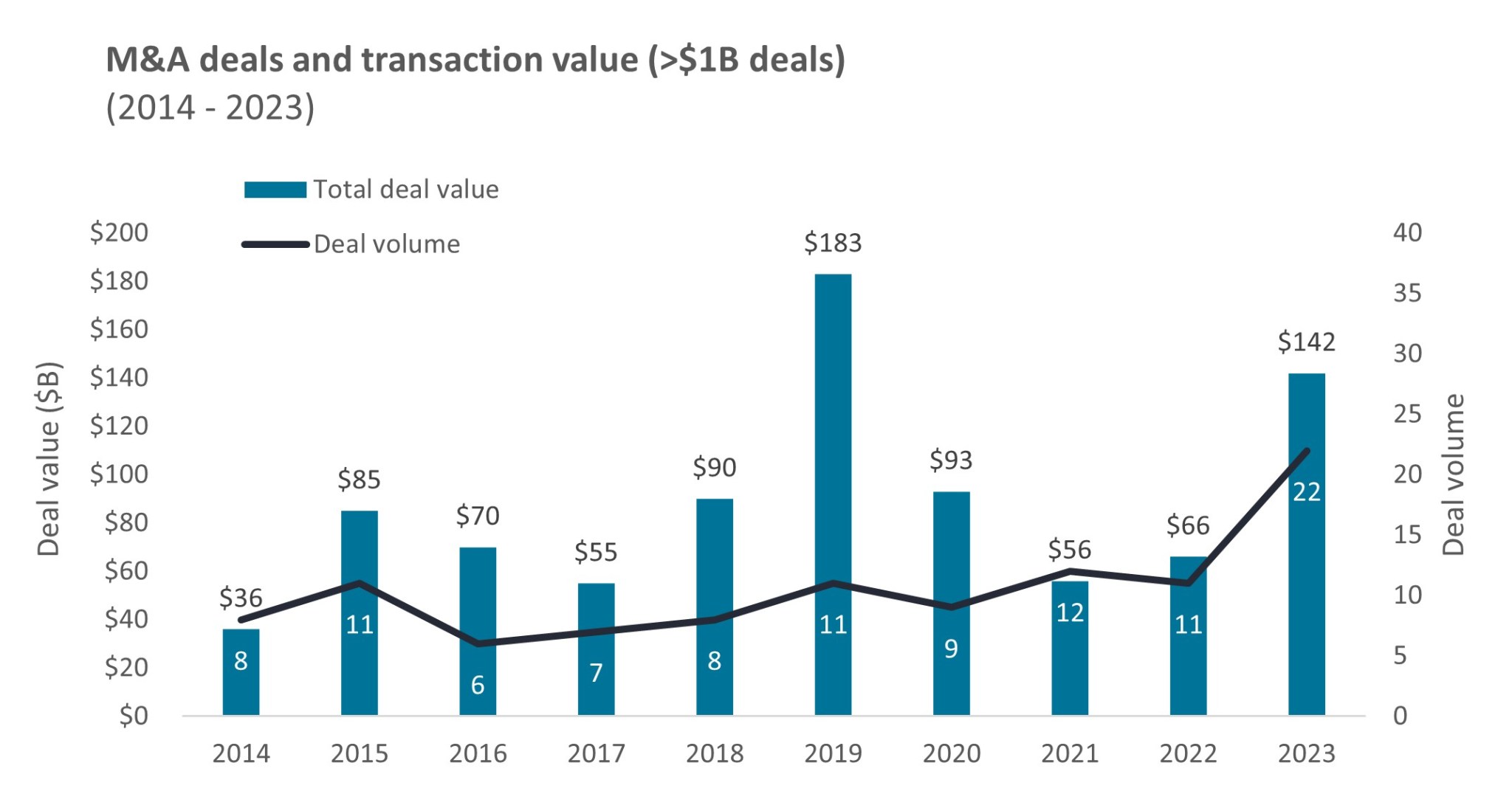

Not surprisingly, in recent months, we’ve seen an acceleration of merger and acquisition activity within the sector, with many firms being acquired at significant premiums. In the fourth quarter of 2023 alone, nine biotech deals valued at $1 billion or more were announced, nearly half of the total for the year (Exhibit 5). And in February, Novo Nordisk said it would acquire Catalent, a global CDMO, for $16.5 billion to help with manufacturing Wegovy, the popular GLP-1 weight-loss drug.

Exhibit 5: Biotech M&A volume and deal values rise

Source: TD Cowen, as of 31 December 2023.

Source: TD Cowen, as of 31 December 2023.

Note: Data reflect M&A deals >$1B in transaction value in the biotech sector.

Longer term, the appetite for medical innovation will likely only get stronger. As fertility rates drop and life expectancy grows in the U.S., Europe, Japan, China, and other economies, the percentage of the population that is elderly will continue to expand. Increased longevity could lead to new medical hurdles – and new market opportunities for innovative healthcare companies seeking to address those challenges. Investors should be ready.

1 Population: United Nations, December 2019. Healthcare spending: JAMA Network, “Comparison of Health Care Spending by Age in 8 High-Income Countries,” 6 August 2020. Data reflect 2015 figures for Australia, Canada, Germany, Japan, the Netherlands, Switzerland, the UK and the U.S.

2 “Emerging Biopharma’s Contribution to Innovation,” IQVIA, 31 June 2022. Data as of 31 December 2021.

3 “Trends in the numbers of spine surgeries and spine surgeons over the past 15 years,” Kazuyoshi Kobayashi, Et al., Nagoya Journal of Medical Science, February 2022.

4 World Health Organization, as of 15 March 2023.

5 “The Growing CDMO Market: 5 Trends Shaping the Industry,” ICQ, 9 March 2023.

6 “Why 90% of clinical drug development fails and how to improve it?” Duxin Sun, Et. al, Elsevier, July 2022.

7 Congressional Budget Office Cost Estimate, as of 15 July 2022.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Any risk management process discussed includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.