Key considerations for Japanese equity investors following the election of new LDP head, Sanae Takaichi.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Marketing communication.

Following French Prime Minister François Bayrou’s loss of a confidence vote, Robert-Schramm Fuchs explores the implications for investors and explains why he remains positive on Europe.

The doubling of Japanese sovereign bond yields over the past year could have negative ramifications for government issuers around the word.

Why the U.S. economy has a chance at avoiding recession. Plus, the opportunity we’re seeing in secular growth businesses.

The material costs of frittering away the U.S. dollar’s reserve currency status must be considered in any trade rebalancing.

Rather than favoring U.S. stocks at any price, investors may want to prioritize a global approach focused on valuation and free-cash-flow growth.

How fixed income markets are responding to Trump’s sweeping tariffs.

Can diversification help investors to ride out the uncertainty as US tariffs reshape global trade dynamics?

Key considerations for investors as markets await clarity on the Trump administration’s evolving tariff agenda.

Assessing market reactions to the Trump administration’s recently imposed tariffs.

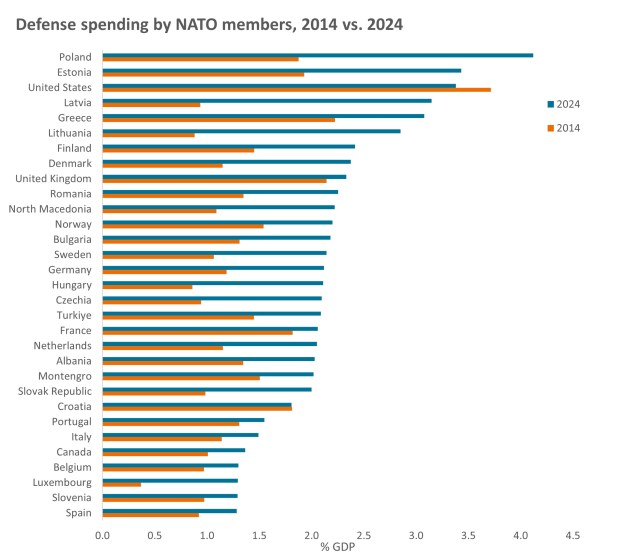

A changing geopolitical landscape is helping revive once slow-growing areas of the market, such as European defense.