Top-performing fixed income sectors in H1 2024: Securitized outpaces the Agg

In their mid-year check-in, Portfolio Managers John Lloyd and John Kerschner review the best-performing fixed income sectors through the first half of 2024 – what has worked, what hasn’t, and what it means for investors going forward.

5 minute read

Key takeaways:

- There has been significant dispersion in returns among various fixed income sectors through the first half of 2024.

- While securitized credit and sub-investment-grade indexes have registered positive returns, longer-duration assets and both the U.S. and Global Aggregate Bond Indexes have lagged.

- We believe investors should think beyond these static indexes – which are not fully representative of the fixed income universe – and consider a multisector approach to their bond allocation to ensure their portfolios are sufficiently diversified.

As we cross the midpoint of 2024, we think it would be beneficial to do a mid-year check-in to review how fixed income markets have progressed so far this year and what investors might expect in the latter half of the year.

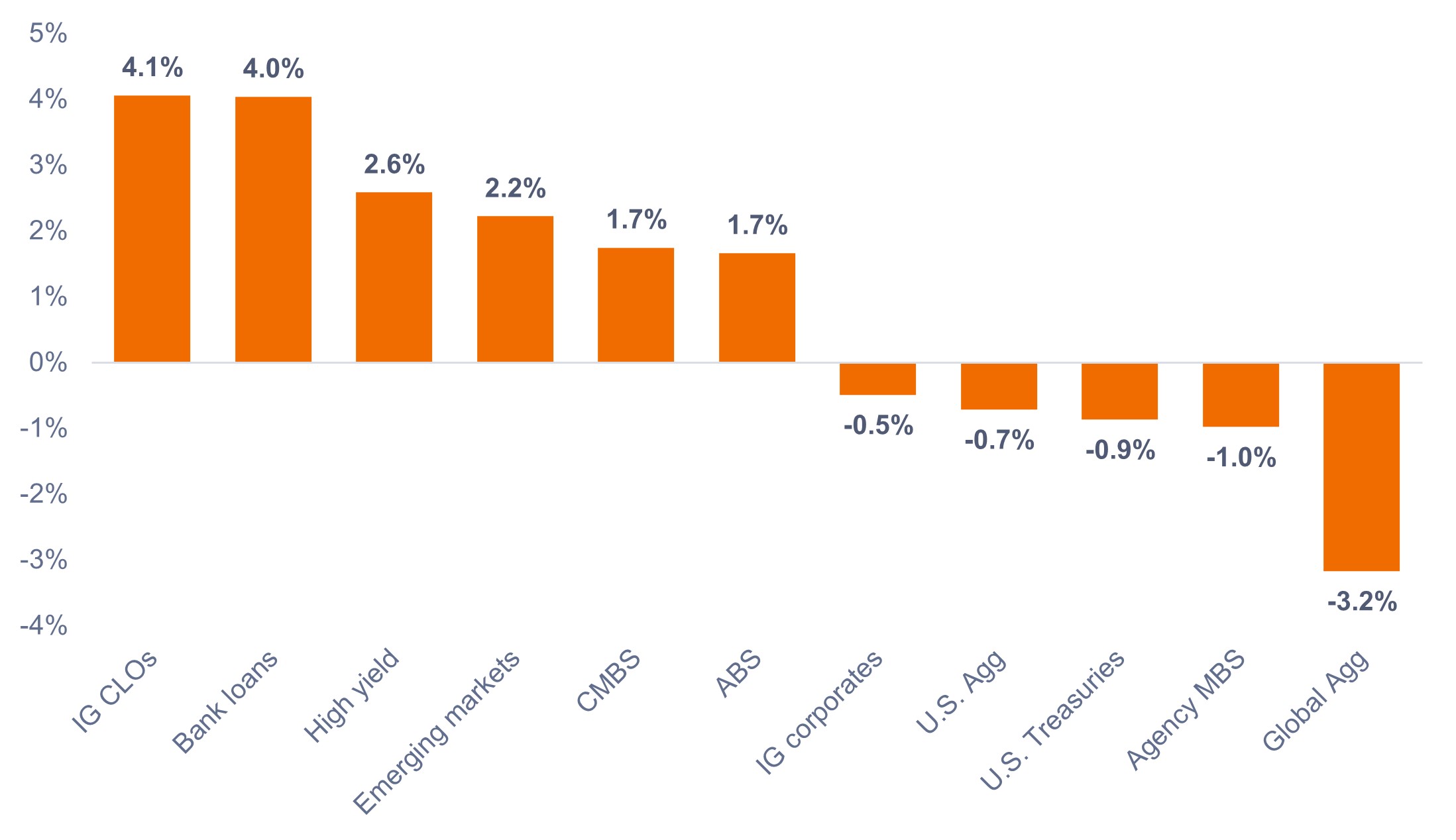

As shown in Exhibit 1, there has been significant dispersion in returns between the various fixed income sectors. Notably, many investors who hold portfolios that track the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) or the Bloomberg Global Aggregate Bond Index (Global Agg) as proxies for diversified bond portfolios may be frustrated by the fact that their portfolios are negative year to date through 30 June 2024.

JHI

In contrast, investment-grade collateralized loan obligations (IG CLOs), bank loans, and high yield were the three best-performing sectors, generating solid positive returns in the first half of 2024.

Exhibit 1: Year-to-date fixed income sector returns (Jan 2024 – Jun 2024)

Source: Bloomberg, as of 30 June 2024. Indices used to represent asset classes as per footnote.1 Past performance does not predict future returns.

Source: Bloomberg, as of 30 June 2024. Indices used to represent asset classes as per footnote.1 Past performance does not predict future returns.

What has performed well?

1. Securitized sectors (outside of agency mortgage-backed securities (MBS)). U.S. securitized credit has been trading cheap relative to corporates for some time and, as such, we believe securitized sectors offer compelling opportunities for attractive risk-adjusted returns. In H1 2024, securitized credit spreads broadly tightened (i.e., their bond prices rose), resulting in outperformance.

While CLOs have been the best-performing fixed income sector so far this year, commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) were other notable securitized subsectors to register positive returns.

2. Dollar-denominated emerging markets (EM) debt. EM debt has also been trading cheap relative to corporate credit, while many developing economies are ahead of the Federal Reserve (Fed) and other developed-world central banks in their rate-easing cycles. Countries with improving fundamentals and ratings potential, as well as countries in the sub-investment grade portion of the EM index, have been standout performers.

3. High yield and bank loans. Despite high-yield credit spreads trading near their historical tight levels and investor concerns around bank loan default rates, the high-yield and bank-loan sectors have outperformed. Robust incoming economic data and earnings, coupled with strong corporate fundamentals and favorable demand-supply dynamics, have supported returns in these sectors.

What has lagged?

Generally, sectors with higher interest rate risk, or duration, such as agency MBS and Treasuries, lagged in the first half of the year. This underperformance was due to yields moving higher as sticky inflation prints early in the year, coupled with sustained economic resilience, forced investors to reconsider the expected pace of rate cuts previously forecasted for 2024.

While yields retraced some of their earlier losses in May and June, the 10-year U.S. Treasury ended the first half at 4.40%, up 53 basis points (bps) from 3.87% at the beginning of the year. Rising yields resulted in the prices of longer-duration bonds falling.

Both the U.S. Agg and Global Agg suffered from their longer-duration profiles. Additionally, the U.S. Agg has only around 2% allocated to securitized credit sectors, so was not exposed to the sectors that performed best. The Global Agg also came under pressure due to its foreign currency exposure, which suffered as the U.S. dollar strengthened in the first half of 2024.

What do we anticipate for the second half of the year?

In our view, the second half of the year may look quite different from a rates perspective, in light of the progress made toward easing inflation in recent months and comments from the Fed suggesting that rate cuts are just around the corner.

The market is pricing in a nearly 100% chance of a 25 bp rate cut at the Federal Open Market Committee’s (FOMC) September meeting. And perhaps more importantly, the market is now expecting three cuts by the end of January 2025.

As a result, we think longer duration assets are likely to make a comeback as rate cuts drive falling yields. In our view, MBS are particularly well-poised to benefit from falling rates due to their longer-duration profile and heightened sensitivity to interest rate volatility, which we think will also diminish once the Fed starts cutting.

And while floating-rate assets will adjust lower when the Fed starts cutting, we believe attractive starting yields coupled with a higher expected terminal rate, leaves room for CLOs to continue to perform.

As many fixed income sectors have witnessed tightening credit spreads recently, we believe the current market is one where investors should focus on picking individual bonds with solid fundamentals and attractive yields instead of making macro bets. As such, we recommend focusing on the “income” component when constructing a diversified multisector bond portfolio.

Takeaway for investors

The U.S. and Global Aggregate indexes are not fully representative of the fixed income universe. As such, we believe investors should think beyond these static indexes and consider a multisector approach to ensure their fixed income portfolio is sufficiently diversified.

Additionally, we believe a flexible investment approach may allow managers to capitalize on relative value opportunities and adjust portfolios as market conditions evolve.

1 IG CLOs = JP Morgan CLO Investment Grade Index, Bank loans = Morningstar LSTA Leveraged Loan Index, High yield = Bloomberg Corporate High Yield Bond Index, EM debt = Bloomberg Emerging Markets USD Aggregate Index, CMBS = Bloomberg Commercial Mortgage Backed Securities Investment Grade Index, ABS = Bloomberg Aggregate Asset Backed Securities Index, IG corporates = Bloomberg U.S. Corporate Bond Index, U.S. Treasuries = Bloomberg U.S. Treasuries Index, Agency MBS = Bloomberg U.S. Mortgage Backed Securities Index, Global Agg = Bloomberg Global Aggregate Bond Index.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

The Bloomberg U.S. Aggregate Asset-Backed Securities (ABS) Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market. The index only includes ABS securities.

The Bloomberg U.S. Commercial Mortgage-Backed Securities (CMBS) Investment Grade Index measures the investment-grade market of U.S. Agency and U.S. Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300m.

The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

The Bloomberg U.S. Corporate High Yield Bond Index measures the USD denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below.

The Bloomberg U.S. Mortgage-Backed Securities (MBS) Index tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Bloomberg Emerging Markets USD Aggregate Index measures the US dollar-denominated, emerging markets sovereign, quasi-sovereign, and corporate debt markets.

Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

The JP Morgan CLO Investment Grade Index is designed to track the investment-grade components of the USD-denominated, broadly syndicated CLO market.

The Morningstar LSTA US Leveraged Loan Index is designed to deliver comprehensive, precise coverage of the US leveraged loan market. Underpinned by PitchBook | LCD data, the index brings transparency to the performance, activity, and key characteristics of the market.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

The sale of an investment for the purpose of rebalancing may be subject to taxes.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.