Productivity: The next propeller of a bull market?

Rising productivity fueled by artificial intelligence (AI), automation, and other innovation could propel economic growth while easing inflationary pressures. Portfolio Manager Jeremiah Buckley examines emerging productivity trends, highlights examples across sectors, and discusses how to position portfolios to capitalize on these developments.

6 minute read

Key takeaways:

- The resurgence of U.S. labor productivity, with growth averaging 2.3% for the past four quarters, underscores a significant shift toward greater efficiency.

- We believe this uptick in productivity is set to continue due to the new innovations and AI productivity gains we are witnessing across sectors. This economic driver could help mitigate inflationary pressures, which bodes well for corporate margins and earnings.

- Investors should focus on two areas: first, infrastructure providers enabling technologies like semiconductors and AI services. Second, large-scale companies that can afford to leverage these technologies to improve productivity, product development, and customer service, ultimately accelerating profit growth.

At the conclusion of a strong first quarter earnings season for U.S. companies, we believe two factors will be increasingly important to the future path of earnings in a higher rate environment: productivity and innovation.

Recent gains in U.S. labor productivity are providing some optimism for market participants, especially in today’s higher inflation environment where productivity improvements serve as a welcome driver of economic growth without further stoking inflation.

The productivity rebound

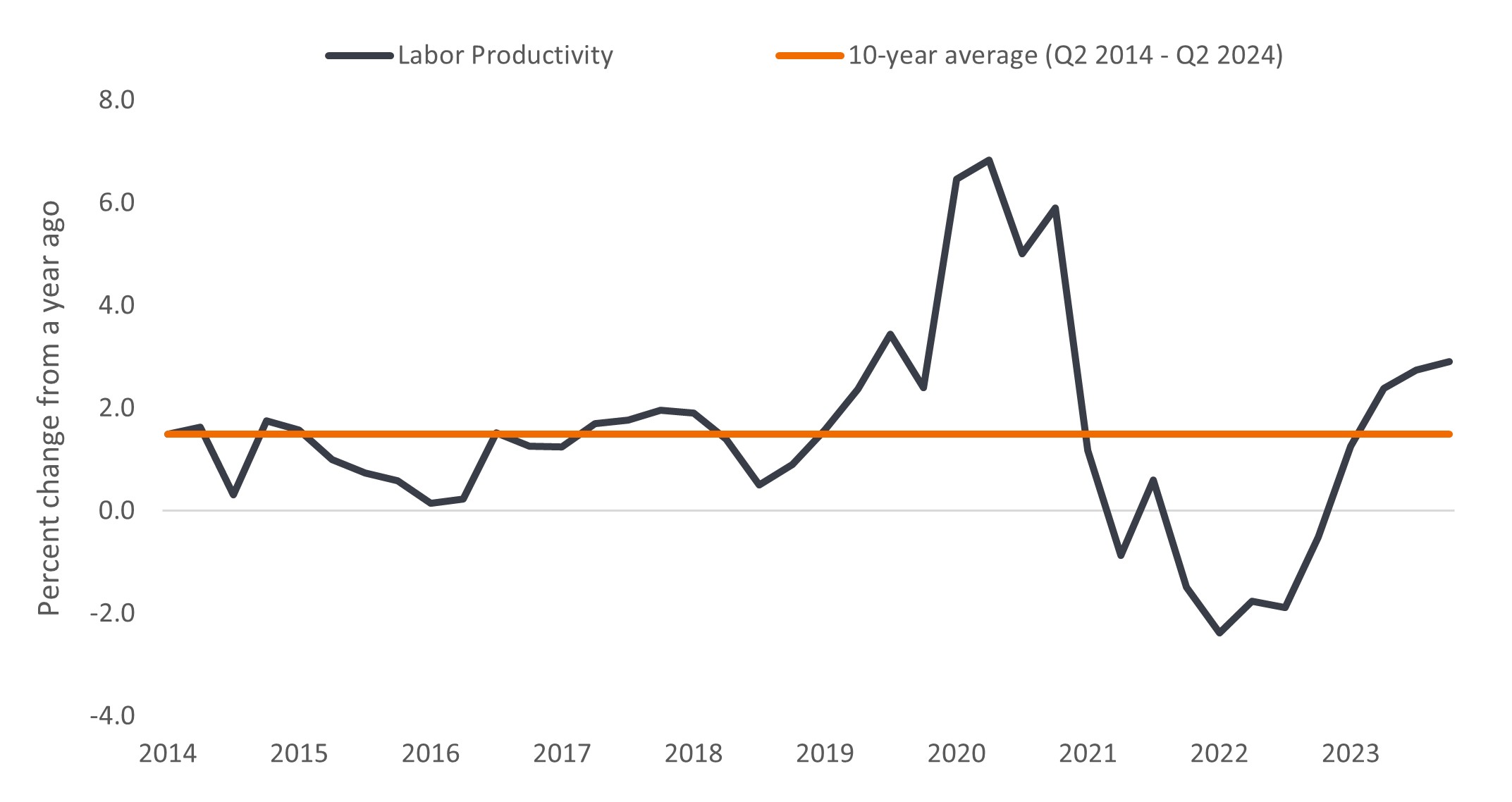

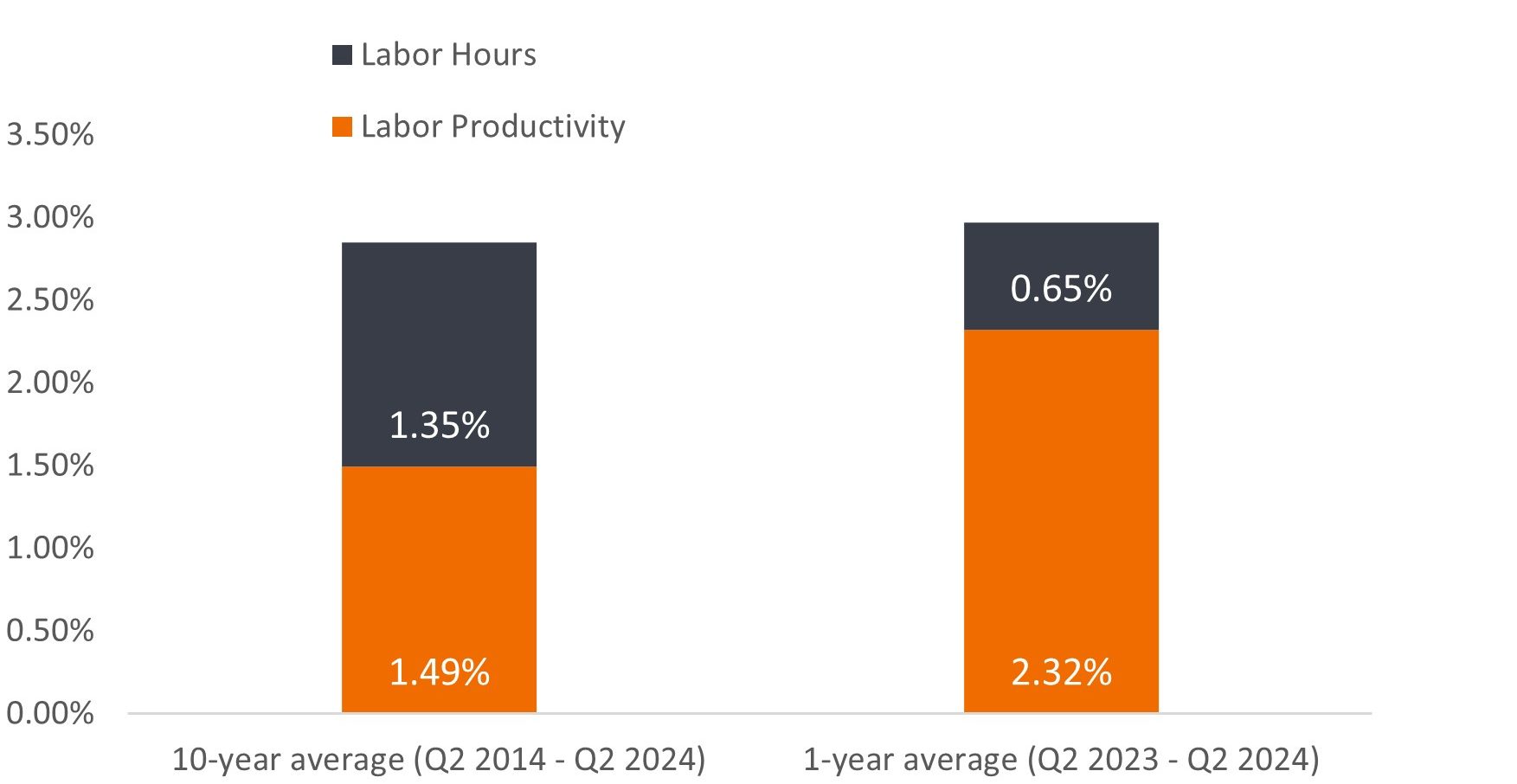

U.S. labor productivity, measured by nonfarm business output per hour, has rebounded after five consecutive quarters of year-over-year declines. For the past four quarters, productivity has averaged 2.3% growth, well above the 1.5% 10-year average (see Figure 1).1 This rebound accounts for 77% of real GDP growth since Q2 2023, while labor input explains only 23%, indicating companies are finding greater efficiency even with full employment (see Figure 2).

Figure 1: U.S. Labor Productivity (2014 – 2024)

U.S. labor productivity has rebounded to above average growth.

Source: U.S. Bureau of Economic Analysis. Labor Productivity: Nonfarm business sector: Labor Productivity (output per hour) for all workers, percent change from year ago, quarterly, seasonally adjusted.

Source: U.S. Bureau of Economic Analysis. Labor Productivity: Nonfarm business sector: Labor Productivity (output per hour) for all workers, percent change from year ago, quarterly, seasonally adjusted.

Figure 2: Contribution to Real GDP Growth

Labor productivity has been the primary driver of real GDP growth in the last year.

Source: U.S. Bureau of Economic Analysis. Labor Hours: Nonfarm business sector: Hours worked for all workers, percent change from year ago, quarterly, seasonally adjusted. Labor Productivity: Nonfarm business sector: Labor Productivity (output per hour) for all workers, percent change from year ago, quarterly, seasonally adjusted.

This productivity resurgence can be attributed to two key factors. First, pandemic-era inefficiencies and labor shortages have normalized, particularly in the retail, restaurants, and service industries. And those companies that initially overstaffed as economic activity resumed have since rightsized their workforces. Many companies, including a leading online retailer and cloud platform provider, are attributing a portion of productivity gains to resuming appropriate staffing levels.

Second, massive technology and digital spending during the pandemic are now bearing fruit across industries. Productivity tailwinds are particularly evident among tech and internet firms. These companies made significant investments in digital tools and software-as-a-service (SaaS) capabilities and then streamlined operations while reducing headcounts. Now, they are realizing the benefits through leaner sales, marketing, and research costs while maintaining or growing revenues.

Early AI productivity payoffs

Moreover, we’re witnessing early examples of AI impacting productivity, though it may be too soon to show up in data. There is widespread belief that we are on the cusp of a structural AI productivity boost akin to the dotcom era (1995 – 2004). AI’s true impact is still unfolding as the general-purpose technology continues to evolve and adoption spreads throughout the economy. Opinions vary on when it will materially impact productivity data, from as soon as one year to as late as the 2030s. In our view, the recent breakneck pace of spending on computing power and data centers by mega-cap companies suggests this timeline is closer than initially anticipated.

In terms of employment, generative AI (gen AI) has not yet had a significant impact. However, the percentages of firms anticipating AI-related employment increases (6.5%) and decreases (6.1%) for the next six months more than doubled from February 2024. Gen AI is still in relatively early adoption but steadily gaining traction, with a projected 6.6% of surveyed firms leveraging the technology by September 2024, up from 3.7% in September 2023.2

By automating manual and repetitive tasks, gen AI can improve worker performance by as much as 40% according to a 2023 Boston Consulting Group study.3 Tangible use cases are already emerging, like software engineers using AI co-pilot assistants to significantly reduce build times and allow for more rapid iteration and code output.

Outside of the tech industry, a leading oilfield service company has implemented AI and machine learning tools to reduce oil and gas exploration and drilling cycle times to a fraction of the months previously required. In healthcare, AI algorithms are speeding up the discovery process and lowering the cost of bringing new drugs to market.

Beyond AI

Productivity enhancements also extend beyond AI. In healthcare, numerous types of innovation are impacting treatment capabilities. An orthopedic device maker, for example, recently rolled out a robotic surgical arm that enables more precise joint replacements. In another example, a cardiovascular-focused medical device company introduced new ablation technology to destroy abnormal tissue that has cut treatment times for atrial fibrillation (irregular heartbeat) by 30 minutes, enabling high-volume centers to handle at least one additional procedure per day.

In financial services, banks are leveraging digital tools and mobile apps to reduce reliance on costlier physical branches while maintaining service quality. Warehouse robots and manufacturing automation are also offering efficiency gains.

Indicators of productivity

Measuring company-level productivity gains can be challenging, as firms are cautious about revealing technology’s impact on human labor. However, examining indicators like operating leverage, revenue per employee, R&D spending, and technology investments can provide insights into efficiency and future productivity gains. Companies investing heavily in these areas, particularly those with scale and financial health, typically signal a commitment to innovation and productivity.

Positioning for productivity trends

Rising productivity allows businesses to generate more output without needing added labor or materials that could trigger higher inflation and restrictive central bank policies. This powerful economic driver could underpin a bull market by reducing inflationary pressures while enabling sustainable wage growth and consumer spending.

For investors aiming to capitalize on productivity trends, focusing on companies providing the enabling infrastructure will be key. Firms in semiconductors, software, and enterprise platforms working on AI and automation solutions should be direct beneficiaries as adoption grows.

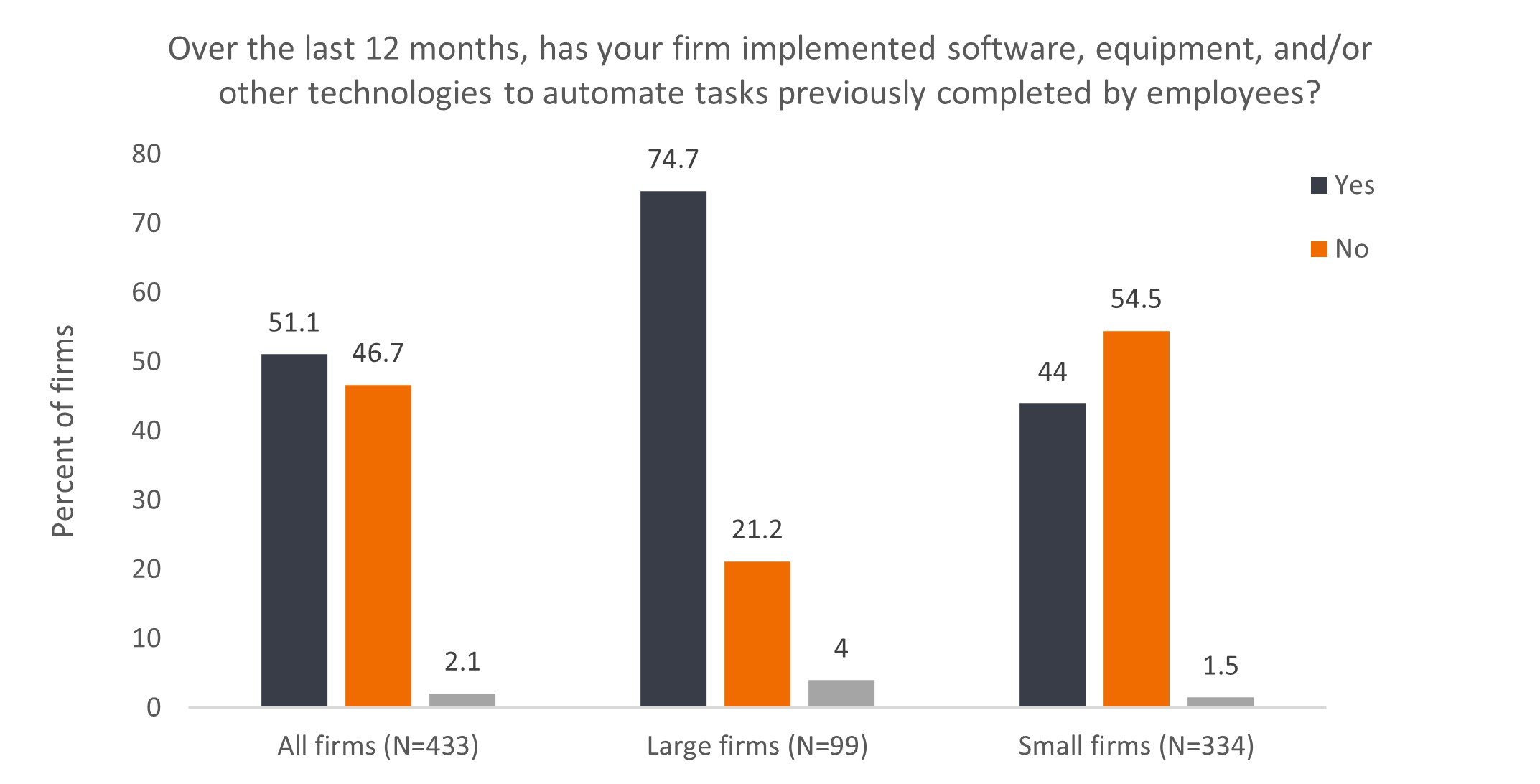

In terms of companies adopting new innovative techniques, those with the scale and resources to invest heavily in research, testing, and implementation appear best positioned. Healthy corporate balance sheets are a prerequisite for the capital investment required to stay ahead of the productivity curve. Companies without sufficient size or investment capabilities risk falling behind and losing market share over time.

Figure 3: CFO survey suggests half of firms are implementing tech to automate employee tasks, including 75% of large firms

Source: Duke University, FRB Richmond and FRB Atlanta, The CFO Survey – Q1 2024 (February 20 – March 8, 2024).

Ultimately, we think it is important to identify companies paving the way, those boosting productivity operationally now and developing solutions that will drive productivity gains for decades.

1 Source: U.S. Bureau of Labor Statistics. As of May 17, 2024.

2 U.S. Census Bureau, Business Trends and Outlook Survey, March 2024.

3 Boston Consulting Group, How People Can Create—and Destroy— Value with Generative AI, September 2023.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.