Sustainable Equities outlook: The future is still electric under a Trump administration

In his 2025 outlook, portfolio manager Hamish Chamberlayne revisits Trump’s first presidency, outlining how history suggests the next four years present compelling sustainable investment opportunities.

5 minute read

Key takeaways:

- History shows that sustainability-focused investments can thrive even under administrations less focused on climate goals.

- The global shift towards electrification and digitalization is irreversible, with China leading in clean energy production and innovation underscoring the importance of gaining exposure to these long-term investment themes.

- The trajectory towards a more sustainable and decarbonized economy is not solely dependent on politics; companies are increasingly committing to long-term decarbonization strategies driven by economic viability, consumer demand, and corporate responsibility.

A compelling time to invest sustainably?

Headlines paint a bleak picture for sustainability-focused investors. A World Meteorological Organization report noted key climate indicators – ocean heat, sea level rise, Antarctic seas loss, and glacier retreat – reached record levels in 2023, with it confirmed as the hottest year on record.1 These records will likely be broken again once the data is in for 2024 given that global energy-related CO2 emissions are yet to stop rising, according to data from the International Energy Agency (IEA).2

In November, COP29 suffered a crisis of credibility after the host nation Azerbaijan was criticized for using the event to boost fossil fuels3 and Donald Trump’s return to the White House is expected to have a negative impact on climate action due to anti-clean energy policies in the short-term.4

But while market sentiment is negative and there are understandable expectations for a slowdown in sustainability-related investment themes, we believe, if history is any guide, we could actually be approaching a compelling time to invest.

Economics will drive the transition

We can all recall the market environment in 2016 when Trump entered the White House for the first time. That year there was a similar Trump trade that saw underperformance of many sustainability-related investments. However, this paved the way for some strong returns, with 2017, 2019 and 2020 being some of the most successful years for sustainable investing opportunities.

While growth in renewable investment will likely slow in the US under a Trump administration, we do not expect it to decline. Many Republican states benefit from renewable investment, and utility-scale wind and solar continue to represent the lowest-cost forms of electricity even without tax credits/subsidies. It is also important to note that during Trump’s first term in the Oval Office, solar and wind investment actually grew.

The 2024 IEA World Energy Outlook report also noted that global emissions are expected to peak in all transition scenarios, even those without subsidies, such as the Economic Transition Scenario (ETS), before 2030, but how fast they drop afterwards varies widely. In fact, clean energy investment is fast approaching US$2 trillion annually, almost twice the funds for new oil, gas, and coal projects. Further, post-pandemic, clean technology costs are dipping again.

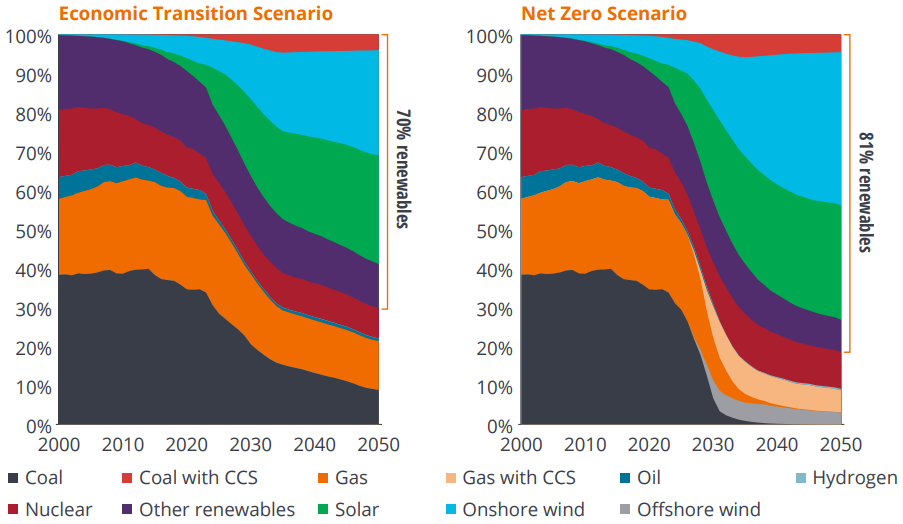

As evidenced by Figure 1, we can see that we are about to hit an inflection in renewable’s share of electricity generation even under ETS which assumes economics alone drives the transition (with no help from subsidies).

Figure 1: Electricity generation by technology/fuel, ETS vs NZS scenarios

Source: BloombergNEF, New Energy Outlook 2024 report. Used here to illustrate future expectations for the economic transition scenario and a net-zero scenario.

The future is electric

China leads the world in clean energy production, making more than 80% of the world’s solar PV modules and EV battery cells, according to data from the IEA. In 2023, its solar PV production capacity hit over 850 GW, dwarfing the global installations of 425 GW, while its battery production capacity soared to 2,140 GWh, far outstripping the global demand of around 870 GWh. This massive capacity cements China’s role in driving robust domestic deployment of renewable technologies.

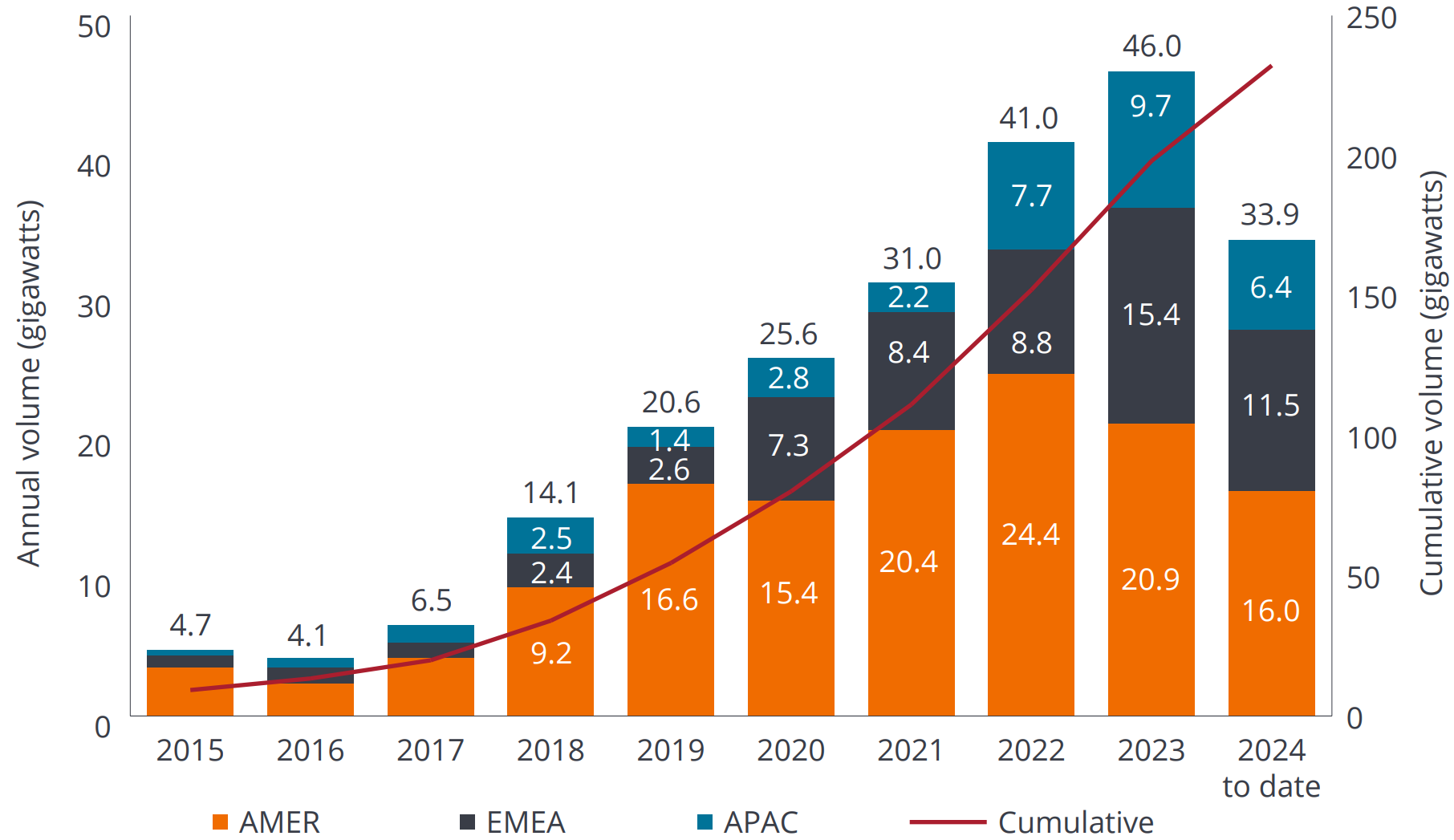

Innovation and sustainability are inseparable, and we believe it is unlikely that US or European firms will let China continue dominating the EV and clean tech sectors. Moreover, companies are very unlikely to ditch their decarbonization strategies; these plans outlast any president’s term. The shift towards directly purchasing clean energy is a longstanding trend that is here to stay, driven by the cost-effectiveness of large-scale wind and solar projects and the climbing prices of grid electricity, further pressured by AI investments. Put simply, the future is still electric and it is still green. (Figure 2).

Figure 2: Deals for clean energy are growing at a record pace

Global annual corporate power purchase agreement volumes, by region.

Source: BloombergNEF

Note: Chart shows only offsite power purchase agreements. Asia Pacific capacity is estimates. Figures are subject to change as more information is made available. Data through October 2024.

Despite headlines about the US withdrawing from the Paris Agreement (again) and cutting subsidies, the drive towards electrification, digitalization, and decarbonization stands strong. Trump’s pro-growth, pro-business stance, including lower taxes, is likely to boost corporate investment and consumer demand, creating a favourable environment for equities. Moreover, should inflation return, it could further encourage investments in efficiency and productivity.

Further, clean energy is just one of the ten sustainable development themes we invest in, with a specific percentage allocation. Our exposure spans environmental and social themes, focusing on enablers like semiconductors, electrical infrastructure, and electronic component providers.

Fear vs reality

Reflecting on the first Trump term, fears did not match reality. Despite potential negative policies towards ESG and sustainability, we do not foresee significant impacts. Companies operate on timelines beyond four-year terms, likely maintaining commitment to sustainability.

Our focus is on investing in companies that are not dependent on government subsidies, recognizing that sustainability must be economically viable on its own. By concentrating on companies offering valuable goods and services to the planet and people, we believe strong opportunities remain to continue compounding wealth through a range of political backdrops when assessed through the right lens.

1World Meteorological Organization, press release – ‘Climate change indicators reached record levels in 2023: WMO’ (19 March 2024)

2International Energy Agency, World Energy Outlook 2024

3The Washington Post, ‘Climate summit host faces backlash over support for fossil fuels, crackdown on dissent’ (18 November 2024)

4BBC News, ‘Trump victory is a major setback for climate action, experts say’ (7 November 2024)

The Announced Pledges Scenario (APS) assumes that all climate commitments made by governments and industries around the world will be met in full and on time.

An Economic Transition Scenario (ETS) is a model that shows how the energy sector might evolve based on economic forces and technology, without new policy action.

The Net Zero Emissions by 2050 Scenario (NZE Scenario) is a normative scenario that shows a pathway for the global energy sector to achieve net zero CO2 emissions by 2050, with advanced economies reaching net zero emissions in advance of others.

The Stated Policies Scenario (STEPS) is designed to provide a sense of the prevailing direction of energy system progression, based on a detailed review of the current policy landscape.