Listed REIT prices declined sharply two years ago, as the market anticipated and priced in the forthcoming drop in property prices, moving lower ahead of the broader commercial real estate market. However, following a prolonged period of weakness for listed real estate, we are now seeing a beacon of optimism for the asset class. A recent resurgence in transaction volumes suggests that the bulk of the private market has now absorbed necessary write-downs, instilling confidence that private market values are stabilizing. Consequently, we believe the stage is set for real estate investment trust (REIT) investors to look forward with a renewed sense of optimism and potentially benefit from the pricing in of potential growth in earnings and assets values.

Early signs of a recovery

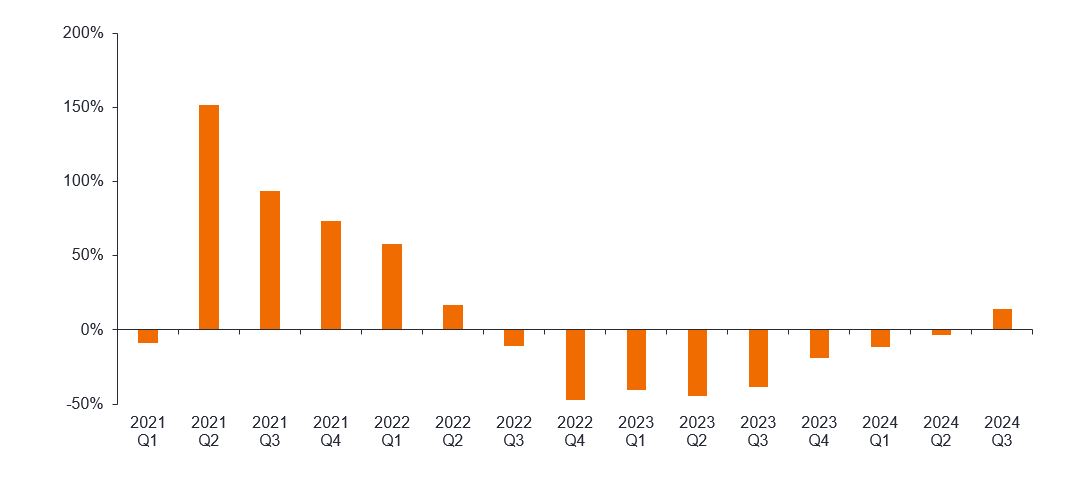

In the third quarter of 2024, for the first time in over two years, US real estate transaction volumes look to have increased as reported by CBRE, the world’s largest property brokerage ─ a bellwether for the corporate real estate sector. This is very welcome news for property investors following a painful period of higher borrowing costs, economic uncertainty, and declining asset values. All told, these factors contributed to transaction levels that collapsed nearly 70% from peak levels in 2021.1 With large gaps between buyer and seller pricing expectations, liquidity was not available at private real estate’s reported valuations. Non-traded (private) REITs’ gated investor funds, queues of unmet redemption requests in core property funds formed, and eventually losses for investors and lenders slowly crystalized through the private markets’ gradual adjustments to reported values. With reported real estate prices now starting to reflect their underlying asset values, supported by central banks beginning to lower interest rates, investor optimism has grown alongside improving real estate debt markets, fostering a recovery in real estate transactions.

CBRE advisory sales (year-on-year % change)

Source: CBRE, as at end 3Q 2024. Past performance does not predict future returns.

CBRE also reported a 20% revenue increase from US investment sales (also known as advisory sales – ie. buy/sell transactions) in the third quarter. According to its CEO, “Capital markets transaction activity has passed an inflection point and is in early stages of recovery.” Management further noted, “We think buyers and sellers have largely come together for most asset classes or are very close to having come together…there is debt available now…there’s increased interest in multi-family. We’ve seen a little bit of cap rate (rate of return) compression in multi-family and industrial.”

CBRE’s commercial mortgage originations advanced over 50% over the same quarter, signaling burgeoning strength in real estate lending as well. We see conditions as being ripe for increased lending as the transaction market recovers and evidence of stronger asset pricing surfaces and becomes better appreciated by the market.2

Mounting evidence for a revival

Elsewhere, there are notable recent transactions illustrating healthy asset pricing and attractive lending, supporting our team’s view that real estate pricing has bottomed and a new cycle is beginning:

- KKR/Lennar: In June this year (2024), private equity company KKR acquired 5,200 apartment units from home construction company Lennar’s multifamily division for US$2.1bn, representing an estimated 15-20% premium to asset value for the listed residential REITs. 3

- Brookfield/DRA: In May, investment firm Brookfield acquired a 14.6m square foot portfolio of industrial warehouses from real estate investment adviser DRA for US$1.3bn. The deal encompasses 128 properties across 20 markets and is 98% leased. 4

- Tishman Speyer/Rockefeller Center: In October, diversified real estate firm Tishman Speyer completed a US$3.5bn refinancing of NYC’s Rockefeller Center in the CMBS market for a 6.5% interest rate. For much of the past two years, office transactions remained dormant and plagued by distressed lending conditions. This refinancing marks the largest single-asset office debt deal in history and was significantly oversubscribed by debt investors. 5

What does the transactions recovery mean for REITs?

Within real estate, REITs are enviably positioned, with 30% loan-to-value ratios (compared to 60% for private real estate), have cheaper cost of funds, and can issue equity in public markets to grow, thereby taking advantage of the resurgent liquidity to buy assets. However, for the past two years, REITs have been stymied in their acquisition pursuits by lack of deal-flow and wide bid-ask spreads. As transactions pick up and pricing improves, REITs across sub-sectors are increasingly deploying capital for acquisitions or development projects, which we believe will advance earnings growth. Furthermore, many REITs have joint ventures or fund management platforms capable of delivering additional returns when assets are sold. These profits have largely diminished over the prior two-year standstill in the transaction market; but as deal volumes recover, REITs are likely to once again be positioned to harvest gains from these vehicles, bolstering profits.

The recovery in transactions, therefore, highlights multiple avenues for REITs to boost earnings growth, strengthening the outlook for asset values, and ultimately, the potential for higher share prices and growing dividends in a new cycle.

1 Green Street Advisors, annual transactions in 2023 versus the 2021 peak.

2 CBRE 3Q 2024 earnings call, 24 October 2024.

3 CoStar.com; KKR Makes $2.1 Billion Bet on Multifamily in Buying Apartments From Lennar’s Quarterra, 26 June 2024.

4 Connectcre.com; Brookfield Closes on $1.3B Light Industrial Portfolio, 19 July 2024.

5 PRNewswire.com; Tishman Speyer Completes $3.5 Billion Refinancing for Rockefeller Center, 21 October 2024.

6 Green Street Advisors, Morgan Stanley, Janus Henderson Investors Analysis, as of December 31, 2022.

Bid-ask spread: the difference between the bid price and the ask price for a particular security.

Capital markets: financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, real estate, and other financial assets.

Cap rate compression: occurs when the capitalization rate (rate of return) on a real estate investment property based on the income that the property is expected to generate decreases.

CMBS: Commercial Mortgage-Backed Securities are fixed rate bonds that represent an investment in a portfolio of mortgages on a range of commercial properties.

Gated fund: a fund with restrictions placed on redemptions/withdrawals, usually when the assets of a fund are illiquid and difficult to turn into cash for redemption in a timely manner.

Liquidity: a measure of how easily an asset can be bought or sold in the market. Assets that can be easily traded in the market in high volumes (without causing a major price move) are referred to as ‘liquid’.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts: invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.