Maximising your outcomes: adding active ETFs to your portfolio

The Portfolio Construction and Strategy Team compares active ETFs and mutual funds, highlighting the benefits of both and flagging the key questions investors need to ask.

6 minute read

Key takeaways:

- Actively managed exchange traded funds (ETFs) are increasingly popular among investors due to their versatility, blending the benefits of traditional mutual funds and the convenience and efficiency of ETFs.

- Whether an active ETF or mutual fund is preferable depends on factors, including market conditions, the nature of the portfolio and how it is managed.

- Before incorporating active ETFs into a portfolio, investors should evaluate their investment goals, and the operational aspects like trading costs, liquidity, and platform availability.

The growth of actively managed exchange traded funds (ETFs) across the world is well documented. Janus Henderson recently expanded its own footprint, acquiring an ETF business in Europe.

But what does this mean for investors? What do you need to know when considering investing in active ETFs versus more traditional mutual fund vehicles?

In this guide, we look at some of these considerations and provide practical insights on how active ETFs can be used in an investor’s portfolio.

Common misconceptions

First and foremost, it’s important to clarify one of the biggest misconceptions on ETFs – that they are passive strategies i.e. managed to an index. It is true that historically, most ETFs in the market place have been passive strategies but that is no longer the case.

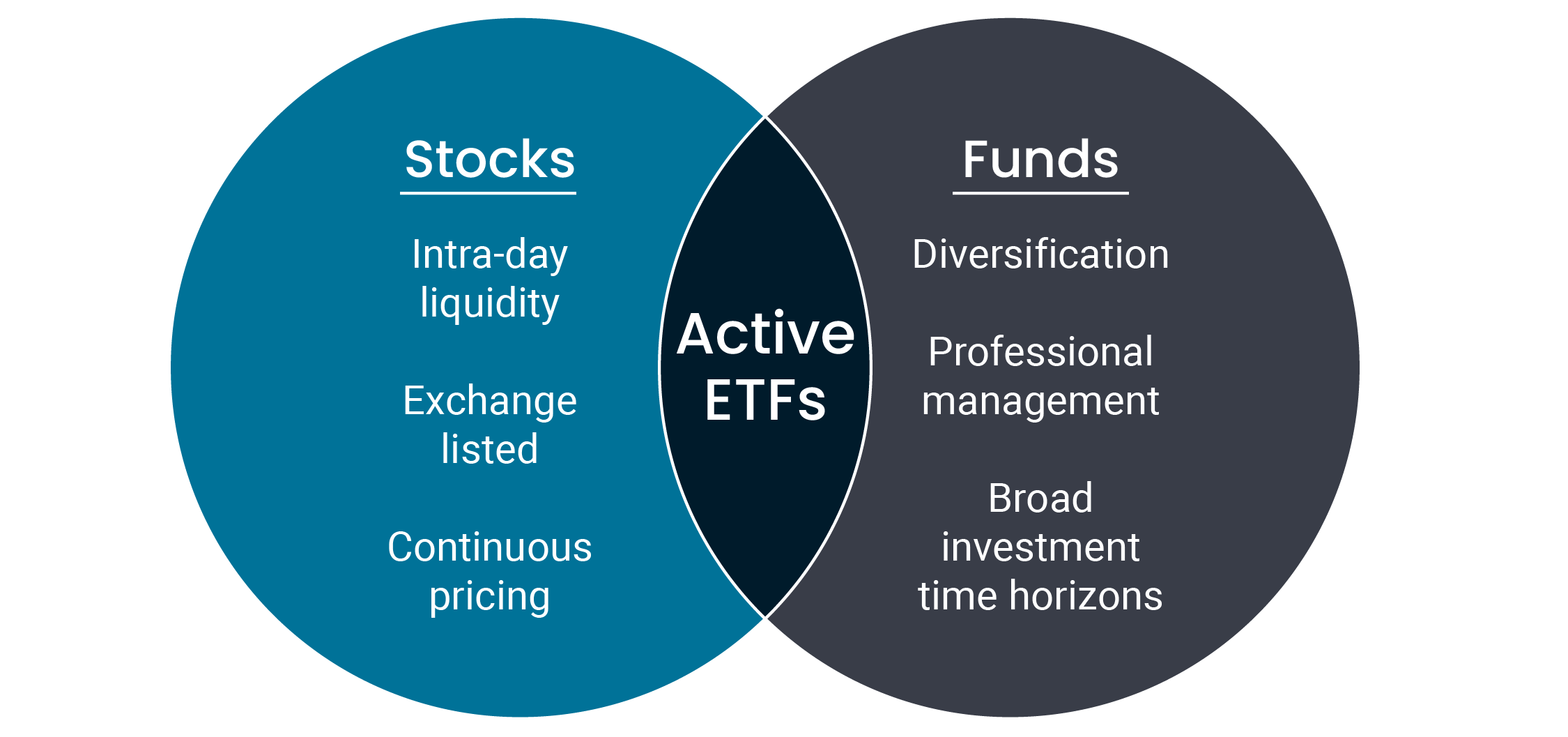

ETFs are as they suggest – exchanged traded funds. That is, funds that can be bought and sold through a stock exchange much like a stock or a bond. Those funds can be active or passive. The key difference is simply how investors buy or sell the strategy. As figure 1 shows ETFs bring together the benefits of both.

Figure 1: Active ETFs incorporate the attributes of a stock into a fund vehicle

Portfolio construction considerations

The answer to whether an active ETF or mutual fund is preferable when building a portfolio largely depends on the nature of the portfolio and how it will be managed. There is no right or wrong answer but there are important considerations when looking at the alternatives.

When an active ETF could be preferred

- Highly active portfolio management: While we strongly advocate for time in the market rather than timing the market, active ETFs can be an excellent way to gain exposure to active strategies while also allowing for intraday transactions. This can become particularly important when material market events are likely to have an ongoing impact (positive or negative) on returns.

- Small accounts: For smaller accounts or for satellite holdings, active ETFs could fill the void where the minimum account sizes of mutual funds are prohibitive. Where a mutual fund will typically have higher minimums and trading sizes, an ETF can be bought or sold for as small an amount as one “share” – which could be as low as £1.

- Rebalancing: Intraday trading and small minimum trade sizes mean that investors are able to rebalance portfolios more accurately and more frequently – providing the benefits of the rebalance outweigh the trading costs. An active ETF allows investors to redeem (or add to) the holding at any time throughout the day at intraday pricing.

- Blending: The greater level of transparency afforded by active ETFs permits more exact portfolio blending with other holdings. In contrast, mutual funds typically disclose only their top 10 holdings on a monthly basis, while active ETFs can disclose their full holdings daily.

- Efficiency: The mechanics behind active ETFs are simple, standardised and highly efficient. This helps to keep trading costs down and means they are also operationally convenient for investors.

- Contrary or “short” positions: It is possible to short some ETFs thus taking the other side of the trade.

- Leverage: Some prime brokers / banks will allow margin lending to be run against ETF positions should investors wish to do so.

- Pricing: Active ETFs are unable pay sales commission to advisers (in Europe) and hence do not have these commissions built into the ongoing charges figure. This allows a non-advised client to access strategies free of such charges.

When a mutual fund could be preferred

Of course, there remains many reasons why mutual funds remain a preferred approach for many investors.

- Long-term time horizon: A major benefit of active ETFs is accessibility and ease of transaction. For many components of a portfolio, investors should be taking a long-term time horizon with their investment. As such, the ability to trade intraday shouldn’t be a necessary feature. Even during times of significant market volatility, rarely does trying to time the market result in better financial outcomes.

- Valuation certainty: An active ETF has two valuations: 1. Net Asset Value (NAV) and 2. share price. Generally, these two should track each other closely and ETF issuers have techniques to ensure that occurs. However, there can be some deviation between the two. A mutual fund just has the NAV and, therefore, the price offered per share aligns to the value of the fund’s assets. Further, if an adviser is buying (or selling) on behalf of underlying clients then all clients will buy (or sell) at one price – this is impossible to achieve for ETF purchases.

- Range of options: Currently, the majority of active strategies are offered via mutual funds. Therefore, it may not be feasible at this moment in time to build an entire active portfolio out of ETFs.

- Availability: Many platforms have yet to fully engage with active ETFs. As a result, investors may find that the mutual fund approach remains the most effective approach, at least in the near term.

Selecting an active ETF – key considerations

For an investor considering an active ETF, there are several questions that should be asked:

- How closely does the active ETF strategy reflect the manager’s existing strategy i.e. is this a genuine strategy or an adapted version?

- What are the trading costs to buy and sell the holding?

- Does the ETF trade at a material discount (or premium) to the NAV?

- How is liquidity guaranteed?

- Can a suitable collection of active ETFs be accessed with the platform/provider used?

We believe that active ETFs have a very promising future as evidenced by their increasing popularity among investors. But as with any investment, it’s crucial to carefully examine the construction, management, and listing details of the ETF.

The Janus Henderson Portfolio Construction & Strategy Team is available to help you navigate the market and determine the most suitable mix of ETFs to complement your current investments.

In addition, we have a dedicated capital markets team, which works with authorised participants, market makers, and banks/brokers to help find the most efficient way to trade ETFs.

IMPORTANT INFORMATION

Past performance does not predict future returns.

There is no guarantee that past trends will continue, or forecasts will be realised.

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis and the investment choices they make. The opposite of Passive Investing.

Bond: A debt security issued by a company or a government, used as a way of raising money. The investor buying the bond is effectively lending money to the issuer of the bond. Bonds offer a return to investors in the form of fixed periodic payments (a ‘coupon’), and the eventual return at maturity of the original amount invested – the par value. Because of their fixed periodic interest payments, they are also often called fixed income instruments.

Discount: Refers to a situation when a security is trading for lower than its fundamental or intrinsic value. The opposite of trading at a premium.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Equity: A security representing ownership, typically listed on a stock exchange. ‘Equities’ as an asset class means investments in shares, as opposed to, for instance, bonds. To have ‘equity’ in a company means to hold shares in that company and therefore have part ownership.

Exchange traded fund (ETF): A security that tracks an index, sector, commodity or pool of assets (such as an index fund). ETFs trade like an equity on a stock exchange and experience price changes as the underlying assets move up and down in price. ETFs typically have higher daily liquidity and lower fees than actively managed funds.

Leverage: has multiple meanings:

The use of borrowing to increase exposure to an asset/market. This can be done by borrowing cash and using it to buy an asset, or by using financial instruments such as derivatives to simulate the effect of borrowing for further investment in assets.

Leverage is also an interchangeable term for gearing: the ratio of a company’s loan capital (debt) to the value of its ordinary shares (equity); it can also be expressed in other ways such as net debt as a multiple of earnings, typically net debt/EBITDA (earnings before interest, tax, depreciation and amortisation). Higher leverage equates to higher debt levels.

Long/short: A portfolio that can invest in both long and short positions. The intention is to profit from combining long positions in assets in the expectation that they will rise in value, with short positions in assets expected to fall in value. This type of investment strategy has the potential to generate returns regardless of moves in the wider market, although returns are not guaranteed.

Margin lending is a type of loan that allows you to borrow money to invest, by using your existing shares, managed funds and/or cash as security.

Net asset value (NAV): The total value of a fund’s (or company’s) assets less its liabilities.

Passive investing: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively managed fund. The opposite of active investing.

Premium: When the market price of a security is thought to be more than its underlying value, it is said to be ‘trading at a premium’. The opposite of discount.

Share price: The price to purchase (or sell) one share in a company, not including fees or taxes.

Short position (shorting): Fund managers use this technique to borrow then sell what they believe are overvalued assets, with the intention of buying them back for less when the price falls. The position profits if the security falls in value. Within UCITS funds, derivatives – such as CFDs – can be used to simulate a short position.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.