| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

I recently went on a field trip across Shenzhen, Suzhou, and Hangzhou to visit some of the most dynamic players in the humanoid robot supply chain. What I witnessed first-hand convinced me that humanoid robotics could be China’s next big industrial story — one with huge implications for global innovation, productivity, and investment opportunities.

As NVIDIA CEO Jensen Huang said recently: “The easiest robots to adapt into the world are humanoid robots because we built the world for us.” Humanoid robots are poised to revolutionise many industries, doing the jobs humans can’t or won’t do. From manufacturing to healthcare, logistics to hospitality, the applications are limitless.

Humanoid robots: hype or vibe?

The buzz around humanoid robots isn’t just market hype. Year-to-date, Chinese humanoid robot-related stocks have outperformed broader Chinese equities.1 This excitement stems from a shared belief among Chinese investors and industry players that humanoids may become the next widely-adopted terminal device after smartphones and electric vehicles. Further, 2025 marks the year of the beginning of mass production of humanoid robots in China.

What investors need to know about China’s humanoid robots industry

1. A comprehensive humanoids ecosystem is being built in China

China’s humanoid robot supply chain is taking shape fast. Many Chinese companies have begun ramping up mass production and speeding up the training of humanoid robots, targeting both industrial and consumer use. These are not just prototypes in labs. While their capabilities are still basic, they are improving fast, with trial deployments. In the next few years, we are likely to see operational humanoids working in security, logistics, retail, and hospitality.

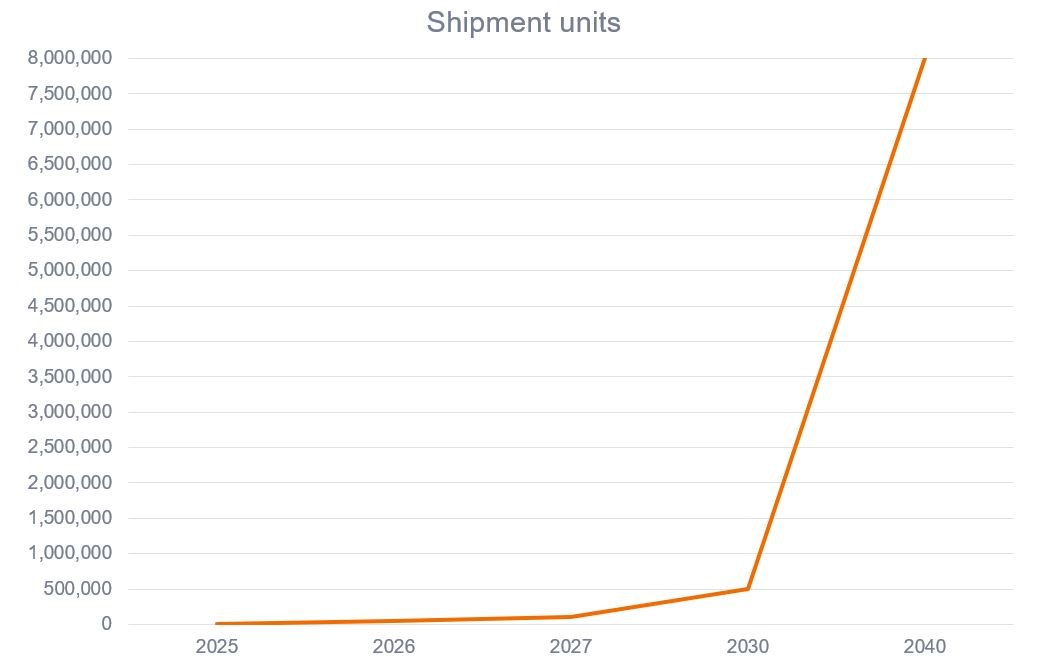

Figure 1 shows the projected sales volumes based on Tesla and other industry participants, but it will require a far more detailed analysis of job stratification to understand the path of humanoid robot substitution. Job stratification looks at the extent to which upward/downward occupational mobility is unlikely/likely for workers in low-paid occupations, relative to workers in high-paid occupations. We also need to factor in the speed of innovation and penetration within industries.

Figure 1: Projected global shipments of humanoid robots

Source: Janus Henderson Investors’ analysis of industry data, sourced at 7 April 2025. There is no guarantee that past trends will continue, or forecasts will be realised.

2. China’s strong strategic policy support

Beijing has made humanoid robotics a strategic priority. In January 2024, China’s Ministry of Industry and Information Technology (MIIT) issued the ’Guidelines for the Innovative Development of Humanoid Robots,’ laying out a roadmap for industrial innovation. The ambition is clear: China aims to be a “global centre of excellence” for robotics by 2029.

By early 2025, more than ten provinces and cities, including Beijing, Shandong, and Shenzhen, have incorporated humanoid robotics into their local economic plans. China is fostering humanoid-focused industrial clusters, especially around Shenzhen and Hangzhou.

Why does this matter? Humanoid robots are viewed as a next-generation strategic sector that combines China’s strengths in AI, semiconductors, batteries, sensors, and advanced materials—similar to how it built global competitiveness in electric vehicles (EVs) and solar energy.

3. B2B first, consumers later

The initial humanoid market is going to be industrial, covering factory automation, warehouse logistics, surveillance & patrol, retail & hospitality services, and emergency operations. For example, Unitree announced its humanoid robot G-1 at just US$16,000, much cheaper than Tesla’s Optimus prototype (circa US$ 50,000–60,000). While performance varies, cost is coming down fast.

Current challenges include insufficient data collection, short battery life, low degrees-of-freedom, and limited strength—but as with autonomous driving, gradual iterative hardware/software upgrades will enhance capabilities and improve performance. Meanwhile, consumer applications such as home assistants and eldercare may take longer due to safety, regulation, and complex home environments — but they are not out of reach.

4. AI & humanoid robots: a feedback loop required

Robots need brains—meaning AI. But here’s the interesting twist: humanoid robots also generate real-world, multi-modal data (vision, force, touch) that can train better AI models, making the algorithms more accurate and robust, forming a self-reinforcing cycle.

This is why China’s AI developers—including those working on large language models (LLMs) like DeepSeek—see humanoid deployment as a key next step to enrich data pipelines and improve model performance.

5. Dual-use technologies: NEV + Robotics

Many new energy vehicle (NEV) component makers (eg. motors, sensors, reducers) are now entering humanoid robot supply chains, creating investment synergies. For example:

- Servo motors & reducers used in EVs and robots

- LIDAR (light detection & ranging) & cameras serving both autonomous driving and humanoid vision

- AI chips used in robot motion control

Why does this sector offer long-term opportunities?

The age of humanoid robots is arriving. This is a strategic combination of deep tech with real hardware, strong policy backing, growing commercial interest, and global relevance.

1. Market potential: Humanoids are still early in the adoption curve. Estimates suggest humanoid robot shipments could reach a million units by 2030. Investors have a chance to get onboard early on a megatrend.

2. China has formed a strong ecosystem: From actuators and harmonic reducers to AI chips and full-stack integrators, China holds a dominant share in the value chain. The West’s humanoid portfolio beyond Tesla and NVIDIA remains thin.

3. Government-led modernisation: As part of its 14th Five-Year Plan and Retail Innovation Blueprint (to 2029), China is doubling down on automation and robotics to offset an aging population and improve productivity.

4. Lower barriers to entry: With decreasing component costs and increased standardisation, even small and mid-cap companies in China are able to participate, creating a wider investable universe.

5. Shared technology with NEVs: There are strong synergies between humanoid robots and NEVs. Both share core technology: sensors, batteries, control systems, which enables cross-industry cost efficiency.

Multiple opportunities to invest in humanoid robotics:

Brain – the semiconductor and software companies that design the brain of the humanoid robots;

Body – the companies that produce the components for the robot body, such as motors, sensors, reducers;

Integrators – the humanoid OEMs that put everything together to develop the full humanoid robots.

As I walked through the robot labs and production lines, I couldn’t help but recall what one engineer told us:

Humanoid robots are not science fiction anymore. They are industrial reality, just in early form.

1 Select humanoid robot stocks vs MSCI China Index, year-to-date to 25 April 2025. Past performance does not predict future returns.

B2B: business-to-business refers to commercial transactions between businesses.

New energy vehicle: all types of electric vehicles, from battery-powered fully electric vehicles to plug-in hybrid cars.

OEM: Original Equipment Manufacturer is a term used in the manufacturing industry to describe companies that produce components or products that are sold to other companies to be integrated into their own products.

Terminal device: a connected device used by end-users to interact with an IoT platform, such as devices capable of running native or web applications.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.