Investing in clean technology for tomorrow’s renewable economy

Hamish Chamberlayne, Head of Global Sustainable Equities, considers the seismic changes that are happening to make renewable energy the new backbone of the global economy.

8 minute read

Key takeaways:

- The pace of investment in clean energy is fast outpacing fossil fuels, and it is forecast that renewable energy will become the largest source of global electricity by 2025.

- Such a shift in the global energy mix will require large scale changes and solutions to the current challenges around renewable energy, including successfully scaling capacity, managing renewable waste and ensuring effective energy storage.

- There are a host of innovative companies across the entire renewable infrastructure supply chain that offer solutions to today’s challenges. We believe that investing in these companies can keep us on the right side of disruption.

Global growth in demand for oil is set to slow significantly by 2028, according to a recent report by the International Energy Agency (IEA). The study suggests that oil demand will peak within the decade as countries actively move away from fossil fuels – a shift that has been expedited by the fallout of the war in Ukraine which has spurred policymakers to bolster energy security by finding alternatives to Russia’s energy supply.

Read more

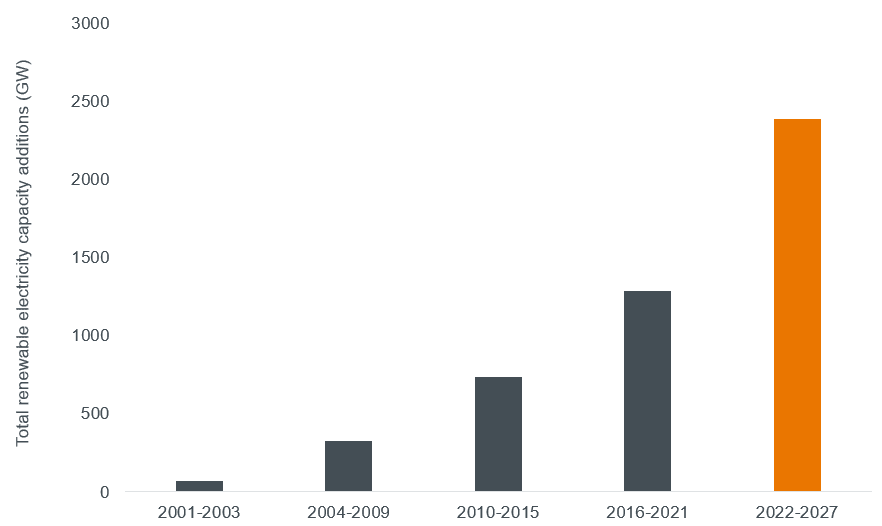

In stark contrast to slowing oil demand, the pace of investment in renewables energy is rising much faster than people realise. The IEA forecasts that renewables will account for over 90% of global electricity capacity expansion, with output growing by almost 2,400 GW over 2022-2027 (see chart 1). By 2025, it is expected that renewables will become the largest source of global electricity generation while the electricity share generated from oil, coal, and natural gas declines. Of the renewables share, wind and solar are forecast to provide almost 20% of global power generation in 2027, with wind capacity doubling and solar capacity tripling.1

Chart 1: Renewables are making up an increasingly larger portion of electricity capacity

Source: International Energy Agency, Renewables 2022 report, 6 December 2022. There is no guarantee that past trends will continue, or forecasts will be realised.

Source: International Energy Agency, Renewables 2022 report, 6 December 2022. There is no guarantee that past trends will continue, or forecasts will be realised.

These sizable forecasts are the result of aggressive policy initiatives put in place to strengthen energy security and meet net zero goals. Notably, the EU’s Green Deal and the US Inflation Reduction Act (IRA) seek to invest €1.8 trillion2 and US$370 billion3 respectively into the green transition while China’s 14th Five-Year Plan aims to increase renewable energy generation by 50% from renewables by 2025.4 Meanwhile India’s green policy is targeting 50% of electricity requirements from renewable sources by 2030.5 These initiatives will see the US, China and India double their renewable capacity expansion over the next five years, accounting for two-thirds of global renewables growth.

Such a seismic shift in the global energy mix will require large scale changes and solutions to some of the current sticking points surrounding renewable energy. As active investors, we take a forward-looking and practical approach when assessing these challenges. Here, we explore some of the hurdles that must be overcome in order for renewable energy to become fully integrated the global economy.

Scaling manufacturing capacity to meet targets

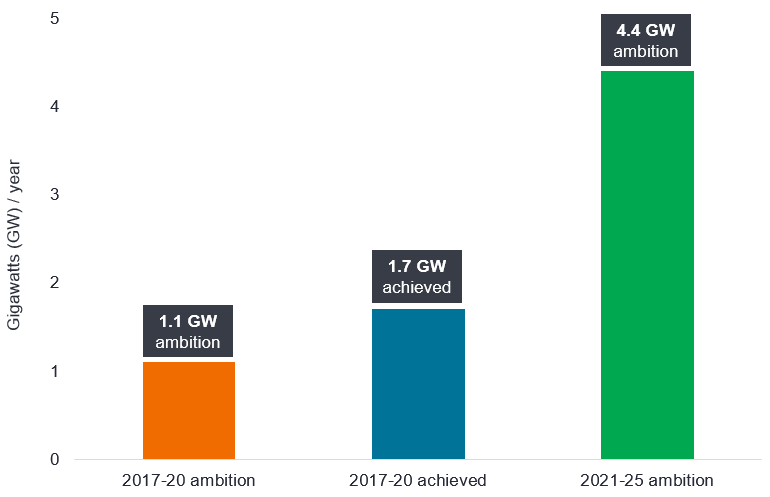

Renewable companies have responded to government incentives with major plans to expand current operations and develop new low carbon projects. In the UK, SSE recently announced plans to invest up to £40 billion in low-carbon energy infrastructure.6 Similarly in Europe, Iberdrola has committed €47 billion to investing in projects which are driving the energy transition.7 While these ambitions are positive for the climate agenda, the challenge will be finding the capacity to meet these goals. As seen in chart 2. companies have already exhibited the potential to perform beyond their own targets but the four-fold ambition to 2025 will be a real test.

Chart 2: High hopes for growth in renewables

Source: McKinsey, An era of renewable growth and development, 28 October 2022. Based on company annual reports. There is no guarantee that past trends will continue, or forecasts will be realised.

Source: McKinsey, An era of renewable growth and development, 28 October 2022. Based on company annual reports. There is no guarantee that past trends will continue, or forecasts will be realised.

Long-term partnerships with suppliers is one way to boost manufacturing capacity and protect against volatility in supply chain prices. One example of such a partnership is Danish power company Ørsted’s recent strategic partnership with German steel producer Salzgitter. Ørsted will supply the renewable energy needed for Salzgitter to produce green steel and Ørsted will use the steel to build its wind turbines. These kinds of relationships are key for renewables companies to be able to build out the infrastructure necessary to meet electricity demand. Other critical infrastructure includes solar photovoltaics (PV), electric vehicles, charging points and energy storage. We expect to see similar capacity growth in the US, with the IRA allocating US$30 billion in production tax credits to supply chain-specific manufacturing in the renewables space.

Is the carbon payback for renewables a problem?

Some critics have suggested that the embedded carbon required to ‘make’ renewable infrastructure – from material mining to manufacture and construction – could diminish the potential carbon saved from using renewables. However, studies have shown that the life-cycle emissions of wind and solar are much smaller than the remaining emissions from existing fossil fuels plants. Various calculations suggest that the carbon payback period (the amount of time required to recover all energy costs associated with manufacture) can range from around seven to nine months for wind turbines and one to two years for solar PV. 8,9,10 This, in our view, is a small and short-lived price to pay for renewables to become the backbone of the world’s energy supply.

In addition to an attractive carbon payback timeframe, renewables also exhibit a favourable energy return on investment (EROI) – the ratio of the amount of usable energy acquired from a particular resource to the energy expended to acquire that energy – compared to other energy sources. Research finds that a coal-fired power station has an EROI of 9:1. In contrast, wind has an EROI of 44:1. To put this more simply, it means that 44 units of energy can be yielded from one unit of energy invested in wind, versus nine units yielded from coal.11

Over the long term, the potential benefits of renewable power far outweigh the immediate carbon cost. As such, there is a clear long-term case for renewable energy in creating a low carbon economy.

Circular principles and effective waste disposal

Currently, wind and solar infrastructure have fixed lifespans of 20-30 years, which poses the problem of what to do with projects when they reach the end of their lives. Turbine blades piling up in landfill and toxic solar panel waste are counter to the positive impact that renewable energy promotes. With growing concern about waste associated with the disposal of renewable infrastructure, companies must consider the way all resources are managed from start to finish.

Boralex, a Quebec-based company which develops and operates renewable power facilities in Canada, France and the US, is responsible for overseeing renewable infrastructure over an entire lifetime. At the outset, Boralex’s activities consume very few raw materials directly, with the company instead choosing to integrate a circular approach to its resource management wherever possible. For used turbine materials, the business is exploring several options, including sales on the second-hand market, refurbishment and recycling. These practices reduce the overall reliance on new materials, thus easing pressure on both the supply chain and waste landfill.

New solutions are also emerging to tackle components of renewable infrastructure that are less easy to dispose. Turbine blades for example contain complex composite materials which create lighter and more aerodynamic blades but pose challenges when recycling. Danish wind turbine manufacturer Vestas recently announced a new chemical technology to break down old blades into liquid before extracting high quality materials to use in new blades. In the solar space, the first specialist recycling facility is opening in France to manage the large amount of waste that is anticipated as the uptake in solar panels increases, with the intention to recycle 99% of components. In addition to recycling, constant innovation in solar panel design is gearing towards a more circular approach to panel manufacture.

Smart energy storage

Storing energy will also be vital to achieving a low carbon economy when the sun isn’t shining and the wind isn’t blowing. Batteries, thermal energy storage and pumped hydro allow for energy to be stored and accessed when it is needed. SSE recently announced plans to convert an old hydro power station in Scotland into pumped storage, which involves pumping water uphill at times of low energy demand and releasing the water through turbines to create electricity when it is needed. The new Sloy hydro-electric power station could provide constant flexible energy for up to 160 hours, enough to power around 90,000 homes for up to one week.12 This will play a significant role in managing the energy supply and is an example of how firms can upgrade existing infrastructure to meet today’s needs.

While pumped hydro makes up the majority of current energy storage, grid-scale battery growth is on the rise. According to the IEA, grid-scale battery growth is projected to account for the majority of storage growth worldwide. In 2021, grid-scale battery installation increased by 60% compared to 2020, with the US leading the way. Despite these changes, the IEA states that more progress is needed in this area to facilitate the hour-to-hour variability of wind and solar electricity generation required for a net zero scenario.8 China is the leader in battery making today but Canada, which has the necessary minerals and skilled workforce, is emerging as the next competitor in battery production.

What does this mean for investors?

The growth runway for renewable energy is huge; not only is it backed strongly by governments across the globe, but the pace of investment in clean technologies is much faster than many have anticipated. As such, we expect to see seismic shift from fossil fuel-based to renewable industries in the next decade.

It is important to note that renewable energy companies are only one aspect of achieving a low carbon economy. Electrification and digitalisation are two highly important vectors for decarbonisation and there are many different companies playing a part in these trends. As sustainable investors, this presents many potential investment opportunities. We take a forward-looking, practical approach to find companies which are innovative and offer solutions all the while maintaining robust balance sheets. This approach, we believe, helps us to stay on the right side of disruption.

1 International Energy Agency, Renewables 2022 Analysis and forecast to 2027, December 2022

2 European Commission, European Green Deal, December 2019

3 The White House, November 2022

4 Energy Foundation China, China’s 14th Five-Year Plans on Renewable Energy Development and Modern Energy System, September 2022

5 International Energy Agency, India’s clean energy transition is rapidly underway, benefiting the entire world, January 2022

6 SSE, SSE announces plans to invest up to £40bn in low-carbon energy infrastructure, May 2023

7 Iberdrola, Strategic Plan 2023-2025, June 2023

8 New Scientist, What is the carbon payback period for a wind turbine, September 2019

9 Vestas, Energy Payback & Return on Energy, 2023

10 Carbon Brief, Solar, wind and nuclear have ‘amazingly low’ carbon footprints, study finds, December 2017

11 SSE, ‘SSE unveils redevelopment plans for Sloy hydro-electric Power Station, May 2023

12 International Energy Agency, Grid-scale storage, September 2022

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.