Can utilities solve the renewable energy storage problem?

Research Analyst Noah Barrett considers the far-reaching implications behind the search for large-scale, long-duration energy storage.

6 minute read

Key takeaways:

- As renewable energy surges, utilities face a renewable integration ceiling due to the intermittent nature of wind and solar power and the lack of a viable large-scale, long-duration energy storage solution.

- The lack of long-duration storage may slow decarbonization efforts, limit renewables expansion, and challenge grid stability. But the full implications are highly dependent on potential breakthrough innovations, utility priorities, and electricity demand growth scenarios.

- Investors could consider diversified exposure to large utilities that are leading in renewables development and are at the forefront of investing in next-generation storage solutions, while recognizing that finding the ultimate storage solution may be a long-term process.

The rapid growth of renewable energy sources like wind and solar power has brought a critical challenge to the forefront: how to effectively store and distribute this intermittent energy. As utilities grapple with increasing load growth and work toward net-zero decarbonization goals, they face a pressing question: How much renewable energy can they integrate before hitting practical limitations?

The renewable integration ceiling

Based on our discussions with utilities in various locations, the upper limit for renewable penetration in their energy mix without significant storage solutions or major interconnection improvements is somewhere between 30%-40%. Beyond this threshold, the intermittency of wind and solar power begins to pose challenges.

While plans vary, many utilities aim for 70%-80% renewables by the early 2030s. While renewables penetration is already high in certain areas, like Texas and California, states in the mid-Atlantic, Northeast, and Pacific Northwest face bigger hurdles in achieving these goals due to less intense wind and solar power generation given weather conditions in those regions.

The elusive long-duration storage solution

For over a decade, utility-scale, long-duration battery storage has been the holy grail for increasing renewable energy penetration. Ideally, this solution would store power for more than 24 hours, and preferably up to a week. However, despite ongoing research, an economically viable option that works at the scale needed to power entire cities or regions has yet to emerge.

Current storage solutions often work well on a small scale but struggle when scaled up. The physics may not work, or costs become prohibitive. While breakthroughs in technologies like solid-state batteries, sodium batteries, or hydrogen solutions occasionally make headlines, they often fall short of being able to power a major city during extended outages or prolonged periods of low renewable generation.

The need for better storage is twofold: to prepare for multi-day renewable energy shortfalls and to reduce waste. In some regions, like California, excess renewable energy generated during peak times goes unused due to lack of storage capacity.

Short-term solutions and alternative technologies

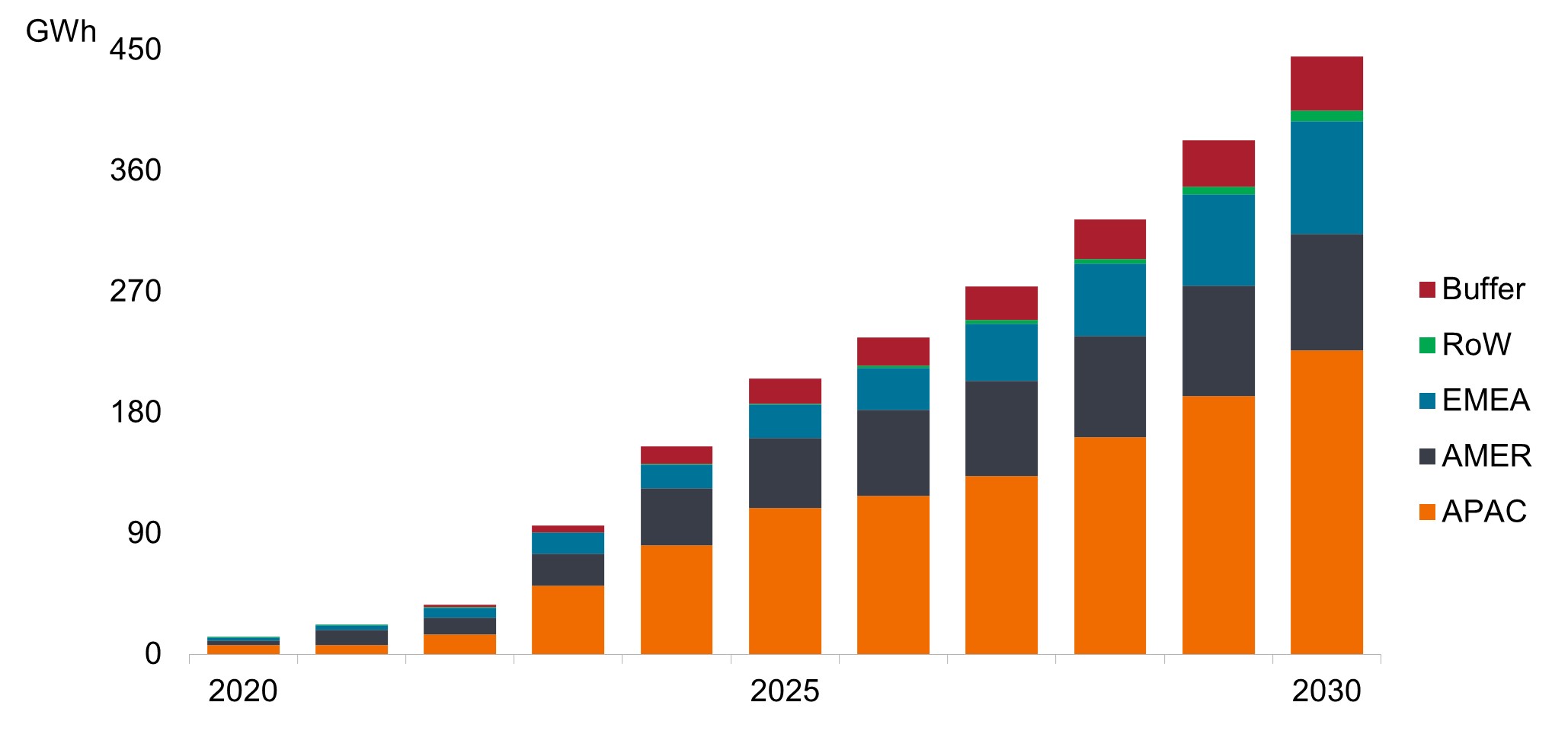

Despite these challenges, utilities are investing heavily in energy storage. The global market nearly tripled last year and is on track to surpass 100 gigawatt-hours of capacity for the first time in 2024 (Exhibit 1). Large regulated utilities like NextEra, Xcel, and AES are leading the charge in building out grid-scale storage.

Exhibit 1: Annual global storage installations outlook by region

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.

Current models typically use lithium-ion batteries that can hold only two to four hours of power. These short-duration solutions help manage daily fluctuations – storing electricity during peak renewable generation periods and discharging it back to the grid when electricity demand is high – but don’t address longer-term power mismatches or resilience planning.

As utilities recognize that lithium-ion batteries probably aren’t the ultimate solution for their long-duration, large-scale storage needs, alternative technologies are gaining attention. Flow batteries and sodium ion batteries, for example, use cheap, abundant materials, potentially solving the sourcing and availability issues associated with lithium. While their weight and size make them impractical for electric vehicles, they could work well for stationary storage.

Hydrogen is another frequently discussed option, though its promise has remained “10 years out” for some time. The main barriers to widespread adoption of these technologies are cost and efficiency. For instance, green hydrogen production needs consistent, high-uptime operation to be economically viable, which is challenging when relying on intermittent renewable energy sources.

Implications and potential scenarios

The lack of a viable long-duration energy storage solution has far-reaching implications:

1. Utilities may need to delay fossil fuel plant retirements and rely more heavily on natural gas as a short-term solution, potentially building new gas-fired facilities. While this could slow progress toward decarbonization goals, it would help ensure grid reliability as electricity demands from AI data center growth and the move to a more electrified economy increase over the next decade.

If regulated public utilities prioritize achieving net-zero goals over building new gas-fired facilities, power could potentially be generated by the private sector. Alternatively, electricity prices could increase, potentially slowing data center growth and bringing electricity demand back to a more manageable level.

2. The expansion of wind and solar installations may face limitations as grid operators struggle to balance intermittent supply and demand. This could potentially slow the pace of renewable energy adoption in some regions.

Furthermore, installations could slow in regions with an abundance of renewable energy and negative power pricing. Adding more renewables could compound the oversaturation problem in these regions without favorable economics for developers.

3. Data centers, which need constant electricity and have Big Tech clients with ambitious sustainability goals, may explore alternative options like small-scale nuclear reactors to meet their energy needs while maintaining sustainability commitments.

4. Grid stability becomes more challenging without adequate storage capacity, potentially leading to increased volatility in power markets and reliability issues during extended periods of low renewable generation.

Incentives could stoke further innovation

The road ahead for renewable energy storage remains uncertain, but incentives for developing and implementing large-scale, long-duration storage solutions are likely to grow. As utilities and tech companies push for solutions, and as the frequency and duration of power outages potentially increase with greater incidence of extreme weather, innovation in this space will be crucial.

For investors, the energy storage market presents a complex landscape with very few pureplay public equity investment opportunities. Many companies are still in the early stages of development and face profitability challenges, particularly cash-intensive businesses in a high interest rate environment. The industry can also be volatile and dependent on government support, making it potentially better suited for diversified portfolios.

We expect larger utility companies leading in renewable development such as NextEra, AES, and Iberdrola to drive long-term progress in energy storage. While regulated, they are at the forefront of current storage buildouts and are investing in next-generation storage technologies like hydrogen.

We believe utilities can eventually solve the renewable energy storage problem. For now, however, despite their progress, the holy grail of energy storage remains just out of reach.

IMPORTANT INFORMATION

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.