8 Aprile 2024

LONDON – Janus Henderson Investors is today announcing the launch of its Short-Term Fixed Maturity Bond Fund (EUR) 1. The Fund, which aims to provide a regular income whilst also aiming to preserve the initial capital invested over the term of the portfolio, will invest in a well-diversified portfolio of primarily investment grade bonds from developed markets around the world. Utilising in-depth fundamental company research the funds aim to exploit price inefficiencies and enhance yield with an emphasis on loss avoidance and minimal turnover.

The Funds’ investment team comprise portfolio managers in the firm’s global corporate credit team: James Briggs, Tim Winstone, Michael Keough, Brad Smith, and Carl Jones who have over 14 years’ experience in managing portfolios with specific yield maturity targets. The portfolio managers cover investment grade, high yield and blended solutions and fully leverage the global corporate credit team’s industry sector insights to enhance portfolio yields. They focus on avoiding defaults and downgrades, while identifying adequate compensation for risk taken.

James Briggs, Corporate Credit Portfolio Manager at Janus Henderson Investors said: “The current environment in short-term investment grade markets presents a particularly attractive opportunity for locking in higher income due to elevated yields. These yields are at levels not seen in over a decade, comparable only to periods of significant turmoil such as the 2008/09 financial crisis. This situation creates an advantageous setting for investors seeking better returns than those typically available. With the expectation of interest rate cuts from the European Central Bank this year, fixed maturity bonds offer a way to mitigate reinvestment risk associated with money market funds. This strategic timing aims to capitalise on the current market conditions to offer potentially higher returns and risk mitigation to investors.

Ignacio De La Maza, Head of EMEA & LatAm Client Group, said: “The current yield environment offers an exceptional opportunity for investors to generate higher income and there has been a noticeable interest from European clients looking to capitalise on this. With this in mind, our credit team has developed an attractive solution, drawing on their extensive experience in managing portfolios with specific yield and maturity targets”.

“The team’s active approach, – added Federico Pons, Country Head Italy – combined with a disciplined and repeatable process to monitor the evolution of portfolio risks is designed to deliver consistently to Italian client expectations.”

The fund will mature in June 2025, and will pay regular coupons semi-annually.

-Ends-

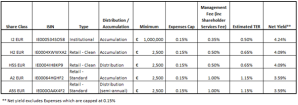

Janus Henderson Short-Term Fixed Maturity Bond fund fee structure

Contatti con la stampa

Lia Esbry

Corporate Communications Manager EMEA, LatAm and APAC

T: +44 (0)207 818 3521

E: Lia.Esbry@janushenderson.com

Janus Henderson Group is a leading global active asset manager dedicated to helping clients define and achieve superior financial outcomes through differentiated insights, disciplined investments, and world-class service.

As of December 31, 2023, Janus Henderson had approximately US$335 billion in assets under management, more than 2,000 employees, and offices in 24 cities worldwide. The firm helps millions of people globally invest in a brighter future together. Headquartered in London, Janus Henderson is listed on the New York Stock Exchange (NYSE).

Fonte: Janus Henderson Group plc

The income amount or capital value is not guaranteed. The value of the shares at the end of the Term may be less than the value at the time of investment because of the Fund’s distribution policy or market movements. Yields may vary over time and are not guaranteed. Due to the fixed maturity, there is only a short window in which to invest. Interested investors can subscribe to the fund between 8 April and 20 May 2024.

This press release is solely for the use of members of the media and should not be relied upon by personal investors, financial advisers or institutional investors. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes. All opinions and estimates in this information are subject to change without notice.

For institutional / sophisticated investors / accredited investors qualified distributors use only. Not for onward distribution. All content in this document is for information or general use only and is not specific to any individual client requirements. Janus Henderson Capital Funds Plc is a UCITS established under Irish law, with segregated liability between funds. This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions. Investors are warned that they should only make their investments based on the most recent Prospectus which contains information about fees, expenses and risks, which is available from all distributors and Paying/Facilities agents, it should be read carefully. An investment in the fund may not be suitable for all investors and is not available to all investors in all jurisdictions; it is not available to US persons. Past performance does not predict future returns. The rate of return may vary and the principal value of an investment will fluctuate due to market and foreign exchange movements. Shares, if redeemed, may be worth more or less than their original cost. This is not a solicitation for the sale of shares and nothing herein is intended to amount to investment advice. For sustainability related aspects please access Janushenderson.com. This document does not constitute investment advice or an offer to sell, buy or a recommendation, nor should it be taken as a basis to take (or stop taking) any decision, for securities, other than pursuant to an agreement in compliance with applicable laws, rules and regulations. Janus Henderson Group plc and its subsidiaries are not responsible for any unlawful distribution of this document to any third parties, in whole or in part, or for information reconstructed from this document and do not guarantee that the information supplied is accurate, complete, or timely, or make any warranties with regards to the results obtained from its use. As with all investments, there are inherent risks that each individual should address. The distribution of this document or the information contained in it may be restricted by law and may not be used in any jurisdiction or any circumstances in which its use would be unlawful. This presentation is strictly private and confidential and may not be reproduced or used for any purpose other than evaluation of a potential investment in Janus Henderson Investors International Limited products or the procurement of its services by the recipient of this presentation or provided to any person or entity other than the recipient of this presentation. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes. With effect from 1 January 2023, the Key Investor Information document (KIID) changed to the Key Information Document (KID), except in the UK where investors should continue to refer to the KIID.

Issued in Europe by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Copies of the Fund’s prospectus, Key Information Document, articles of incorporation, annual and semi-annual reports are available in English and other local languages as required from www.janushenderson.com. These documents can also be obtained free of charge from the Registered Office of the Company at 2 Rue de Bitbourg, L-1273, Luxembourg. Janus Henderson Investors Europe S.A. (“JHIESA”), 2 rue de Bitbourg, L-1273 Luxemburg, is the Facilities Agent in Austria, Belgium Germany, Portugal, Sweden, Liechtenstein and Luxembourg. JHIESA is also the Facilities Agent for France (Sub – TA is CACEIS). State Street Bank International GmbH – Succursale Italia, Société Générale Securities Services S.p.A (SGSS S.p.A), Allfunds Bank S.A.U filiale di Milano, Caceis Bank Italy Branch, and Banca Sella Holding S.p.A. are the Sub Transfer Agents for Italy. Allfunds Bank S.A., Estafeta 6, La Moraleja, Complejo Plaza de la Fuente, Alcobendas 28109, Madrid, Spain is the Facilities Agent in Spain. Janus Henderson Capital Funds Plc is an Irish collective investment scheme (IIC) registered in the National Securities Market Commission’s (CNMV) registry with registration number 265. Any further dissemination of this document to other persons who do not qualify as professional investors is not permitted nor is authorised by Janus Henderson Investors. The summary of Investors Rights is available in English from https://www.janushenderson.com/summary-of-investors-rights-english. Janus Henderson Investors Europe S.A. may decide to terminate the marketing arrangements of this Collective Investment Scheme in accordance with the appropriate regulation

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc. For more information or to locate your country’s Janus Henderson Investors representative contact information, please visit www.janushenderson.com