Energy disruption, not geopolitics, is driving emerging markets as higher energy prices could reshape the winners and losers. The persistence of higher prices will determine the eventual impact.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

An early reaction to military strikes in Iran and the implications for investors.

Key highlights from NVIDIA’s latest quarterly earnings call includes the company citing 2026 as an agentic AI inflection point, driving increasing compute demand and revenue generation.

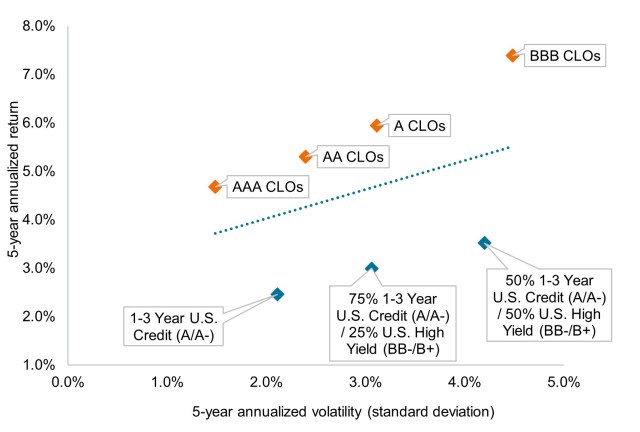

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Three essential elements to consider for an effective balanced strategy, plus trends to watch in equities and fixed income in 2026.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

What Trump’s nomination of Kevin Warsh as the next Fed chairman could mean for markets and the future path of monetary policy.

A stabilizing U.S. labor market gives the Fed room to wait and see whether inflation resumes its downward path.

Active vs passive? How a blended approach could work better in global equities

US–EU tensions escalate as new US tariffs prompt European unity and raise market escalation risks.