An options-implied analysis of the US presidential election – Part III

In part three of a series on the U.S. presidential election, Head of Asset Allocation Ashwin Alankar explains how options markets are likely better indicators of an election’s potential outcome than polling data.

3 minute read

Key takeaways:

- Echoing polling data, which are largely within their margin of error, information within options markets indicates an extremely close race, with former President Trump recently gaining the slightest of edges.

- We believe options prices can contain powerful signals on an election’s potential outcome, as there is a cost to being wrong, and options prices tend to incorporate a broader array of information than polling data.

- With only days remaining until the election, investors would be well served to consider options market signals not only for divining the election’s outcome but also over the longer term to gain insight on how the next administration’s policies could impact the economy.

With just days to go before the pivotal U.S. presidential election, analysts, pundits, and investors are seeking whatever information possible to determine which campaign has the upper hand. Most rely upon an array of polling data, which have lately had a dubious track record in predicting election outcomes. With a bit of creativity, we can use options market signals to gain insights into its view on which party is likely to prevail.

Pricing risk – to the upside and downside

The options market can be considered an insurance market on financial assets. Just like an insurance premium, the price of an option provides information about the expected future risk to an underlying asset. Moreover, rather than just identifying total risk, the options market distinguishes the good risk, or upside volatility of the asset, from the bad risk, or downside volatility. Accordingly, by looking at options prices, one can measure the attractiveness of an asset, such as a stock. Academic research shows that the ratio of upside to downside volatility has good forecast ability in determining the attractiveness of an asset.

Crowdsourced and hard data

We consider the forward-looking information derived from options signals efficient as they are based on the collective insights of thousands of market participants. In other words, it is a crowd-sourced information measure. And unlike polling or survey data, which is soft data, options estimates are hard data as they are based on investments, and there is a monetary cost to being wrong.

Over the past few months, we’ve leveraged the options market to seek insight into the U.S. presidential contest. By identifying a basket of stocks that is aligned with the Democratic party, we can use the options prices of these securities to estimate the attractiveness of the basket. We can then do the same with a Republican basket.

Fortunately, research firm Strategas has constructed such baskets, enabling us to gauge the movement in options prices on these stocks. If the attractiveness of the Democratic basket is greater than the Republican basket, the market implies a greater probability of a Democrat win, and vice versa. The magnitude of the differences in attractiveness should correlate to how much greater probability the options market is assigning to the win of one party versus another.

Priorities

In our analysis, the Democratic basket has exposures to climate-focused companies, technology companies (less protectionism), and healthcare, while the Republican basket has exposures to financials (less regulation), the defense industry, and fossil fuels.

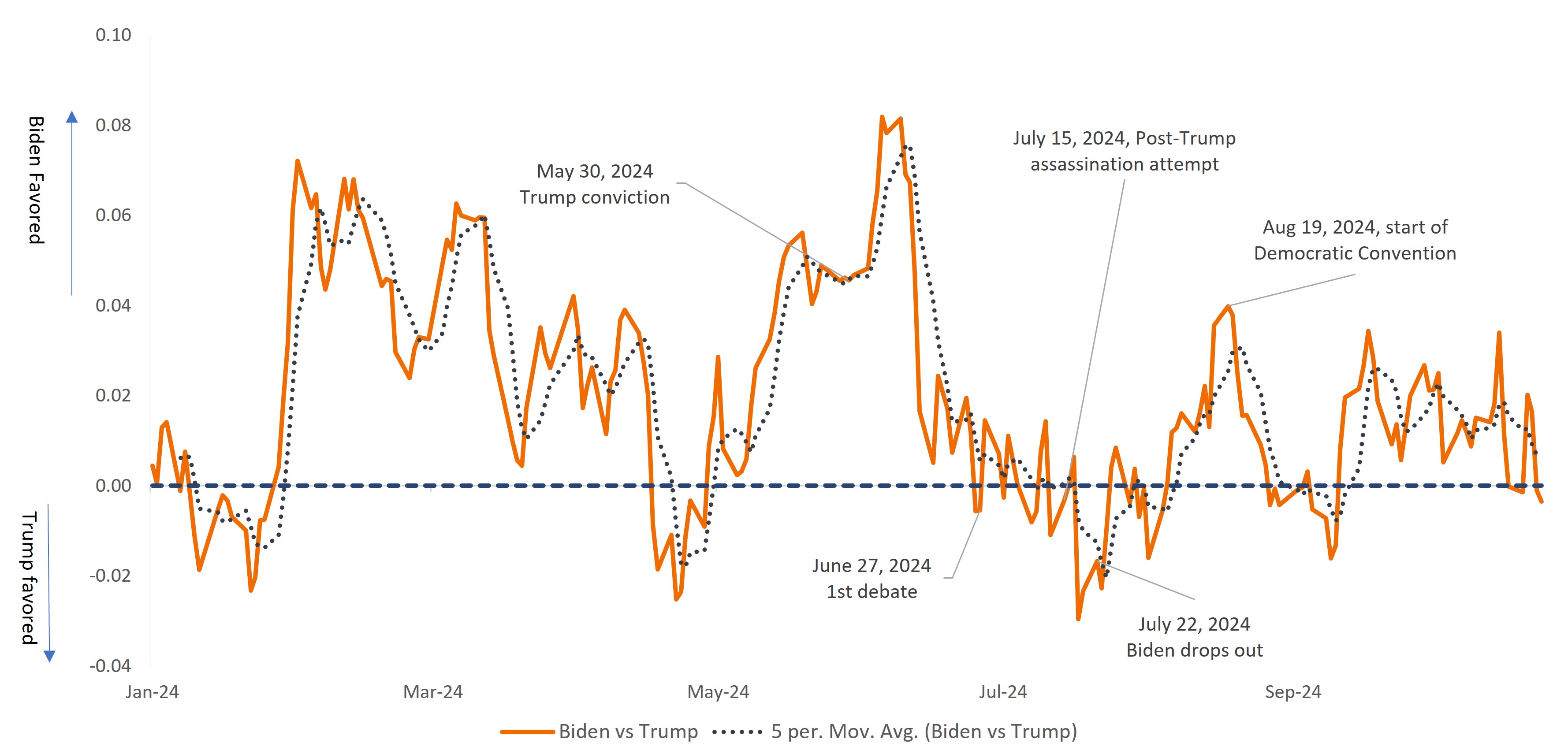

The chart below plots the difference in attractiveness between these two baskets and indicates the options market is very slightly favoring the Republican basket for a potential Trump win. For all intents and purposes, the options market sees the contest as a toss-up. An absolute difference larger than 0.05 would imply a quite strong view or conviction implied from options prices. Today we are far from this level.

Exhibit 1: Relationship of Democrat-to-Republican tail-Sharpe ratios

After a volatile campaign season, the upside potential for the Republican basket of options is slightly more favorable than the signals embedded in the Democrat basket.

Source: Strategas, Janus Henderson Investors, as at 25 October 2024.

IMPORTANT INFORMATION

Options (calls and puts) involve risks. Option trading can be speculative in nature and carries a substantial risk of loss.

Volatility measures risk using the dispersion of returns for a given investment.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Gli emittenti di obbligazioni (o di strumenti del mercato monetario) potrebbero non essere più in grado di pagare gli interessi o rimborsare il capitale, ovvero potrebbero non intendere più farlo. In tal caso, o qualora il mercato ritenga che ciò sia possibile, il valore dell'obbligazione scenderebbe.

- L’aumento (o la diminuzione) dei tassi d’interesse può influire in modo diverso su titoli diversi. Nello specifico, i valori delle obbligazioni si riducono di norma con l'aumentare dei tassi d'interesse. Questo rischio risulta di norma più significativo quando la scadenza di un investimento obbligazionario è a più lungo termine.

- I mercati emergenti espongono il Fondo a una volatilità più elevata e a un maggior rischio di perdite rispetto ai mercati sviluppati; sono sensibili a eventi politici ed economici negativi e possono essere meno ben regolamentati e prevedere procedure di custodia e regolamento meno solide.

- Il Fondo potrebbe usare derivati al fine di conseguire il suo obiettivo d'investimento. Ciò potrebbe determinare una "leva", che potrebbe amplificare i risultati dell'investimento, e le perdite o i guadagni per il Fondo potrebbero superare il costo del derivato. I derivati comportano rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.