Words matter. Since the Chairman of the US Federal Reserve (the Fed) intimated that the central bank might be done hiking rates in June last year, investors were treated to an early Christmas present, which saw markets rally hard, with listed property equities amongst the biggest winners.1

As listed real estate investment trust (REIT) specialists, sometimes we forget that the wider investing public may not always recognise or be following the nuances of commercial real estate (CRE), let alone the role of listed REITs within the asset class. So, after the stellar run since early November last year, three key questions for investors are: What is priced into real estate equities today? What should they expect going forward? And does the public versus private market opportunity still exist?

Party pooper!

Over the past couple of years, we have witnessed changes in capital markets, most notably in government bond yields, that are unprecedented in terms of magnitude and rapidity. Specifically, the US 10-year Treasury yield advanced from less than 1% to 5% over the course of about 36 months, and then fell back down to about 4% in the last two months of 2023.2 This kind of seismic volatility should typically drive a corresponding response in the price of any asset, like fixed income or real estate, that is directly or indirectly priced relative to the risk-free rate.

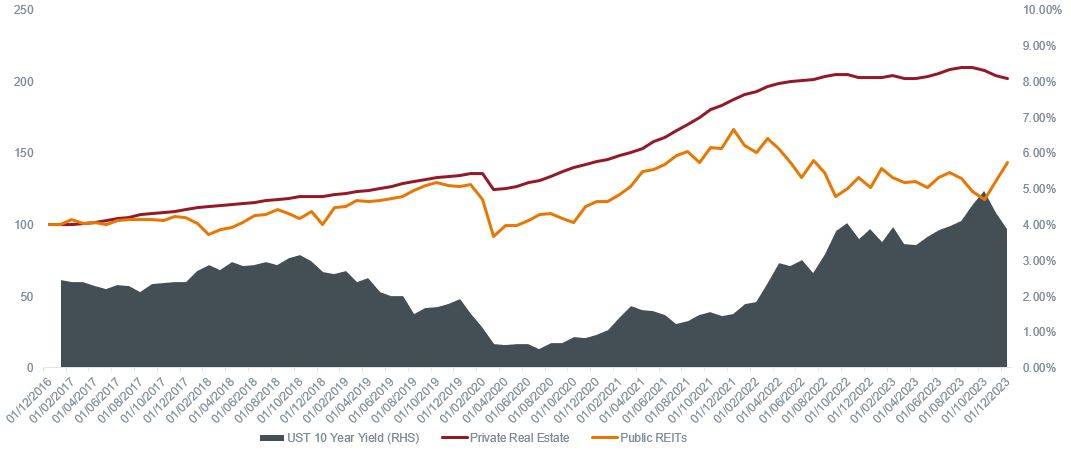

We often speak to clients who are worried about the downside risk to real estate valuations. These concerns are valid, but are far more relevant to valuations reported by privately-owned commercial real estate (which represent the vast majority of all CRE). Using the world’s largest non-traded REIT – Blackstone Real Estate Income Trust as a gauge, private real estate valuations remain frozen in an interest rate regime that no longer exists. In contrast, public REIT share prices have reacted to changing interest rates in real time given they are valued by the market daily.

Public versus private real estate pricing reconverging?

Source: breit.com, Bloomberg, Janus Henderson Investors analysis as at 31 December 2023. BREIT (Blackstone Real Estate Income Trust) used as a proxy for private real estate and FTSE Nareit Equity REITs as a proxy for public REITs. Indexed to 100 from BREIT inception in 2017. Past performance does not predict future returns.

The recent and rapid move down in interest rates is a result of markets taking on the view that the Fed’s aggressive hiking cycle has ended. Although past performance is not a guide to future returns, listed REITs have historically been among the best performing equities following a cycle’s final Fed hike.3 Whilst it remains early days since the “pivot party” began, we are encouraged by the fact that since 1 November, real estate was the best performing sector within the S&P 500 to the end of December 2023.4 Here it’s important to remember that stock prices are inherently forward looking, and that because the market helped public REITs discard stale valuations, they were in a position to rebound in response to a favourable move in rates. While the ride may be bumpy, there is reason to believe falling rates will be a tailwind for REIT share prices similar to how rising rates were a headwind over the past few years.

Pass the (debt) parcel

Another concern we hear from clients relates to leverage (debt levels) within commercial real estate, delinquent loans, difficulty in refinancing low coupon debt and potential defaults. Again, these concerns are valid and again they pertain mainly to privately-owned CRE. Bank lending and commercial mortgage-backed securities (CMBS) are two primary debt sources for private commercial real estate in the US. Debt issuance volumes from each of these were down 67% and 40% respectively over the first nine months of 2023 (most recent data available).5

Conversely, public REITs are predominantly investment-grade borrowers in the unsecured bond market, and have had continued access to debt capital. US REIT bond issuance was up 65% year-on-year in 2023 and is already off to a strong start in January 2024 with some deals oversubscribed multiple times.6

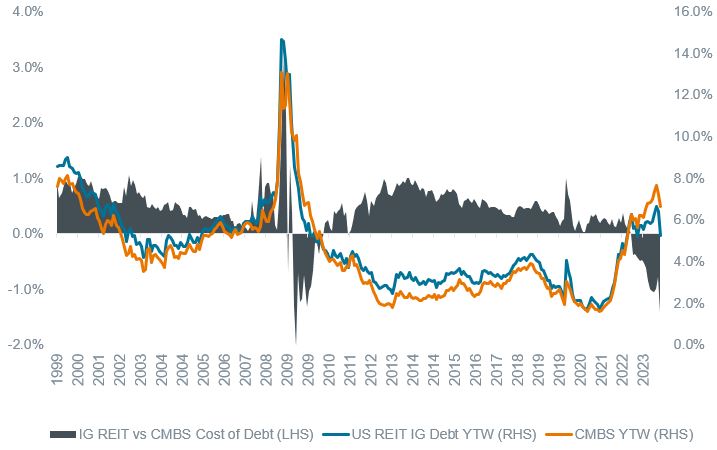

In addition, the cost of debt for investment grade REITs is as favourable relative to the CMBS market (a proxy for private real estate cost of debt) as it has been since the Global Financial Crisis. It’s noteworthy that public REITs typically operate with far less leverage (about 35%) than private real estate (about 60%+).7 This allows for opportunistic equity issuance, which should also be an important source of growth capital for public REITs. As their share prices recover, public REITs can benefit from more favourable cost of debt and equity capital than they have in years.

Investment grade public REITs benefit from relatively lower debt costs

Source: Bloomberg, Janus Henderson Investors analysis, as at 30 November 2023. ICE BofA Fixed Rate CMBS Index, Bloomberg Investment Grade (IG): REITs Statistics Index. Area chart shows IG REIT YTW (yield-to-worst) minus CMBS YTW.

We do believe many owners of CRE will face debt service coverage problems related to the now higher cost of refinancing existing debt in an environment where real estate values have declined, and traditional lenders are tight-fisted. However, this really only applies to highly levered private owners of CRE. While we don’t believe there will be widespread distress in private CRE, we do expect lenders will require additional capital injections to refinance debt, which is likely to come from asset sales.

As for public REITs, we expect their cost and access to capital advantages will be put to good use to acquire “good buildings with bad balance sheets” from private owners, and they look well placed to continue expanding market share as they have over the past three decades.

Party planner

As we head into a new capital markets environment, we acknowledge that broader commercial real estate does face challenges – some US$600bn of CRE debt will need to be refinanced in 2024 with most of this belonging to private real estate.8

Public REITs, on the other hand, have already felt the chill of capital markets and with the change in sentiment brought about by a potential change in Fed policy taking the worst-case scenarios for real estate off the table, we believe investors stand to gain as public REITs have a clear advantage versus the more challenged private CRE and as capital markets normalise.

1 Nareit.com, as at 31 December 2023.

2 Trading Economics as at 31 December 2023.

3 UBS, Datastream, Janus Henderson analysis, as at 31 December 2022.

4 Bloomberg, S&P 500 Economic Sectors Index. Real estate = S&P 500 Real Estate Index. Past performance does not predict future returns.

5 Mortgage Bankers Association (MBA) Commercial/Multifamily Databook Q3 2023.

6 S&P Capital IQ Transactions Statistics 2023.

7 Green Street, Morgan Stanley, Janus Henderson Investors analysis, as at 31 December 2022.

8 Moody’s Analytics, Mortgage Bankers Association, Raymond James Research.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time, used to gauge the financial health of a company.

Bond yield: level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields means higher bond prices.

Capital market: part of the financial system that deals with raising capital through investments or trading investments with other investors. The stock, bond, currency and derivatives markets are examples of this.

CMBS: commercial mortgage-backed securities are a type of fixed-income security created by banks by bundling a group of commercial real estate loans, which are rated according to risk then sold to investors.

FTSE EPRA Nareit Developed Index tracks the performance of real estate companies and real estate investment trusts (REITs) from developed market countries.

Leverage: the amount of debt that a REIT carries. The leverage ratio is measured as the ratio of debt to total assets.

Risk-free rate: the rate of return of an investment with, theoretically, zero risk. The benchmark for the risk-free rate varies between countries. In the US, for example, the yield on a US 10-year Treasury note is often used.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.

Yield-to-worst: the lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe a portfolio, this statistic represents the weighted average across all the underlying bonds held.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Le azioni di società a piccola e media capitalizzazione possono presentare una maggiore volatilità rispetto a quelle di società più ampie e talvolta può essere difficile valutare o vendere tali azioni al momento e al prezzo desiderati, il che aumenta il rischio di perdite.

- Un Fondo che presenta un’esposizione elevata a un determinato paese o regione geografica comporta un livello maggiore di rischio rispetto a un Fondo più diversificato.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Questo Fondo può avere un portafoglio particolarmente concentrato rispetto al suo universo d’investimento o altri fondi del settore. Un evento sfavorevole riguardante anche un numero ridotto di partecipazioni potrebbe creare una notevole volatilità o perdite per il Fondo.

- Il Fondo investe in fondi d’investimento immobiliari (REIT) e altre società o fondi impegnati nell’investimento immobiliare, che comportano rischi maggiori di quelli associati all’investimento immobiliare diretto. In particolare, i REIT possono essere soggetti a normative meno rigide di quelle del Fondo stesso e possono registrare una maggiore volatilità delle rispettive attività sottostanti.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Le spese correnti possono essere prelevate, in tutto o in parte, dal capitale, il che potrebbe erodere il capitale o ridurne il potenziale di crescita.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

Specific risks

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Le azioni di società a piccola e media capitalizzazione possono presentare una maggiore volatilità rispetto a quelle di società più ampie e talvolta può essere difficile valutare o vendere tali azioni al momento e al prezzo desiderati, il che aumenta il rischio di perdite.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Questo Fondo può avere un portafoglio particolarmente concentrato rispetto al suo universo d’investimento o altri fondi del settore. Un evento sfavorevole riguardante anche un numero ridotto di partecipazioni potrebbe creare una notevole volatilità o perdite per il Fondo.

- Il Fondo investe in fondi d’investimento immobiliari (REIT) e altre società o fondi impegnati nell’investimento immobiliare, che comportano rischi maggiori di quelli associati all’investimento immobiliare diretto. In particolare, i REIT possono essere soggetti a normative meno rigide di quelle del Fondo stesso e possono registrare una maggiore volatilità delle rispettive attività sottostanti.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Le spese correnti possono essere prelevate, in tutto o in parte, dal capitale, il che potrebbe erodere il capitale o ridurne il potenziale di crescita.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

- Oltre al reddito, questa classe di azioni può distribuire plusvalenze di capitale realizzate e non realizzate e il capitale inizialmente investito. Sono dedotti dal capitale anche commissioni, oneri e spese. Entrambi i fattori possono comportare l’erosione del capitale e un potenziale ridotto di crescita del medesimo. Si richiama l’attenzione degli investitori anche sul fatto che le distribuzioni di tale natura possono essere trattate (e quindi imponibili) come reddito, secondo la legislazione fiscale locale.

Specific risks

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Un Fondo che presenta un’esposizione elevata a un determinato paese o regione geografica comporta un livello maggiore di rischio rispetto a un Fondo più diversificato.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Questo Fondo può avere un portafoglio particolarmente concentrato rispetto al suo universo d’investimento o altri fondi del settore. Un evento sfavorevole riguardante anche un numero ridotto di partecipazioni potrebbe creare una notevole volatilità o perdite per il Fondo.

- Il Fondo investe in fondi d’investimento immobiliari (REIT) e altre società o fondi impegnati nell’investimento immobiliare, che comportano rischi maggiori di quelli associati all’investimento immobiliare diretto. In particolare, i REIT possono essere soggetti a normative meno rigide di quelle del Fondo stesso e possono registrare una maggiore volatilità delle rispettive attività sottostanti.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo può sostenere un livello di costi di operazione più elevato per effetto dell’investimento su mercati caratterizzati da una minore attività di contrattazione o meno sviluppati rispetto a un fondo che investa su mercati più attivi/sviluppati.

- Le spese correnti possono essere prelevate, in tutto o in parte, dal capitale, il che potrebbe erodere il capitale o ridurne il potenziale di crescita.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

- Oltre al reddito, questa classe di azioni può distribuire plusvalenze di capitale realizzate e non realizzate e il capitale inizialmente investito. Sono dedotti dal capitale anche commissioni, oneri e spese. Entrambi i fattori possono comportare l’erosione del capitale e un potenziale ridotto di crescita del medesimo. Si richiama l’attenzione degli investitori anche sul fatto che le distribuzioni di tale natura possono essere trattate (e quindi imponibili) come reddito, secondo la legislazione fiscale locale.

Specific risks

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Le azioni di società a piccola e media capitalizzazione possono presentare una maggiore volatilità rispetto a quelle di società più ampie e talvolta può essere difficile valutare o vendere tali azioni al momento e al prezzo desiderati, il che aumenta il rischio di perdite.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Il Fondo investe in fondi d’investimento immobiliari (REIT) e altre società o fondi impegnati nell’investimento immobiliare, che comportano rischi maggiori di quelli associati all’investimento immobiliare diretto. In particolare, i REIT possono essere soggetti a normative meno rigide di quelle del Fondo stesso e possono registrare una maggiore volatilità delle rispettive attività sottostanti.

- Il Fondo potrebbe usare derivati al fine di conseguire il suo obiettivo d'investimento. Ciò potrebbe determinare una "leva", che potrebbe amplificare i risultati dell'investimento, e le perdite o i guadagni per il Fondo potrebbero superare il costo del derivato. I derivati comportano rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Le spese correnti possono essere prelevate, in tutto o in parte, dal capitale, il che potrebbe erodere il capitale o ridurne il potenziale di crescita.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

- Oltre al reddito, questa classe di azioni può distribuire plusvalenze di capitale realizzate e non realizzate e il capitale inizialmente investito. Sono dedotti dal capitale anche commissioni, oneri e spese. Entrambi i fattori possono comportare l’erosione del capitale e un potenziale ridotto di crescita del medesimo. Si richiama l’attenzione degli investitori anche sul fatto che le distribuzioni di tale natura possono essere trattate (e quindi imponibili) come reddito, secondo la legislazione fiscale locale.