As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Assessing the potential impact of President Trump’s “most favored nation” drug pricing policy on biopharma companies.

Why the U.S. economy has a chance at avoiding recession. Plus, the opportunity we’re seeing in secular growth businesses.

The material costs of frittering away the U.S. dollar’s reserve currency status must be considered in any trade rebalancing.

Rather than favoring U.S. stocks at any price, investors may want to prioritize a global approach focused on valuation and free-cash-flow growth.

How fixed income markets are responding to Trump’s sweeping tariffs.

Can diversification help investors to ride out the uncertainty as US tariffs reshape global trade dynamics?

Key considerations for investors as markets await clarity on the Trump administration’s evolving tariff agenda.

Assessing market reactions to the Trump administration’s recently imposed tariffs.

Could plans to loosen Germany's debt rules open the door to more robust growth in Europe's powerhouse economy?

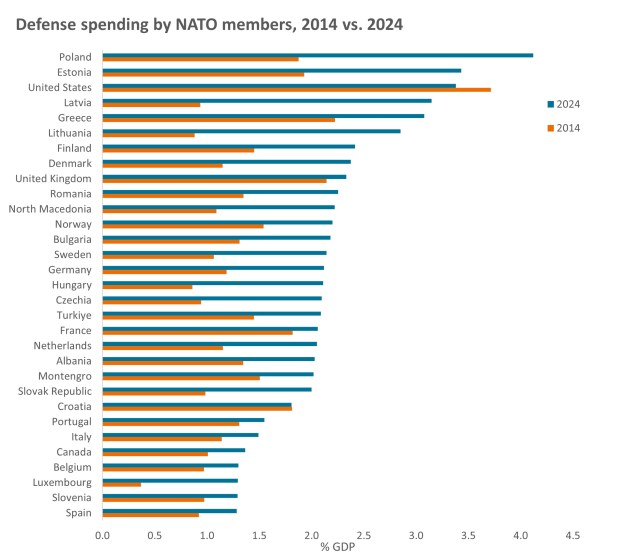

A changing geopolitical landscape is helping revive once slow-growing areas of the market, such as European defense.