Why rational pricing and rising dispersion represent a rare opportunity for absolute return investors.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Why absolute return strategies are set to play a pivotal role in 2026, offering diversification and resilience to offset uncertainty and evolving market dynamics.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

Tokenization's potential to revolutionize investing.

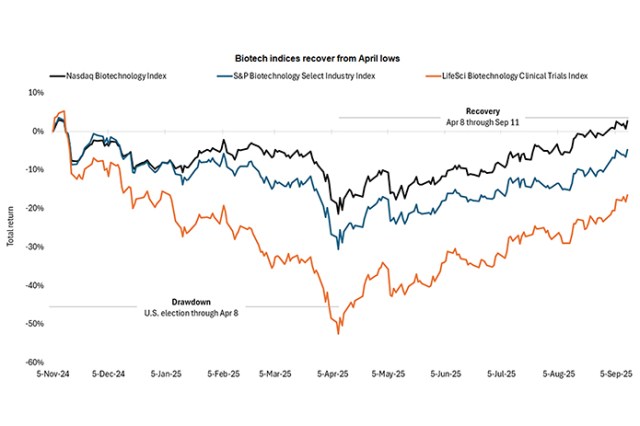

Optimism is returning to the biotech space, and we see durable drivers behind the recent performance recovery.

Are shifting market dynamics building the need for real diversification in investors’ portfolios?

Amid significant market volatility, we explore how absolute return investing and diversification can enhance investor portfolios.

Can absolute return strategies enhance portfolio diversification in today's dynamic markets?

Modern investors tend to underappreciate the power of diversification across assets, time, and direction, which ancient societies, perhaps ironically, understood.

With Trump's tariffs reshaping global trade, our portfolio managers share insights on the longer-term implications for financial markets.

David Elms, Head of Diversified Alternatives, explores the potential strategic advantages of multi-strategy investing in uncertain times.