Three charts and three questions to guide your client conversations

Wealth Strategist Ben Rizzuto highlights three questions from Janus Henderson’s 2024 Investor Survey that can serve as useful conversation starters for meetings with clients or prospects.

5 minute read

Key takeaways:

- Any meeting with a client or prospect can be viewed as an opportunity to better gauge where they are in their financial journey.

- Many of the questions posed in our latest Investor Survey provide effective starting points for delving deeper into how clients are feeling.

- Understanding clients’ emotions – and the reasons behind those emotions – can help advisors build stronger relationships and allow them to provide more personalized guidance.

You probably have a meeting coming up with a client or prospect. It could be an annual review, an introductory meeting, or a just a quick pop-in to fill out some paperwork. These meetings should all be seen as opportunities to better understand where a client or prospect is in their financial journey.

That’s one of the reasons I really enjoy seeing all the data we’re able to compile in our annual Investor Survey. Many compelling trends in the way investors are thinking and feeling about their financial situations can be found in the recently released 2024 edition.

Along with those trends, I uncovered several findings that I think are important for advisors to be aware of, and that also serve as good conversation starters for meetings with clients or prospects.

Below I’ve included three charts highlighting findings from our survey and at least three questions based on those charts that you can pose to clients or prospects the next time you see them.

How satisfied are you with your financial situation?

Many people might see this chart and think there is little work to do. However, I view this result from the standpoint of, if we don’t have 100% of clients saying they are “very satisfied” with their financial situation, then there is more that we can do to help.

If nothing else, I think “How satisfied are you with your financial situation?” is an important checkpoint question to ask on a periodic basis. Inevitably, many clients will say “things are fine” or “things are good.” If that’s the answer you get, don’t simply end the conversation there; try following up with: “What’s something you would change if you could?” By digging a little deeper and asking a more open-ended question, you might prompt the client to offer up a few more specifics on where improvements could be made or where pain points exist.

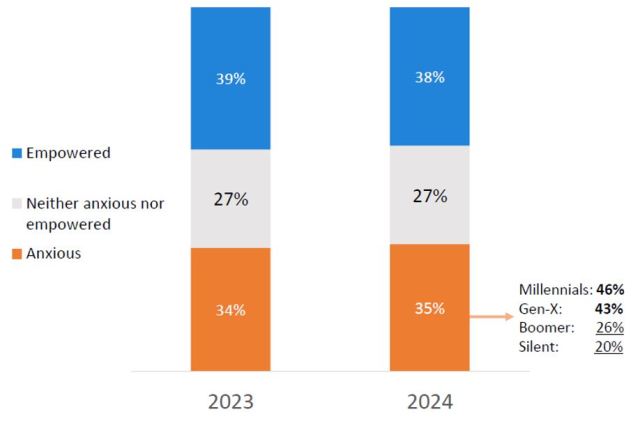

How does thinking about finances make you feel?

This chart reminds us how emotions and money are inherently intertwined. With 62% of respondents feeling less than enthusiastic about their finances, this serves as a great reason to figure out how we can help ease the negative stress clients are feeling about their finances or in their lives.

Remember that while anxiety around certain issues may be uncomfortable to discuss, this emotion is one that allows us to truly understand what clients think is important. Are they anxious about the election? Are they anxious about their account balance? Those are good starting points, but what’s most important to understand is what, exactly, about those things is making your client anxious. Is it that your client feels the winner of the election is going tank the stock market? Or does your client have a mental anchor in place where they like to see their account at a specific amount?

Whatever is producing this anxiety, understanding the reason behind the emotion will allow you to see how you might be able to help.

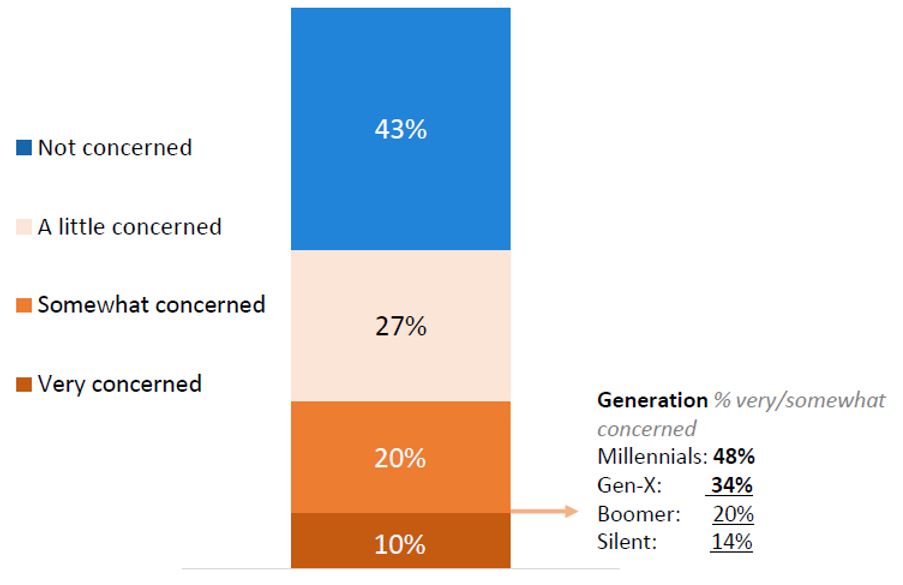

Are you concerned that family issues may arise because of money or wealth transfer?

The Great Wealth Transfer is something our industry has talked about for years, and there is still quite a bit of concern about how it will ultimately play out among clients –especially younger (Gen X and Millennial) clients.

This concern may actually be well founded considering 70% of wealth transfers fail, and 60% of those failures are due to a lack of trust or communications between family members.1 There are several issues and topics that come up within this conversation, but some of the most common questions that arise are:

Who is going to receive my wealth?

When will they receive it?

What will they receive?

How will the wealth transfer process work?

These questions can help clients crystalize their estate plan and address many of the financial and non-financial issues involved in the transfer of wealth.

The key questions this chart highlights are:

Are you concerned that family issues may arise because of money or wealth transfer, and if so, what issues do you anticipate?

Have you discussed your wealth transfer plans and the rationale behind them with your family?

If families haven’t discussed their wealth transfer plans with family members, this may be a good reason for advisors to encourage a family meeting. These meetings serve as a great opportunity to set expectations and answer questions. They can also help ensure that the individuals who will be inheriting your clients’ assets know you and the value you can provide as an advisor.

Furthermore, these types of planning conversations not only help ensure a smooth transfer of wealth, but facilitating these conversations can also lead to greater client satisfaction. In fact, our survey found that clients who had quality money conversations with loved ones were twice as likely to be very satisfied with their financial advisor.

So, there you have it. Three charts, three questions, and a significantly better understanding of how you can help your client. And for more findings on how investors are thinking, be sure to read the full report on our 2024 Investor Survey.

1 Institute for Preparing Heirs; “Preparing Heirs: Five Steps to a Successful Transition of Family Wealth and Values”, Roy Williams and Vic Preisser.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.