For nearly 30 years we have recognised the link between sustainability and innovation, and today we believe we are entering a decade of transformational change. The transition to a low carbon economy is finally accelerating. We view decarbonisation as a generational investment trend that will have a profound impact on almost every sector of the economy.

What does low carbon investing mean?

Low carbon investing is much more than simply investing in renewable energy companies and removing fossil fuels from a portfolio. For the last 250 years, since the beginning of the Industrial Revolution, humankind has made tremendous progress using a fossil fuel-driven economic growth engine. Unfortunately, tremendous industrial progress has not come without its consequences. The world today relies heavily on the use of carbon-emitting processes in everyday life, such that it would be hard to live without them. In essence, the fossil economy has been woven into our global economic system.

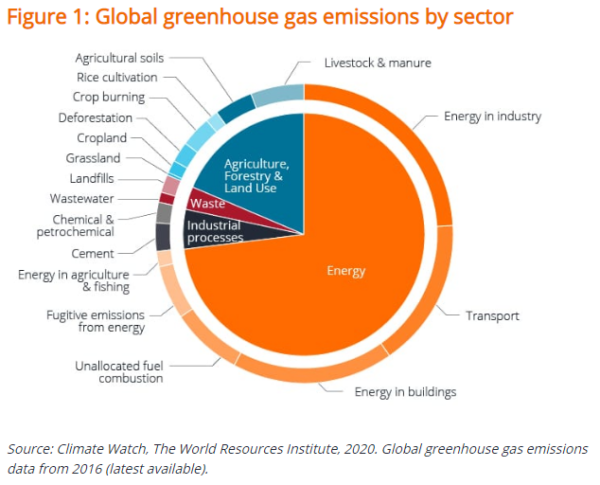

Greenhouse gas emissions are produced across almost all industries. The largest emitters include transportation, electricity, power generation, industry, commercial and residential buildings, and agriculture. However, it is important to consider that the fossil fuel economy is a highly complex and interdependent system, as shown in Figure 1. Within each sector are various sub sectors and industries with differing levels of fossil fuel-driven economic activity. Detangling the web of carbon-emitting processes is no easy feat.

Synchronised investment boom into clean technologies

This year, the world’s most influential governments have made ambitious commitments to tackle climate change head on. In April 2021, 40 world leaders convened virtually to address the climate crisis at the Leaders Summit on Climate. The White House stated its aim to reduce US emissions by 50% to 52% by 2030 based on 2005 levels and China premier Xi Jinping announced intentions to phase out coal use from 2026. Meanwhile, the UK government announced the world’s most ambitious climate change target – to cut emissions by 78% by 2035 compared to 1990 levels. The UK’s sixth carbon budget is set to include international aviation and shipping emissions and would bring the UK more than three-quarters of the way to net zero by 2050. Today, we are pleased to see much greater global political harmony on the climate agenda. The stars are aligning for what we believe will be a globally synchronised investment boom into clean technologies.

So, what do these climate commitments mean for the fossil fuel economy? In order to align with the 1.5oC climate limit, we will need multiple solutions to address the multiple sectors and industries involved. Countries must increase electricity share of the primary energy mix from 20% to 50% over the next few decades. The US has set out material provisions to electrify a portion of the school bus fleet, retrofit buildings to higher environmental standards, reduce the use of coal and gas generation, and invest in the country’s electric and renewable energy infrastructure. The UK, meanwhile, has banned the sale of diesel and petrol cars by 2030 and announced a £20m funding pot for electric vehicles.

“Today, we are pleased to see much greater global political harmony on the climate agenda. The stars are aligning for what we believe will be a globally synchronised investment boom into clean technologies.”

A decade of transformational change

Electrification of the global automotive fleet is one area that we are particularly excited about. As battery and computing technology continue to improve and associated costs decrease, we expect to see mass production and adoption of electric vehicles. This is often referred to as the S-curve. When plotted on a chart, the S-curve illustrates the innovation of a technology from its slow early beginnings as it is developed, to an acceleration phase as it matures and, finally, to its stabilisation over time. The electrification of vehicles is just one example of this. We believe we are standing at the beginning of a decade of transformational change that will induce multiple S-curves across many different industries.

At the heart of this change is electrification. Picture a light-emitting diode (LED) bulb, which emits light through a process called electroluminescence. In contrast to the traditional incandescent bulb, which emits light through the heating of a small metal filament, LEDs pass electrical currents through semiconducting material in order to emit photons. This same photon emitting process can be used to transmit data. LiFi, similar to WiFi, is a wireless communication technology which utilises the LED process to transmit data from one object to another.

“At the heart of this change is electrification. … As electrification continues to develop, everything will become ‘smart’ and connected, blurring the lines between sectors and industries.”

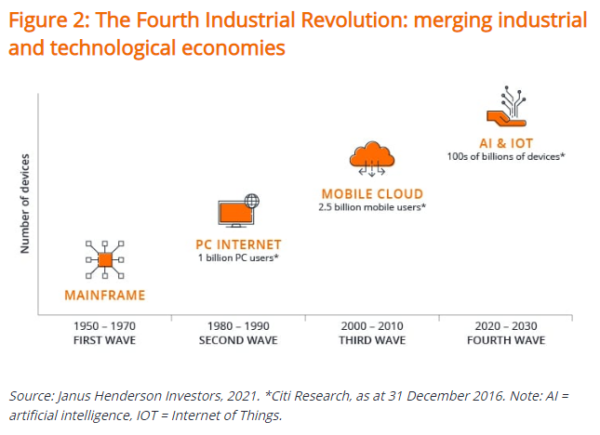

While the details of LiFi might be fascinating, the key takeaway is that the electrification and digitalisation are intrinsically linked. As electrification continues to develop, everything will become ‘smart’ and connected, blurring the lines between sectors and industries. Over the next decade, we anticipate the inception of multiple S-curves as technology improves and connectivity progresses. Traditional analogue products will make way for the new era of cloud computing and the Industrial Internet of Things. This shift has already started happening in smart cars, smart watches and even smart fridges. We consider this to be the Fourth Industrial Revolution (see Figure 2).

The Fourth Industrial Revolution is enabling us to move from a ‘fossil analog’ economy towards a ‘renewable electric digital’ economy. It is at the heart of decarbonisation and the transition to a low carbon economy. We refer to the trio of digitalisation, electrification and decarbonisation (DED) as the ‘DED nexus’. These dynamics are impacting every sector and every corner of the global economy. We highlight the importance of considering the implications of these changes on portfolios. The DED nexus has been accelerated by the events of last year and we believe that, combined, they are powerful agents of positive change with regards to both societal and environmental sustainability goals.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Le azioni di società a piccola e media capitalizzazione possono presentare una maggiore volatilità rispetto a quelle di società più ampie e talvolta può essere difficile valutare o vendere tali azioni al momento e al prezzo desiderati, il che aumenta il rischio di perdite.

- Il Fondo si attiene a un approccio d’investimento sostenibile, il che potrebbe condurlo ad essere sovrappesato e/o sottopesato in alcuni settori e pertanto ad ottenere performance diverse da quelli di fondi con obiettivi analoghi, ma che non si avvalgono di criteri d’investimento sostenibile per la selezione dei titoli.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

- Il Fondo segue uno stile d’investimento di tipo “growth” che privilegia determinati tipi di società. Conseguentemente, il Fondo potrebbe sottoperformare o sovraperformare significativamente la media del mercato.