While the US election result was undoubtedly a key moment for financial markets, few anticipated the scale of domestic policy change, or level of uncertainty driven by an unexpectedly belligerent stance on trade from the new government. In Trump’s first stint as President, he showed willing to take on both China and America’s traditional allies, imposing tariffs and quotas on imports.

Back then, Trump used tariffs as a negotiating tool. The US-Mexico Joint Declaration in 2019, for example, designed to put pressure on Mexico to increase enforcement against ‘irregular’ migration to the US. Or the renegotiation of a new US-Mexico-Canada Agreement (USMCA) in 2020, replacing the existing North America Free Trade Agreement (NAFTA).

The concern this time is that Trump might be willing to take things further in response to reciprocal tariff measures from the EU, China or traditionally close allies, like Canada or the UK. The risk for markets is that escalation could hamper global trade, feed through to higher prices, undermine consumer confidence and demand, and affect corporate hiring, expenditure and investment plans. Central banks are warning that global trade policy uncertainty is intensifying, adding questions about the direction and scale of any interest rate changes.

Trump was already seen as a likely disruptor in his second term. But this is not a normal environment for financial markets. Asset prices are well above their historical averages, market concentration is the highest it has ever been given the strength and dominance of the MAG7 tech stocks, global debt is at a record high (US$318 trillion at the end of 2024[1]), and we are seeing what may turn into a sustained drive towards reshoring (or onshoring) and repatriation.

The argument here is that strategies that have worked so far this century, such as ‘buying the dip’, or the reverse correlation that made holding equities and bonds a good diversifier, may not behave the same way in the future. In our view, this is a clear signal for investors to look more broadly at strategies that are designed to operate in uncertain environments, such as multi-strategy investments.

Navigating points of failure

The idea of multi-strategy investing is that you can take a broad range of investment strategies and allocate risk across them in such a way that you are not overly exposed to any one risk factor, should it turn into a point of failure. The key to successful multi-strategy investing revolves around identifying and managing the complexities of the world and how the underlying strategies fit together.

When we look at the market conditions of today, there is undoubted complexity to current trade tensions and geopolitics:

- Trade wars and inflation: It is very hard to predict the ultimate outcome of current trade tensions. While markets might ignore trade rhetoric for a while, or we might see certain expectations priced in, the moment a policy stance is enforced, its real impact on the economy and security prices is likely to be significant. Our view is that tariffs are inflationary – they are going to increase the prices of imported goods and if the market is not fully baking in that inflation now, it will have to bake it in the future. This has implications for both fixed income investments, where higher inflation typically leads to lower bond prices, and equity markets, where noise and volatility represent both risk and opportunity

- Equity market concentration: Market concentration remains a key risk, especially with the dominance of the MAG7 tech stocks. Despite the recent market correction, global equities remain disproportionately weighted toward US mega-cap technology names, which means that the market has risk embedded by the nature of that concentration.

- Volatility: We expect uncertainty over government and central bank policy, and geopolitical factors like the conflict in Ukraine to feed through to higher volatility.

Differentiated performance drivers

The response to these factors from a multi-strategy perspective is that market inefficiencies create investment opportunities for strategies that are not dependent on the same factors to drive performance.

For example, an Equity Market Neutral strategy can be positioned to take advantage of market concentration or increased dispersion in stock performance, if you limit factor exposure and focus more on stock selection. Concerns around capital flows, where large ‘block’ trades require a discount to encourage participation, are a built-in market inefficiency that can drive a Price Pressure strategy. We would also expect Trend Following or options-based hedging strategies to thrive in high-volatility environments.

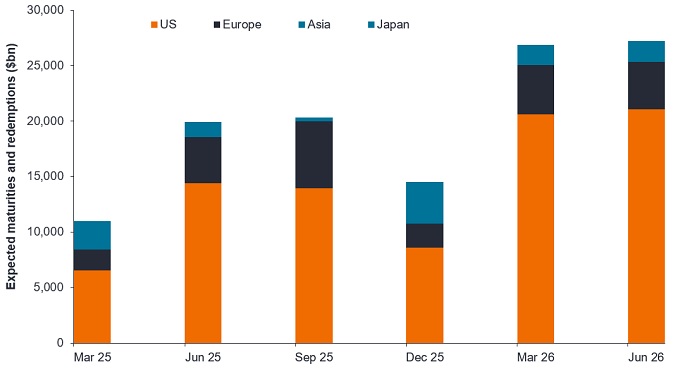

We have also seen some fairly fundamental changes in the convertible arbitrage market. Hedge funds have replaced long-only investors (hedge fund ownership of the convertible bond market is at its highest level since the Global Financial Crisis), leading to greater price discipline and better valuation-driven opportunities, in a market where refinancing pressures are growing (Figure 1).

Figure 1: Market dynamics are favourable for higher convertible bond issuance

Source: BofA Merrill Lynch Global Research, ICE Data Indices, LLC, Bloomberg, Janus Henderson Investors Analysis, as at 31 December 2024 and 30 June 2023. Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

Strategies for the road ahead

We see two possible scenarios unfolding over the next year or so. First, a high-volatility environment, driven by a potential economic downturn or geopolitical shocks. In that scenario, a protection-focused strategy could help to stabilise returns acting as a backstop for risk taken elsewhere. Second, a more ‘normal’ environment, where asset prices stay within historical ranges. In that scenario, a Risk Transfer strategy would be more likely to do well. By diversifying strategies, much in the same way that investors diversify risk-taking strategies in their portfolios, a multi-strategy product can potentially help investors to better navigate a variety of adverse market conditions.

[1] Global debt marches to record high, raising risk of bond vigilantes, Reuters, 25 February 2025.

Capital flows: The movement of money for the purpose of investment, trade or business activity between countries.

Factor risk/factor exposure: An underlying characteristic, variable or exposure that can be used to explain the returns (or return drivers) of an asset or asset class.

Hedging: Trading strategies that involve taking an offsetting position to another investment that will lose value as the primary investment gains, and vice versa. These positions are used to reduce or manage various risk factors and limit the probability of overall loss in a portfolio. Various techniques may be used, including derivatives.

MAG7: The term ‘Magnificent Seven’ refers to the seven major technology stocks – Apple, Microsoft, Nvidia, Amazon, Tesla, Alphabet and Meta – that have dominated markets in recent years.

Market correction: Where a stock market or index falls by more than 10% from its most recent peak in response to investors selling their holdings on a large scale.

Onshoring/reshoring: The process of bringing business operations back in-house, or relocating them within domestic (or regional, in the case of the EU) borders. While it can be more expensive to run local operations, due to higher wages or the cost of regulation, it offers more control and helps to reduce the impact of geopolitical uncertainty or currency changes.

Option: A contract between two parties that gives one of them the right to buy or the right to sell a specific asset, such as shares, bonds or currencies, at a date and price that is fixed when the option is bought. Option trading can be speculative in nature and carries a substantial risk of loss. An option is a form of derivative.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Gli emittenti di obbligazioni (o di strumenti del mercato monetario) potrebbero non essere più in grado di pagare gli interessi o rimborsare il capitale, ovvero potrebbero non intendere più farlo. In tal caso, o qualora il mercato ritenga che ciò sia possibile, il valore dell'obbligazione scenderebbe. Le obbligazioni ad alto rendimento (non investment grade) sono più speculative e sensibili ai cambiamenti avversi delle condizioni di mercato.

- L’aumento (o la diminuzione) dei tassi d’interesse può influire in modo diverso su titoli diversi. Nello specifico, i valori delle obbligazioni si riducono di norma con l'aumentare dei tassi d'interesse. Questo rischio risulta di norma più significativo quando la scadenza di un investimento obbligazionario è a più lungo termine.

- Il Fondo potrebbe usare derivati al fine di conseguire il suo obiettivo d'investimento. Ciò potrebbe determinare una "leva", che potrebbe amplificare i risultati dell'investimento, e le perdite o i guadagni per il Fondo potrebbero superare il costo del derivato. I derivati comportano rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo comporta un elevato livello di attività di acquisto e di vendita e pertanto sosterrà un livello più elevato di costi di operazione rispetto ad un fondo che negozia con meno frequenza. I suddetti costi di operazione si sommano alle spese correnti del Fondo

- I CoCo (Obbligazioni contingent convertible) possono subire brusche riduzioni di valore in caso d’indebolimento della solidità finanziaria di un emittente e qualora un evento trigger prefissato comporti la conversione delle obbligazioni in azioni dell’emittente o il loro storno parziale o totale.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

- Le SPAC sono società di comodo create per acquisire aziende. Essendo complesse e spesso prive della trasparenza delle società consolidate, presentano maggiori rischi per gli investitori.