Investor Survey: AI is fueling financial exploitation fears

Our latest Investor Survey reveals high levels of concern around financial exploitation, particularly as artificial intelligence (AI) leads to increasingly sophisticated scams. Wealth Strategist Ben Rizzuto discusses how advisors can help protect clients from financial fraud and explores the use of AI in advisors’ practices.

4 minute read

Key takeaways:

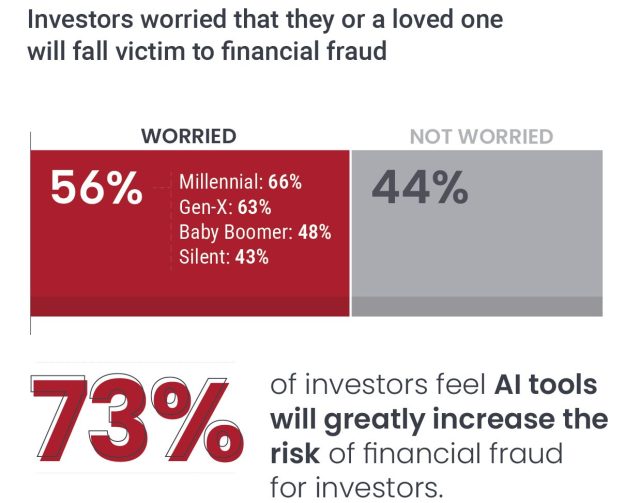

- Our survey found that 56% of investors are worried that they or a loved one will fall victim to financial fraud, and 73% of investors believe AI will greatly increase this risk.

- Among advised investors, 45% have received resources on avoiding financial exploitation, and 29% said they have not received resources but would like to. This represents an opportunity for more advisors to engage clients on the topic and offer support.

- While investors are wary of AI’s role in facilitating financial scams, most are open to their advisor using the technology for certain administrative aspects of their practice.

Artificial intelligence (AI) is a topic that tends to be as polarizing as it is ubiquitous. As the technology makes its way into the workplace, some employees have embraced AI’s capabilities and consider it a boon to productivity and efficiency. Others question its usefulness or worry it could render their positions obsolete.

Regardless of how you may feel about AI personally, there’s little doubt that it is a powerful force that is having a transformative impact on businesses, consumers, and the economy – and that impact is only likely to grow in the years ahead. Our investment teams have written extensively about the history of AI and why it has the potential to be the greatest productivity enhancer since the Industrial Revolution.

AI tools are facilitating financial exploitation

Like many advanced technologies, AI holds the potential for misuse when it falls into the wrong hands. Notably, the evolution of AI has enabled fraudsters to develop increasingly sophisticated financial exploitation scams, leading to over $3 billion in losses in 2023.1

These risks are hardly a secret: Our latest Investor Survey found that 73% of investors believe AI will greatly increase the risk of financial fraud.

Financial exploitation in general is a key area of concern among investors. More than half (56%) of our survey respondents said they are very or somewhat worried that they or a loved one could fall victim to a financial exploitation scam.

While financial scams disproportionately impact those over age 60, all of us, regardless of age, are at risk of exploitative attempts on our assets. What’s more, it appears that younger generations may be more concerned than older cohorts.

Among our survey respondents, 66% of Millennials and 63% of Gen X investors said they were worried about financial fraud, compared to 48% of Baby Boomers and 43% of Silent Generation investors. This could be due to younger investors being more tech-savvy and hence more aware of how AI can be used to commit financial scams. It could also stem from younger individuals being worried about their parents’ and/or grandparents’ vulnerability to fraudsters.

A useful tool in advisor practices – within limits

While investors are clearly wary of AI’s role in facilitating financial exploitation, they don’t have an entirely negative view of the technology. Our survey sought to gauge how investors feel about their financial advisors using AI for various areas of their practice, and the feedback was largely positive – but varied significantly based on how AI was being used.

Among investors who use a financial advisor or would consider hiring one in the next two years, a large percentage (83%) said they feel either good or neutral about their advisor using AI for administrative tasks or to create educational content (85%). However, more than a third would object to their advisor using AI to make investment recommendations, and 44% would be upset if their advisor used AI to respond to texts or emails. These findings are a clear indication that clients still strongly value the human element for these key aspects of their advisory relationship.

How advisors can help clients avoid financial fraud

Financial advisors are in a unique position to educate clients about the risk of financial fraud, and many forward-thinking advisors have already taken steps to reduce their clients’ vulnerability.

Among advised investors responding to our survey, 45% said they have received resources from their advisor on avoiding financial exploitation scams, and another 29% reported they have not yet received resources but would like to.

A critical first step to raising awareness around how to identify and avoid scams is communication. Investors may be feeling vulnerable and uncertain about how to protect themselves, and having proactive, candid discussions can help destigmatize the issue while providing valuable education.

1 2023 IC3 Elder Fraud Annual Report. Federal Bureau of Investigation. Justice.gov.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.