How to help clients protect themselves as financial exploitation losses rise

Wealth Strategist Ben Rizzuto discusses key findings from the FBI’s latest Elder Fraud Report and how advisors can use the information to raise clients’ awareness of increasingly sophisticated financial exploitation scams.

5 minute read

Key takeaways:

- According to the FBI’s latest Elder Fraud Report, the number of financial exploitation cases and total losses both increased year over year.

- As new technologies make these scams more sophisticated – and more successful – clients of all ages are at risk.

- Having candid conversations can help destigmatize financial exploitation and educate clients on how to identify and avoid potential scams.

One of the topics we highlighted in our 2024 Wealth Planning Trends is the growing vulnerability Americans face with regard to financial exploitation. While these scams largely impact those over age 60, as more and more of our lives move online, all of us, regardless of age, are at risk of exploitative attempts on our assets. The rapid evolution of artificial intelligence (AI) has also made these attempts more sophisticated and harder to detect – and therefore more likely to succeed.

While this likely sounds rather distressing, there are steps we can take to protect ourselves. The first, most critical step, is to be informed. The Federal Bureau of Investigation released their 2023 Elder Fraud Report recently, and it identifies several important trends that advisors should be discussing with their clients. (Again, this applies to clients of all ages, despite the report’s title.)

Increased communication about these issues is incredibly important as it helps to raise awareness about how to identify and avoid scams. It can also help destigmatize the issue, which should make clients more comfortable talking about their experiences and concerns and help them understand what resources are available to them through you as their trusted financial professional.

To help facilitate those conversations, following are some of the highlights from the FBI’s latest Elder Fraud Report.

Headline figures

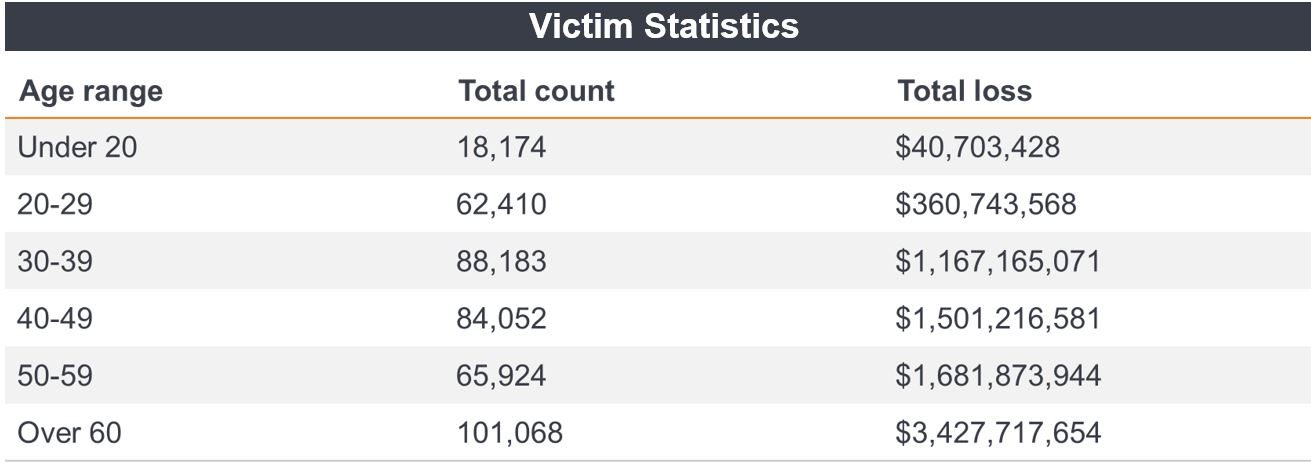

The main headline from the report is that the number of financial exploitation cases and total losses in the U.S. continued to increase year over year. Total complaints increased from 88,262 (2022) to 101,068 (2023) and total losses increased from $3.1 billion to $3.4 billion. Along with that, the number of Americans aged 60 and over who lost more than $100,000 increased in 2023, although the average dollar loss among this age group decreased.1

Again, while the focus here is investors over age 60, it’s important to remember that we are all vulnerable to financial exploitation. As shown in the statistics below, even those who may not be as likely to experience physical or cognitive declines have been taken advantage of by scammers.

Growing trends

Digging into the numbers a bit more, I found a few areas where scammers have become more active and unfortunately more successful. The type of complaint that saw the largest increase in number of claims as well as dollars lost was Cryptocurrency/Cryptocurrency Wallet.

Cryptocurrency investment scams accounted for approximately 64% of all losses but may also be the payment mechanism of choice for scammers in other types of scams, such as tech and customer support fraud. More specifically, the number of cases involving crypto increased by 70% in 2023 and the amount lost increased by 56% ($1.6B).2

Extortion, which the FBI defines as the “unlawful extraction of money or property through intimidation or undue exercise of authority, which may include threats of physical harm, criminal prosecution, or public exposure” also increased year over year, with the number of cases rising 26% and losses rising 48%.3 This is a category of exploitation that I believe may continue to grow with advances being made in AI. As I’ve discussed previously, AI makes exploitation much easier as it allows scammers to spoof a loved one’s voice using just three seconds of recorded audio.

One final area that I have had personal experience with is Government Impersonation. These scams occur when someone impersonates a government official to collect money from a would-be victim. The number of claims in this area increased by only 3%, but the dollar amount lost in 2023 grew by 32%.4

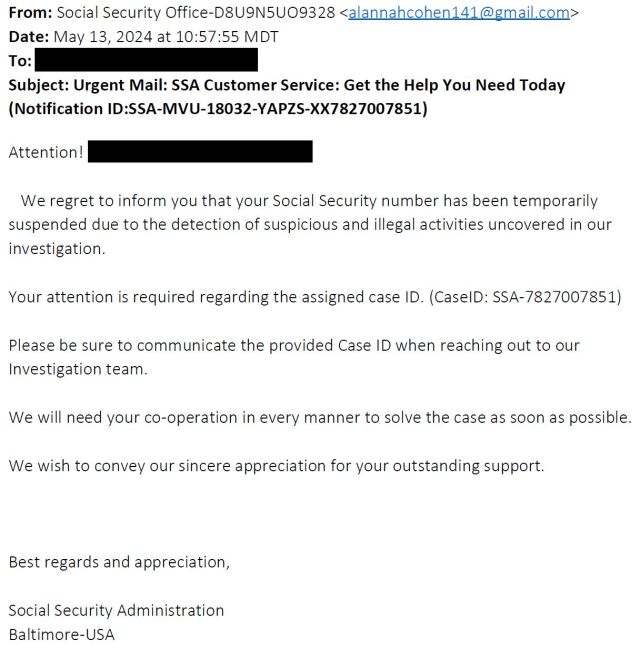

This type of attempt occurred to me recently when I received an email letting me know that my Social Security number had been “temporarily suspended.” Below I’ve included a screenshot of the email I received:

First, it’s important to note that the Social Security Administration (SSA) will never suspend your Social Security Number. But if you look at the email, you’ll notice a number of red flags.

First, the greeting was to my email address (redacted) rather than to me. You can also see some odd spacing at the beginning of the first line and between the last line and the salutation. The salutation itself is suspicious as well. “Best regards and appreciation” simply isn’t a common or natural-sounding way to conclude an email, especially one that is allegedly coming from an official government agency like the SSA.

Finally, I expanded the “From: Social Security Office-D8U9N5UO9328” field to see the email address this “Urgent Mail” had been sent from. When I did that, I found that the sender’s email was AlannaCohen141@gmail.com. Something tells me the SSA doesn’t use Gmail for their external communications!

Luckily there were so many red flags in my particular scam attempt that I was able to avoid any damage pretty easily. But I’m sharing this because I know how important a subject Social Security is to people. If this email was received by an older adult who was getting ready to or had already started receiving their Social Security benefits, they may have been tempted to reply and thereby become one of the thousands of people who fall for these scams every year.

A difficult – but necessary – conversation

Finally, in this year’s report the FBI noted that “only half of the 880,000 total complaints received by the FBI in 2023 included age data5.” This tells me that the issue may be affecting more older Americans than we think, and it also highlights the embarrassment and shame people feel when they are victimized.

That is why I am encouraging advisors to talk about this topic more and to utilize the resources we’ve created with Wayne State University to help educate and protect clients. Advisors and clients alike may be reluctant to talk about a subject like financial exploitation because it’s negative and fraught with emotion. But it is only by having these difficult – but necessary – conversations that we can help clients be more aware and more vigilant and let them know you are here to help.

1 2023 IC3 Elder Fraud Annual Report. Federal Bureau of Investigation. Justice.gov.

2 Ibid.

3 Ibid.

4 Ibid.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.