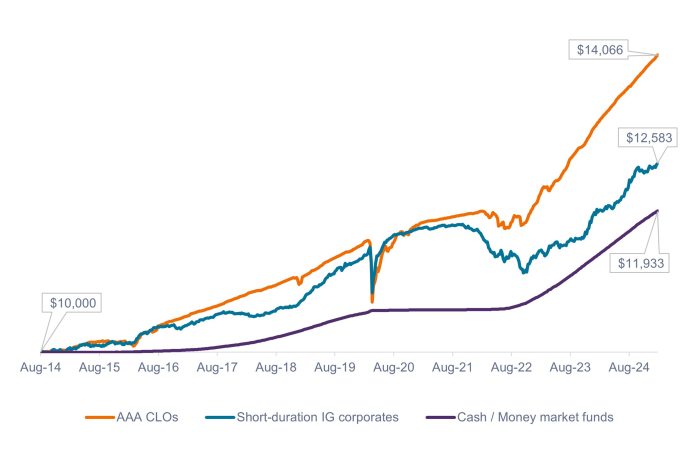

Source: Bloomberg, J.P. Morgan, as of 24 January 2025. Indices used to represent asset classes: AAA CLOs = J.P. Morgan AAA CLO Index, Short-duration IG corporates = Bloomberg U.S. Corporate 1-3 Year Index, Cash / Money market funds = Bloomberg U.S. 1-3 Month Treasury Bills Index. Past performance does not predict future returns.

Some investors who are hesitant to put their short-term cash reserves at risk may feel uneasy with any volatility in their short-duration holdings. We believe this approach may be overly cautious, as many investors could handle an incremental amount of volatility in exchange for potentially higher returns. Historically, despite occasional drawdowns, AAA CLOs and short-duration IG corporates have ended up comfortably ahead of cash over the long term.

– John Kerschner, Head of U.S. Securitized Products

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.