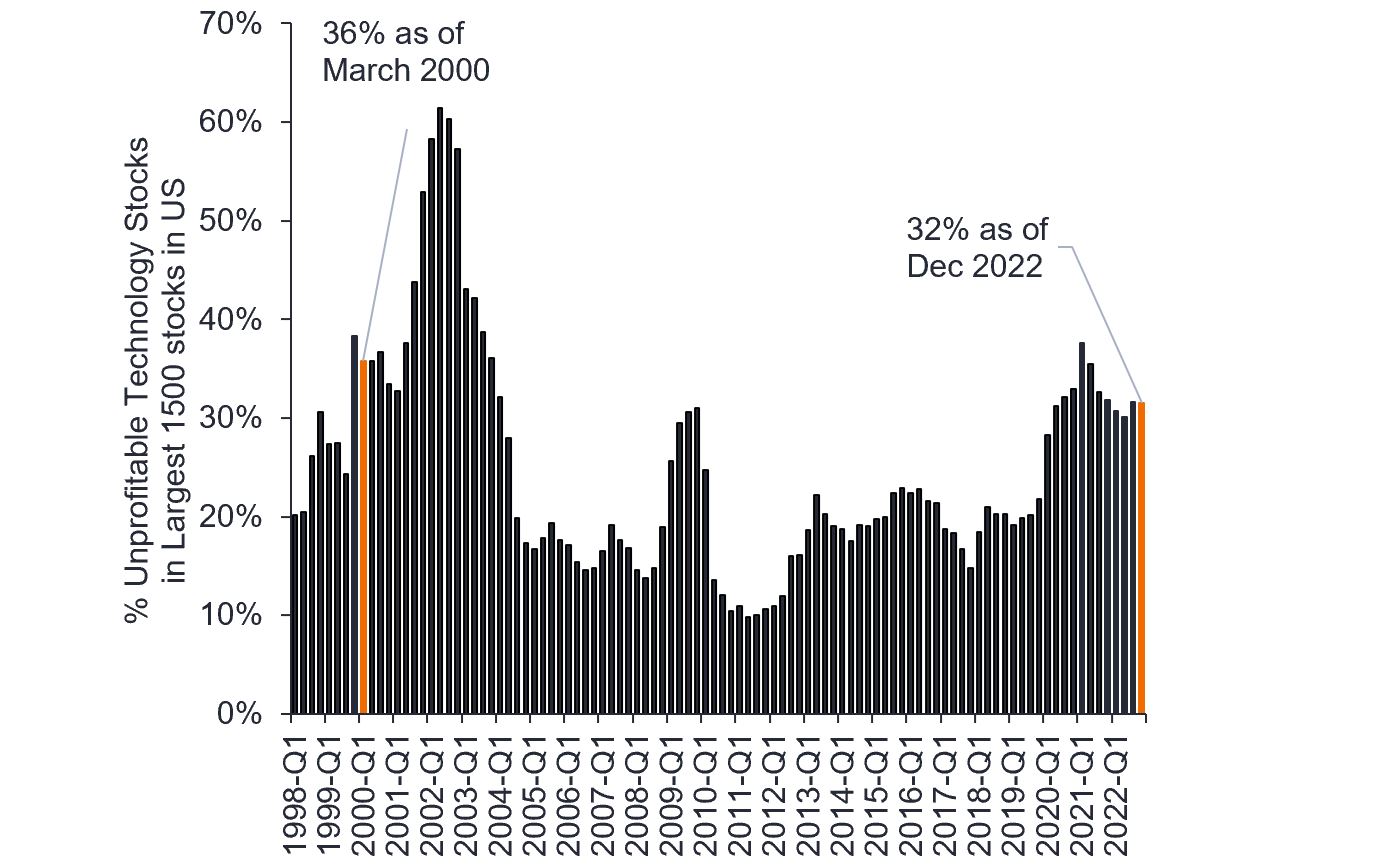

In hindsight 2020 was a generational anomaly, combining an unprecedented global pandemic with central bank helicopter money to repair the economic damage inflicted by global lockdowns. The subsequent two years were a painful reminder to investors that extrapolating pandemic growth rates and assuming almost 600 unprofitable technology companies in the US would all become the very profitable technology leaders of tomorrow was unrealistic. Echoes of the 2000 dot.com bubble and crash were evident in drawdowns that exceeded 70% for some unprofitable cloud software, e-commerce and fintech stocks, among others1, and the significant declines experienced by the highest-valuation tech companies that performed so well in 2020.

Tech valuations have been reset

The catalyst for that pain was a major resetting of interest rates expectations as inflation surged. However, with the US Federal Reserve (Fed) belatedly aggressively hiking rates and with the economy already slowing, we believe peak rate expectations have passed and therefore peak discounts for valuations for growth technology companies too. Much of the valuation derating to deflate the excess gains in the tech sector in 2020, as a result of the pandemic accelerating technology adoption, now appears done.

Investor focus will be on profitability and cash flow

Even if the Fed is successful in taming inflation, rates will not be returning to zero and central banks will need to continue to taper bloated balance sheets (central bank inflated their assets as a result of bond-buying to stimulate the economy) built up through the Global Financial Crisis and pandemic. The bull market from 2009-22 was defined by zero interest rates and quantitative easing (QE); the next bull cycle will be very different. Companies are being forced to be self-sufficient in terms of funding and capital raising, driving a focus on profitability and positive free cashflow.

The days of funding growth “via the next cheque from Softbank” are over. This new normal has exposed the poor quality of the growth of many pandemic beneficiaries that are now in a de-growth phase (shrinking). Identifying true growth companies in a slowing global economy will require skill and in-depth company analysis, instead of just buying the latest thematic exchange-traded fund (ETF).

True growth companies will need to have a competitive moat and the right business model to make money. It took around 20 years for unprofitable technology stocks to come back in vogue post the dot-com bubble; unless there is a return to global lockdowns and ‘free’ money it is unlikely those type of technology stocks will define the next bull cycle.

Figure 1: A third of tech companies were unprofitable

Source: Janus Henderson Investors, Bernstein, as at 4 January 2023. Unprofitable technology stocks= (# unprofitable technology stocks/total number of tech stocks within largest 1500 US stocks).

Stock picking needed to identify winners and losers

FAANG was an acronym for the five best-performing US tech stocks, which came to define the growth of the technology sector in the last bull cycle. That was a function of being key beneficiaries of the mobile cloud era and their commanding franchises, allowing then to outgrow the rest of the stock market. Looking forward, given their size, the saturation of some of their markets and regulatory headwinds, it is unrealistic to expect these tech giants to demonstrate a similar growth premium in the next bull cycle. New technology trends will emerge, as will new leaders that are capable of delivering outsized growth. And the stock market will reward them, coining new marketing acronyms. Similar to a decade ago when the technology index was loaded with PC and storage companies, this new cycle is likely to present significant opportunities for bottom-up stock pickers and active investors who can identify those future leaders.

Tech, the provider of solutions

Long-term technology trends continue to be strong because they are addressing a multitude of global challenges. Whether to meet climate change targets, a declining Chinese workforce, shortage of skilled labour or the inflationary costs of raw materials, all companies are seeking efficiency and to do more with less. Technology continues to be the solution, offering faster, better and cheaper products, driven by Moore’s Law, to a growing digital native demographic that is more willing to adopt new technologies.

ChatGPT is just the latest example of technology’s ability to boost productivity and is a watershed moment for generative, content creation AI. While still limited in its true intelligence, ChatGPT has democratised AI. After reaching 100 million users in only two months since its launch, the chatbot is driving a period of rapid innovation, bringing AI co-pilots to numerous software applications. Coding, education, legal, marketing and journalism are just some of the industries that could benefit from the productivity gains generative AI can provide.

A need to separate hype from true secular growth

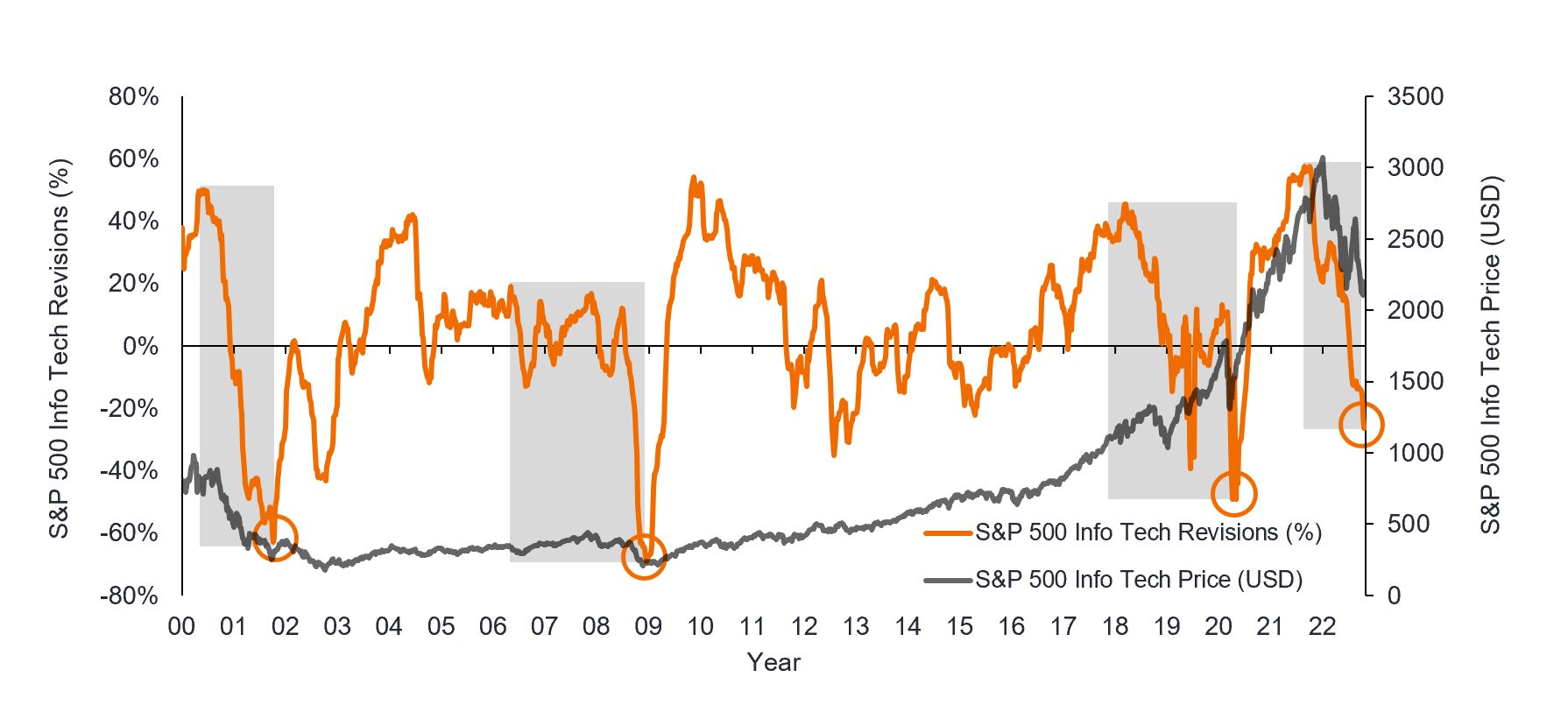

In the assessment of new technologies, it is important to navigate the hype cycle by focusing on realistic expectations of growth and profit, not just revenue growth. We believe the trajectory of earnings estimates is the primary driver of stock returns. The pandemic led to unrealistic expectations for growth, which proved unsustainable. The broader stock market, including the technology sector, now needs to factor in a slowing economy, with the only real debate being a soft or hard landing.

Corporate earnings expectations remained stubbornly high through 2022 for most technology companies, except some cyclical, more economically-sensitive areas, but by later in the year we started to see the first, broader earnings estimates cuts, a process that has continued into early 2023. This has brought earnings expectations down to more reasonable levels. We believe the sector is close to completing that revision process (see figure 2). Recently, we saw Intel’s 4Q profit fall by the most in two decades, Samsung’s memory business profits falling 90% in the fourth quarter and Amazon Web Services reporting much weaker-than-expected revenue growth in January 2023. These are just some examples of the major resets we have factored in for the sector.

Figure 2: Tech earnings revisions – closer to a bottom than a top

Source: Morgan Stanley, Bloomberg, as at 14 November 2022. Number of technology companies with positive or negative earnings revisions.

Summary

A combination of more reasonable earnings expectations and rational valuations make us more optimistic on the outlook for the technology sector, in addition to the long-term technology trends that remain intact. The experience of 2022 was painful but ultimately cathartic for active stock pickers who focus on fundamentals such as profits and cashflow. Bear markets historically have not tended to last for that long and entering 2023 we were already over a year into that bear market. The next bull market cycle will come and could even have already started. Historically, the technology sector has outperformed other sectors in 20 of the prior 23 bull cycles since the 1930s, making this far from just a recent phenomenon.2 However, this new bull cycle when it comes, will likely reward profitable technology companies and the passing of the baton from the FAANG stocks to new leaders.

1From late 2021 to early March 2022. Cnbc.com: Here are the 10 of the worst-performing tech stocks from recent washout.

2Oppenheimer & Co., Bloomberg. Past performance does not predict future returns.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Bull cycle/market: a financial market in which the prices of securities are rising, especially over a long time. The opposite of a bear market.

Derating: occurs when investors want to pay a lower price for shares, usually in anticipation of lower future earnings.

Growth stocks: investors believe such companies have strong growth potential and expect their earnings growth to be above-average compared to the wider market. Therefore, it is anticipated the share prices will increase in value.

Quantitative easing (QE): an unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system.

Free cash flow: cash that a company generates after allowing for day-to-day running expenses and capital expenditure. It can then use the cash to make purchases, pay dividends or reduce debt.

FAANG: an acronym for stocks that were widely considered to be among the highest growth tech stocks namely Facebook (now Meta Platforms), Amazon, Apple, Netflix and Google (now Alphabet).

Softbank: Japan’s SoftBank, with its investment partners is a major investor in the global technology industry, including startups via its SoftBank Vision venture capital fund.

Moore’s Law: in 1965 Gordon E. Moore, Intel co-founder suggested that the number of transistors that can fit onto a microchip would double every two years. Thus, we can expect the speed and capability of computers to increase every couple of years, and at lower cost. Another tenet of Moore’s Law asserts that this growth is exponential.

Navigating the hype cycle: the “hype cycle” represents the different stages in the development of a technology, from conception to widespread adoption, which includes investor sentiment towards that technology and related stocks during the cycle.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Le azioni di società a piccola e media capitalizzazione possono presentare una maggiore volatilità rispetto a quelle di società più ampie e talvolta può essere difficile valutare o vendere tali azioni al momento e al prezzo desiderati, il che aumenta il rischio di perdite.

- Un Fondo che presenta un’esposizione elevata a un determinato paese o regione geografica comporta un livello maggiore di rischio rispetto a un Fondo più diversificato.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Il Fondo si attiene a un approccio d’investimento sostenibile, il che potrebbe condurlo ad essere sovrappesato e/o sottopesato in alcuni settori e pertanto ad ottenere performance diverse da quelli di fondi con obiettivi analoghi, ma che non si avvalgono di criteri d’investimento sostenibile per la selezione dei titoli.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.

Specific risks

- Le Azioni/Quote possono perdere valore rapidamente e di norma implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Un Fondo che presenta un’esposizione elevata a un determinato paese o regione geografica comporta un livello maggiore di rischio rispetto a un Fondo più diversificato.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Questo Fondo può avere un portafoglio particolarmente concentrato rispetto al suo universo d’investimento o altri fondi del settore. Un evento sfavorevole riguardante anche un numero ridotto di partecipazioni potrebbe creare una notevole volatilità o perdite per il Fondo.

- Il Fondo potrebbe usare derivati al fine di ridurre il rischio o gestire il portafoglio in modo più efficiente. Ciò, tuttavia, comporta rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.