Quarterly Update

The investment team recap this quarter.

(Note: Filmed 16 October 2025).

INVESTMENT OBJECTIVE

Performance objective

The Fund seeks to achieve a total return before fees that exceeds the total return of the Benchmark by 0.75% p.a. over rolling 3-year periods.

Sustainability objective

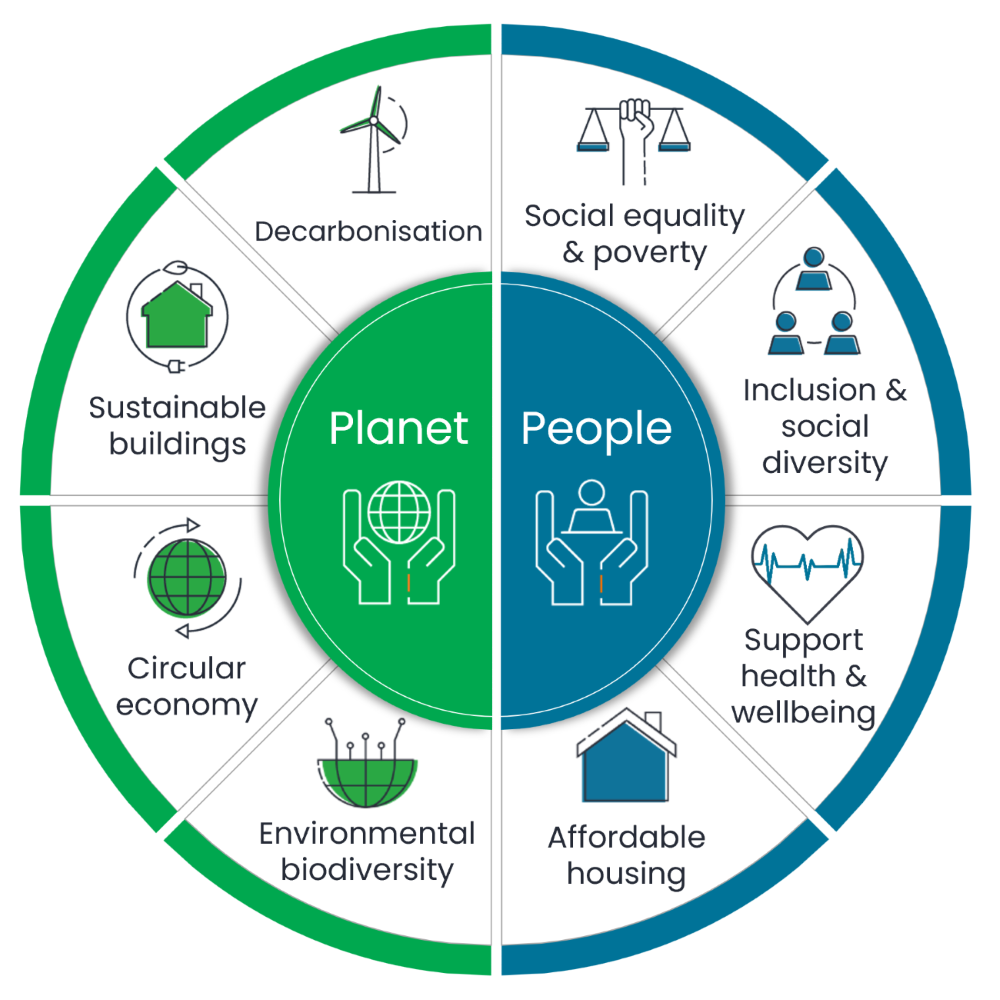

The Fund seeks to invest in credit securities which the Manager expects currently or will in the future contribute positively towards eight ‘People’ and/or ‘Planet’ themes.

INTRODUCING SUSTAINABLE CREDIT

ABOUT THIS FUND

- Provides access to an actively managed, diversified portfolio of Australian and global investment grade and sub-investment grade credit securities that are issued by entities with robust sustainable practices and are considered by the Manager to currently, or in the future, contribute positively towards ‘People’ and/or ‘Planet’ themes.

- The Fund seeks to achieve a total return before fees that exceeds the total return of the Benchmark by 0.75% p.a. over rolling three year periods.

- The Manager utilises a proprietary ‘Holistic’ framework combining qualitative environmental, social and governance (ESG) assessments with third-party ESG measures and metrics to assess issuers; a process then complemented by active stewardship and engagement activities.

Please see the ‘Investment policy/approach’ section of the Product Disclosure Statement (PDS) for definitions and explanations of all terms used.

HEADLINE

Text.

Notification date: DD Mmmmmm YYYY