Quarterly Update

The investment team recap this quarter.

(Note: Recorded in January 2026).

30 YEAR HISTORY OF

Providing S&P 500®-Like Returns with Significantly Less Volatility

Fund Highlights

- High-conviction large-cap growth equities paired with an active intermediate-term bond strategy

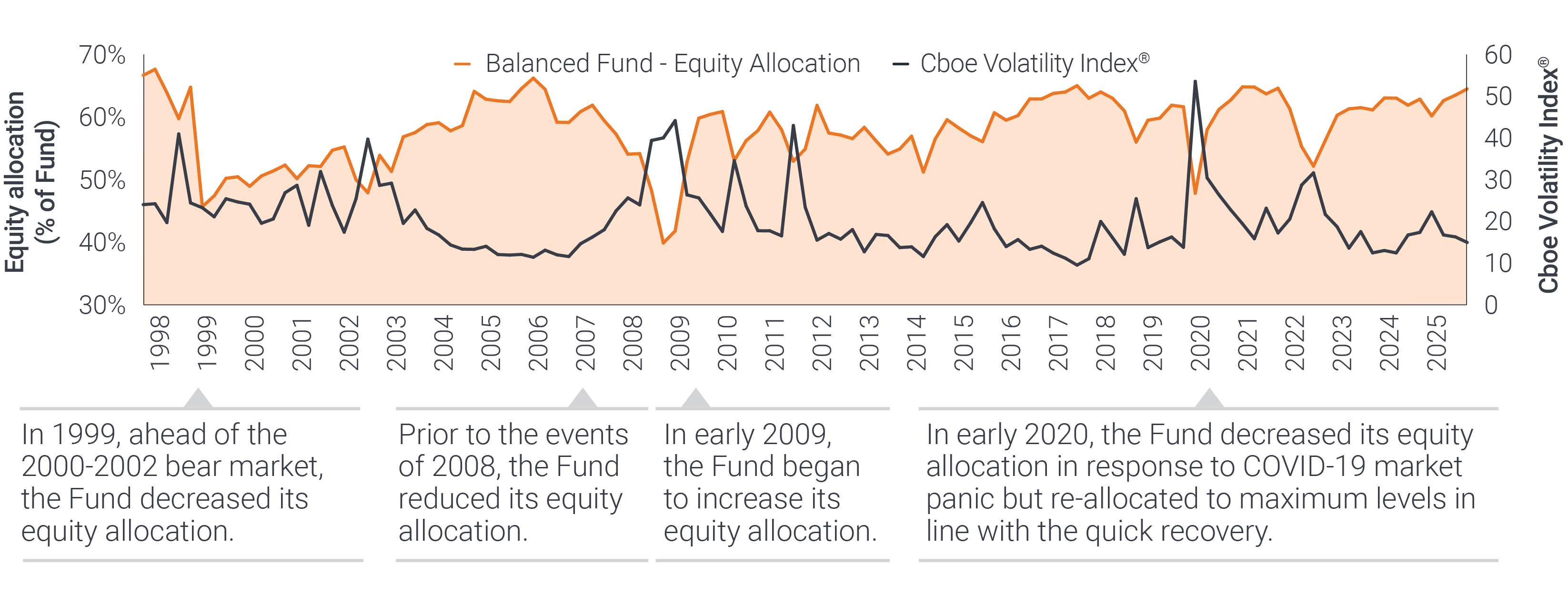

- Dynamic asset allocation approach that migrates between 35%-70% equity depending on market conditions

- Integrated research allows our equity and fixed income analysts to work side by side covering the same global sectors

Equity allocation adapting to market changes

Cboe Volatility Index® or VIX® Index® shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500® index options and is a widely used measure of market risk. The VIX Index volatility methodology is the property of Chicago Board of Options Exchange, which is not affiliated with Janus Henderson.

As of 12/31/25, Balanced Fund Class I Shares Morningstar Ratings™ in the Moderate Allocation category: 4 stars out of 464 funds, 4 stars out of 444 funds, and 5 stars out of 370 funds, for the 3-, 5-, and 10-year periods, respectively.

RATINGS AND AWARDS

S&P assigns a Principal Stability Fund Rating (PSFR) for money market funds within a range from AAAm (highest) to Dm (lowest), where AAAm indicates S&P's opinion of a fund's extremely strong capacity to maintain principal stability and to limit exposure to principal losses due to credit risk and Dm indicates a failure to maintain principal stability resulting in a realized or unrealized loss of principal. Ratings do not eliminate risk and should not be used as the sole basis for evaluating an investment product. Please see Ratings Criteria at disclosure.spglobal.com/ratings/en/regulatory/ratings-criteria for further information. A fee was paid for the use of this data.

AN UNCOMPROMISING APPROACH

Equity markets may shift.

Our focus never does.