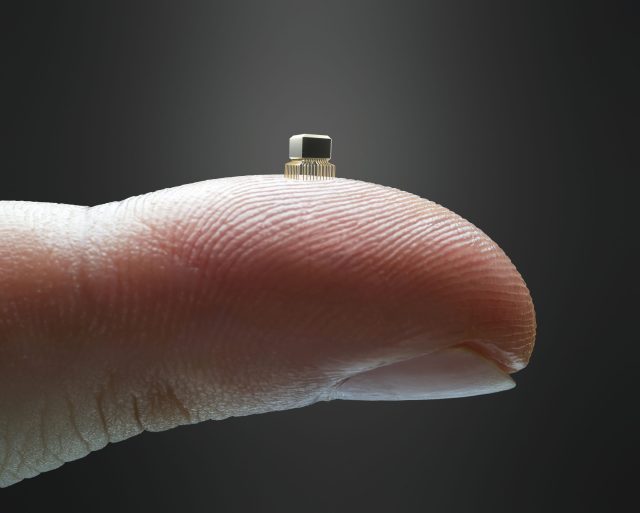

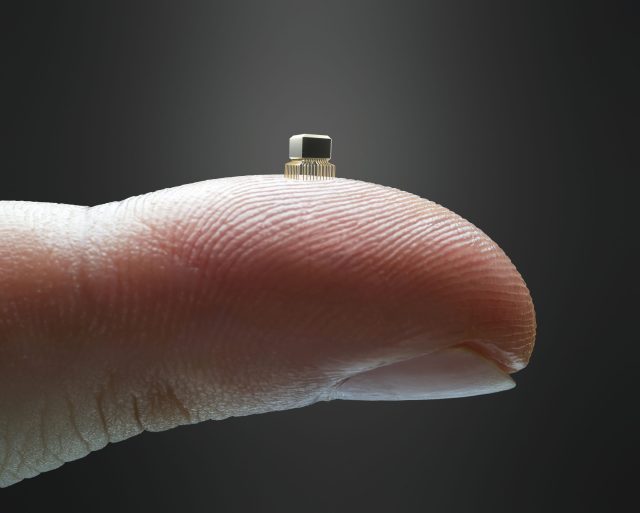

The increasing use of AI has positive implications for the semiconductor sector.

Semiconductors: Tailwinds from tectonic shifts in the AI compute sands

The increasing use of AI has positive implications for the semiconductor sector.

When considering investing in the UK market, many people tend to rely heavily on the overall state of the economy to guide their investment decisions. This is especially common when it comes to UK small cap stocks, which are perceived to be more cyclical and dependent on the domestic market. So when the UK economy

The pandemic exposed supply chain vulnerabilities and the need for businesses to be more resilient, leading to a reassessment of strategies, supply chains and investment. As such, knowledge of local markets is now more important than ever to assess how these factors impact the investment landscape. Here, we look at how the Bankers Investment Trust is utilising its regional managers to uncover opportunities.

A reliable approach to income Over the past year, bond yields have risen significantly, lifting fixed income return expectations to their most attractive point in well over a decade. Some non-investment grade bonds are yielding north of 8.0% – a rate that seems compelling following years of lacklustre bond returns. As such, some investors have

How will this cycle be different for European equities?

Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Emma Lawson is a Fixed Income Strategist – Macroeconomics on the Australian Fixed Interest Team at Janus Henderson Investors.

Have rising interest rates presented opportunities for loans?

In this webinar, Ben Rizzuto, Retirement Director and Jeremiah Buckley, co-Portfolio Manager of the Janus Henderson Balanced Fund, will discuss how financial advisors should position their business for this new generation of investors, ways they can engage with families across generations, and why a Balanced portfolio may be best suited for them.