OWN REAL ESTATE IN A DIFFERENT WAY

Own. Innovate. Diversify

Renovate your portfolio. Enhance your income with global perspectives and a diversified real estate approach

OWN REAL ESTATE IN A DIFFERENT WAY

Own. Innovate. Diversify

Renovate your portfolio. Enhance your income with global perspectives and a diversified real estate approach

Janus Henderson Horizon Asia-Pacific Property Income Fund; Janus Henderson Horizon Global Property Equities Fund; Janus Henderson Horizon Pan European Property Equities Fund:

1. Janus Henderson Horizon Asia Pacific Property Income Fund invests at least 75% in equities or equity-related instruments of real estate companies or REITs (or their equivalents) listed or traded on a regulated market, which derive the main part of their revenue from engaging in real estate businesses in the Asia-Pacific region.

Read more

2. Janus Henderson Horizon Global Property Equities Fund invests at least 80% in equity or equity-related instruments of real estate companies or Real Estate Investment Trusts (“REITs”) (or their equivalents) listed or traded on a regulated market, which derive the main part of their revenue from engaging in real estate businesses.

3. Janus Henderson Horizon Pan European Property Equities Fund invests at least 75% in equities or equity-related instruments of real estate companies or REITs (or their equivalents) having their registered office in the European Economic Area (“EEA”) or United Kingdom if not part of the EEA and listed or traded on a regulated market, which derive the main part of their revenue from engaging in real estate businesses in Europe.

4. Investments involve varying degree of investment risks (e.g. liquidity, market, equity-related securities, property securities related, small/mid-capitalisation companies related, economic, political, regulatory, taxation, financial, interest rate, hedging and currency risks). In extreme market conditions, you may lose your entire investment.

5. Investments in financial derivatives instruments (“FDIs”) (such as futures, options, forwards and warrants) involve specific risks (e.g. counterparty, liquidity, leverage, volatility, valuation and over-the-counter transaction risk). The Fund may use FDIs to reduce risk and to manage the Fund more efficiently.

6. Some sub-funds may invest in a region (e.g. Asia) /industry sector (e.g. technology, property) and may subject them to higher concentration risk.

7. Some sub-funds may invest in Eurozone (in particular Portugal, Italy, Ireland, Greece and Spain) securities and may suffer from European sovereign debt crisis risk.

8. In respect of distribution shares classes of some sub-funds, the directors may at its discretion pay distributions (i) out of gross investment income and net realised/unrealised capital gains while charging all or part of the fees and expenses to the capital, resulting in an increase in distributable income for the payment of distributions and therefore, the sub-fund may effectively pay distributions out of capital, and (ii) additionally, for certain share classes of some sub-funds, out of original capital invested . This amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment, and may result in an immediate reduction of the sub-fund’s net asset value per share.

9. The sub-funds may charge performance fee and may be subject to performance fee risk.

Janus Henderson Global Real Estate Fund:

10. Janus Henderson Global Real Estate Fund may invest in any one or a combination of the following instruments:

– equity securities;

– futures, options and swaps and other financial derivative instruments (“FDI”) for investment purposes, up to 10% of the net asset value ("NAV") of the Fund. Given the leverage effect of FDI, such investments may result in substantial loss (as much as 100% of the NAV of the relevant Fund);

– mortgage and asset-backed securities, other collateralised products and/or in index/structured securities. These financial instruments may be rated below investment grade.

11. Investing in the Fund may involve equity market, substantial credit/counterparty, property securities related, small/mid-capitalisation companies related, market, liquidity, currency, leverage, interest, index, swap and valuation risks. If the issuers default, or such securities or their underlying assets, cannot be realised or perform badly, investors’ entire investments may be lost.

12. Series 3 share class of the Fund may at its discretion pay dividends out of gross income while charging all or part of the fees and expenses to the capital of the Fund, resulting in an increase in distributable income available for the payment of dividends by the Fund and therefore, the Fund may effectively pay dividends out of capital. This may result in an immediate reduction of the Fund’s net asset value per share, and it amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment.

13. The Fund's investments involve developing markets. Owing to its potentially higher volatility and risk levels, as well as lower political and economic stability than developed markets, asset values could be affected in various levels.

14. The Fund’s investments may be more concentrated in terms of industry risk than others that diversify across industries and may therefore be subject to higher industry risk than funds with more diversified holdings.

Note: The investment decision is yours. If you are in any doubt about the contents of this document, you should seek independent professional financial advice. Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Less

Why global property equities?

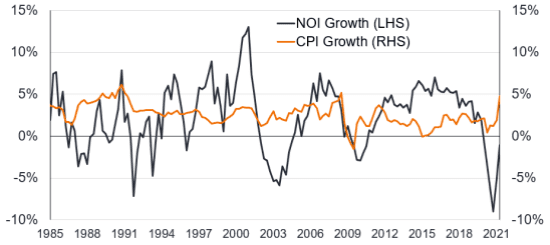

1. Real estate income benefits from growth/inflation

A recovering economy typically leads to rising rental income and increases the value of underlying real estate assets. Rental contracts are often linked to inflation through annual uplifts or are reset when they expire.

US real estate Net Operating Income (NOI) growth correlation with inflation

Source: Janus Henderson Investors, NCREIF, US Department of Labour, CEIC, Datastream, UBS estimates, as at 30 June 2021.

Note: NOI growth calculated as sum of 4 QoQ NOI growth, CPI calculated as sum of 4 QoQ growth.

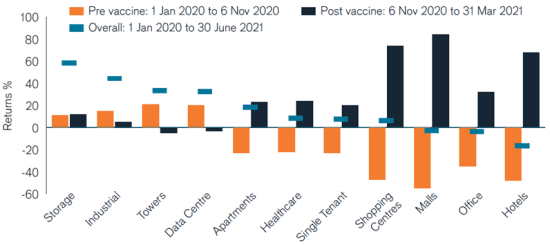

2. Identifying ‘quality compounders’ – REITs in “growth” sector

REITs in ‘growth’ sectors offer highly visible long-term compounding return potential, driven by permanent and powerful secular tailwinds such as e-commerce, mobile data, cloud computing, 5G and changing demographics.

US total return by property sector

Source: Janus Henderson Investors, Bloomberg, as at 30 June 2021. Note: Property sector: Bloomberg REIT Sectors, Data centres = FTSE EPRA NAREIT North America Data Centre Index.

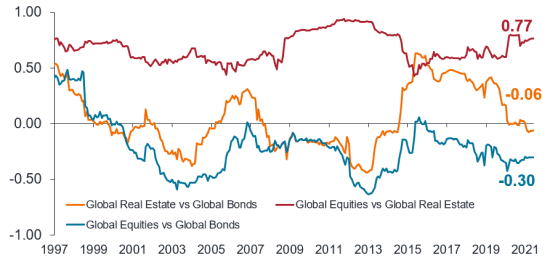

3. Diversification and Liquidity

Global property equities offer a low cost, liquid and transparent way to gain exposure to a wide range of property sectors across geographies. Historically, REITs have shown a low correlation to bonds and equities, making them an efficient way to diversify portfolios and potentially enhance risk-adjusted returns.1

Correlations With Other Asset Classes

Source: Janus Henderson Investors, EPRA, monthly statistical bulletin, as at 30 June 2021.

Note: 36 month rolling data. Global Equities: FTSE All-World TR Local Index. Global Bonds: JPM GBI Global Unhedged Local Index. Global real estate: FTSE EPRA Nareit Developed Index.

Why Janus Henderson for property equities?

1. Capture powerful secular themes

Focus on areas of structural growth such as industrial/logistics, rental residential, technology focused real estate assets with little exposure to more challenged sectors.

2. Actively managed by experienced experts with local expertise

Janus Henderson has managed listed real estate assets since 1997. Our active management approach allows the integration of ESG into portfolio construction that can lead to meaningfully better performance.

Our property equities funds have won numerous fund awards in the past five years2

3

3

3. Various distribution options to suit your needs

Our property equities funds offer monthly and quarterly distribution share classes and a wide range of currencies.

Aims to pay dividend on monthly basis (A4m USD) / quarterly basis (A3q USD). (Dividend amount or dividend rate is not guaranteed. Positive dividend does not mean positive return. Distributions may be paid out of capital.Please read key risks 8 & 12)

Explore our suite of property equities funds

Global

Pan European

Asia-Pacific

Meet our team

Janus Henderson has managed listed real estate assets since 1997 and manages a total of US$3.4 bn in global and regional portfolios.

Europe

Guy Barnard, CFA

Co-Head of Property Equities

18 years' industry experience

Nicolas Scherf

Portfolio Manager

14 years' industry experience

Tom Foster, CFA

Investment Analyst

6 years’ industry experience

North America

Asia Pacific

Greg Kuhl, CFA Portfolio Manager

16 years' industry experience

Danny Greenberger Portfolio Manager

15 years' industry experience

Alex Koslover, CFA Investment Analyst

8 years' industry experience

Tim Gibson

Co-Head of Property Equities

20 years' industry experience

Xin Yan Low

Associate Portfolio Manager

14 years' industry experience

Meet our team

Janus Henderson has managed listed real estate assets since 1997 and manages a total of US$3.4 bn in global and regional portfolios.

Europe

Guy Barnard, CFA

Co-Head of Property Equities

18 years' industry experience

Nicolas Scherf

Portfolio Manager

14 years' industry experience

Tom Foster, CFA

Investment Analyst

6 years’ industry experience

North America

Greg Kuhl, CFA Portfolio Manager

16 years' industry experience

Danny Greenberger Portfolio Manager

15 years' industry experience

Alex Koslover, CFA Investment Analyst

8 years' industry experience

Asia Pacific

Tim Gibson

Co-Head of Property Equities

20 years' industry experience

Xin Yan Low

Associate Portfolio Manager

14 years' industry experience

Source: Janus Henderson Investors, as at 30 June 2021.

Related Insights

Footnote:

-

Nareit, FactSet as of 31/3/21, 10- and 30-year correlation data to 31/3/21, for FTSE Nareit All Equity REITs Index versus bond and equity indices.

-

For more fund awards information, please visit Awards

-

For more fund awards information, please visit the Janus Henderson Investors Awards page. Fund Selector Asia Awards 2022 Singapore, reflecting fund performance from 13 November 2020 to 12 November 2021, Equity Sector for Janus Henderson Horizon Global Property Equities Fund. Refinitiv Lipper Fund Awards Singapore 2022, reflecting fund performance based on Janus Henderson Horizon Global Property Equities Fund, class A2 USD share, Equity Sector Real Estate Global, 3 and 5 years as of 31st December 2021. Refinitiv Lipper Fund Awards Singapore 2021, reflecting fund performance based on Janus Henderson Horizon Global Property Equities Fund, class A2 USD share, Equity Sector Real Estate Global, 5 years as of 31 December 2020. For more information, see lipperfundawards.com. Refinitiv Lipper Fund Awards, ©2022 Refinitiv. All rights reserved. Used under license.

-

Morningstar, as at 30 September 2021. Europe OE Property - Indirect Global

-

Morningstar, as at 30 September 2021. Europe OE Property - Indirect Europe

-

Morningstar, as at 30 September 2021. Europe OE Property - Indirect Asia

Janus Henderson Global Real Estate Fund, Janus Henderson Horizon Asia-Pacific Property Income Fund, Janus Henderson Horizon Global Property Equities Fund and Janus Henderson Horizon Pan European Property Equities Fund (the “Sub-funds”)- the Sub-funds are authorized by the SFC under the Code on Unit Trusts and Mutual Funds, but not authorized or regulated under the SFC Code on Real Estate Investment Trusts. The dividend policy of the Sub-funds is not representative of the distribution policy of the underlying REITs. The SFC authorization does not imply official recommendation or endorsement of the Sub-funds nor does it guarantee the commercial merits of the Sub-funds or the performance. It does not mean the Sub-funds are suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.