- The Fund's investments in equities are subject to equity market risk due to fluctuation of securities values.

- The Fund invests in debt securities (including below investment grade or unrated) and asset/ mortgage-backed securities/ commercial papers; and is subject to greater interest rate, credit/ counterparty, volatility, liquidity, downgrading, valuation, credit rating risks. It may be more volatile.

Read more

- Investments in the Fund involve general investment, currency, hedging, economic, political, policy, foreign exchange, liquidity, tax, legal, regulatory and securities financing transactions related risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments for investment and efficient portfolio management purposes. This may involve counterparty, liquidity, leverage, volatility, valuation, over-the-counter transaction, credit, currency, index, settlement default and interest risks; and the Fund may suffer total or substantial losses.

- The Fund's investments are concentrated in US companies/ debt securities and may be more volatile.

- The Fund may at its discretion pay dividends (i) pay dividends out of the capital of the Fund, and/ or (ii) pay dividends out of gross income while charging all or part of the fees and expenses to the capital of the Fund, resulting in an increase in distributable income available for the payment of dividends by the Fund and therefore, the Fund may effectively pay dividends out of capital. This may result in an immediate reduction of the Fund’s net asset value per share, and it amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Less

For over 30 years, the Balanced strategy has offered a simple and optimal mix of stocks and bonds designed to capture the best opportunities across market cycles.

For over 30 years, the Balanced strategy has offered a simple and optimal mix of stocks and bonds designed to capture the best opportunities across market cycles.

For over 25 years, this dynamic allocation strategy has delivered our equity and fixed income expertise in a one-stop core solution

The advantage of a combination of stocks and bonds

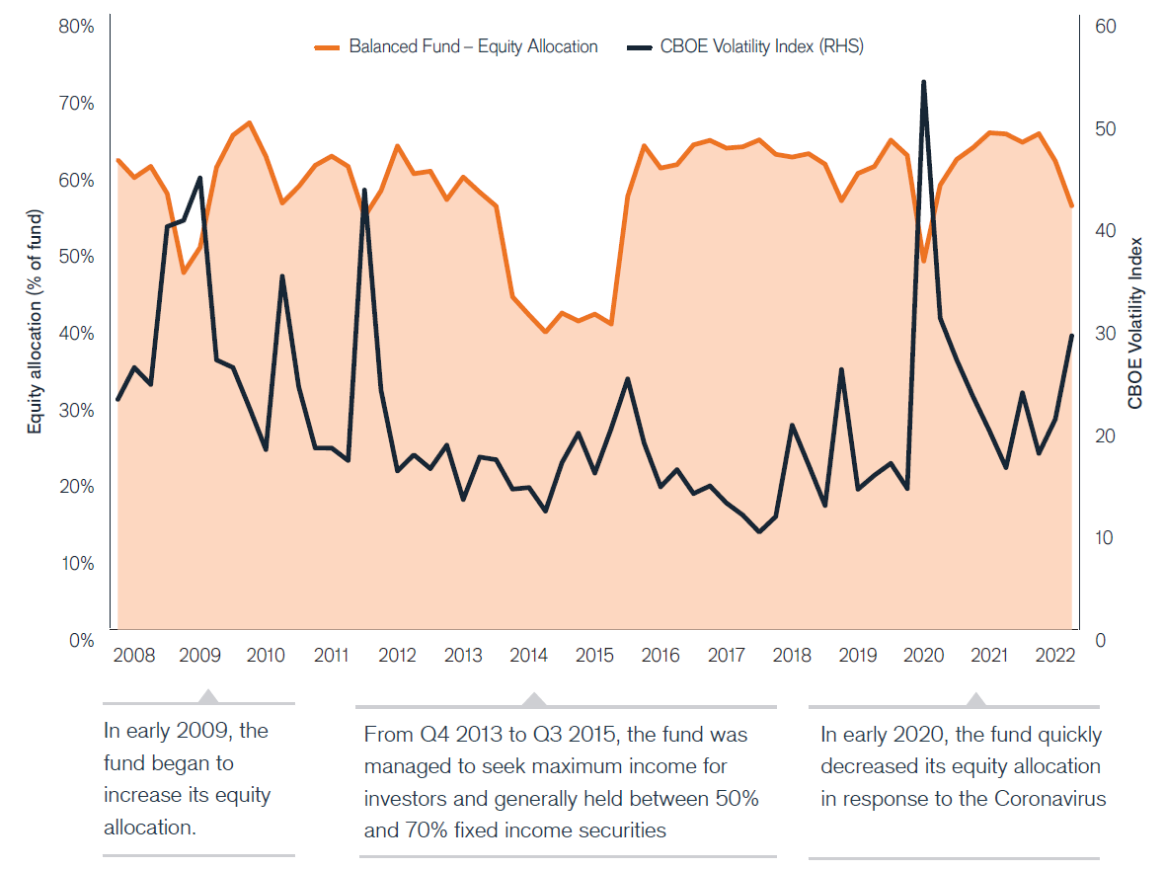

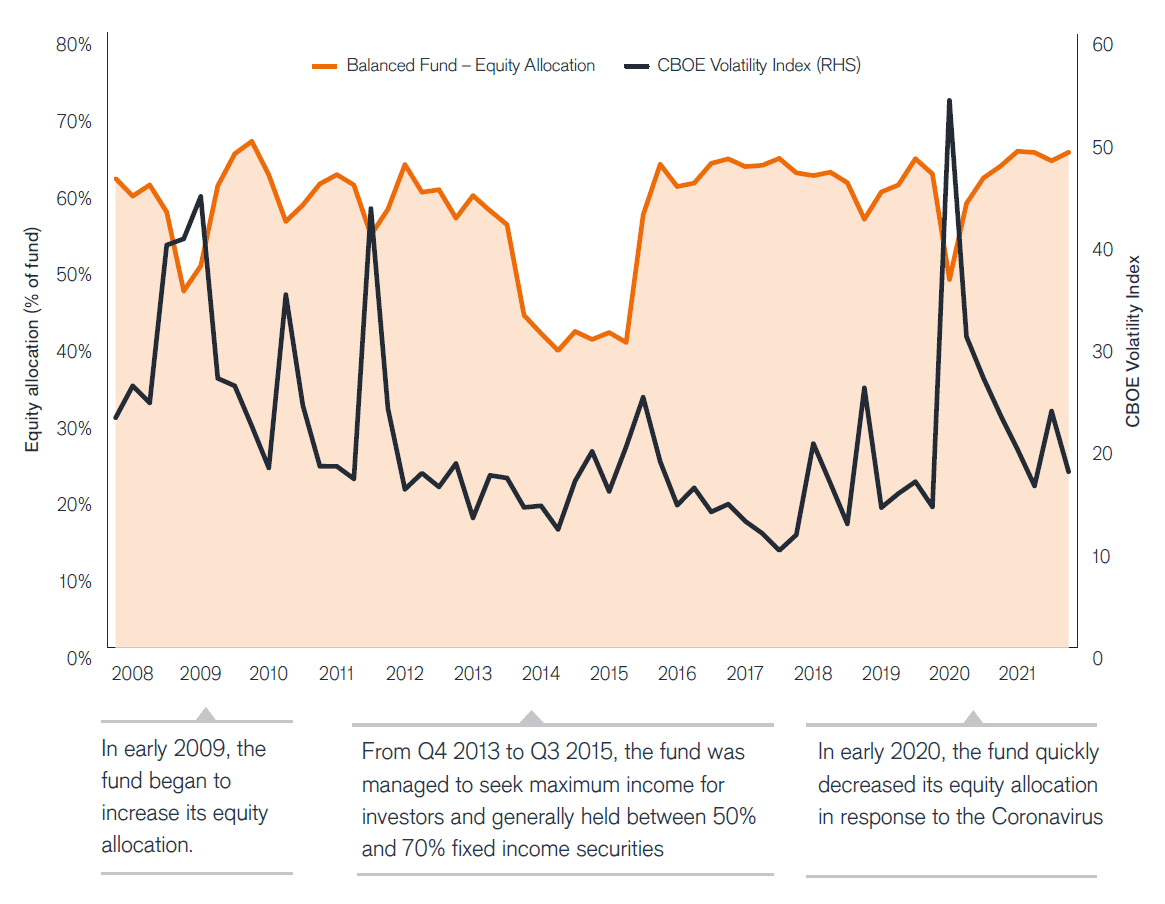

The Balanced Fund’s dynamic asset allocation strategy has the flexibility to defensively position in anticipation of market volatility while seeking strong risk-adjusted returns. Unlike many competitor products where asset allocation is constrained by static targets, the Balanced Fund can actively pivot between an equity weighting of 35% to 65% depending on market conditions.

The Fund is designed to:

Offer a dynamic blend of mainly US stocks and bonds

Adapt to all market conditions

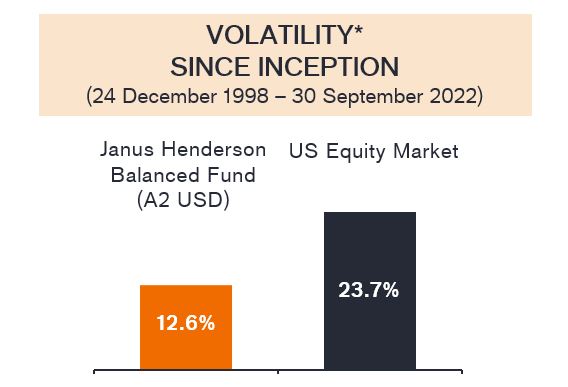

Limit volatility relative to the stock market

"We actively position the portfolio based on the most attractive opportunities in the equity and bond worlds, based on evolving economic conditions".

Jeremiah Buckley, CFA,

Co-Manager of the Janus Henderson Balanced Fund

The advantage of a combination of stocks and bonds

The Balanced Fund’s dynamic asset allocation strategy has the flexibility to defensively position in anticipation of market volatility while seeking strong risk-adjusted returns. Unlike many competitor products where asset allocation is constrained by static targets, the Balanced Fund can actively pivot between an equity weighting of 35% to 65% depending on market conditions.

The Fund is designed to:

Offer a dynamic blend of mainly US stocks and bonds

Adapt to all market conditions

Limit volatility relative to the stock market

"We actively position the portfolio based on the most attractive opportunities in the equity and bond worlds, based on evolving economic conditions".

Jeremiah Buckley, CFA,

Co-Manager of the Janus Henderson Balanced Fund

The advantage of a combination of stocks and bonds.

The Balanced Fund’s dynamic asset allocation strategy has the flexibility to defensively position in anticipation of market volatility while seeking strong risk-adjusted returns. Unlike many competitor products where asset allocation is constrained by static targets, the Balanced Fund can actively pivot between an equity weighting of 35% to 65% depending on market conditions.

The fund is designed to:

Offer a dynamic blend of mainly US stocks and bonds

The US has been a driver of growth outperforming the rest of world by 81.4%

Adapt to all market conditions

When downturns occur, a 60/40 portfolio experiences lower losses and faster recoveries

Limit volatility relative to the stock market

Since inception, the Fund has delivered nearly half the volatility of the S&P 500 Index

Source: Bloomberg, as of 31st March 2023. Past performance does not predict future returns.

Core solution

- Purposeful mix of stocks and bonds to serve as the foundation of your portfolio.

- Balanced blend of growth potential, income and ballast to smooth the investment journey.

- Consistent, disciplined approach to help realize long-term goals.

Power of downside protection

- Active and flexible to weather the ups and downs of an ever-changing market.

- Focus on portfolio stability to keep you invested over the long-term.

- Decreased volatility to mitigate the potential for damaging losses.

Proven experience

- Over 30 years of fundamental, bottom-up research and active asset allocation.

- Team-based, with deep expertise across the equity and fixed income markets.

- Collaborative, to identify a decisive path through difficult market environments.

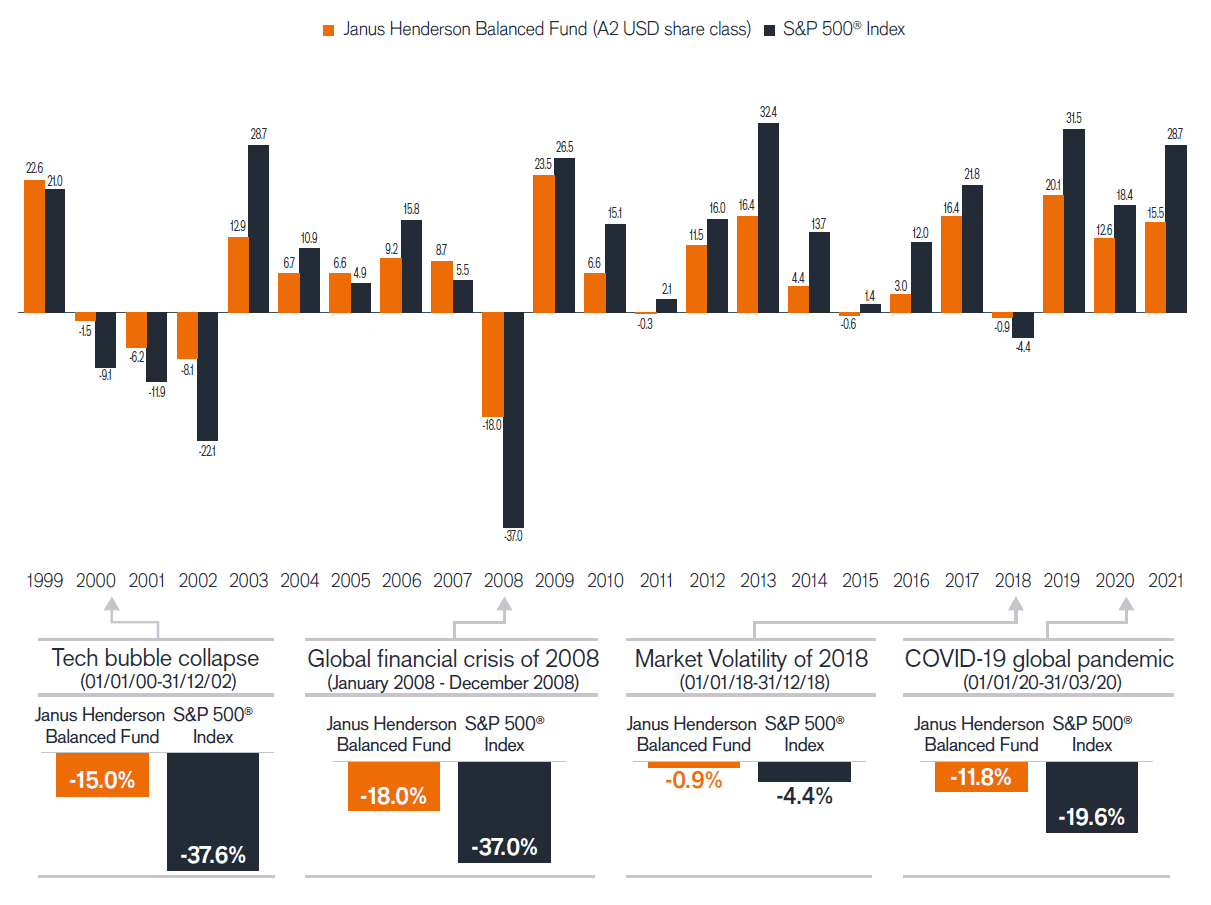

What does this approach mean for drawdowns?

The Balanced Fund has historically delivered when it has counted – on the downside. Whether it was market downturns like the tech bubble collapse of the early 2000s or the global financial crisis of 2008, the Fund captured less of the downside.

It is easier to climb out of a small hole than a big one

In its more than 25-year history, the Balanced Fund has outperformed the average of its competitors. The dynamic asset allocation has also helped the fund deliver index-beating performance over the long term outperforming the S&P 500 Index.

Past performance does not predict future returns.

Further information on this fund, disclosures and performance information

As we enter a new era characterised by structurally higher interest rates and higher inflation, investors face further uncertainty.

Are we in a new interest rate regime?

Where will economic growth go to from here?

How could these challenges affect my asset allocation decisions?

For financial professionals facing this list of important questions, we on the Portfolio Construction and Strategy (PCS) Team believe that a nimble allocation of flexible, one-stop actively managed asset allocation strategies is key to avoiding analysis paralysis.

A successful allocation to a ‘Balanced’ fund may potentially help clients to manoeuvre through multiple economic cycles and difficult markets, although robust due diligence is necessary.

"A balanced approach may provide clients with the best of both worlds – the prospect for higher returns than bonds while reducing the potential magnitude of any significant drawdowns from equities".

Matthew Bullock,

EMEA Head of Portfolio Construction and Strategy

Our experts

Empowering you to make better investment and business decisions.

How we serve:

- One-on-one consultations

- Keynote speeches

- Client-facing seminars online and in person

Documents

"We actively position the portfolio based on the most attractive opportunities in the equity and bond worlds, based on evolving economic conditions".

Jeremiah Buckley, CFA,

Co-Manager of the Janus Henderson Balanced Fund

A balanced approach may provide clients with the best of both worlds – the prospect for higher returns than bonds while reducing the potential magnitude of any significant drawdowns from equities.

Janus Henderson Portfolio Construction and Strategy Team

Janus Henderson's PACs

Simple, affordable, regular

Gradually invest in major asset classes thanks

to Janus Henderson's wide range of sub-funds

available in Italy

Insights

OWN REAL ESTATE IN A

DIFFERENT WAY

Own. Innovate. Diversify

How can we help?

Whenever you need to, there are many ways to contact us.

Important information

This campaign is intended solely for the use of professionals and is not for general public distribution.

Past performance does not predict future returns. Marketing Communication. The value of an investment and the income from it can fall as well as rise and investors may not get back the amount originally invested. There is no assurance the stated objective(s) will be met. Nothing in this campaign is intended or should be construed as advice. This campaign is not a recommendation to sell, purchase or hold any investment.

There is no assurance that the investment process will consistently lead to successful investing. Any risk management process includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors.

Various account minimums or other eligibility qualifications apply depending on the investment strategy, vehicle or investor jurisdiction. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors UK Limited (reg. no. 906355) registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority. Investment management services may be provided together with participating affiliates in other regions.

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

For investors in Peru only: The Strategy is being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This communication and any accompanying information are intended solely for informational purposes and do not constitute (and should not be interpreted to constitute) the offering, selling, or conducting of business with respect to such securities, products or services in the jurisdiction of the investor (this “Jurisdiction”), or the conducting of any brokerage, investment advisory, banking or other similarly regulated activities in this Jurisdiction. Neither Janus Henderson Investors, nor the securities, products and services described herein, are registered (or intended to be registered) in this Jurisdiction. Furthermore, neither Janus Henderson Investors or the securities, products, services or activities described herein, are regulated or supervised by any governmental or similar authority in this Jurisdiction.

For investors in Uruguay only: Nothing in this campaign or the content within it shall constitute a communication to acquire, sell or exchange securities and does not imply an authorization for the distribution to any person by any means of the Strategies mentioned or referred to in this campaign or the content within it or any other information, which should be subject to Janus Henderson Investors prior consent. In such regards, this campaign does not constitute an invitation or offer to contract, to which Janus Henderson Investors will not be obliged. In any case, the Strategies mentioned or referred to on this campaign and the content within it shall not be offered or distributed to the public in Uruguay, and/or by any means or circumstances which would constitute a public offering or distribution under Uruguayan laws and regulations.

For investors in Brazil only: The information contained herein does not constitute and is not intended to constitute an offer of securities and accordingly should not be construed as such. The products or services referenced in this campaign may not be licensed or authorized to distribution in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document or the merits of the products and services referenced herein. This campaign is provided for informational purposes only and may not be reproduced in any form. Before acting on any information in this campaign, prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions and obtain independent advice if required.