Key takeaways from the Bank of Japan’s latest rate hike decision and its more optimistic economic forecasts.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

European AAA CLOs offer the opportunity to capture high credit quality, defensive income and improve portfolio diversification. How do CLOs work and what can history tell us about the asset class?

The mass of capital flowing into US AI infrastructure signals a durable shift towards more capital-intensive operations, with ramifications across markets – including Europe.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable.

Why we believe the recent slide in healthcare stocks presents a potential buying opportunity.

Discussion on the implications of the mega AI infrastructure project on the technology sector.

Three strategies to help advisor teams stay focused on the goals they establish at the start of the year.

Multiple factors rationalise why investors should consider a strategic allocation to natural resources equities in 2025.

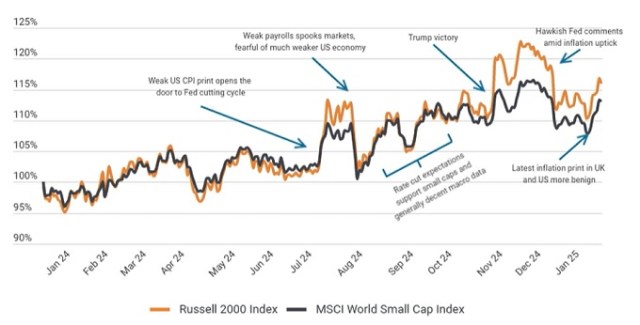

What do current market dynamics mean for asset allocation? The Market GPS Multi-Asset Quarterly highlights key drivers and positioning.

While the growing potential of generative AI is undeniably exciting, expectations and stock valuations need to be realistic to identify the true beneficiaries of this technological evolution.

Investment team's personal insights on being long-term investors in the listed real estate space.