Aim higher with

high yield

Amid rocky markets, investors are seeking a guiding hand for their fixed income portfolios.

Aim higher with

high yield

Amid rocky markets, investors are seeking a guiding hand for their fixed income portfolios.

Converting risk into reward

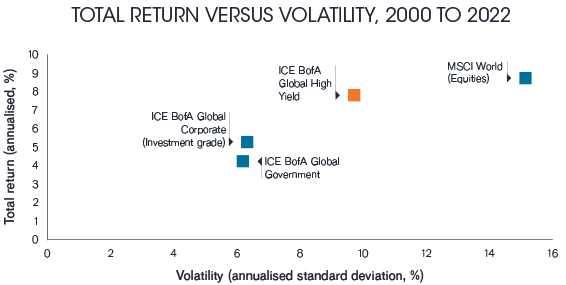

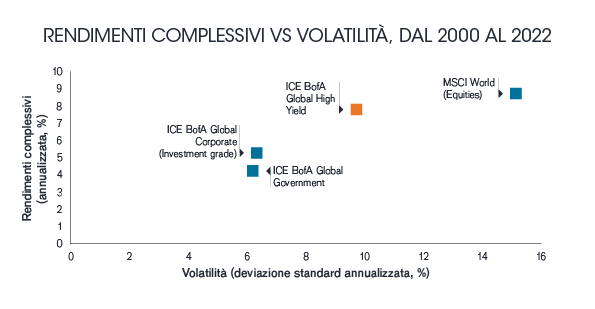

Mixed economic data and central banks raising interest rates can create challenging markets. High yield bonds offer a high yield to help mitigate the risk of default and have historically delivered attractive total returns over the long term. Through a selective approach we believe it is possible to identify those companies better able to meet their repayments and capture returns.

Past performance does not predict future returns.

The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Source: Refinitiv Datastream, total return indices in US dollars, 31 December 2001 to 31 December 2021. Volatility is annualised standard deviation using monthly data returns.

Source: Refinitiv Datastream, total return indices in US dollars, 31 December 2001 to 31 December 2021. Volatility is annualised standard deviation using monthly data returns.

A role for high yield

For investors prepared to accept some risk we believe that through a selective approach high yield bonds can play a valuable role within a diversified portfolio by offering:

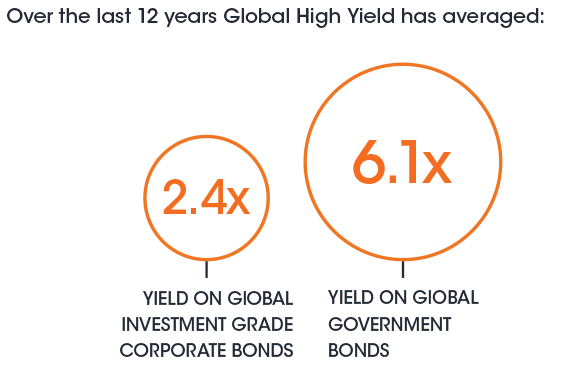

Income potential

High yield bonds offer an attractive source of income with yields often multiples of other fixed income assets.

OBBLIGAZIONI

GOVERNATIVE

GLOBALI

GOVERNMENT BONDS

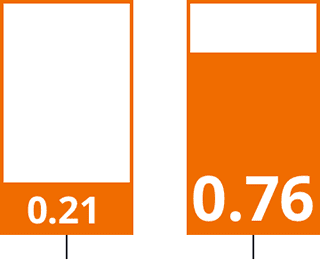

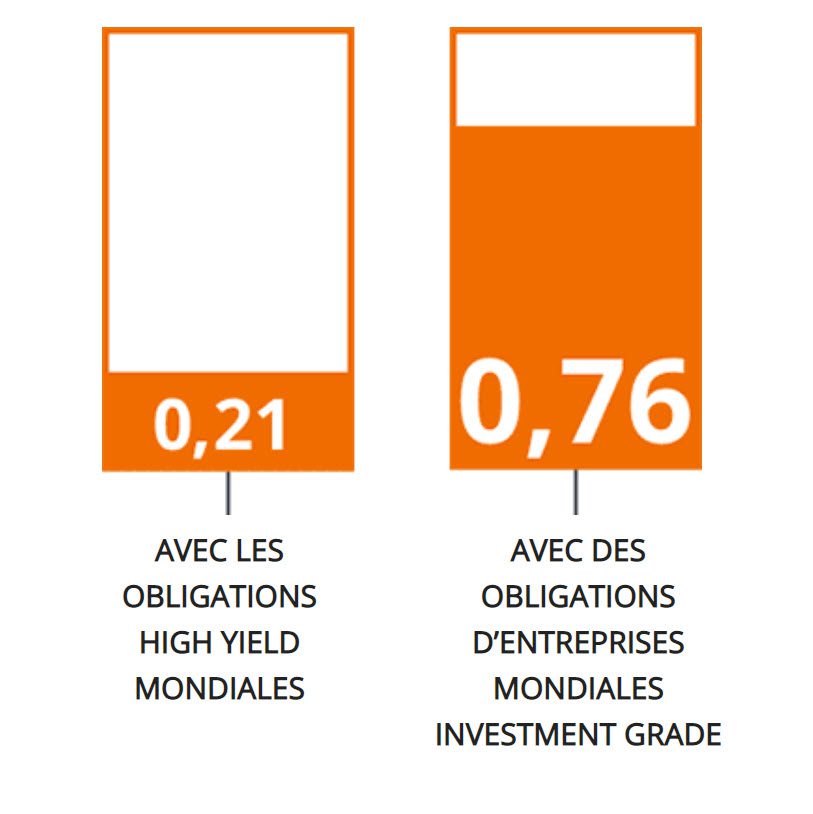

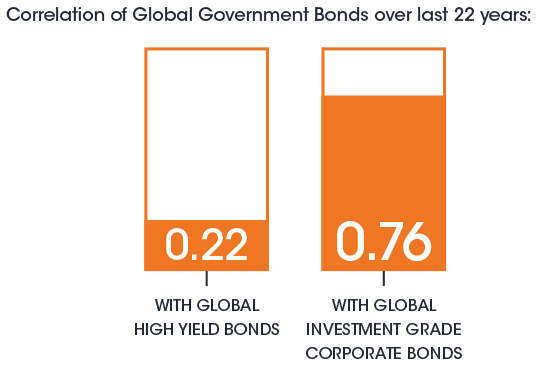

Diversification

High yield bonds typically have a much lower correlation with government bonds, making them a useful diversifier within a fixed income portfolio.

HIGH YIELD GLOBALI

INVESTMENT GRADE

GLOBALI

Yields may vary and are not guaranteed.

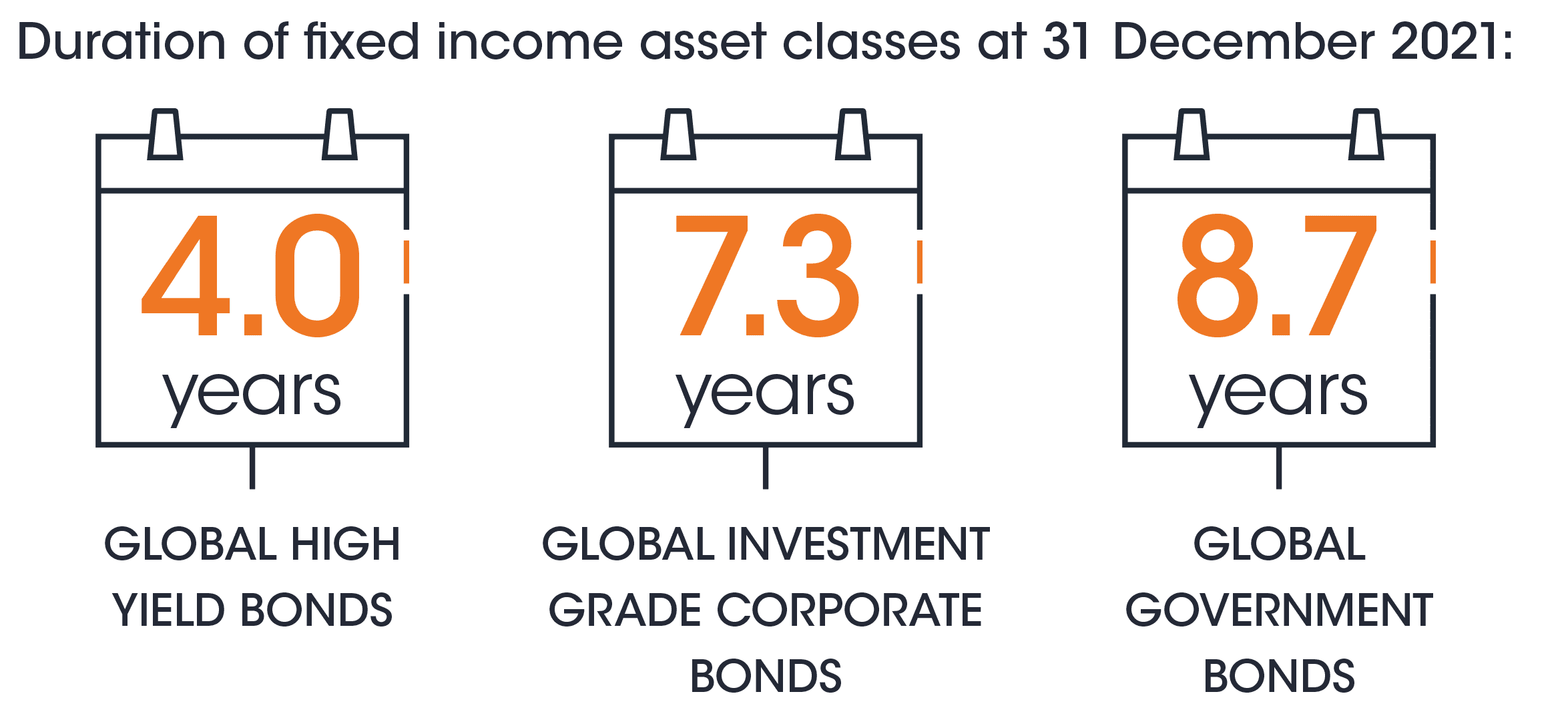

Low duration

High yield bonds have relatively low duration (interest rate sensitivity), which can help cushion against inflation concerns.

Source for average yield and duration: Bloomberg, data at 31 December 2021, ICE BofA bond indices, effective yield, effective duration; source for correlation: Refinitiv Datastream, same indices, correlation of monthly total returns, USD, over 20 years to 31 December 2021.

Past performance does not predict future returns.

YIELD BONDS

GRADE CORPORATE

BONDS

GOVERNMENT

BONDS

YIELD BONDS

GRADE CORPORATE

BONDS

GOVERNMENT

BONDS

The case for high yield bonds

Interested in knowing more about high yield? A deeper exploration of the asset class can be found here.

Why Janus Henderson for high yield?

We have a distinct approach to managing high yield bonds:

Repeatable, active management

that blends higher return opportunities with core stable income, adjusting the portfolio’s sensitivity to market and security risks according to the economic and credit cycle.

Research driven team with co-ownership of risk

between analysts and portfolio managers to maximise idea generation; analysts cover issuers across the full credit spectrum (both HY and IG) and capital structure and are ESG integrated.

Globally aligned team

working from both the UK and the US ensures an unbiased approach to regional allocation and helps identify opportunities regardless of issuer domicile.

Robust risk management

focused on taking the right amount of risk throughout the cycle, together with a unique semi-mechanical stop-loss process.

Explore our funds

Article 8*

Horizon Euro High Yield Bond Fund

For investors seeking the potential for high overall yield and capital growth from investing primarily in European high yield corporate bonds.

Learn moreArticle 8*

Horizon Global High Yield Bond Fund

A fund that accesses the total return potential of a diverse portfolio of high yield bonds from around the world.

Learn moreHigh Yield Fund

A fund that seeks to provide strong risk-adjusted returns from a portfolio of primarily US high yield corporate bonds.

Learn more*For investors seeking the potential for high overall yield and capital growth from investing primarily in European high yield corporate bonds. In accordance with the Sustainable Finance Disclosure Regulation, the Fund is classified as Article 8 and promotes, among other characteristics, environmental and social characteristics.

L’attention des investisseurs est attirée sur le fait que ces fonds présentent, au regard des attentes de l’Autorité des marchés financiers, une communication disproportionnée sur la prise en compte des critères extra-financiers dans leur gestion.

Discover our latest views on high yield

We believe in sharing expert insights for better investment decisions.

Meet the managers

Our high yield portfolio managers located in London and Denver form part of our globally-integrated corporate credit team.

Tom Ross, CFA

Portfolio Manager

- Industry since 2002

- Joined firm in 2002

- Based in London

Seth Meyer, CFA

Portfolio Manager

- Industry since 1998

- Joined firm in 2004

- Based in Denver

Tim Winstone, CFA

Portfolio Manager

- Industry since 2003

- Joined firm in 2015

- Based in London

Brent Olson

Portfolio Manager | Credit Analyst

- Industry since 1997

- Joined firm in 2017

- Based in Denver

ENGAGE WITH US

Access the contact details and our sales representatives here.

PURSUE FIXED INCOME

In uncertain times, fixed income can provide stability. We seek to help you overcome uncertainty with flexible solutions designed to strengthen the core of your portfolio.