Peter Harrington-Howes

Peter Harrington-Howes is a Senior Portfolio Strategist at Janus Henderson Investors, a position he has held since 2022. He is a member of the Portfolio Construction and Strategy Team. Peter partners primarily with U.S. clients to deliver actionable portfolio insights and generate proprietary thought leadership. Prior to joining the firm, he spent nine years at Natixis Investment Managers working with intermediary and institutional clients across U.S., Latin American, and U.S. offshore markets, specializing in portfolio construction, most recently as senior portfolio advisor in the Solutions Group. Earlier, Peter was a relationship manager with Global Retirement Solutions at Brown Brothers Harriman & Co. He began his career at JP Morgan in 2006 as a shareholder service representative.

Peter received a Bachelor of Science degree in mathematics from The Ohio State University. He holds FINRA Series 7 and 63 securities licenses and has 19 years of financial industry experience.

Articles Written

With a growing economy and strong markets, equity investors should focus on earnings

The Portfolio Construction & Strategy Team discusses the importance of earnings growth in unearthing overlooked opportunities.

Portfolio pivot? Balancing defense and offense

An economic downturn presents challenges for markets but could the risks already be priced in? Our Market GPS mid-year outlook PDF explores portfolio positioning considerations.

Look beneath the surface for small- and mid-cap opportunities

Why the small- and mid-cap space may present opportunities in the current economic environment.

European Equity: A warmer spring after a cold winter?

The more cyclical nature of European equities versus the U.S. and their lower relative valuations may present strong upside potential.

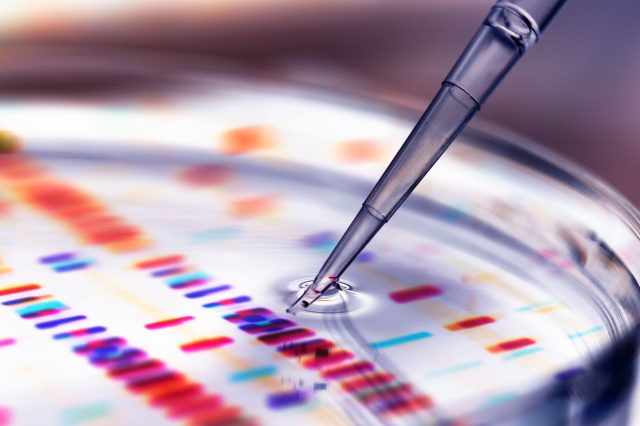

Healthcare: Immunity from the downturn?

The healthcare sector has proved resilient during past market downturns and may offer growth opportunities regardless of the recession outlook.

Sea change in short duration

How being nimble and flexible in a short-term fixed income allocation can help investors maintain stability during rate volatility.

Back to basics with intermediate duration

After investors had wisely been moving to the short end of the yield curve, intermediate-duration bonds may now be more attractive.

Starting ahead with a strong yield

The PCS Team explains why certain trends may prove to be supportive for both investment-grade and high-yield credit in 2023.

Public vs. private real estate: Similar assets, different prices

Public REITs and private real estate are two seemingly different universes that converge after adjusting for timing.