Alison Porter

Alison Porter is a Portfolio Manager on the Global Technology Leaders Team at Janus Henderson Investors, a position she has held since joining Henderson in 2014.Prior to Henderson, she was at Ignis Asset Management (formerly Resolution and Britannic Asset Management) as an investment analyst, portfolio manager, and head of US equities.

Alison has a BA degree (Hons) in economics and industrial relations from the University of Strathclyde and a master’s degree in investment analysis from the University of Stirling. She has 30 years of financial industry experience.

Products Managed

Articles Written

Technology stocks: AI is giving the tech ‘vampire’ superpowers

Alison Porter discusses the team’s positive view on the technology sector in 2025.

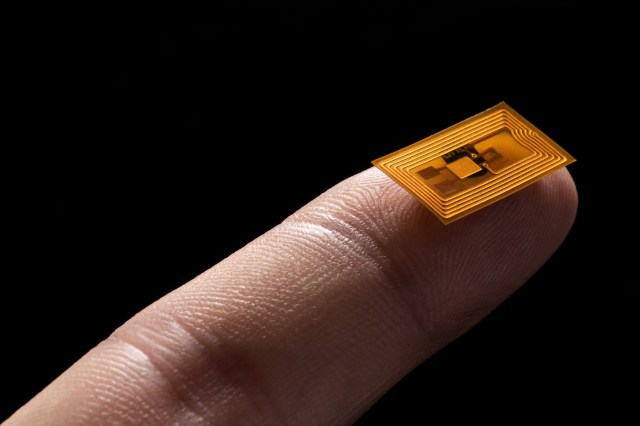

Impinj is enabling resource and productivity optimisation

Tech companies like Impinj are providing solutions to businesses in the quest to achieve better efficiency, productivity and sustainability.

Shifting demographics are driving tech and sustainability preferences

Findings from a study into generational preferences and attitudes toward technology and sustainability.

Building the foundations for responsible AI investing

At a recent London event, we outlined the environmental and social implications of AI, highlighting the need for responsible deployment.

Technology stocks: AI giving the tech ‘vampire’ superpowers

As the AI tailwind begins to mature in 2025, Alison Porter says investors in technology stocks should recognise that waves are lengthy and be prepared for higher volatility.

Global Perspectives: AI – Invest with patience

Discussion on the implications for tech investing in terms of demographic differences, geopolitical factors, and why patience is needed to invest in AI opportunities.

A new dawn with AI?

Alison Porter, Technology Portfolio Manager, and Sarah de Lagarde, Global Head of Corporate Affairs, discuss the potential applications of artificial intelligence (AI).

Demographic shifts: Trends and implications for businesses and investors

Explanation of how generational preferences impact workforce success, consumer choices, as well as investment returns, and how to navigate them.

Global Technology Leaders – Strategy update

Please watch Alison Porter, Portfolio Manager on the Global Technology team, provide a quarterly update on the Global Technology Leaders strategy, and her latest market perspectives and outlook. This webcast took place on Thursday 23 April.

Technology is bringing the future of autonomous driving closer

Despite signs of progress, a pragmatic approach towards investing in the autonomous driving space is warranted.

AI ChatGPT – the next great hype cycle?

A discussion on ChatGPT and the implications of its release on the tech sector.