As monetary policy works its way through various economies reducing final demand it has, by design, the dual outcomes of softening labour markets and lowering corporate profitability. The world has changed, and the price of money, in our view, is now at much healthier levels whilst the availability of credit becomes more discerning.

Funding costs for corporates have normalised, not just from the abnormally easy conditions during the pandemic, but also versus the decade of cheap money between the Global Financial Crisis and the pandemic. For investors, the late stage of this economic cycle has arrived and this brings the normal advent of rising delinquencies, re-structures and defaults. Whilst ordinarily this phase of the cycle would spell caution for investors, we believe ultimately it is a healthy development and that taking a nuanced approach to credit investing will likely deliver investors strong risk adjusted returns over the period ahead.

Key considerations for investors include:

- The starting point for corporate fundamentals matter

- This cycle is different despite the policy playbook not being new

- Not all corporate debt is made the same, a nuanced approach is required

- Outsized prospective returns for credit investors still exist, and

- Cheap ways to hedge for the unlikely left field events are available.

Starting point matters

As the economic and business cycle nears the latter stages, any slowdown in economic growth, softening of labour markets will inevitably impact corporate earnings adversely. This cycle will be no different. However, the starting point is worth assessing for different segments of the corporate debt market. To provide some context, corporates in Australia and abroad were healthy, making adequate profits prior to the pandemic. During the pandemic, these very companies shifted upward to making abnormally high profits, aided by both monetary and fiscal policy as well as a resumption of demand. Inflation on nominal revenues also assisted the larger, stronger companies in gaining market share and achieving margin expansion. Meanwhile, highly-levered consumer cyclical and small-medium enterprise (SME) segment survived and in some cases temporarily thrived during the pandemic. However, this segment was never fundamentally strong nor sustainable and is now facing the reality of falling demand and higher funding costs.

A different cycle

For the most part investment grade companies today remain well funded with debt termed out and highly profitable. From a fundamentals perspective, they remain relatively resilient to an economic growth slowdown. We see profits as moderating rather than falling precipitously. The same cannot necessarily be said for the SME segment. Nor for highly leveraged and/or cyclical, consumer centric businesses. A default cycle has commenced in loans, and pockets of high yield and private credit across the globe. Domestically this was most visible in SME delinquencies. It was initially centred around the property construction sector, but is now widening to hospitality, domestic tourism, recreational goods and services, and other consumer segments. Business models reliant on ongoing cheap debt or easy re-financing with little or no revenue is in the grips of a reality check, likely with harsh ramifications.

A nuanced approach to credit investing

Not all default cycles end in a crisis for credit markets. This cycle would suggest that defaults in investment grade companies should remain quite low by historical standards, but may be elevated in higher yielding segments. Importantly, rather than a uniform spike of defaults, we are more likely to see a rotation of defaults from industry to industry within lower quality credit. This will, in turn, keep the default rate rolling over multiple years. Recovery rates in these lower quality segments are being realised at lower levels than the past. Of course, market dislocations can occur with concerns around defaults lower down in credit markets, and cause mark to market underperformance in higher quality credit segments. We would assess these events as opportunities to add to investment grade credit without fear, rather than one to be cautious about.

Outsized credit returns available

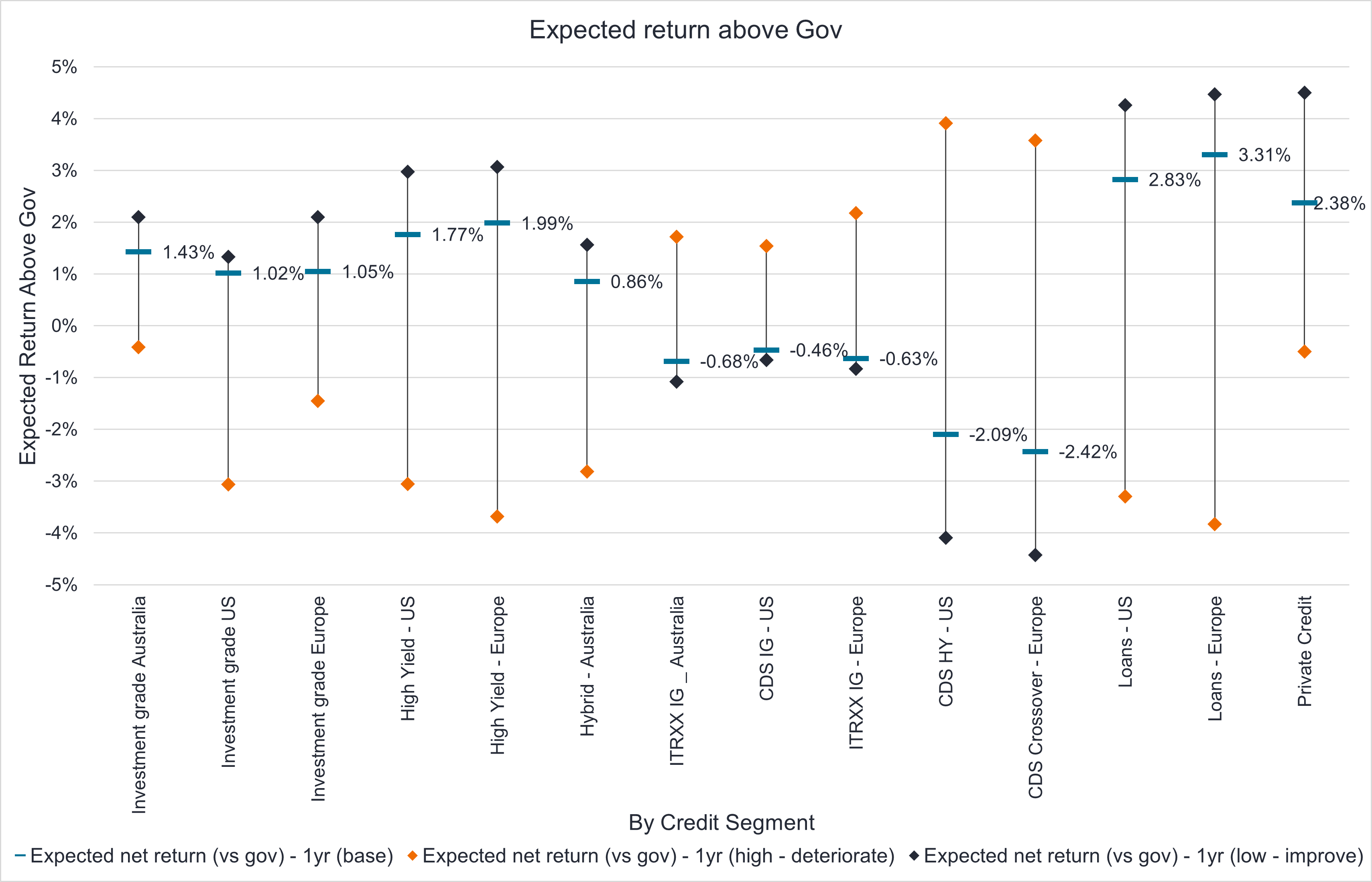

Overall, higher quality credit in the investment grade space remains the sweet spot for delivering healthy yields. However, to assess relative value, the sticker yields of lower credit quality, higher yielding segments need to be adjusted down for defaults and loss. The relative value of higher beta segments of the credit market currently remains less compelling in our assessment but a widening of credit spreads in this area would be valuable entry points for investors.

Source: Janus Henderson, Bloomberg as at 31 August 2024

With the exception of a left field event, the most probable scenario points to strong prospective relative performance of credit, with investment grade credit being the sweet spot for investors on a risk adjusted basis. For the brave, the loans segment is potentially shaping up to be an opportunity, albeit security selection will be critical given the expected higher defaults and lower recoveries. A beta exposure is not recommended.

Cheap ways to invest in credit and hedge tail risks

Tail ends of economic and market cycles have always been volatile, with investors seeking duration, quality risk-free assets and high compensation for default risk. Liquidity can also become fleeting in an environment of uncertainly.

In order to preserve capital and also extract good returns in this environment, one must not passively sit on the sidelines; this is the wrong part of the cycle to be beholden to benchmarks. To ensure portfolios retain their defensive attributes, levers such as active management of duration, yield curve positioning and credit protection through the Credit Default Swap (CDS) market can be invaluable.

We are confident dislocations will occur and opportunities will emerge. Again, actively utilising the full spectrum of inflation linked bonds, bond/swap and bond/semi-government spreads, corporate and asset backed betas (such as global loans, high yield and emerging market debt) can further drive return outcomes. Individual industry positioning will become important if markets dislocate more meaningfully. Today, both CDS protection and duration are cheap and effective tools that can be relied upon whilst fully utilising the prospective value in investment grade credit. We assess this as a great way for investors to enhance overall portfolio outcomes on a risk adjusted basis.