Over the last few years, the confidence in the 60/401 portfolio (60% stocks, 40% bonds) has been put to the test. Historically, there have been just four times in the past 95 years when both equity and bond markets fell during the same year: 1931, 1941, 1969 and, most recently, 2022.

Janus Henderson Investor

The Portfolio Construction and Strategy (PCS) Team at Janus Henderson believes that it is (once again) too early to call time on the classic 60/40 and traditional balanced portfolios.

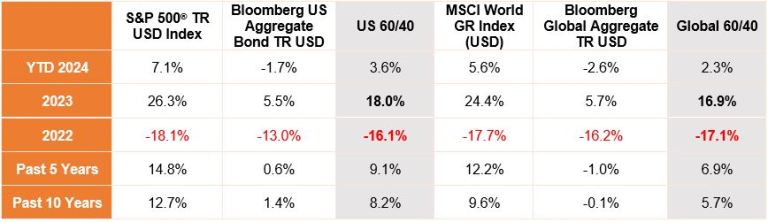

We believe that the story of the balanced portfolio is one of consistency and long-term investing. Despite 2022 being one of the worst years on record, patient investors were rewarded for staying the course (see Exhibit 1) with double-digit returns in 2023.

Exhibit 1: US and Global Balanced portfolio returns

Source: Morningstar & Janus Henderson Portfolio Construction and Strategy Team. As of 29 February 2024. US 60/40 = a hypothetical portfolio invested 60% in the S&P 500 TR USD Index and 40% in the Bloomberg US Aggregate Bond TR USD Index. Global 60/40 = a hypothetical portfolio invested 60% in the MSCI World Gross Index (USD) and 40% in the Bloomberg Global Aggregate Bond TR USD Index. Past performance does not predict future returns.

When considering allocations to balanced funds, the most common question we hear in our portfolio consultations is “what is the best way to use a balanced fund in a portfolio?” Of course, the answer to this will depend on an investor’s individual circumstances and objectives. But overall, we see balanced funds being used in three different ways:

1. As an entire portfolio

Using one or several balanced funds to build a portfolio can work effectively for investors who aim to fully outsource their allocation process. Balanced funds can automatically rebalance and shift their allocation across multiple assets and/or regions to fit a pre-set risk model. We have seen this methodology work well for financial professionals who rely upon the resources of outside managers, or for those who manage accounts where the thresholds required for a bespoke discretionary investment account are too great.

With almost 4,500 different strategies2 categorised as “balanced”, financial professionals are not without options to create a portfolio to fit their clients’ needs. However, with that variety comes the need to truly understand the risks, exposures and intended goals for each solution.

2. As a core allocation

Perhaps most commonly, investors utilise one or more balanced fund as the core component of their portfolio and strengthen this core allocation by adding high-conviction satellite or tactical positions, such as alternatives or specific regional or sector exposures.

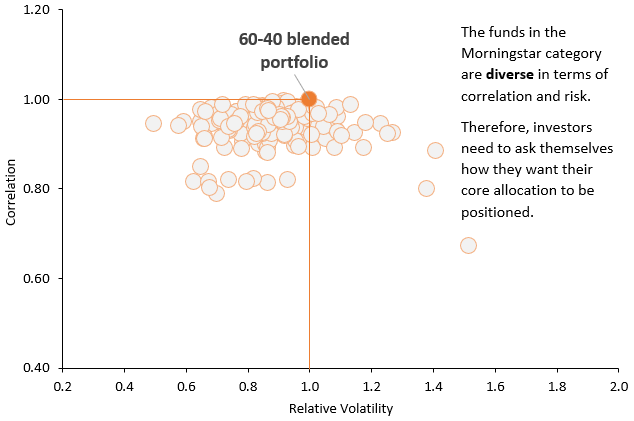

While balanced funds can provide a solid foundation for a core allocation, investors may be surprised to see that the correlations of solutions to a moderate blended 60/40 benchmark range from 0.5 to 1.5. Moreover, there is also a volatility spread amongst the funds in the Morningstar category as demonstrated in Exhibit 2.

Due diligence is therefore critical as investors looking to balanced funds as a core replacement might see a high correlation to a traditional 60/40 benchmark as an indicator that the balanced fund can indeed meet their objectives.

Exhibit 2: Due diligence is critical – many balanced funds are not core replacements

5-year correlation and relative volatility of funds in the Morningstar USD Moderate Allocation category versus a 60/40 blended-index portfolio.

Source: Morningstar, Portfolio Construction and Strategy Team, as at 29 February 2024. EAA Funds USD Moderate Allocation Morningstar category (N=169), relative to the 5-year correlation and relative volatility (annualised) of a blended benchmark of 60% FTSE All-World Index and 40% FTSE World Government Bond Index (WGBI), March 2019 to February 2024. Returns in USD. Past performance does not predict future returns.

3. As a tactical overlay

Finally, investors will often introduce balanced funds to round out their core equity, bond, and alternative allocations. The role of a balanced fund in these circumstances is to serve as an overlay to broader asset allocation decisions – hopefully enhancing portfolio returns without jeopardising the overall risk and return goals.

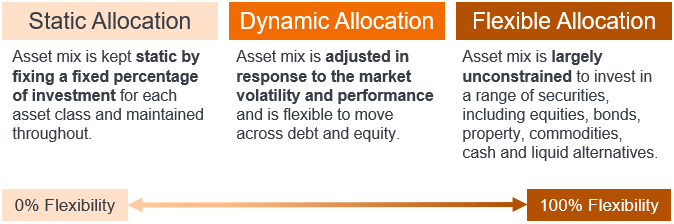

Within this role, we believe it is more important to distinguish options that can truly be both flexible and complementary. Active portfolio management and dynamic asset allocation can be key when choosing balanced funds as a tactical overlay given approaches with these features are typically more apt to benefit from short-term market dislocations.

Exhibit 3: Flexibility is key for balanced funds acting as a tactical overlay

Introducing a balanced fund in investors’ portfolios comes with several potential benefits, depending on its role:

- Simple, cost-effective diversification: With one single investment, investors can gain exposure to different asset classes, styles, and markets. The cost, complexity, or time constraints to otherwise accomplish this with individual investments can be quite significant.

- A more efficient solution: A core allocation to one or more balanced funds frees up significant time for investors to focus on areas of a portfolio that may have larger alpha potential, such as alternatives, concentrated sectors, etc.

- Consistency: Investors can be left feeling more confident in their core asset allocation, knowing that it is designed to adjust and navigate through various market conditions.

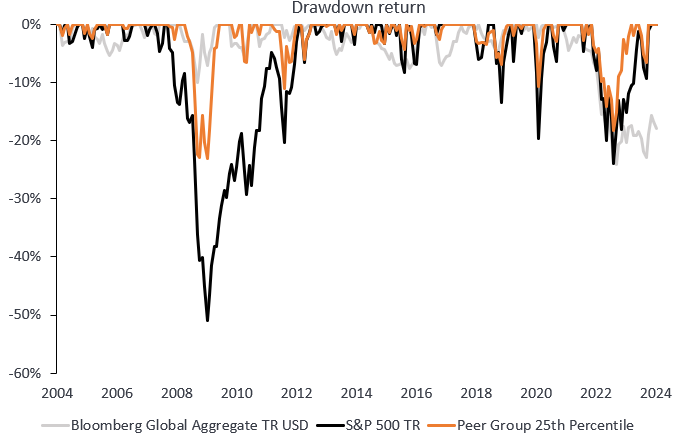

Exhibit 4: A top-performing balanced fund can potentially provide ballast in times when equity markets struggle

Outperforming balanced funds can reduce overall risks while potentially improving returns.

Source: Morningstar, Portfolio Construction and Strategy, 28 February 2004 to 29 February 2024. Drawdowns based on monthly returns in USD. Peer Group 25th Percentile of the aggregated Morningstar EAA and OE EUR and USD Moderate Allocations with global or US investment areas. Average return of 1,935 funds in the category. Past performance does not predict future returns.

It is worth keeping in mind that, while balanced funds offer various potential advantages, their use can make an overall portfolio less straightforward to assess in terms of exposure and potential risk. This conundrum, coupled with the range of solutions available in the market, highlights the importance of thorough research.

1 The term ‘60/40’ is generally used to describe a ‘balanced’ portfolio with a 60% allocation to stocks and a 40% allocation to bonds. Depending on clients’ individual investment objectives and goals, however, balanced portfolios typically range between 40%–60% equities.

2 Morningstar Global Broad Category of “Moderate Allocation” funds, oldest share class only, as at 29 February 2024.

—–

About the Portfolio Construction and Strategy team

Our Global Portfolio Construction and Strategy (PCS) Team has analysed more than 20,000 model portfolios with over 4,900 clients. The team’s goal is to help investors make sense of what’s happening in the market, understand the implications for portfolio construction and seek an investment edge through practical insights.

IMPORTANT INFORMATION

Investing involves market risk and it is possible to lose money by investing. Investment return and value will fluctuate in response to issuer, political, market and economic developments, which can affect a single issuer, issuers within an industry, economic sector or geographic region, or the market as a whole.

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Alternative investments include, but are not limited to, commodities, real estate, currencies, hedging strategies, futures, structured products, and other securities intended to be less correlated to the market. They are typically subject to increased risk and are not suitable for all investors.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis.

Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

FTSE All-World Index is a market-capitalisation weighted index representing the performance of the large- and mid-cap stocks of Developed and Emerging markets.

FTSE World Government Bond Index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds.

MSCI World Index reflects the equity market performance of large and mid cap securities across 23 Developed Markets (DM) countries.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment. Volatility spread, in relation to this article, is the difference in volatility between the most volatile and least volatile portfolio. The larger the spread, the greater the difference in volatility between the various portfolios.