In past U.S. election cycles, healthcare stocks have often underperformed as investors speculate how healthcare policy might change under a new president. That is not the case so far this year. In fact, the S&P 500® Health Care Sector has been largely keeping pace with the broader equity market, returning 8.9% year to date, compared with 10.6% for the S&P 500® Index.1

What’s different about the 2024 election? Both candidates have already been president – a rare occurrence in U.S. election history (the last instance was over 100 years ago in 1912, when former president Teddy Roosevelt ran against his successor, William Howard Taft). As such, investors seemingly have opted to focus on the candidates’ track records on healthcare reform, rather than campaign rhetoric.

JHI

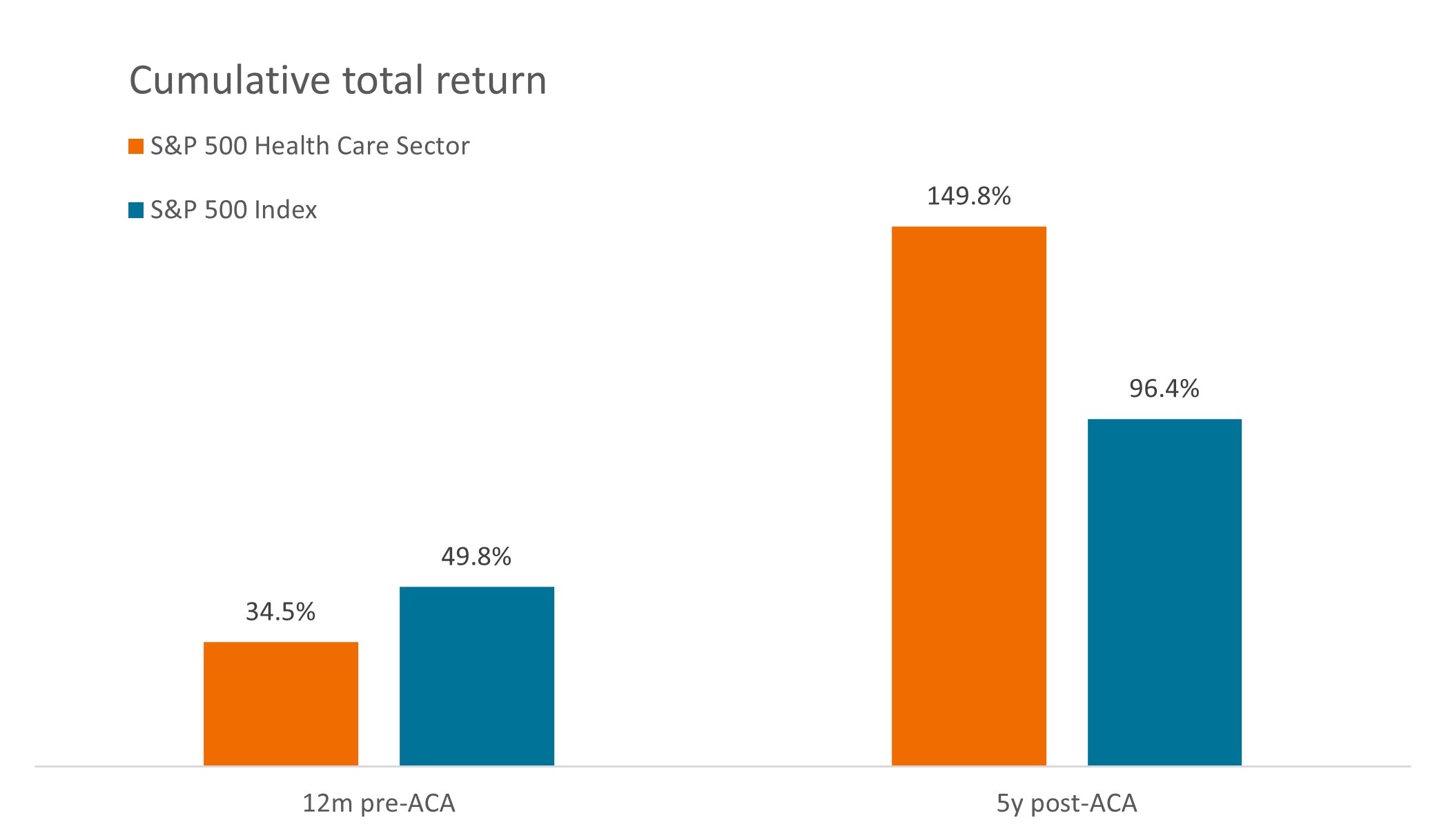

We think this makes sense. Historically, healthcare stocks tend to underperform as investors anticipate reform, then recover once policy is enacted. For example, the sector lagged the broader equity market in the months leading up to the passage of the Affordable Care Act (ACA) in 2010, only to outperform in subsequent years as investors realized the ACA – which expanded healthcare coverage to millions of Americans – came with more net benefits for the industry than costs.

Exhibit 1: Healthcare stock performance before/after passage of the Affordable Care Act

Source: Bloomberg. Pre-ACA period is 31 March 2009 to 31 March 2010. Post-ACA period is 31 March 2010 to 31 March 2015. The Affordable Care Act was signed into law on 23 March 2010. The S&P 500 Health Care Sector comprises those companies included in the S&P 500 that are classified as members of the GICS® healthcare sector.

Source: Bloomberg. Pre-ACA period is 31 March 2009 to 31 March 2010. Post-ACA period is 31 March 2010 to 31 March 2015. The Affordable Care Act was signed into law on 23 March 2010. The S&P 500 Health Care Sector comprises those companies included in the S&P 500 that are classified as members of the GICS® healthcare sector.

For this election, major new ideas in healthcare have, so far, not been campaign talking points. President Joe Biden successfully passed the Inflation Reduction Act in 2022, which allowed the government to negotiate prices for some drugs in Medicare (the U.S. health plan for the elderly) and capped out-of-pocket drug spending for seniors, starting this year. Looking ahead, Biden has proposed expanding on the legislation – growing the number of drugs eligible for negotiation and extending out-of-pocket drug spending caps to the commercial market.

For his part, former president Donald Trump has resumed his criticism of the ACA but has yet to propose an alternative to the legislation. He has also pushed to lower drug pricing and, as president, delivered regulation around hospital and health insurer price transparency.

An election year without major healthcare proposals

The main point is that there’s no discussion of wholesale change, such as during the 2020 campaign when candidates proposed Medicare for All, a single-payer health system, or in 2016, when Democratic candidate Hillary Clinton made drug pricing a centerpiece of her presidential bid and Trump proposed repealing and replacing the ACA (for the first time). A lack of big ideas means less uncertainty – and likely less volatility – for healthcare stocks.

That’s not to say healthcare is free of political discord. At the end of February, the Justice Department announced an antitrust investigation into UnitedHealth, a major provider of insurance, pharmacy benefit management services, and doctor networks. Under review: whether UnitedHealth’s acquisition of doctor groups could have unfair consequences on rivals and consumers. Meanwhile, Medicare drug price negotiations have started, with the pharmaceutical industry contesting the legality of the process via numerous lawsuits.

The bigger story – secular growth trends

But in the end, the biggest healthcare story of 2024 might not be politics at all. Markets instead may focus on a growing number of secular tailwinds that are gathering strength in the sector. For example: aging demographics. By 2050, one in six people worldwide will be 65 or older – an age cohort that typically spends three times as much on medical services than younger generations, and in the U.S., more than 10,000 people now turn 65 every day.

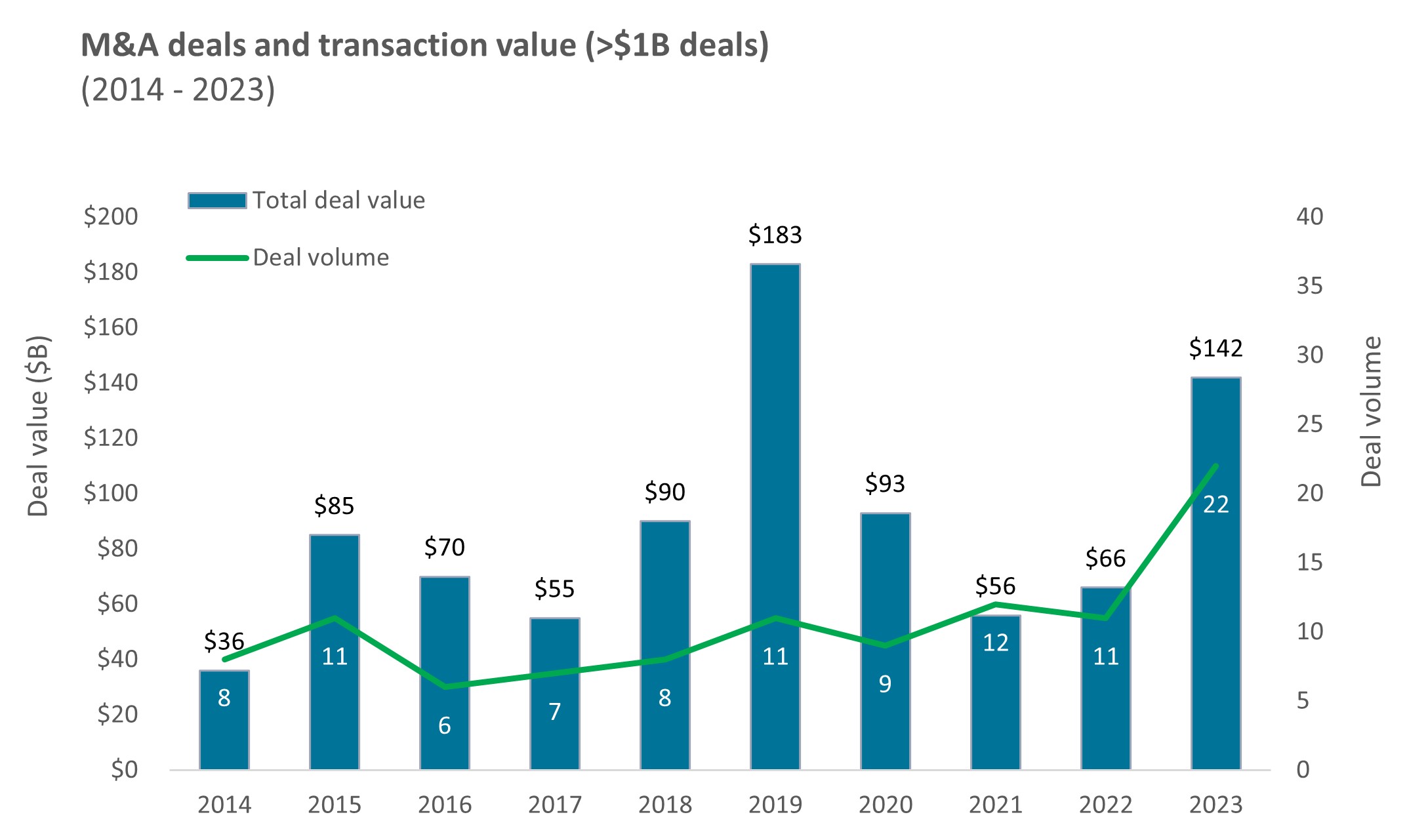

Valuation is another. After a year of working through imbalances created by COVID-19, healthcare stocks began 2024 trading at a discount to the broader market. This valuation gap could help limit the downside of negative shocks (including political ones) and has helped kick off a flurry of mergers and acquisitions, including 22 deals in 2023 each worth more than $1 billion, representing a new record.

Exhibit 2: Merger and acquisition activity accelerates

Source: Source: TD Cowen, as of 31 December 2023. Data reflect M&A deals >$1B in transaction value in the biotech sector.

Source: Source: TD Cowen, as of 31 December 2023. Data reflect M&A deals >$1B in transaction value in the biotech sector.

Finally, there’s innovation. Last year, the Food and Drug Administration approved a record 73 novel medicines. These drugs represent new product cycles that could drive growth for 10 years or longer. What’s more, many address large disease categories, such as Alzheimer’s, immunology, cancer, and diabetes. Not to mention obesity – the new class of weight-loss drugs known as GLP-1s is proving so popular that the therapies could top $100 billion in sales before the end of the decade. Even with widely different payor systems around the world, we’ve found true innovation is usually rewarded regardless of politics.

With those kinds of tailwinds, it may be no wonder investors are taking the long view this election year.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.