Murky waters

To say that the year has not unfolded as investors expected would be an understatement. For the last decade, one of the most discussed themes in the corporate world has been the disruption of industries and business models by technological innovation. And yet, over the last twelve months, the world has experienced disruptions of a very different kind. As a result, 2022 has the potential to be a year that is remembered as one where a significant number of long-held assumptions were challenged and maybe changed forever.

The war in Ukraine has shaken politicians’ and investors’ expectations that disagreements between major countries can be settled by diplomacy – Europe’s energy and defence policies have been upended in the process. In financial markets, persistent inflation has challenged central bank orthodoxy that inflation would be muted and transitory due to long-term structural issues. As a result, central banks have been forced to unwind easy monetary policies despite slowing growth, leading to higher interest rates unthinkable at the start of this year. All of this is happening at the same time that Covid continues to linger, particularly in China.

Against such a backdrop, many of the investments that investors hoped might help them preserve capital have proved to be more volatile than expected; inflation linked bonds and REITS have sold off as interest rates have increased, precious metals have been volatile, and real assets such as property were richly priced coming into the year. In our view, investors continue to underestimate the inflation defence offered by dividends through the cycle, especially in inflationary periods.

Dividends: a buffer against market volatility

Why is the investment power of dividends often overlooked, despite the fact they have played a major role in equity portfolio returns for decades? Its partly because dividends can be the tortoise rather than the hare when it comes to investment returns. Equity markets can be volatile, and many investors spend a lot of time focusing on timing investments to catch periods when markets rally. Looking back through history though, dividends have accounted for 40% of stock market returns since 1930 and 54% during decades when inflation has been high – an important point given the current economic climate.1 Being invested through cycles can be rewarding, and not being invested means you miss out on the dividend returns.

Ben Lofthouse, Portfolio Manager of Henderson International Income (HINT), believes that investing in companies with a consistent and growing dividend can help investors navigate the current environment. There are two key reasons for his view. Firstly, during periods of low or below-average share price returns, dividends can act as a buffer and offset the fall the share prices. In essence, investors are being paid to wait until the market normalises. Just of think of it as collecting rent payments from your property. Secondly, for investors that do not need to take the income, the reinvestment of dividends when capital returns are dull and valuations low can be very powerful. Compounding interest was anecdotally described by Albert Einstein as “the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it “. The same principle can be said of dividend reinvestment.

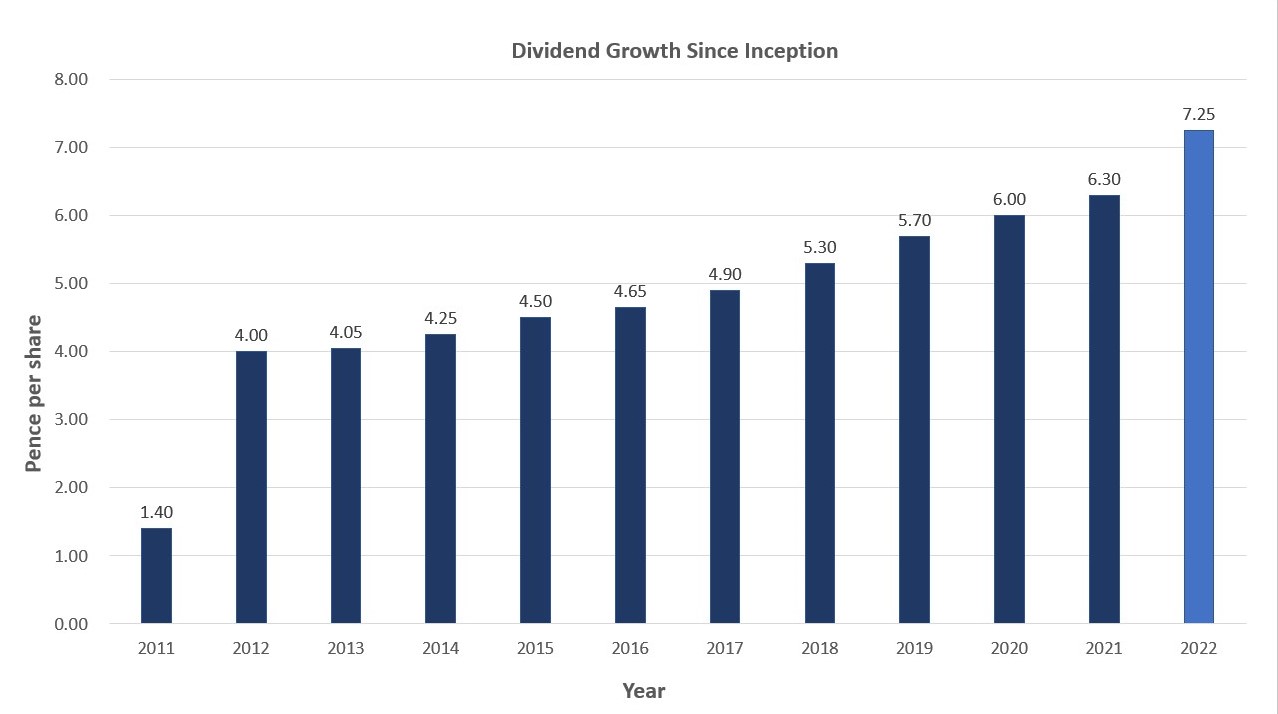

And the proof is in the pudding; HINT has a strong dividend record. It has grown its dividend every year since inception, and for its latest financial year, it increased its dividend from 6.30p to 7.25p per ordinary share. This is an increase of 15% year-on-year. For those investors worried about income, this is a no brainer. The revenue return rose by 23% YoY for the latest financial year, more than covering the increased dividends paid to investors.

Source: Henderson International Income Trust, Annual Report 2022

Quality matters

Of course dividends are important for returns, but the quality of the underlying portfolio companies plays a vital role in ensuring that the payouts are stable and consistent. After all, not all dividends are created equal. HINT focuses on well-run companies with attractive dividend yields, strong cash flow generation, and the potential to grow capital via earnings and dividends in the future whilst continuing to invest in the business. They are often leaders of their respective industries, with established competitive advantages. It is the latter of these characteristics – competitive advantage – that has been essential this year as it allows these companies to pass on rising input costs.

In an environment where inflation and energy costs remain stubbornly high and supply chain issues persist, there has been a marked difference in earnings trends for companies with a competitive edge and ultimately pricing power versus those that don’t. Companies with pricing power have been able to defend their margins and maintain profitability whilst their competitors have been struggling with cost inflation. Pricing power has been a key criterion for HINT’s stock selection over the last few years and this has come through in results this year. Many companies held in the portfolio have delivered better than expected results despite difficult conditions. This has translated into dividend growth. The top ten holdings, for example, on average, announced dividend increases during the year of 4.7%, ranging from 11% from Microsoft to 1.8% from Nestle.2

It is also worth noting that dividends are significantly less volatile than earnings and tend to reflect the medium-term outlook for companies rather than being overly driven by short-term earnings moves.

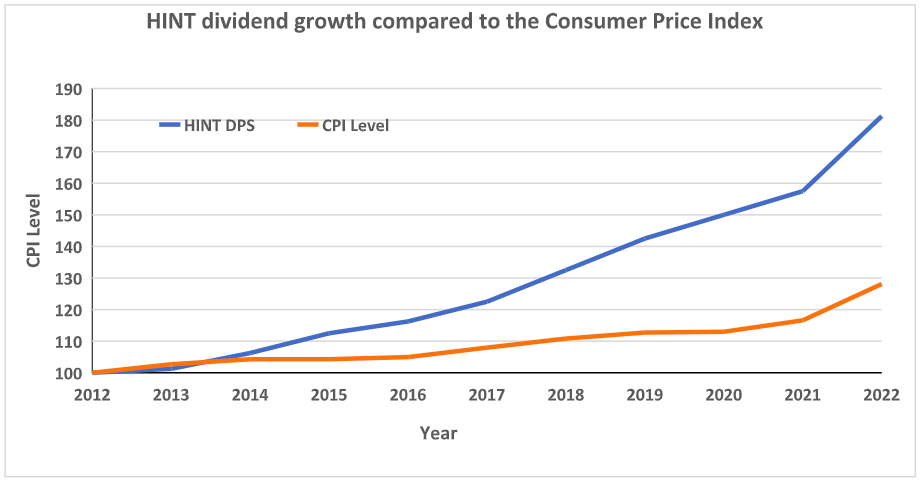

Source: Henderson International Income Trust, Annual Report 2022

Note: CPI – Consumer price index

Data for the 10 years to 31st August 2022

Facing uncertainty from a position of strength

There’s no doubt that the months ahead are going to be challenging, with a recession now the base case for many economies. However, Ben Lofthouse believes that companies will face this uncertainty from a position of strength. Corporate fundamentals remain strong and the outlook for dividends remains encouraging. Profits are forecast to end the year around 50% higher than their pre-pandemic levels, and dividend cover remains at record levels. In addition, dividends are supposed to come in at $1.56 trillion in 2022, up 8.3% year-on-year.3 So for those looking to shelter their portfolios from the ravages of higher interest rates and inflation, it’s time to look at Henderson International Income Trust.

1Source: https://www.fidelity.com/learning-center/trading-investing/inflation-and-dividend-stocks

2Source: Henderson International Income Trust, Annual Report 2022

3Source: https://cdn.janushenderson.com/webdocs/JHGDI_Issue+36+Final+%28English%29.pdf

Dividend yield – The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

Inflation-linked bonds – Inflation-linked bonds are bonds whose interest payments and principal (the payment made by the issuer at maturity) are linked to an index of inflation. In contrast, the interest payments and principal value of conventional bonds are fixed in nominal (money) terms.

Monetary policy – The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. See also fiscal policy.

Real estate investment trust (REITs) – An investment vehicle that invests in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like a normal share.