The impulse to protect and preserve

The advent of a high-interest rate, high inflation economy heralding the prospect of a drawn-out downturn has hit the confidence of potential investors. As a result, many are sitting on the side lines, waiting to see how things play out before committing to new investments. The impulse to protect and preserve what we have is instinctive in all of us. This applies to all our possessions, not least our wealth, which is crucial for our daily lives and future needs. Therefore, it is understandable why investors might want to ‘park the bus’ during periods of uncertainty.

The recent uptick in interest rates on savings accounts has also made it increasingly tempting to hold cash, with leading banks offering regular savers rates of around 5% – an incredible number compared to what was on offer just 18 months ago.1 However, with inflation set to remain high for some time, energy bills doubling compared to 2021, and interest rates driving up mortgage rates – trying to ride out the storm in cash may prove more costly in the long run.

The cost of cash

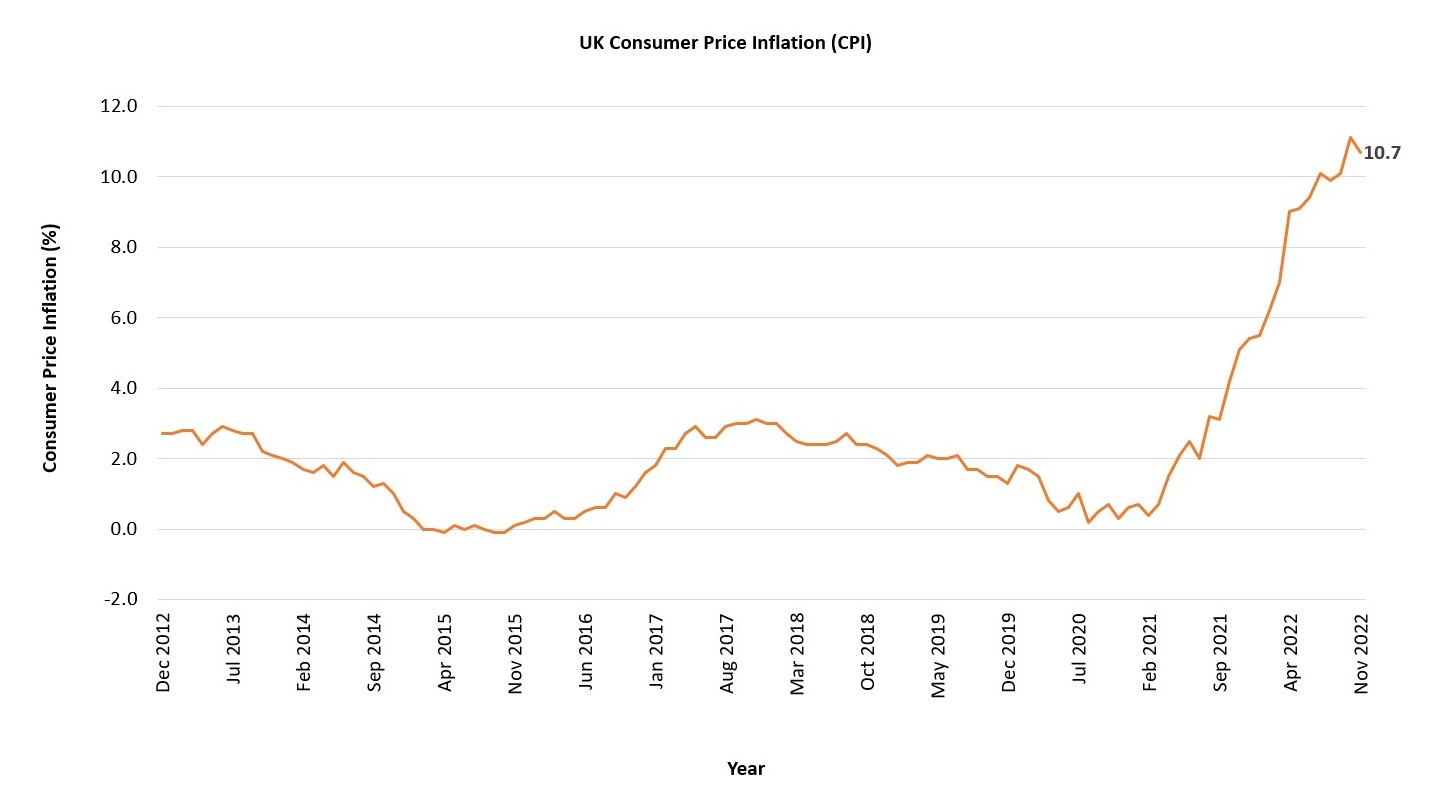

The first problem with holding cash is inflation. When inflation is low, its impact can seem relatively modest. However, when it is high – such as it is now – it can drastically erode your purchasing power. For example, if the inflation rate is 1.0%, then the price of bread that cost £2.00 a year ago would now be £2.02. However, if the rate goes up to 10.0%, that same loaf of bread would now cost £2.20. With UK inflation currently standing at a 40-year high of 10.7% (see chart below) and expected to remain elevated for some time, the danger inflation poses to your purchasing power becomes clearer.

Source: Office for National Statistics, November 2022

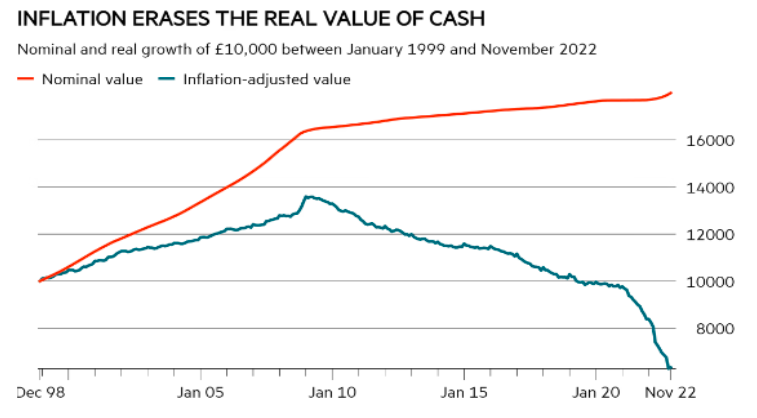

Another important factor to consider is the opportunity cost of holding cash which people often forget. Money carries a price in the form of opportunity cost. And that is the return forgone by saving rather than investing. In an inflationary environment, holding cash can be costly because it erodes the real value of your savings. For example, let’s say you had £10,000 in a savings account last year with a 5% interest rate. You would receive £500 in interest, and your balance, provided nothing changed, would rise to £10,500. However, with inflation running at 10%, that same £10,000 worth of goods and services that could have been bought a year earlier would now cost £11,000. So even though you may have earned £500 in interest, when you take into account inflation, the value of your cash savings has actually declined by £500 in real terms.

Source: Vanguard, Investors Chronicle, December 2022

Note: Uses the ICE LIBOR – GBP 3 Month (at a rate which banks lend to each other) as a proxy for savings rates

If you extend this over a longer period, it becomes clear that holding cash may not be the most effective way to preserve and protect your wealth. With equity valuations looking low and long-term forward returns more attractive than last year, now might be a good time to put any extra cash to work rather than keeping it in the bank. And the key is to look for investments that can shelter you from volatility whilst providing you with consistent and stable returns that keep up with inflation.

Backing the tried and tested

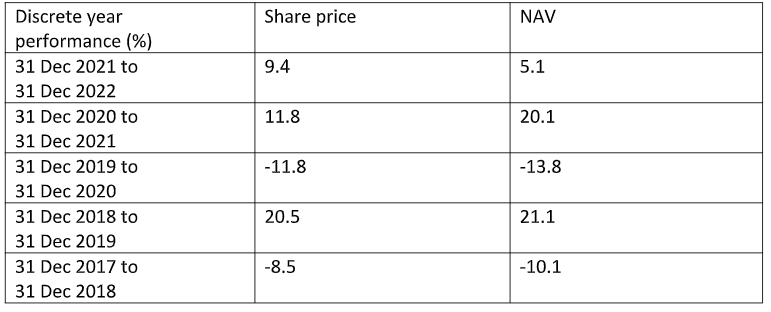

One such investment is The City of London Investment Trust (CTY). CTY is one of the Association of Investment Companies (AIC) Dividend Heroes – a title reserved for investment companies that have increased their dividends for 20 consecutive years. In fact, CTY sits at the top of the table, having raised its dividend for 56 straight years – the longest of any investment company. By principally investing in large UK equities that offer an attractive dividend yield compared to global peers, it has succeeded in providing a healthy income for its shareholders.

Source: The City of London Annual Report 2022

Past performance does not predict future returns

Managed by Job Curtis since 1991, CTY has benefited from a consistent and steady hand through the crises and bouts of market volatility investors have endured over the last three decades. This includes navigating the dot-com crash of 2000, the 2008 global financial crisis, and the unprecedented effects of the COVID-19 pandemic in 2020. As proven stock-pickers, Job and his team have worked hard to build a well-deserved reputation and track record for delivering positive portfolio returns.

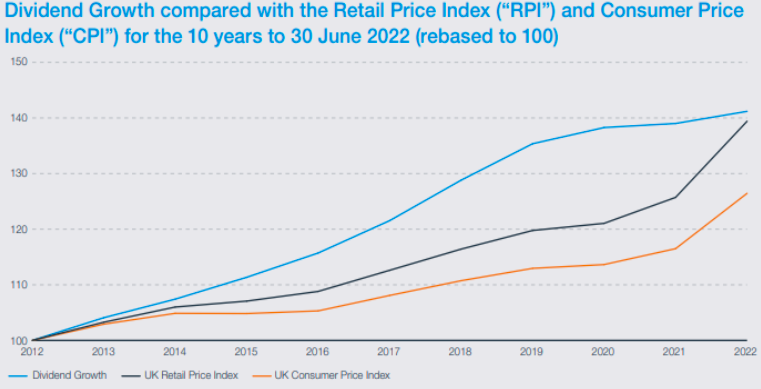

Over the last year, CTY outperformed its benchmark, the FTSE All-Share Index and was the best-performing in its UK Equity Income sector. Longer term, CTY has also outperformed its benchmark on a 3,5- and 10-year basis. Moreover, when considering inflation, CTY has increased its dividend by 41.2% over the last 10 years compared with a cumulative increase in UK CPI inflation of 26.5% (see chart below). For investors looking to protect their money from the ravages of inflation, such a return is worth considering.

Source: The City of London Annual Report 2022

Past performance does not predict future returns

We live in uncertain and expensive times, and the need for safety, especially when it comes to money, is the top priority. Cash feels safe because the number remains the same. But investors need to remember; that number does not represent the power of money that – in cash – is shrinking every day because of inflation. It is what you can do with your money today that matters. Those looking for a conservatively managed fund that can provide consistent and stable returns, whilst sheltering them from the impact of inflation, may find CTY well-suited to their needs.

Consumer price index (CPI) – A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate ‘inflation’. Headline CPI or inflation is a calculation of total inflation in an economy, and includes items such as food and energy, in which prices tend to be more prone to change (volatile). Core CPI or inflation is a measure of long-run inflation and excludes transitory/volatile items such as food and energy.

Volatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Net asset value (NAV) – The total value of a fund’s assets less its liabilities.