Knowledge. Shared Blog

September 2019

When Fixed Income Diversification Becomes “Diworsification”

The proliferation of new income investment solutions since the Global Financial Crisis is stretching the risk boundaries of traditional fixed income asset classes by utilizing increasingly complex instruments. Our Portfolio Construction & Strategy Team explains why this could be hindering portfolios.

Key Takeaways

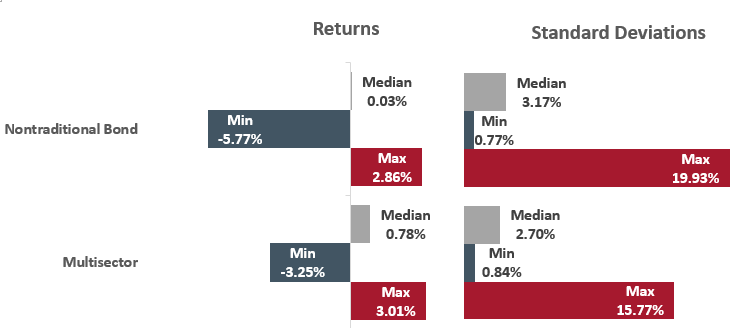

- August’s bond market volatility led to significant dispersion of returns and standard deviation within the Morningstar Multisector and Nontraditional bond categories.

- It is important for investors to scrutinize diversifying fixed income strategies and look not just at yield, but also at the complexity with which that yield is created.

- We think now is the time to focus on straightforward credit solutions that limit exposure to esoteric asset classes and other complex approaches that can generate unintended risk.

With August 2019 finally over, fixed income investors (i.e., all of us) are stepping back, taking a deep breath and asking ourselves, “What the heck just happened?!” A 50 basis point drop in the 10-year Treasury has officially put us in head-scratcher territory, but 10-year rates are just the calm surface above the carnage and confusion we’re seeing in fixed income portfolios.

As we have mentioned before, bond allocations should be built to feel like bonds – especially for when you need them to feel like bonds. The proliferation of new income investment solutions since the Global Financial Crisis is commonly stretching the risk boundaries of traditional fixed income asset classes by utilizing increasingly complex and esoteric instruments. To wit, the chart below shows the range of return and volatility we saw in the Morningstar Multisector and Nontraditional bond categories in August alone:

The Good, the Bad and the Ugly: Morningstar Multisector and Nontraditional Bond Category Average Returns and Standard Deviations (August 2019)

Source: Morningstar. Past performance is no guarantee of future results.

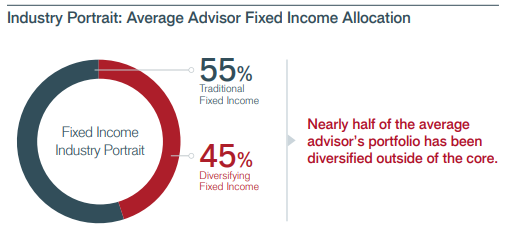

In our study of financial professionals’ fixed income portfolios, From Wallflower to Center Stage: The State of Modern Fixed Income Portfolios, we focused on the fact that the average financial professional (in our database of over 5,000 financial professionals models) has diversified nearly half of his or her fixed income portfolio outside of the core:

With so much of many fixed income portfolios diversified outside of the core, the dispersion in returns and risk in August alone could necessitate a lot of explaining in the next round of client portfolio reviews. The implication here is that investors need to scrutinize existing and potential diversifying fixed income strategies and look not just at yield, but also at the complexity with which that yield is created.

When balancing income potential with the ability to articulate expectations to clients, we believe the most complicated solutions are often the wrong solutions. We think now is the time to focus on straightforward credit solutions that limit exposure to esoteric asset classes (e.g., derivatives, leverage, currency, etc.) and other complex approaches that can generate unintended risk.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe