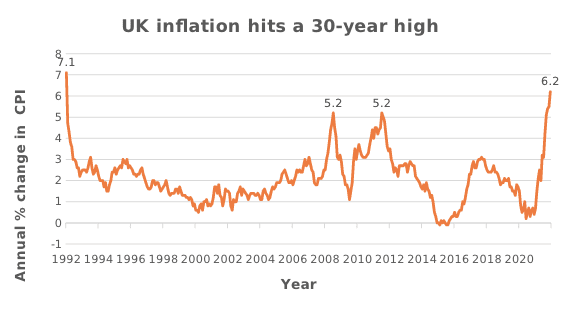

Sadly, despite the easing of restrictions and life starting to return to normal, the shocking events of Russia’s invasion of Ukraine have probably changed the shape of the post-pandemic recovery. While Western Europe is less directly exposed to the current conflict, the impact of the war is likely to be felt through sharply rising commodity prices, especially oil, gas, and wheat, which will further exacerbate an inflation problem that started to assert itself last year.

Source: Bloomberg, as at 24/03/2022

As retailers pass on higher raw material and shipping costs to the end consumer, food prices have also significantly increased. Together with the government’s proposed increase in National Insurance – which is set to rise by 1.25 percentage points – and the Bank of England raising interest rates, consumers are facing real pressure on their living standards.

While household savings accumulated during the pandemic – the UK savings ratio rose rapidly during this period – will help soften the impact, this is arguably a blunt tool to determine the underlying financial health of the average household. In fact, while the average savings in the UK are £76k per household, this is skewed by a small number of homes with very high savings levels. The median family in the UK has savings of £12.5k, meaning 50% of households in the UK have less than £12.5k in savings. The bottom 25% have less than £2,100 in savings.

With the real income squeeze likely to impact the majority of households in the UK, we believe that companies that offer consumers good value in this environment should benefit. B&M European Value Retail is one such company, providing customers with ambient food and household products from leading FMCG brands and general merchandise lines at low prices. The company has an attractive business model which focuses on a limited number of best-selling items, creating buying power given their significant volumes – which is then passed on to customers at lower prices. B&M is the market-leading in value retail in the UK, and its low-cost discipline is key to maintaining its price advantage over its competitors.

Another business we like is Whitbread, given it owns the market-leading UK budget hotel chain, Premier Inn. The company’s integrated business model, which combines the ownership of property, hotel operations, brand, and distribution capabilities, has enabled the business to provide a well invested and consistent offer at low prices. While the company has faced significant challenges during the pandemic, its financial strength has seen it not only survive but thrive in the recovery as it takes market share off weaker competitors.

While current high levels of inflation are likely to put pressure on consumers, not all consumer facing companies will suffer a drop in demand. Those businesses that have set up their operations to be the low-cost leader, can help consumers by offering good value for money and benefit in this environment.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. Fast-moving consumer goods (FMCG) – Fast-moving consumer goods are products that sell quickly at relatively low cost. These goods are also called consumer packaged goods.![]()