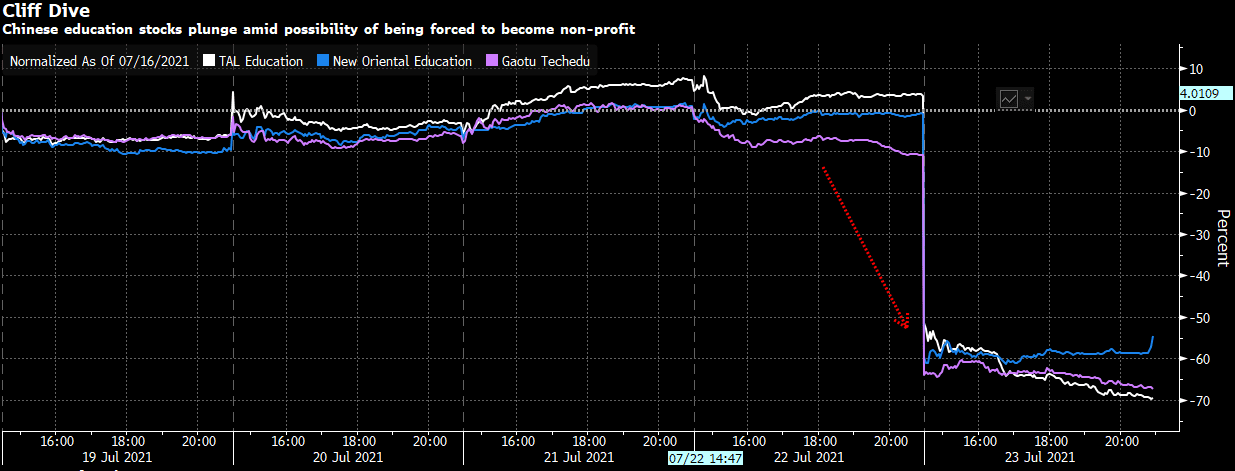

Since the suspension of Ant Group’s blockbuster IPO last year, Beijing has embarked on an unprecedented clampdown of its technology sector. The natural progression to this was when Alibaba was hit with a record anti-trust fine of 18 billion yuan in April for supposedly abusing its market dominance.1 More recently, however, the regulatory clampdown has intensified, causing a sell-off in those sectors deemed “socially sensitive” and leading many to question whether it is worth investing in China.

3Source: Bloomberg, as at 23, July 2021

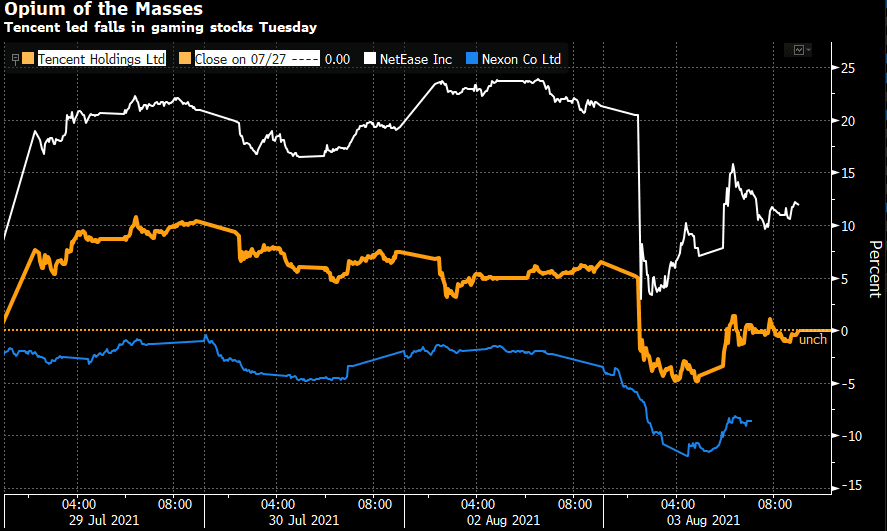

More recently, the casualties have included online gaming and social media company Tencent – Asia’s largest stock by market value – after the Chinese state media described games as “spiritual opium” and “electronic drugs”. Rivals NetEase and Nexon Co were also caught in the storm, with investors already on edge after Beijing came down hard on online industries from e-commerce to ride-hailing apps.

4Source: Bloomberg, as at 3 August 2021

On the surface, China’s crackdown has been interpreted by some investors as a clash between the government and private businesses. The reality, however, is more complicated. China’s government is looking to level the playing field and reduce widespread inequality, which is reflected in the areas that have seen increased levels of regulation.

Firstly, the Chinese internet platforms have grown rapidly over the last few years, partly due to the lax regulatory environment. This has resulted in some businesses gaining unfair competitive advantages, and we have even seen some exhibit monopolistic characteristics. Therefore, the new regulation aims to address the regulatory loopholes that some businesses have exploited to promote fair competition, sustainable growth and ultimately level the playing field. To look at this as a ‘crackdown’ on private companies, some might say, is a misunderstanding of the government’s plan.

Secondly, after declaring that it had eradicated poverty, China has turned its focus towards “common prosperity,” which has led to increased regulation in areas with crucial social welfare implications, such as healthcare, education, and property. For many residents in the larger cities, their lives have become riddled with anxieties’ that belie the broader sense of progress – from seemingly unattainable home prices to the pressure of securing the best education for their children and coveted places at leading universities. Therefore, the recent ban on tutoring and compulsory education, intensified regulation in the real estate market, and the broader coverage of social security and the health care system are all trying to address the top concerns of the average family in China. We have also seen steps towards improving safety and labour rights for delivery workers.

What does this mean for investors?

The measures undertaken are not a huge surprise considering the well-documented goals of the Chinese government. Perhaps what may have caught some investors off guard is the scale and the timing of the regulation – an order from on high has been jumped upon by regulators and acted upon without coordination or thought for the consequences. That being said, it was only a matter of time before the internet sector became so large that it started impinging on the powers of the state. At the same time, excess levels of profitability in core areas such as education, healthcare, and property would only be tolerated for so long.

The Henderson Far East Income has circa 17% exposure to China, considerably below the index weight of 30%.5 We do not own Chinese property, education, health care, or the major internet platforms, which have been the areas most affected by the recent regulatory clampdowns. We do own NetEase, the gaming company which has been affected by the current regulation, however we believe the market response in this area is overdone The focus on the gaming sector is centred on minors and the time spent online by under 18 year olds. Both Tencent and NetEase have brought in strict measures to limit time spent by young people on games and to monitor online behaviour, which are much broader than those applied in the western world. The 20% fall in the share price appears out of kilter with the 2% of company revenue deriving from purchases by under 18’s.

We do not think these measures impact the number of opportunities in China, however, these opportunities are now different. Paying high multiples for structural sectors with high margins and strict regulatory oversight is fraught with danger, but there are other opportunities in areas that fit in with government aims and goals at much more attractive valuation points. The latest five-year plan clearly outlines areas where the government is focusing and investing around these themes makes the most sense to us. Clear targets have been set in terms of localisation (avoiding reliance on US imports) and improvements to the environment while a focus on reducing inequality should be good for trends in low to middle income consumption. An ageing population and shrinking workforce will prompt innovation around working practices involving greater automation, while industrial innovation will be encouraged and supported. In our view, the opportunities lay mainly with the enablers of the transition rather than the frontline players or platforms. For us, that is the software and components in China, materials elsewhere, and consumer discretionary, focusing on low to middle income spend.

Does this change our investment case for China?

Taking a longer-term view, this doesn’t change our outlook for China as the long-term structural trends remain intact. It is the second-largest economy in the world and is forecast to grow by 8.1% in 2021, compared to 4.6% growth in Europe and 7.0% growth for both the UK and US.6 It remains the region’s growth engine, and the emerging middle class is becoming an ever-larger local market for goods and services, as the exponential profit growth of relative newcomers like Alibaba illustrates. China is also experiencing rapid infrastructure development, technology advancement (much of it homegrown), and rapid adoption and integration into the wider Asian region with a combined population of 4.5 billion, which is estimated to contain 66% of the world’s middle class in 10 years.7 This is a reality that is difficult to ignore for many investors.

There is no doubt that the new regulations have got the market spooked. However, comments that China is now uninvestable, in our view, are wide of the mark. Of course, there will be uncertainty in the short-to-medium term, but this will pass as people go back to looking at companies and not government policy. We suspect that earnings revisions will be weak in the coming months as analysts adjust margin expectations. However, the baseline is that revenue should continue to grow commensurate with an economy with high single-digit nominal GDP growth, and hence opportunities will most likely continue to present themselves.

1Source: Reuters, 10.04.2021: China fines Alibaba record $2.75 bln for anti-monopoly violations

2Source: CNBC, 23.07.2021: Another group of U.S.-listed Chinese stocks plunge as Beijing regulators crack down

3Source: Bloomberg, 23.07.2021

4Source: Bloomberg, 3.08.2021

5Source: Janus Henderson, 13.08.2021

6Source: International Monetary Fund, World Economic Outlook, July 2021

7Source: Henderson Far East Income Annual Report, 2020 Gross domestic product (GDP) Expand

The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period and is a broad measure of a country’s overall economic activity.

IPO ExpandInitial public offering; when shares in a private company are offered to the public for the first time.

Monopoly ExpandA monopoly refers to when a company and its product offerings dominate a sector or industry. The term monopoly is often used to describe an entity that has total or near-total control of a market.

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security. Janus Henderson Investors, one of its affiliated advisor, or its employees, may have a position mentioned in the securities mentioned in the report.