GEOPOLITICS

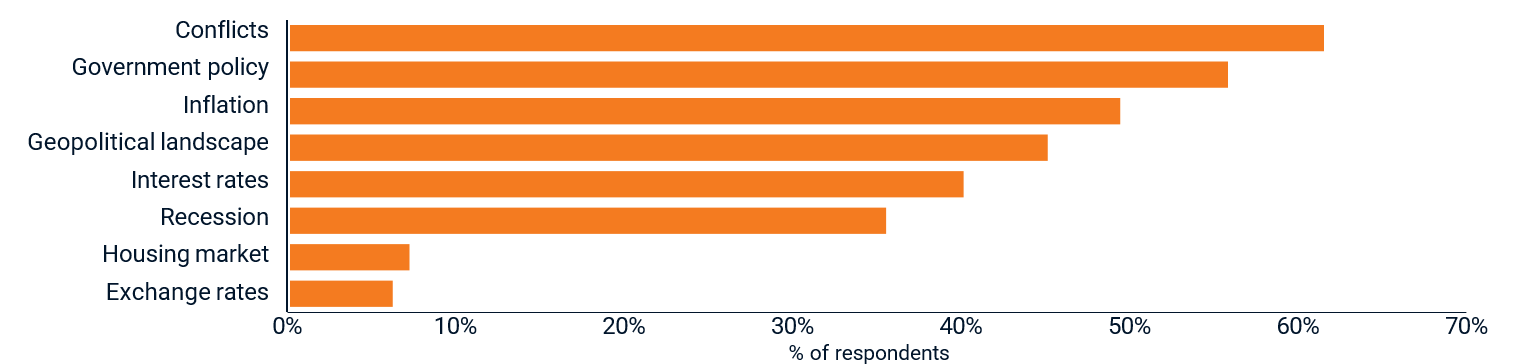

1. What are your top investment concerns? (select up to three)

We sought to identify your top concerns. Interestingly, conflicts had displaced inflation, which was your top concern 18 months ago. Government policy had also climbed as investors clearly worry about potential taxes under a new government.

2. Mining and oil extraction can be polluting and emit greenhouse gases. Which response below best describes your view?

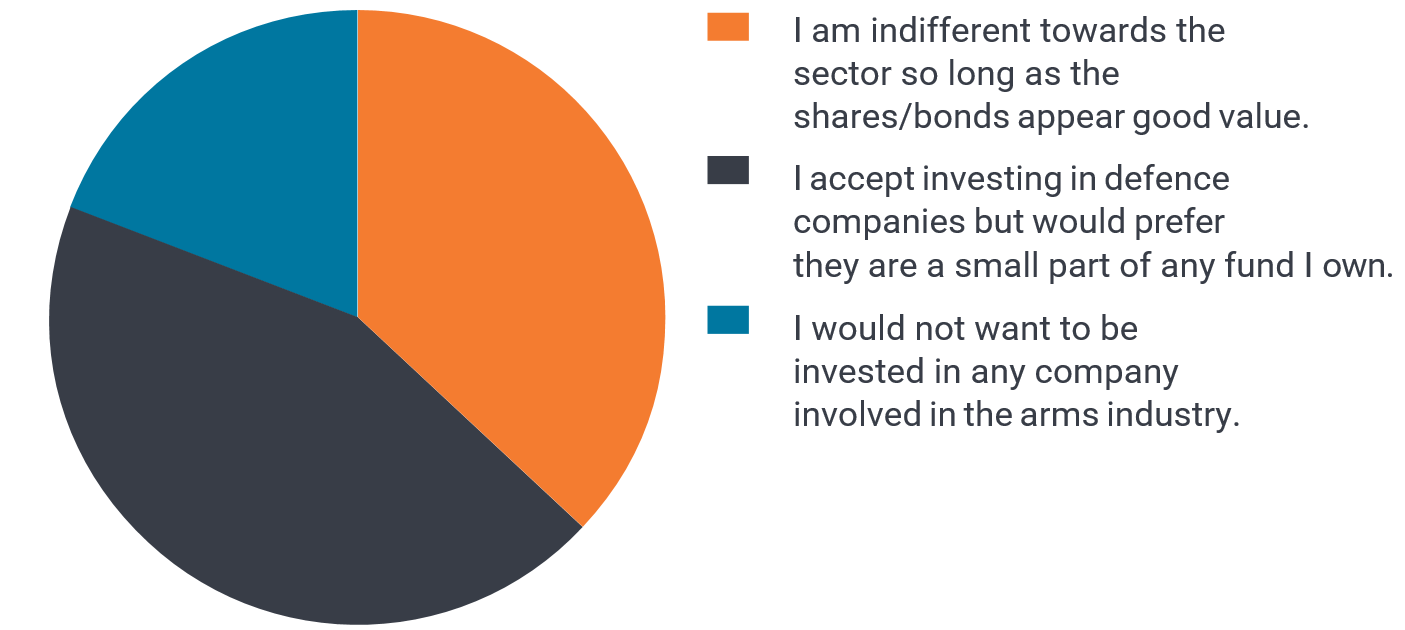

3. Global instability has led many governments to reassess the amount they spend on defence, which is likely to lead to more spending on military equipment. Given this outcome, what best describes your view?

I’m not surprised that a majority of investors are happy to own defence companies. The world has become a less secure place in recent years and countries need to equip themselves for potential threats even if they hope it is never used. With a NATO target of at least 2% of gross domestic product spend on defence, this should bolster earnings at defence companies.”

-Julian McManus,

Global Equities Portfolio Manager

*The North Atlantic Treaty Organization (NATO) is an intergovernmental military alliance.

CENTRAL BANK POLICY

The Swiss National Bank was the first major developed market central bank to cut interest rates in 2024 and several others have since followed. We were intrigued to get your views on where you thought interest rates and inflation were heading.

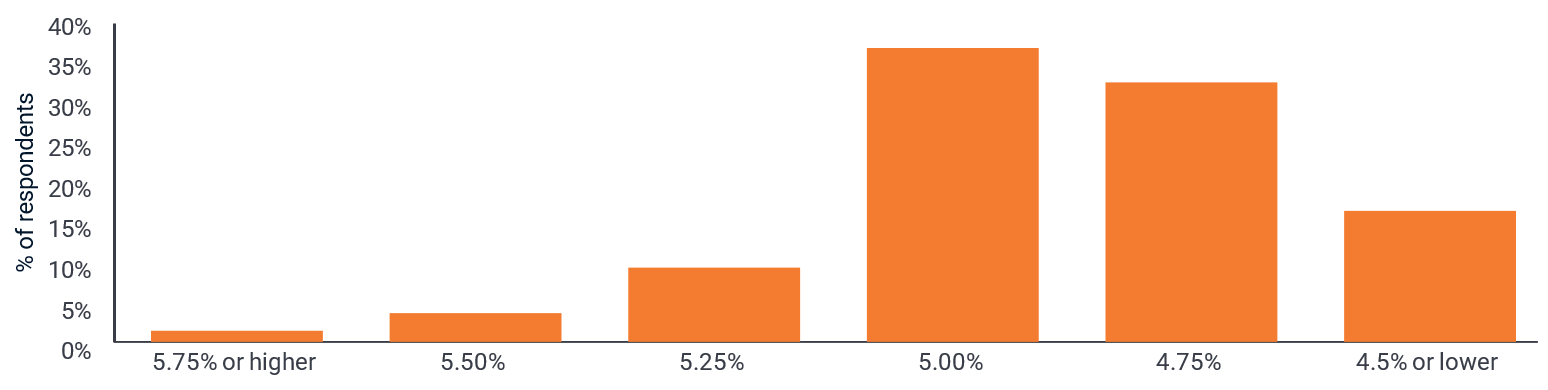

4. Where do you think the Bank of England’s interest rate will be by the end of December?

(It was at 5.25% at the time of questioning.)

A clear majority of you thought interest rates would be lower by the end of the year.

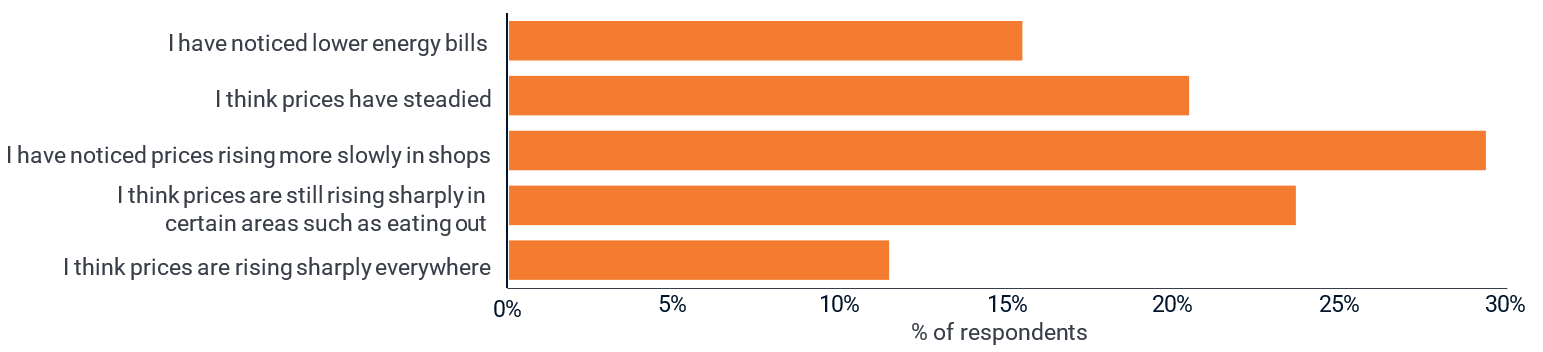

5. Central banks seek to control inflation (general rise in prices of goods and services). What best describes your recent experience?

There was a mixed response here, possibly because lower inflation does not mean prices are falling, just rising less quickly. As the next question revealed, however, most of you were confident that inflation would now stay at around 2-3%.

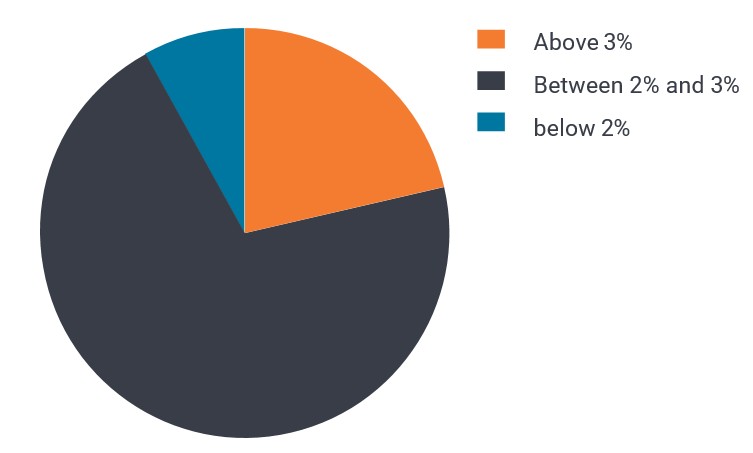

6. Where do you think UK inflation will be in June 2025?

(Inflation as represented by the Consumer Price Index year-on-year change at April 2024 was 2.3% at the time of questioning.)

The moderation in inflation during 2024 is welcome. While companies may have to work harder to boost revenues as they cannot rely on price rises, margins may be protected by softening wage demands and the scope for interest rate cuts should take some of the pressure off rising refinancing costs.

-James Briggs,

Portfolio Manager, Fixed Income

ARTIFICIAL INTELLIGENCE

Artificial intelligence (AI) has made headlines throughout the year as investors wake up to the potential applications and boost to productivity that AI can unleash. This includes helping design and discover new medical treatments to swifter data analysis and generating content for the entertainment industry.

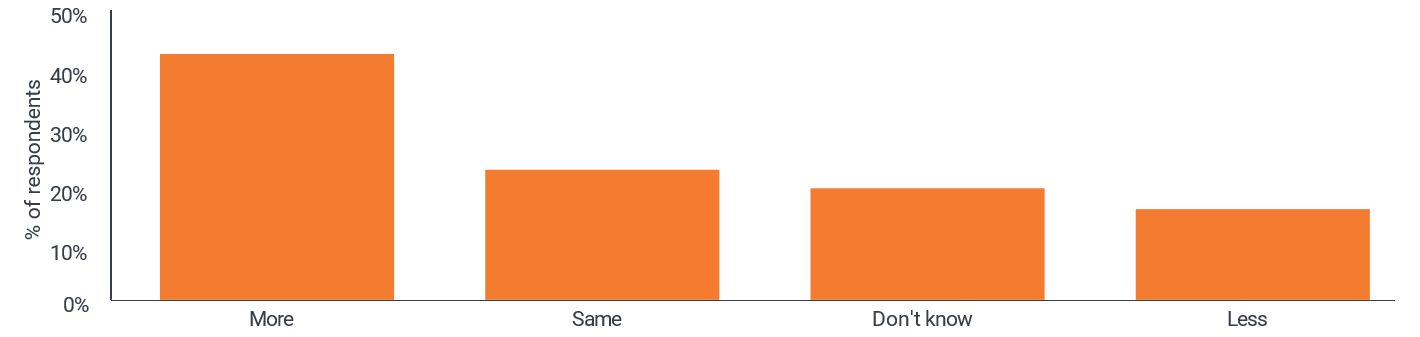

7. Do you think AI will be more or less impactful than the internet?

Two thirds of you reckoned it would either be the same or more impactful than the internet.

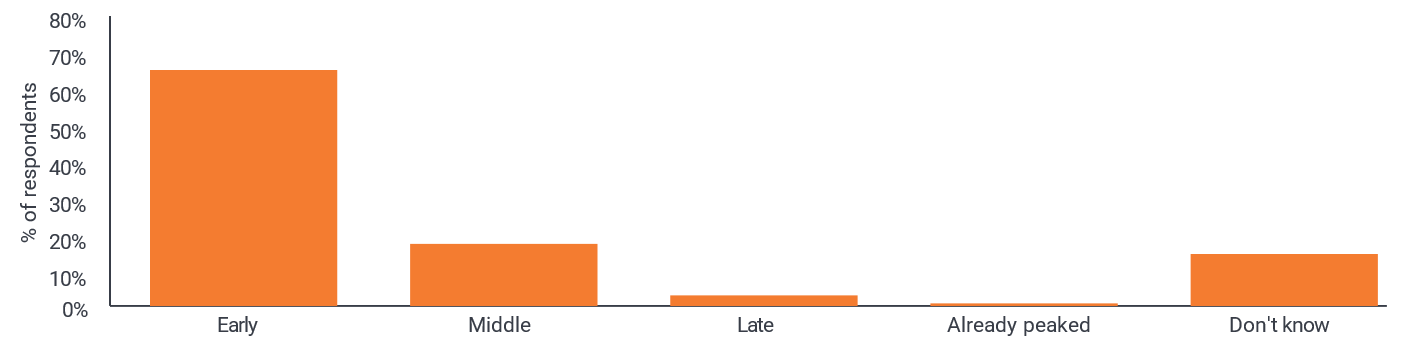

8. Where do you think AI will be more or less impactful than the internet?

It was clear from your responses that you thought we were only just beginning to see investment take off in AI.

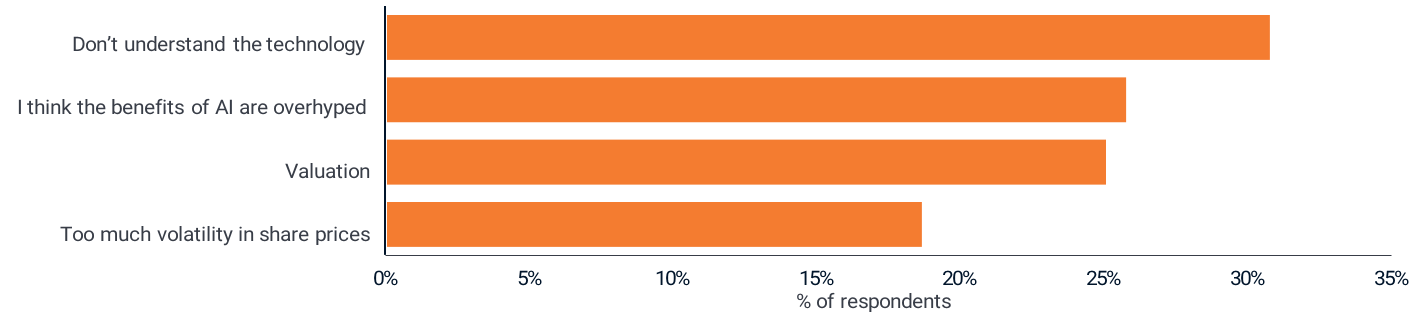

9. What concerns you around investing in AI?

Your concerns around AI were fairly evenly spread. Some of you reckoned valuations were expensive, others worried about volatility (sharp movements in share prices) but many of you felt it was either overhyped or you did not yet know enough about the technology.

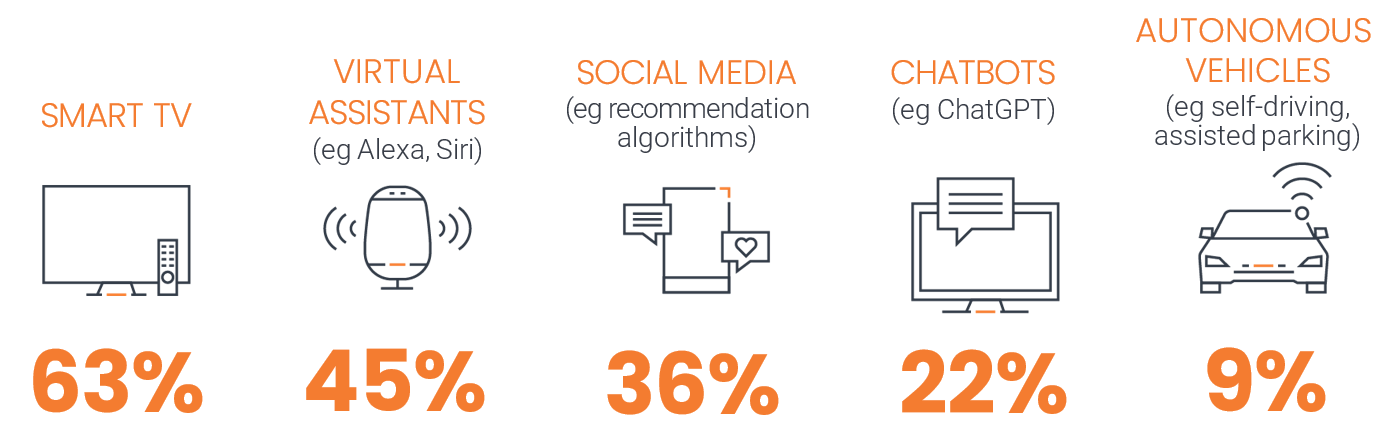

10. You may already be interacting with AI applications, which of these do you use? (Select all that apply)

Many of you were already interacting with AI across multiple formats.

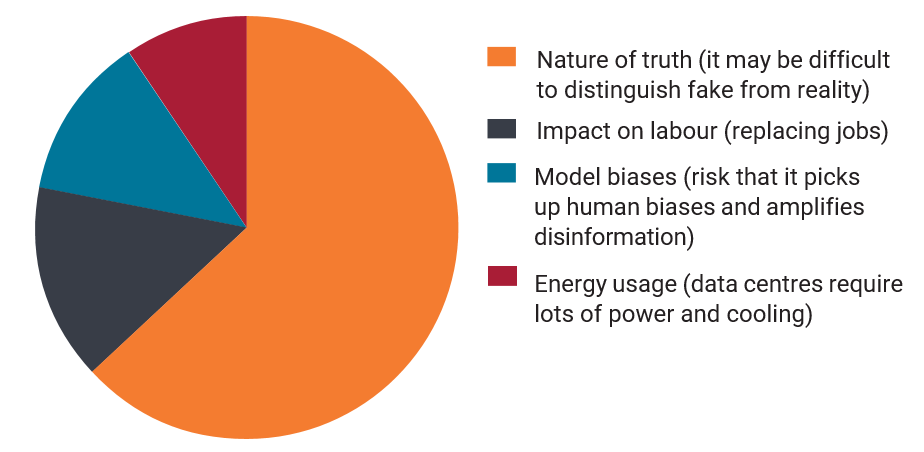

11. There are some risks surrounding AI. Which do you find the most worrying one?

We know our investors value trust and this came through loud and clear in your response to this question.

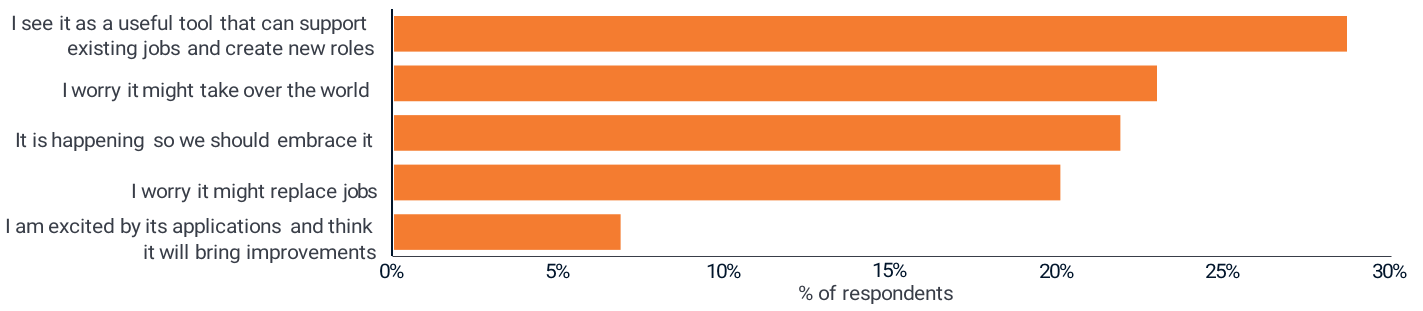

12. Which best describes your view of AI? (Select one)

There were mixed responses here, with some of you seeing clear benefits and others voicing concerns.

If you are interested in participating in the Customer Panel Surveys, please email customer.panel@janushenderson.com with your name and email address and we will get in touch with you. Existing members will continue to be included and do not need to reapply. To join the Panel you must be 18 years of age or over and hold an investment directly with Janus Henderson Investors. The survey is conducted a few times each year and participation is voluntary. Please note that your individual responses are confidential and remain anonymous but we may publish the aggregate results from time to time.

The Customer Panel Survey was conducted between 30 May 2024 and 17 June 2024. 280 respondents took part online.