I, and many of my colleagues, have opined on numerous occasions that UK equities are undervalued compared to other global markets and therefore represent a potentially attractive investment prospect for the coming years. It is fair to say that we have been ‘early’ (a less charitable appraisal would be ‘wrong’) on this call thus far. While Aesop’s fable about the boy who cried wolf might be a lesson about telling the truth, rather than calling a market too early, he was eventually right, and I still believe our views on UK equities will be too, in predicting that the UK equity market will outperform over the next decade. The question now becomes, how do you convince investors long since habituated to mistrusting such opinions?

The price paid for an asset remains a key determinant of future returns

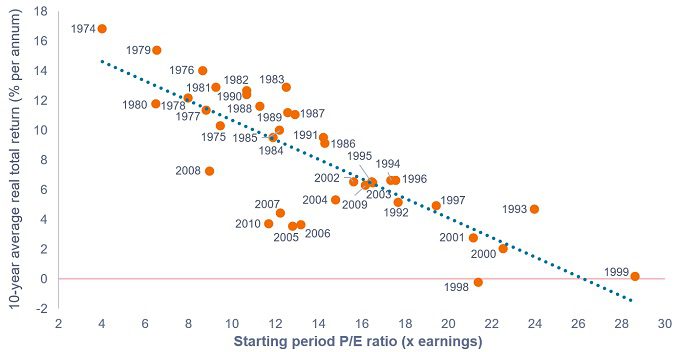

Exhibit 1 shows a high and consistent correlation between the starting price/earnings ratio (P/E) and performance of the UK equity market. Simply put, the cheaper the market has been in any given year, the higher the return over the following decade.

This argument has become ever more pertinent in 2021, as P/E ratios in the UK market have shifted even lower (Exhibit 2), falling from 15x earnings at the start of the year to slightly above 12x earnings in September, even though the market is healthily up. This is because earnings in the UK have risen much more than share prices. While there are no assurances that history will repeat itself (Exhibit 1 implies a 10-year real return of approximately 9% per annum at these P/E levels), these are objectively attractive entry levels for investors, relative to other developed markets, particularly the US.

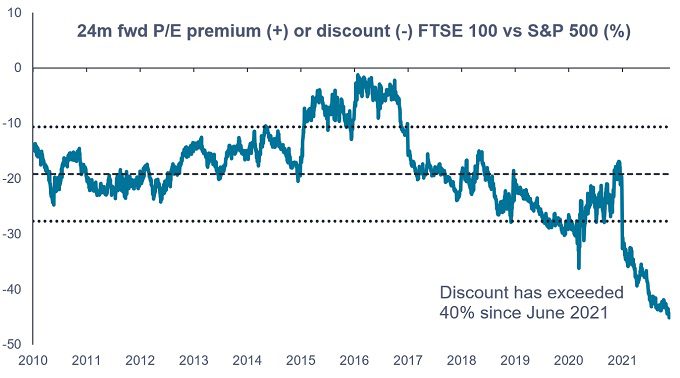

This is not just our view. Morgan Stanley produce research each year that models 10-year nominal expected returns based upon regression analysis and prevailing valuation levels. This research predicts that the UK equity market is expected to produce the highest returns across all major global markets, with estimated returns of 10.3% per annum for the MSCI UK Index. This compares to a more modest 5.2% expected from the S&P 500 Index, reflecting the scale of the premium for US equities relative to the UK (Exhibit 3).

The argument for UK equities is not just price

There are also fundamental structural arguments behind why we expect the UK equity market to perform better from here. The UK market is more heavily weighted towards parts of the market perceived as ‘value’ (such as commodities and financials) than the US, while being underweight growth sectors, like technology. This has been a drag on UK equity market performance for many years. But we believe that this could all be changing. While we do not expect current high inflation levels to persist, we do expect inflation to settle at a higher mark than we have grown used to over the past decade. We see the era of disinflation as behind us, hence our view that the trend of ever-lower bond yields has ended too. If this is true, then the environment no longer supports growth sectors over value ones. As the discount rate goes up, the low yields on longer-duration growth sectors (ie. those stocks where earnings are anticipated to be high further in the future) look less attractive, while rising yields usually favour perceived ‘inflation hedges’… such as financials and commodities.

The Janus Henderson Cautious Managed Fund is predominantly a UK portfolio. In recent years this has been a significant headwind against our IA Mixed Investment 20-60% Shares peer group, which is, in the main, much more globally orientated. Irrespective of stock selection, these peers have often benefited from both stronger relative equity market returns and the appreciation of overseas currencies against sterling. Brexit and our COVID experience are two obvious culprits for the UK’s relatively weak performance. But as Brexit steadily recedes into the past, and we adapt to, and see better treatments to deal with COVID, these headwinds could easily switch to tailwinds.

Bond yield: The level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price.

Disinflation: A fall in the rate of inflation.

Growth investing: Growth investors search for companies they believe have strong growth potential. Their earnings are expected to grow at an above-average rate compared to the rest of the market, and therefore there is an expectation that their share prices will increase in value.

Inflation hedge: An asset or investment that is expected to maintain or increase in value relative to the level of inflation over time.

Nominal/Real return: ‘Real return’ is the return on an investment after taxes and inflation. ‘Nominal return’ includes taxes and inflation.

Price/earnings (P/E) ratio: A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark, such as the FTSE All-Share Index. It is calculated by dividing the current share price by its earnings per share.

Regression analysis: A statistical process for estimating the relationship between different variables, quite often over time.

Value investing: Value investors search for companies that they believe are undervalued by the market, and therefore expect their share price to increase. One of the favoured techniques is to buy companies with low price to earnings (P/E) ratios.

Yield: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. Expensive stocks will therefore often have a lower yield, reflecting their higher price. For a bond, this is calculated as the coupon payment divided by the current bond price.