2022 was not the year that economists predicted. What was forecast to be a year of steady economic recovery following the pandemic was instead a year in which war returned to Europe. This brought significantly higher-than-expected inflation driven by higher energy prices, putting material pressure on real household disposable income and indirectly adding to disruption elsewhere in the UK economy, notably in the form of widespread industrial action. Cost of living pressures on the consumer, as well as disappointingly low business investment, means that the UK economy is already likely in modest recession, with market consensus for a slight economic contraction in 2023.

UK equities ended 2022 flat

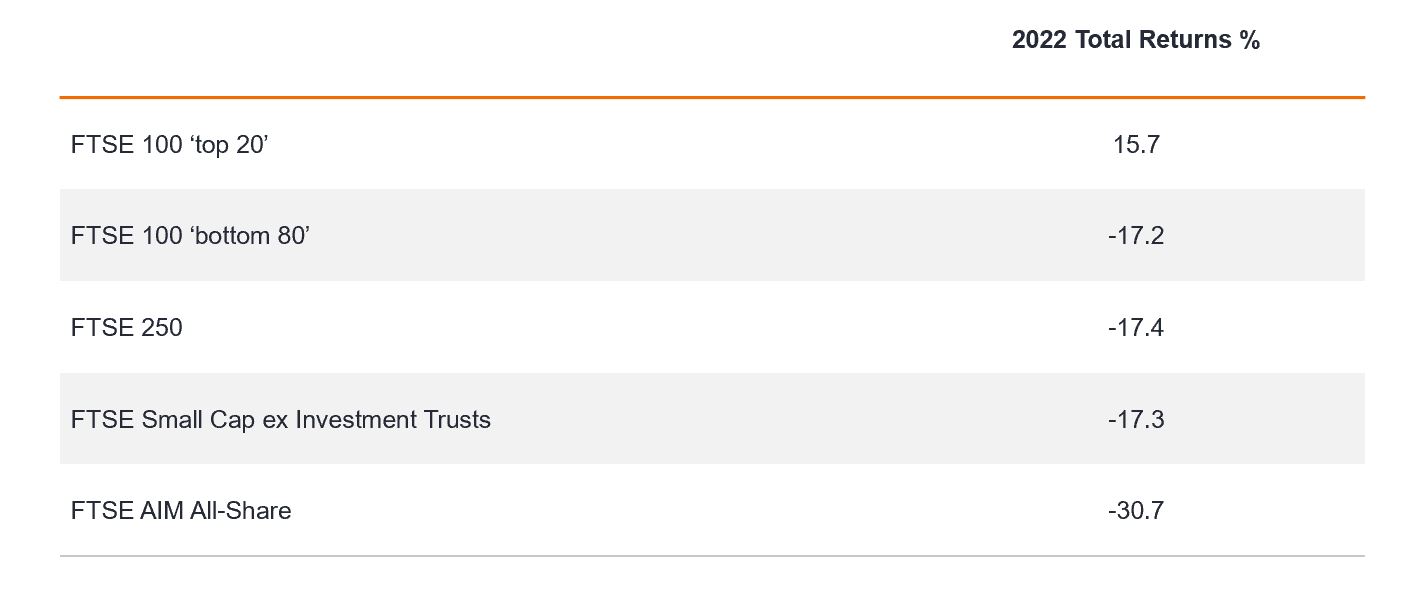

In this difficult economic backdrop, it is perhaps surprising that UK equities ended 2022 almost flat with the FTSE All-Share Index delivering total returns of 0.34% (Refinitiv Datastream, 12 months to 31 December 2022). A large part of this headline resilience, however, is due to the unusual sectoral make-up of the UK equity market, with a comparatively high concentration in companies that benefit from higher commodity prices. It has been these large natural resource companies (such as Shell, BP and Glencore) that have driven the majority of UK outperformance versus overseas equity markets in 2022. In contrast, outside of this narrow selection of stocks, on average UK share prices fell materially in 2022. This can be demonstrated by comparing the returns of UK companies by size, with only the top 20 companies in the FTSE 100 showing positive share price performance (figure 1):

Figure 1: 2022 returns by UK company size groupings

Source: Bloomberg, calendar year 2022 total returns in GBP terms. Past performance does not predict future returns.

The sharp share price falls seen across small and medium-sized UK companies in 2022 can be explained by the fact that these companies on average, have more domestic exposure in terms of sales and earnings, and tend to be more economically sensitive. Therefore, as the market attempts to ‘price in’ a more challenging economic backdrop, these companies bear the brunt of share price falls. The key question for us as fund managers, therefore, is whether the market has already adequately reflected upcoming earnings weakness, or whether there is further downside to share prices from current levels.

A modest rather than severe recession for the UK is likely

Forecasting the longevity and depth of any recession will always be challenging; attempting any degree of precision with economic forecasting is likely to be a fool’s errand. That being said, when considering whether the UK equity market has adequately priced in economic weakness, there are two key variables to determine:

- What could be the depth and longevity of the recession?

- What is the starting point in terms of valuations?

For this particular recession, the key factors to consider are:

- There was a build-up of savings by UK consumers during the course of the pandemic that is yet to be fully spent. It remains unclear at what pace these savings will be drawn down, but it provides the consumer with a potential ‘buffer’ to withstand the cost of living pressures.

- The labour market is therefore entering the recession from a position of ‘tightness’, and ultimately the key factor in consumer spending power is whether someone retains their job.

- Bank lending has remained subdued since the Global Financial Crisis (GFC), with banks instead focusing on rebuilding their balance sheets and implementing strict affordability tests with regards to, for example, mortgage lending. This means that despite recent interest rate rises we are yet to see any notable balance sheet stress at major UK lenders (while there have been some pockets of stress seen elsewhere, such as the pension funds industry).

- UK-listed company balance sheets generally remain healthy. This is partly due to timing, as many companies raised financing during COVID, and they have yet to fully work through this additional capacity (with this recession coming unusually only two years after the last one).

We of course need to recognise that despite the above reasons for optimism there are significant external factors which we cannot possibly predict – the outcome of the war in Ukraine, for example. However, as fund managers we always operate with varying degrees of uncertainty and therefore need to take a view on the balance of probability. The above factors mean that, in our view, there is a greater likelihood of a modest, rather than severe, recession. This brings us onto where UK valuation levels currently sit.

UK stocks remain cheap

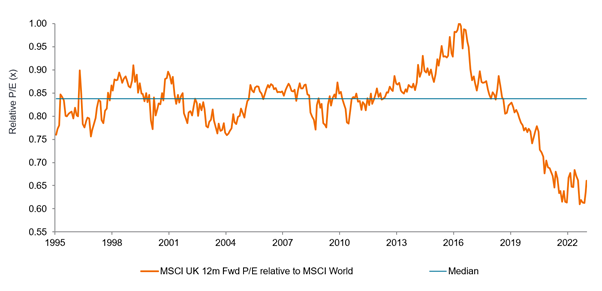

UK equities continue to trade at a significant valuation discount to overseas peers (MSCI UK Index versus MSCI World Index 12-month forward price-to-earnings (P/E). This valuation gap began to emerge in 2016 and is now wider than it has been in over 25 years – see figure 2:

Figure 2: UK stocks’ valuation gap to global peers widest in 25 years

Source: JP Morgan Research as at 3 January 2023. Past performance does not predict future returns.

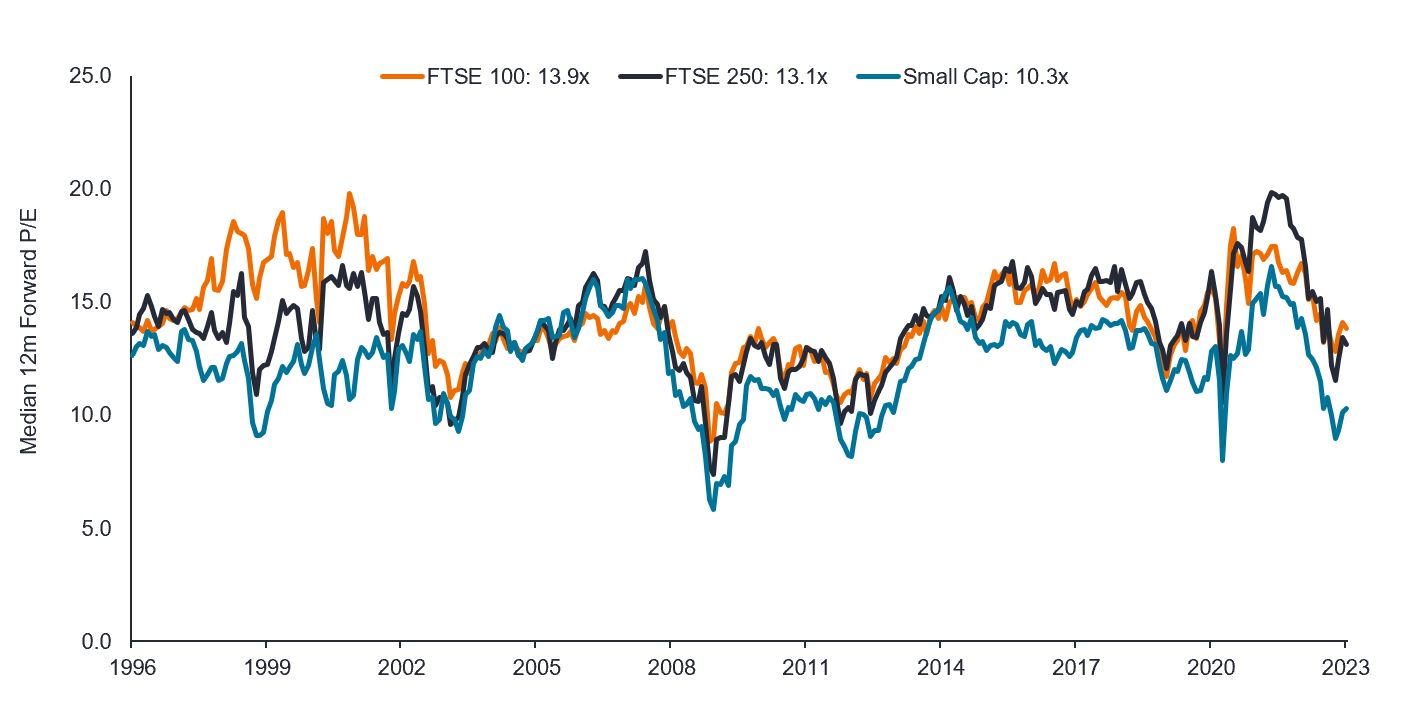

As mentioned earlier, 2022 saw significant underperformance of small and medium-sized companies. Therefore, while UK equities as a whole trade at a discount to overseas peers, within the UK the lowest valuation is currently seen within the smallest companies (listed on the FTSE Small-Cap Index – see chart below).

Figure 3: Smaller companies are the most undervalued

Source: Liberum, Refinitiv Datastream, as at 1 January 2023. Past performance does not predict future returns.

Bringing all of this together, we could be entering a modest recession at a point where UK smaller company valuations are already trading at levels rarely seen outside of severe recessions such as the GFC and the pandemic. That does not mean there is not further potential downside to share prices, or that there will not be economic shocks to come, however it does suggest to us that a significant degree of economic ‘pain’ is already reflected in UK share prices. Our current focus is on UK smaller companies, which saw the steepest underperformance in 2022 and suggests to us that this is likely to be where the best investment opportunities can be found.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a point in time.

Tight labour market: occurs when there are many vacancies but workers are scarce, typically leading to higher wages.

12-month forward price-to-earnings ratio (PE): is calculated by dividing the current share price by projected earnings for the next 12 months to value a company’s shares.